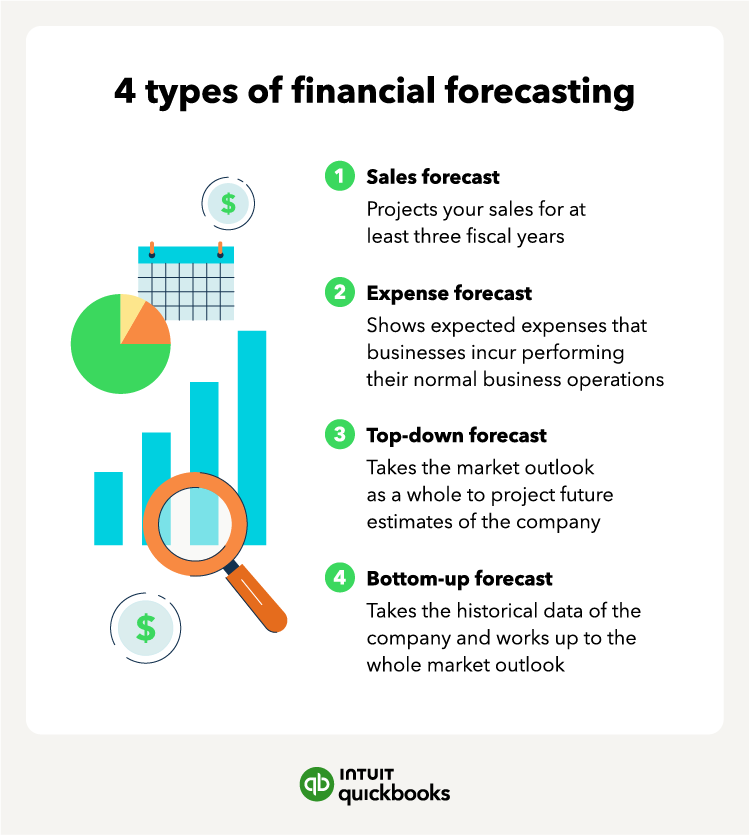

Along with qualitative and quantitative forecasting methods, there are also different types of financial forecasts you can use. Financial forecasting methods are the techniques that predict future financial outcomes based on historical data, market conditions, and management insights.

Additionally, each financial forecasting type refers to a specific financial aspect. There are four types of financial forecasting:

Sales forecast

A sales forecast can project your sales for at least three fiscal years, including monthly sales for the first year, then quarterly for the following two years.

This type of forecast answers questions such as:

- How many customers can you expect?

- How many units will be sold?

- What is the cost of goods sold?

- How will you price your products?

Sales projections can forecast revenue. And when the cost of goods sold is also a consideration, you can estimate gross profit for each of those years.

After accounting for your operating costs, subtract this from your gross profit to calculate your actual profit—otherwise known as net income (or profit). Calculate operating expenses based on your expense budget.

Expense forecast

Operating expenses are any expenses businesses incur from performing their normal business operations. These include fixed costs, like rent for your physical location, and variable costs, like marketing expenses.

The expense forecast model allows you to:

- Plan for upcoming short-term and long-term expenses based on previous years or quarters.

- Prepare for unexpected expenses that could occur.

- See which expenses only occur periodically, such as subscriptions.

- Plan for increased expenses due to operations and output.

You don’t need to do an incredibly detailed breakdown, such as listing the cost of every office chair, but you do need general figures.

Top-down forecast

Top-down forecasting involves taking the market outlook as a whole to project future estimates for the company. This way, you’ll start with a big picture and slowly work your way down to produce a view of the company based on various components.

For example, if you sell car parts, you would:

- Look at the overall market for car sales.

- Narrow it down to used cars vs. new cars.

- Narrow down further to the make and model of the parts you need to produce.

This approach is most common for newer companies with little historical data to go off.

Bottom-up forecast

A bottom-up approach works in the exact opposite fashion. Instead of starting with a big picture and working it down, you simply reverse. For example:

- Start with the product or service you provide.

- Work your way up to view the market of your product or service as a whole.

This is a much more involved process than top-down because it uses historical data on the company to make assumptions about achieving certain objectives for the upcoming term. Taking and organizing your company's historical data can pose an extra step but one well worth the time and effort.

5 steps to create a financial forecast