When you think of bookkeeping, you may think it’s all just numbers and spreadsheets. That’s not exactly the case. Bookkeeping is the meticulous art of recording all financial transactions a business makes. By doing so, you can set your business up for success and have an accurate view of how it’s performing.

So, what is bookkeeping? And what are the benefits? Let us walk you through everything you need to know about the basics of bookkeeping.

- Overview: What is bookkeeping?

- 2 types of bookkeeping for small businesses

- Bookkeeping vs. accounting: What’s the difference?

- What does a bookkeeper do?

- 3 key benefits of bookkeeping

- 3 disadvantages of bookkeeping

- Bookkeeping best practices

- Should I do my own bookkeeping? 3 questions to ask yourself first

- Ready to get started?

Overview: What is bookkeeping?

Bookkeeping is the process of tracking and recording a business’s financial transactions. These business activities are recorded based on the company’s accounting principles and supporting documentation.

Examples of these documents include:

Business transactions can be recorded by hand in a journal or an Excel spreadsheet. To make things easier, many companies opt to use bookkeeping software to keep track of their financial history.

Bookkeeping is just one facet of doing business and keeping accurate financial records. With well-managed bookkeeping, your business can closely monitor its financial capabilities and journey toward heightened profits, breakthrough growth, and deserved success.

2 types of bookkeeping for small businesses

When it comes to bookkeeping, there are two main types: single-entry bookkeeping and double-entry bookkeeping. Follow along to learn more about which method might be best for you and your business.

1. Single-entry bookkeeping

The single-entry bookkeeping method is often preferred for sole proprietors, small startups, and companies with unfussy or minimal transaction activity. The single-entry system tracks cash sales and expenditures over a period of time.

With this bookkeeping process, you must maintain three pieces of documentation:

- Cash sales journal: This is where the business records all revenue.

- Cash disbursements journal: This is where the business records all expenses.

- Bank statements: All journal entries should align with the business’s bank statements.

In these documents, transactions are recorded as a single entry rather than two separate entries.

2. Double-entry bookkeeping

Double-entry bookkeeping is the practice of recording transactions in at least two accounts, as a debit or credit. When following this method of bookkeeping, the amounts of debits recorded must match the amounts of credits recorded. This more advanced process is ideal for enterprises with accrued expenses.

The following documents are required for double-entry bookkeeping:

- Journal entries

- General ledgers

- Inventory

- Cashbooks

- Accounts payable

- Accounts receivable

- Loans

- Payroll

The double-entry system of bookkeeping is common in accounting software programs like QuickBooks. With this method, bookkeepers record transactions under expense or income. Then they create a second entry to classify the transaction on the appropriate account.

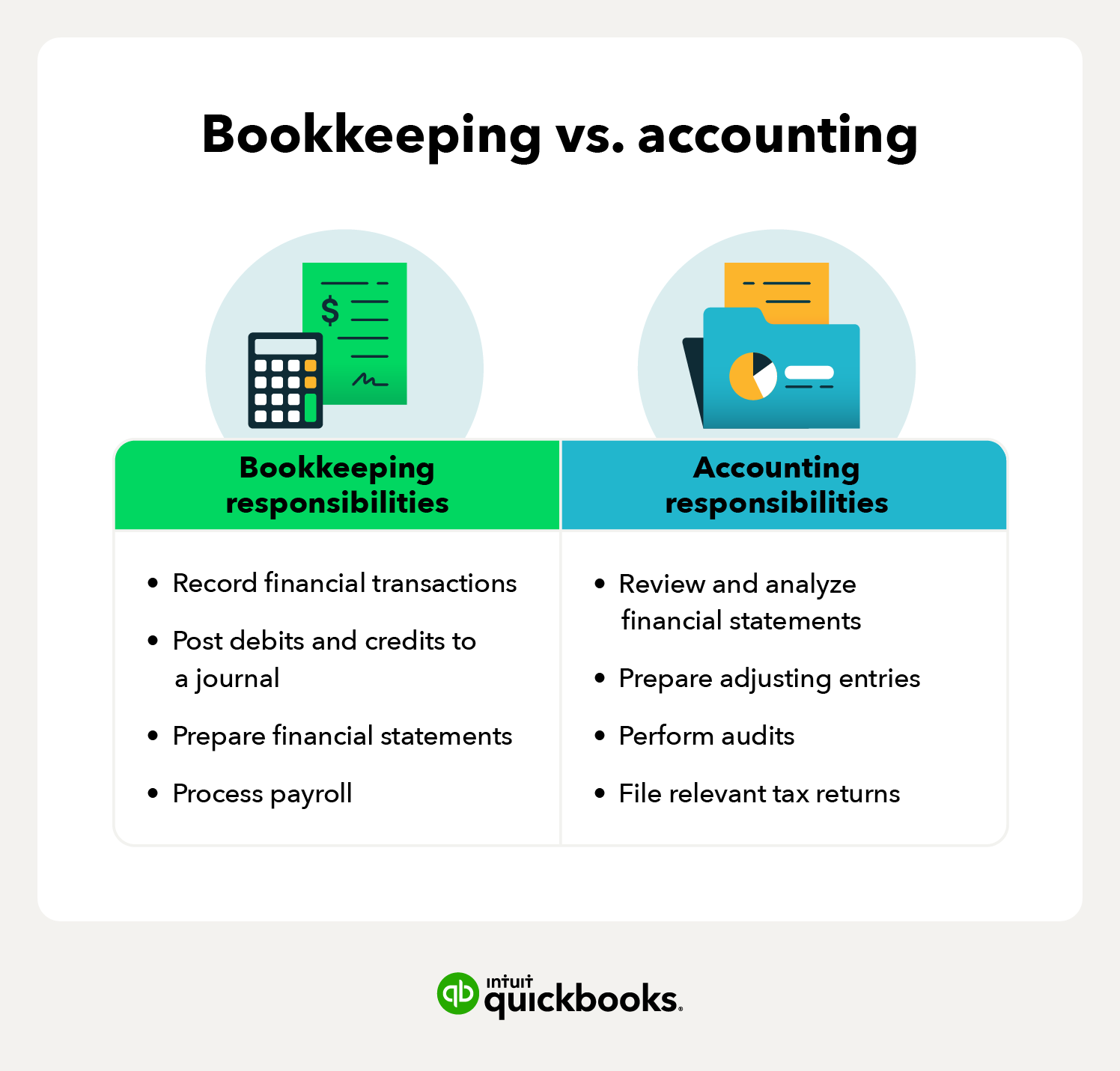

Bookkeeping vs. accounting: What’s the difference?

At first glance, bookkeeping and accounting may seem interchangeable. While it may be easy to confuse the two, they are not the same thing. Accounting is the umbrella term for all processes related to recording a business’s financial transactions, whereas bookkeeping is an integral part of the accounting process.

Common examples of bookkeeping include:

- Recording financial transactions

- Posting debits and credits to a journal

- Preparing financial statements

- Processing payroll

Unlike accounting, bookkeeping zeroes in on the administrative side of a business’s financial past and present. Accounting, on the other hand, utilizes data from bookkeepers and is much more subjective.

Common examples of accounting include:

- Reviewing and analyzing financial statements

- Preparing adjusting entries

- Performing audits

- Filing relevant tax returns

Without bookkeeping, accountants would be unable to successfully provide business owners with the insight they need to make informed financial decisions.

What does a bookkeeper do?

A bookkeeper organizes your business’s finances and records every transaction accurately and consistently. Think of them as the backbone of your financial operations. They manage the daily finances so you can see the big picture and focus more on running and growing your business. Let’s take a look at some of a bookkeeper’s key responsibilities.

Enter transactions and track spending

Bookkeepers keep records of every financial transaction, including payments, purchases, and income. They use bookkeeping software or spreadsheets to ensure every dollar is accounted for.

Organize financial records

To keep your business prepared for taxes, audits, and future financial planning, bookkeepers organize and store important financial documents — e.g., receipts, bank statements, and invoices.

Create financial statements

They put together key financial statements like balance sheets, income statements, and cash flow reports, which give you a snapshot of how your business is doing and can help you make better decisions.

Reconcile accounts

Account reconciliation is another common responsibility. During this process, a bookkeeper compares your recorded transactions with your bank statements so they can catch and fix any errors.

Handle invoices and pay bills

Bookkeepers can handle invoicing, track incoming payments, and manage bill payment. They help make sure money flows smoothly and that your business pays bills and vendors on time.

Run payroll

In some cases, bookkeepers can manage payroll services to ensure your employees are paid accurately and on time.

3 key benefits of bookkeeping

If you’re new to business, you may be wondering about the importance of bookkeeping. Whether you outsource the work to a professional bookkeeper or do it yourself, you’ll be able to reap a variety of benefits.

1. Access to detailed records of all transactions

By logging and keeping track of all financial transactions, you will have easy access to any financial information you might need. To make it even easier, bookkeepers often group transactions into categories.

Common transaction categories include:

- Goods

- Services

- Wages

- Taxes

When it’s finally time to audit all of your transactions, bookkeepers can produce accurate reports that give an inside look into how your company delegated its capital. The two key reports that bookkeepers provide are the balance sheet and the income statement. The goal of both reports is to be easy to comprehend so that all readers can grasp how well the business is doing.

2. Ability to make informed decisions

Because bookkeeping involves the creation of financial reports, you will have access to information that provides accurate indicators of measurable success. By having access to this data, businesses of all sizes and ages can make strategic plans and develop realistic objectives.

Examples of financial statements that can help with decision-making include:

- Balance sheets

- Income statements

- Cash flow statements

Not only can this help you set goals, but it can also help you identify problems in your business. With an accurate record of all transactions, you can easily discover any discrepancies between financial statements and what’s been recorded. This will allow you to quickly catch any errors that could become an issue down the road.

3. Better tax preparation

When it’s time to file your taxes, you’ll need to comply with the Internal Revenue Service’s (IRS) legal regulations and systems that govern their finances. Some of the most common documentation businesses must provide to the federal government include:

- Financial transactions

- Financial statements

- Tax compliance

- Cash flow reports

By staying up to date with your bookkeeping throughout the year, you can help alleviate some of the stress that comes with filing your taxes.

3 disadvantages of bookkeeping

Bookkeeping has its benefits, but it also comes with a few disadvantages, depending on whether you’re hiring someone or doing it yourself. Here are some bookkeeping drawbacks you might face as a small business owner.

1. Time-consuming

If you’re thinking about managing the books yourself, bookkeeping can take up a lot of time, especially if you’re managing it manually or have complex finances.

Also, if you’re juggling multiple responsibilities already, keeping up with bookkeeping tasks — e.g., recording transactions, reconciling accounts, and generating reports — can quickly become overwhelming. Plus, this time could be better spent on growing your business or serving customers.

If this sounds familiar, QuickBooks Live Expert Assisted could be the perfect solution. This service lets you maintain control of your books while benefiting from expert support whenever you need it.

Learn more about Quickbooks Live Expert Assisted.

2. Cost

Hiring a professional bookkeeper, especially an in-house employee, can be expensive. Along with salary, there are other costs to consider, like employee health benefits, training, and any necessary software or tools.

You could go down the freelance bookkeeping route, which can save you money on salary and benefits. However, they may not provide the same level of commitment and familiarity with your business as an in-house bookkeeper.

With this mind, you may want to consider With this in mind, you may want to consider QuickBooks Live Expert Full-Service Bookkeeping. This service offers an affordable and flexible solution, providing you with access to a dedicated team of bookkeepers without the overhead costs of hiring in-house staff.

Learn more about Quickbooks Live Expert Full-Service Bookkeeping.

3. Risk of errors

When you’re handling bookkeeping on your own, mistakes can happen — especially with data entry or categorizing transactions. Even small errors can add up over time, which can lead to inaccurate records that might cause problems during tax time or an audit. While hiring someone helps, human error is still a reality, and it’s easy for mistakes to slip through the cracks if you’re not familiar with bookkeeping yourself.

QuickBooks Live Expert Assisted can give you peace of mind by connecting you with seasoned bookkeepers who’ll review your records and provide guidance to keep everything accurate.

Learn more about Quickbooks Live Expert Assisted.

Bookkeeping best practices

Now that you’ve got a firm grasp on the basics of bookkeeping, let’s take a deeper dive into how to practice good bookkeeping. There’s no one-size-fits-all answer to efficient bookkeeping, but there are universal standards. The following four bookkeeping practices can help you stay on top of your business finances.

1. Consider a phased approach

Trying to juggle too many things at once only works to put your organization in danger. If you’re looking to convert from manual bookkeeping to digital, consider a staggered approach. Overhauling all at once can be overwhelming and discouraging, so it’s best to take it slow and make meaningful and intentional shifts.

Those baby steps can help you manage your organization on a new and improved system. Small steps also give everyone time to familiarize themselves with the new bookkeeping software.

2. Keep your general ledger current

A general ledger is a collection of accounts that classify and store all records associated with a company’s financial transactions. The general ledger includes balance sheet accounts (liabilities, equity, assets) and income statement accounts (revenue, expenditure, gains, losses).

Under the double-entry accounting structure, every business transaction will affect two or more general ledger accounts. General ledger accounts include:

- Asset accounts such as cash, accounts receivable, investments, land, equipment, and inventory

- Liability accounts such as accounts payable, accrued expenses payable, customer deposits, and notes payable

- Stockholders’ equity accounts such as common stock, treasury stock, and retained earnings

Your general ledger should be up to date so that your bookkeeping software is able to provide functionality that you can navigate easily. QuickBooks is an excellent option for novice and seasoned digital bookkeepers alike.

3. Plan for taxes throughout the year

Whether it’s updating your books or keeping in contact with your tax adviser, maintain your business’s financial records and expenses throughout the year. That way, you can be well prepared when it’s time to file taxes with the IRS. Without any hiccups or last-minute scrambles, you’ll be able to enter tax season confidently.

4. Keep your personal and business finances separate

As you dive deeper into the bookkeeping process, it may be tempting to blur the lines between your personal and business finances, but it’s not the best idea. By avoiding this, you’ll reduce the risk of triggering an IRS audit and will allow an accurate picture of your business finances.

Some common ways to help keep your personal and business finances separate include:

- Utilizing a business credit card for all business expenses

- Setting up separate checking accounts

- Keeping all personal and business receipts organized and separate

By following these tips and diligently working to keep your personal and business finances separate, you’ll get a clear view of the performance of your business, while minimizing the risk of accidentally misrepresenting your business’s finances.

5. Back up financial records

Whether it’s a natural disaster, hardware failure, or a cyber threat, you never know when the unexpected will strike and leave financial data vulnerable. Consider using secure cloud accounting software that automatically backs up your data and keeps it accessible at all times.

In fact, QuickBooks Advanced continuously saves your records in the background, so you can restore data to a specific point if needed. This level of security protects your business against data loss and gives you peace of mind knowing that your financial information is safe and always available when you need it.

6. Reconcile accounts regularly

Keeping your financial records accurate means reconciling your accounts regularly. You can be sure that everything in your books matches what actually happened by going over your bank accounts, credit card statements, and other financial records each month. This way, you can catch any discrepancies early, spot possible fraud, and fix issues before they become bigger problems.

With tools like QuickBooks, reconciliation becomes much easier. It can automatically pull in your bank transactions and flag any mismatches, letting you quickly review and confirm everything.

Should I do my own bookkeeping? 3 questions to ask yourself first

Now that you have a better understanding of bookkeeping, you may be wondering if it’s something you want to take on yourself or with the help of a professional. When making this decision, there are three things you should keep in mind.

1. Do I have the expertise?

How does your accounting and bookkeeping experience size up? You may be hoping for the best and have a few college courses in your back pocket. Even with these tools, you may not have the expertise you need to handle the responsibilities of a bookkeeper.

If you’re unfamiliar with local and federal tax codes, doing your own bookkeeping may prove challenging. On the other hand, if you have in-depth tax and finance knowledge beyond the bookkeeping basics, you may be able to get the job done.

2. Do I have the time?

Bookkeeping can be time-consuming and tedious. If you’re a new business owner, you’re likely already spread thin. Adding bookkeeping to the mix may overwhelm you. But if you have the time to dedicate to updating your books regularly, doing your own bookkeeping may be feasible.

If you’re like most modern business owners, odds are you didn’t become one so that you could practice professional-level bookkeeping. Outsourcing the work to a seasoned bookkeeper can allow you to focus on your business plan and growth.

3. Can I afford to outsource bookkeeping?

Consider your budget when deciding whether to do your own bookkeeping or hire a professional. Outsourcing can offer peace of mind and free up your time, but it also adds an ongoing expense. Look closely at your finances. Can your budget comfortably support the cost of a bookkeeper, or would that money be better invested elsewhere in your business?

If hiring a bookkeeper doesn’t fit within your budget right now, accounting software like QuickBooks can help you streamline and manage the basics yourself. On the other hand, if the cost of outsourcing is manageable, a professional bookkeeper could save you time and reduce the risk of costly mistakes.

Ready to get started?

Take routine bookkeeping off your never-ending to-do list with the help of a certified professional. A QuickBooks Live bookkeeper can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert CPAs and QuickBooks ProAdvisors average 15 years of experience working with small businesses across various industries.

Whether you’re trying to determine the best accounting system for your business, learn how to read a cash flow statement, or create a chart of accounts, QuickBooks can guide you down the right path.

Whether you've started a small business or are self-employed, bring your work to life with our helpful advice, tips and strategies.