*Offer terms

30-day free trial: First thirty (30) days of subscription to QuickBooks Time, starting from the date of enrollment is free. To continue using QuickBooks Time after your 30-day trial, you’ll be asked to present a valid credit card for authorization, and you’ll be charged on a monthly basis at the then-current fee for the service(s) you’ve selected until you cancel. Each worker is an additional $[8/10]/month depending on your selection of QuickBooks Time Premium or Elite. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QuickBooks Time customer and sign up for the monthly plan using the “Try it free for 30 days” option. This offer can’t be combined with any other QuickBooks Time offers. Offer available for a limited time only. To cancel your subscription at any time go to “Account & Billing” in QuickBooks Time and select the “Close Account” tab then “Permanently Close My Account.” You will not receive a prorated refund. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

**Product Information

Phone Support: For hours of support and how to contact support, click here.

System Requirement: QuickBooks Time requires a computer or a device with a supported Internet browser and an Internet connection (a high-speed connection is recommended). The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Time subscription.

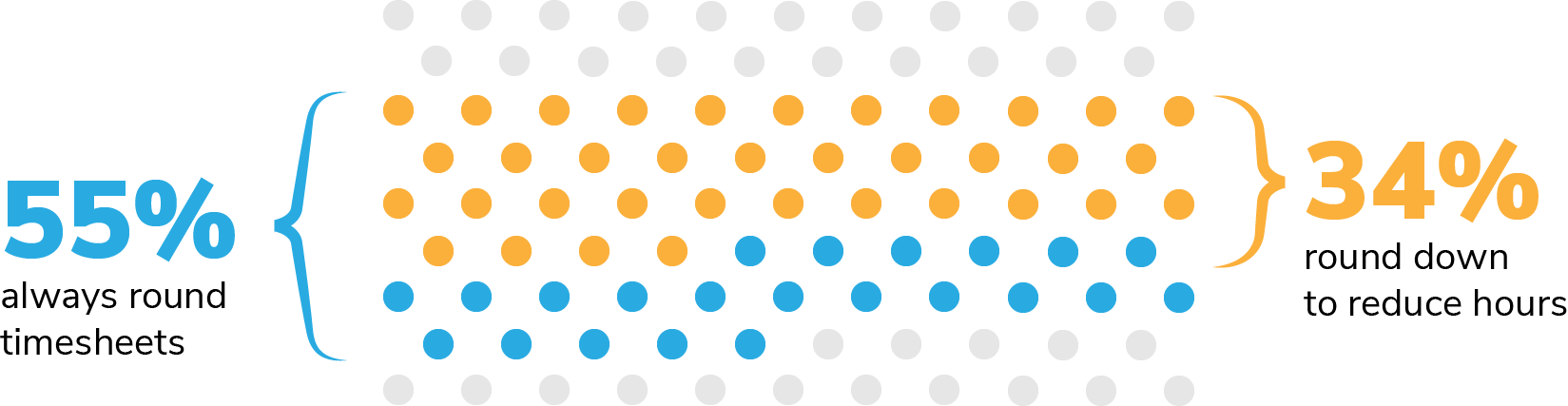

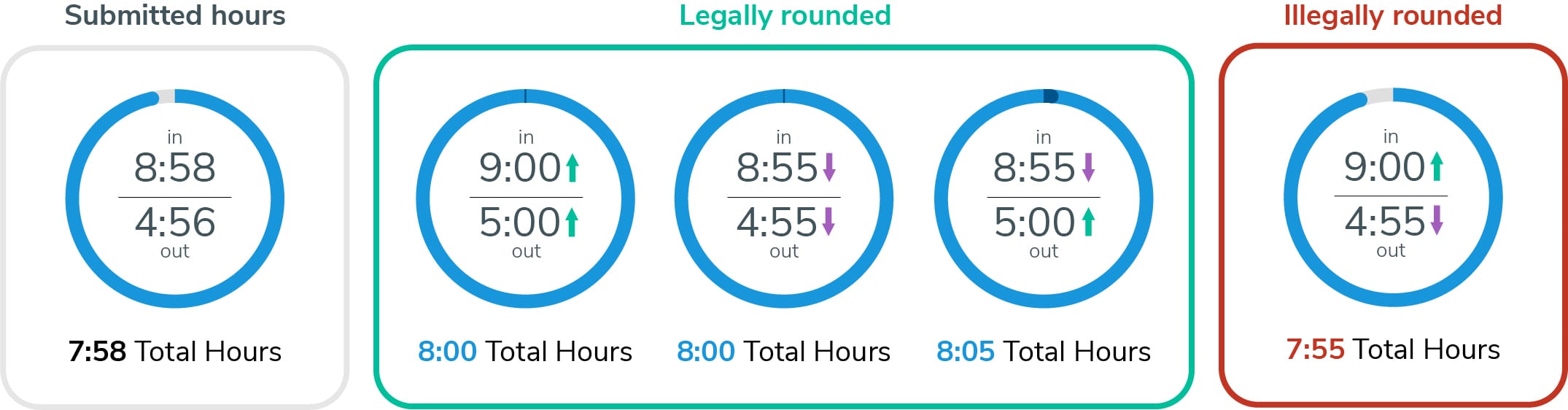

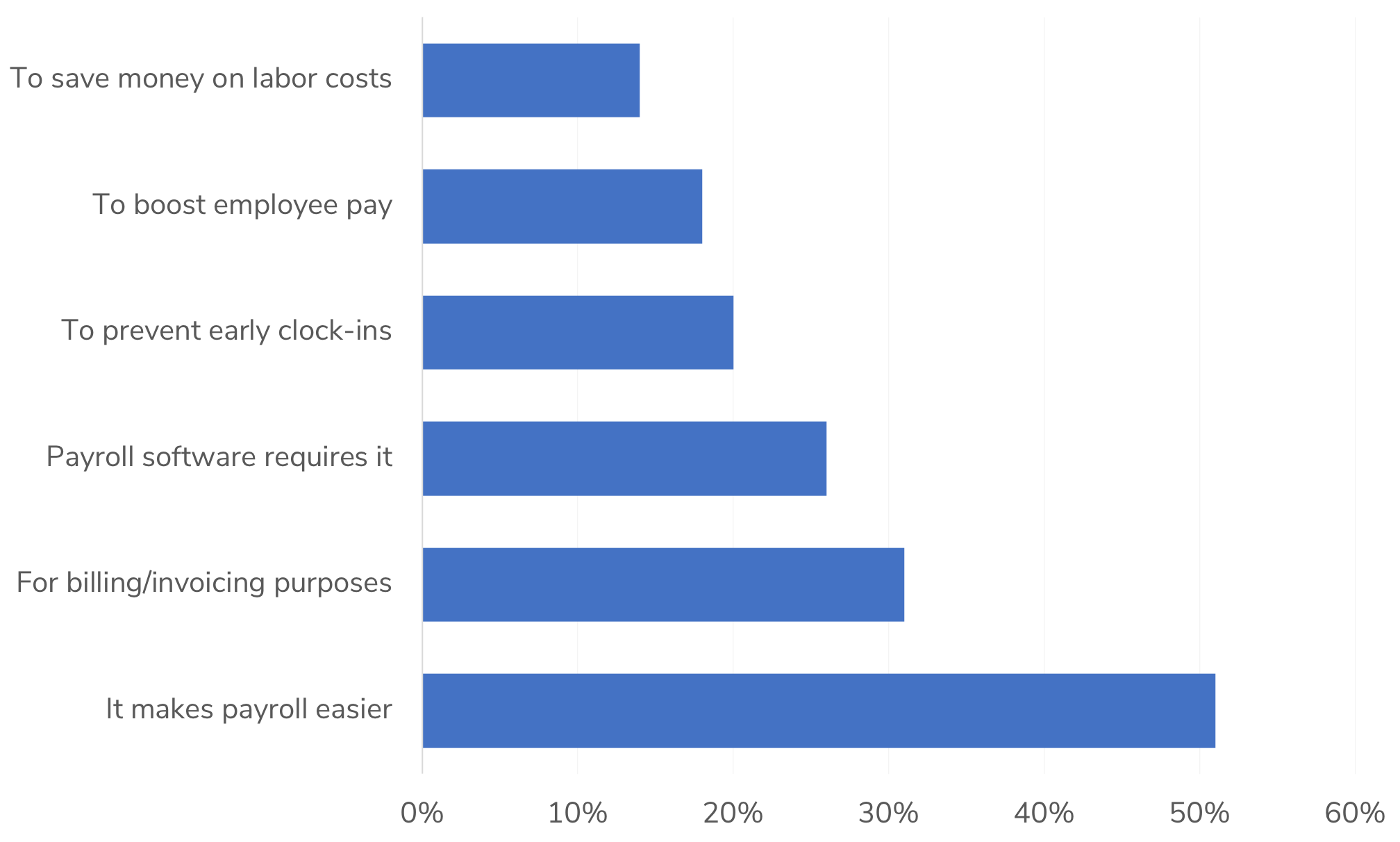

#Claims 1. QuickBooks Time commissioned Pollfish to survey 731 anonymous business owners (age 18+) throughout the U.S., in September 2018, to learn more about their time tracking habits and policies. Quickbooks Time designed and paid for the survey and welcomes the re-use of this data under the terms of the Creative Commons Attribution License 4.0, which permits unrestricted use, distribution, and reproduction in any medium, provided the original source is cited with attribution to “Quickbooks Time”.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.