for 3 months*

QuickBooks gives S corps peace of mind with accurate payroll and tax penalty protection.

Check out these payroll service features

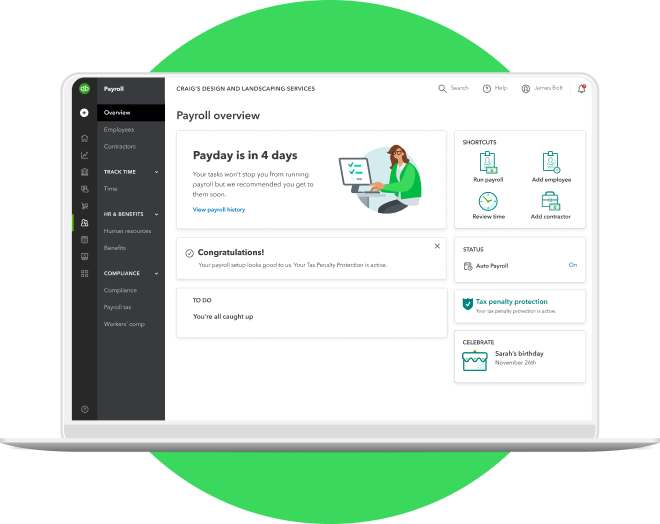

Error-free tax filing

Let QuickBooks Payroll file your federal and state payroll taxes for you.** Enjoy added peace of mind with tax penalty protection, included with QuickBooks Online Payroll Elite.

Same-day direct deposit

Run payroll automatically after you complete the initial setup. Save time and money with same-day direct deposit.**

Expert review

Let the experts review your payroll setup or do it for you. They can also offer step-by-step help when you need it.**

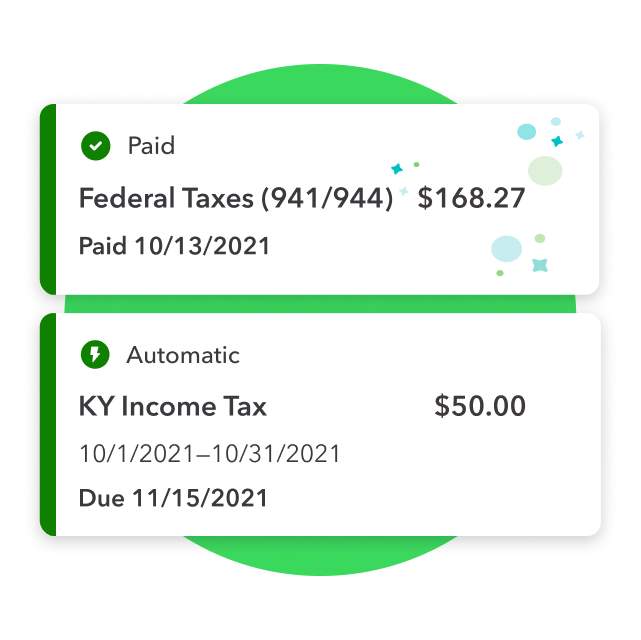

Payroll tax calculations

Spend time doing what matters most. With automated tax filings and payments, we’ll help you manage your taxes once you complete your payroll setup.**

Payroll reports

Clear financial reporting leads to better business decisions. Get real-time business insights in QuickBooks with income statements and payroll reports.

Error-free tax filing

Let QuickBooks Payroll file your federal and state payroll taxes for you.** Enjoy added peace of mind with tax penalty protection, included with QuickBooks Online Payroll Elite.

Same-day direct deposit

Run payroll automatically after you complete the initial setup. Save time and money with same-day direct deposit.**

Expert review

Let the experts review your payroll setup or do it for you. They can also offer step-by-step help when you need it.**

Payroll tax calculations

Spend time doing what matters most. With automated tax filings and payments, we’ll help you manage your taxes once you complete your payroll setup.**

Payroll reports

Clear financial reporting leads to better business decisions. Get real-time business insights in QuickBooks with income statements and payroll reports.

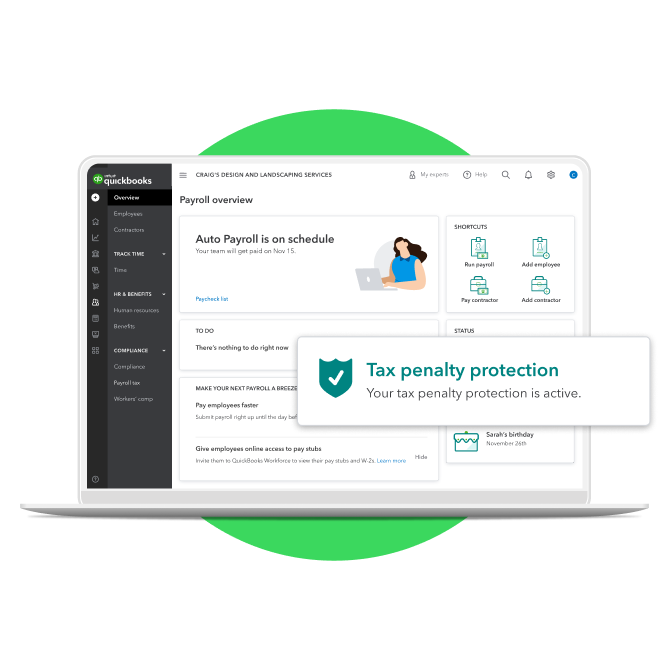

S corp payroll taxes

Any S corp business owner can tell you S corp payroll taxes are complicated. This is why QuickBooks’ tax penalty protection is so important. Even if you experience errors that lead to tax penalties, QuickBooks can resolve those errors and reimburse penalties and interest.

Set up payroll for your S corp

S corps are unique because even if you’re the owner and sole employee of your business, you must pay yourself “reasonable compensation.” You also have to prove you paid that income with a Form W-2 at the end of the year. QuickBooks makes that easy, with automated tax payments and filings for federal and state payroll taxes.**

Why use QuickBooks Payroll for S corporations

QuickBooks Online Payroll is the #1 payroll provider for small businesses.1 Access all your S corp payroll tax and benefits in one place, including workers’ comp (powered by Next)** and get peace of mind with tax penalty protection (included with QuickBooks Payroll Elite).**