November 6th, 2023

November 6th, 2023

Whether you choose to manually process payroll, utilize industry-leading bookkeeping software, or hire an accountant—streamlining the process and staying organized is the key to successfully running your small business.

Using this payroll guide, we’ll walk you through the entire payroll process step by step. Keep reading to learn about the different processing methods or jump right to the section that’s most relevant to you.

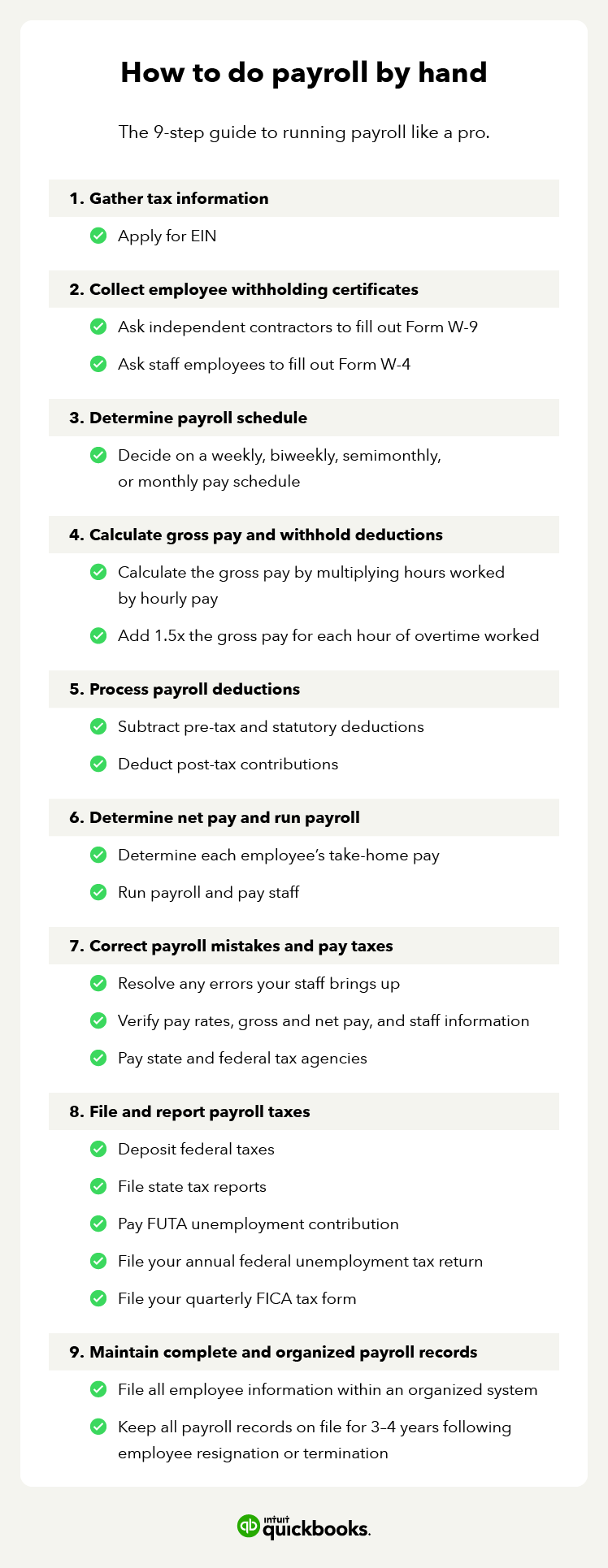

How to do payroll yourself in 9 steps

Calculating tax withholding amounts, gross and net pay, and additional deductions is no easy task, but it has to get done.

“Doing payroll yourself manually involves several steps. First, you need to establish tax and registration information for your business. This includes getting your federal identification number, or FEIN, then establishing a payroll deposit schedule, and finally, registering with both federal and state agencies to submit those payroll taxes electronically,” says Garcia.

If you’re hoping to save money on payroll-related costs and ready to get those brain neurons firing, follow along with these 9 steps to learn how to do payroll by yourself.

Step 1: Collect your tax information

Before running payroll for the first time, you’ll need to set up an Employer Identification Number (EIN) with the Internal Revenue Service (IRS). Your EIN is a unique number that identifies your business. The application is free and you can access it online, by mail, or by phone.

- You can apply for an EIN online or mail in Form SS-4.

The government identifies U.S. citizens using their social security numbers. The equivalent for businesses is an Employer Identification Number (EIN). You will need this ID number to open a bank account, apply for a business license, hire employees, run payroll, and file taxes.

Step 2: Ask employees to fill out an Employee Withholding Certificate

Once you have received your EIN, you will need to request pertinent tax information from your employees. You can collect all of the necessary information by asking new hires to fill out:

- Form W-4 on or before their first day if they’re a traditional employee

- Form W-9 if they’re an independent contractor or freelancer

The information your employees provide will help you determine the proper withholding amounts and send out accurate W-4s and 1099-MISCs at the end of the year.

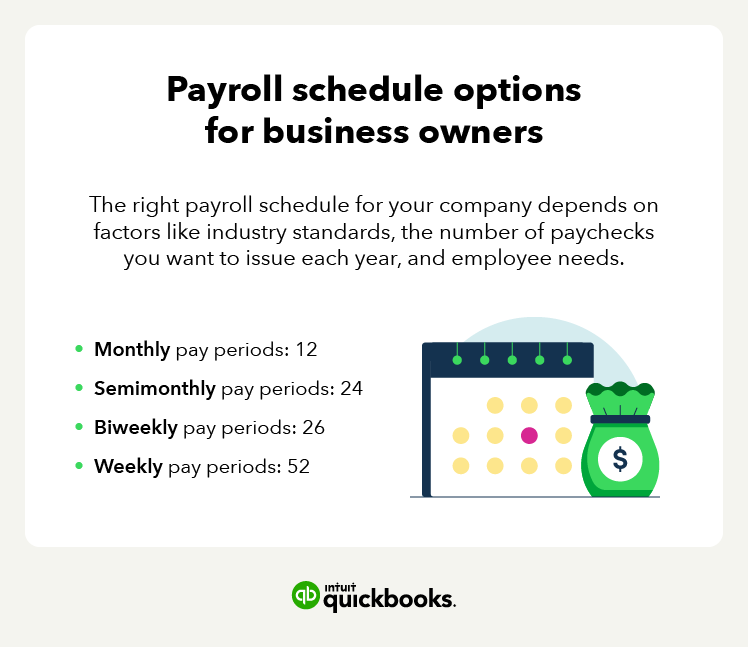

Step 3: Determine a payroll schedule

Deciding on a payroll schedule is up to the business owner, so long as they’re within the guidelines mandated by the state and federal governments, relevant collective bargaining agreements, and union demands.

“In some cases, the [payroll] schedule could be semi-weekly, monthly, or quarterly. At the end of each period, you must file and report your payroll, which happens to be in both quarterly and annual intervals, depending on the form,” says Garcia.

Weekly pay

52 pay periods each year

Typically, companies that pay employees a minimum wage default to a weekly payment schedule.

- Common in: grocery stores, restaurants, and manufacturing companies.

Employees at these jobs often live paycheck to paycheck which is partly (and unfortunately) why frequent payments are so important.

Biweekly pay

26 pay periods each year

This is great for hourly employees because it makes it easier to account for the overtime from the week prior.

- Common in: retail, construction, education, health services, leisure, and hospitality establishments

Semimonthly pay

24 pay periods each year

This is a standard payment schedule for salaried employees because it offers consistency and predictability for staff and employers alike. This is very common in professional and business services, informational companies, finance, and tech.

Monthly pay

12 pay periods each year

This pay model is great for employers because it’s the least expensive method. However, it’s usually reserved for staff and executives with exceptionally high salaries. This is most common in finance and professional companies, but even then, it’s the least popular option.

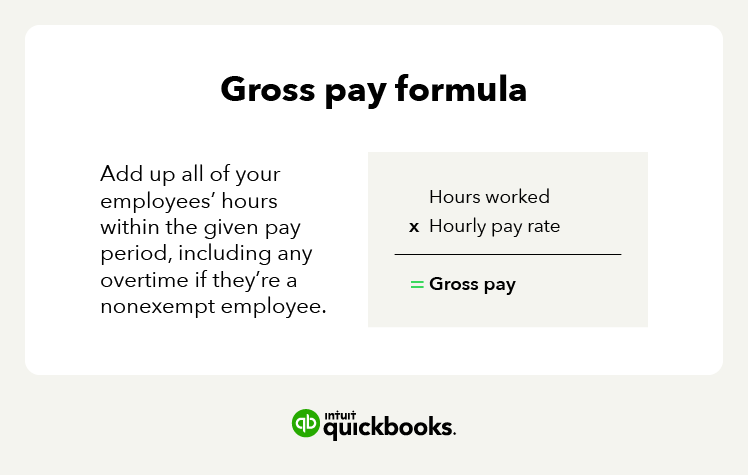

Step 4: Calculate gross pay and withhold tax deductions

Gross pay is the number of hours an employee worked during a specific pay period multiplied by their hourly rate. You can collect the necessary data using paper timesheets, punch clocks, or spreadsheets. Use an automated payroll software and employee time tracking solution.

To manually calculate payroll:

- Add up the total hours worked for each employee.

- Multiply that number by each employee’s hourly wage to determine gross pay.

- Account for any tips and overtime hours accrued by non-exempt employees.

Overtime regulations by district

To properly calculate overtime hours, multiply each hour worked in a week above 40 hours by at least 1.5x the employee’s regular hourly rate.

Alaska, California, Nevada, Puerto Rico, and the Virgin Islands also have laws that stipulate that you must pay overtime rates anytime an employee works more than 8 hours in a day.

Step 5: Process payroll deductions

After you calculate gross pay, you can process payroll deductions using your employee’s W-4 information. You will need to take out:

- Pre-tax deductions for things like retirement plans and flexible savings accounts.

- Federal and state-mandated deductions like FICA, Medicare, and Social Security.

- Post-tax deductions like wage garnishments, union dues, and Roth IRA contributions.

In addition to regular tax withholdings and deductions, you must factor in payroll processing factors like:

Step 6: Calculate net pay and run payroll

Once you’ve calculated your employee’s gross pay and withheld the necessary taxes, calculate the amount they get to take home.

After you know each employee’s net pay, you can run payroll and deposit funds into their bank accounts or send them a check in the mail. You can also make payments using convenient pay cards to save money.

Step 7: Correct mistakes and pay payroll taxes

The trickiest part of processing your own payroll is calculating how much to withhold from employee paychecks for Medicare, Social Security, state and federal unemployment, and FICA taxes.

If you’re doing your taxes by hand, you might make some errors. If one of your employees comes to you with an incorrect pay stub or a missed payment, it’s an opportunity to spring into action and resolve the issue. Some mistakes you may need to correct include:

- Misspellings

- Incorrect payment calculations

- Overtime discrepancies

- Outdated tax rates

- Pay period dates

Step 8: File and report payroll to tax agencies

“After you issue your payroll checks, make sure to remit payroll taxes withheld and accrued to both IRS and state and local agencies. The frequency of those payments is dictated by your total payroll liability amount. Make sure to check with the IRS and your state for those,” says Garcia.

After distributing your employee paychecks, you must file, pay, and report all of your payroll taxes to the IRS. To meet federal and state regulations, you need to:

- Deposit federal taxes: You must pay all employee tax withholdings and FICA taxes to the IRS. The IRS requires filers to use electronic funds transfer (EFTPS) to make federal tax deposits.

- File state tax reports: If your state requires you to collect and pay state income tax and unemployment taxes, you will need to adhere to your state’s individual pay schedule and code.

- Make FUTA payment: You must make Federal unemployment tax payments to the IRS quarterly.

- File Form 940: The Annual Federal Unemployment (FUTA) tax return.

- File Form 941: You need to file this form quarterly to pay your FICA taxes.

Tip: Be sure to pay your FUTA dues out of pocket and not to withdraw these funds from employee paychecks—these taxes are the sole responsibility of the employer.

QuickBooks Payroll includes auto taxes and forms meaning QuickBooks will calculate, file, and pay your payroll taxes for you.

Step 9: Maintain complete and organized payroll records

An essential piece of the payroll puzzle is maintaining accurate and organized records. At some point, the IRS may audit you and investigate to ensure that all of your employees are working legally and that you’re adhering to labor and payroll laws.

If this happens, it’s important that you have the necessary records and that they are neatly filed away. You should keep the following information on file for each employee from the time they’re hired until 3–4 years after their termination or resignation from your company:

- Name and job title

- Residential and/or mailing address

- Social security number (SSN)

- Payment schedule

- Hourly pay rate

- Employee classification

- Regular and overtime earnings for each pay periods

- Gross and net wages

- Payroll deductions

- Form W-4 or W-9

How to do payroll with software in 4 steps

Using payroll software is a great option because it’s efficient, cost-effective, and comes with built-in knowledge about payroll laws and regulations. When you run payroll services with QuickBooks, you can:

- Approve timesheets from hourly employees

- Generate payroll checks

- Print paychecks with paystubs or pay employees with direct deposit

An additional advantage of these bookkeeping programs is that they automatically withhold and submit taxes at the right time. To run payroll with software, all you need to do is to follow these 4 simple steps.

Step 1: Select a payroll service

A payroll software service is a great addition to any company, but it can only take you so far. When selecting the best payroll provider for your needs, it’s important to consider ease of use, integrations, customer support, and bonus features.

11 questions to ask when considering a payroll service provider

Ultimately, any software you use needs to complete accurate calculations, understand tax guidelines, and increase efficiency within your company. Try asking the payroll company or service provider you’re considering these questions to determine if they’re the right fit.

- What accounting services do you offer?

- Do you offer anything that your competitors don’t?

- What information would you need me to provide?

- How do you handle and protect my private information?

- When will I be able to run my first payroll?

- Are you able to share any professional references with me?

- Will I be locked in at this rate or is there a possibility that you will raise prices?

- Do you have any hidden fees or contracts?

- Will you take financial responsibility for payroll errors?

- Do you understand the unique regulations within my industry?

- What technologies do you utilize?

Step 2: Set up payroll

The process of running payroll with software mirrors the manual payroll method.

First, you need to set your company up with the IRS and obtain an EIN. Before you can process your first payroll run, you need to enter the information on your employee’s Form W-4 or Form W-9 into the software system.

Then, the program you’re using can start to run payroll calculations.

Step 3: Review payroll information

Go through your payroll to ensure that all of the information and calculations are correct. Bookkeeping software is an amazing aid, but it’s not always perfect. For example, it can’t determine if the hours submitted equate to the actual amount of hours worked—it’s up to you as the business owner to make those determinations.

Step 4: Process your first payroll run

Once your payroll software calculates employee wages and withholding amounts, hit the “run” or “send” button, and you’re done. The software will automatically pay your employees on the prescribed date. Do note that depending on the payroll provider you use and the level of service you’ve subscribed to, you may still need to pay payroll taxes yourself.

How to do payroll with an accountant in 4 steps

Once your company starts to grow, the DIY payroll accounting strategy you started out with may no longer be viable. Especially if you’re hoping to play a more active role in daily operations and client-side projects. Likewise, if compliance, efficiency, and data security are important to you, hiring an accountant or third-party payroll company may be the best option for you.

Hiring a professional accountant or an outsourced payroll service is the easiest solution, but often the most costly. You will delegate most—if not all—of the payroll responsibilities to an accounting professional. Just be sure that your accountant has all the information they need to complete payroll on schedule.

Tip: Work with a local accountant if you value flexibility and access to advice.

Step 1: Hire a qualified payroll specialist or company

Most business owners choose to hire candidates with a Bachelor’s in accounting or a related field since this role is critical to your company’s well-being. Or if you’d rather, you can work with a payroll company instead of an individual CPA.

The person you hire to help with payroll will ensure that:

- Time sheets are accurate

- Payroll deductions and taxes have been entered

- You meet federal, state, and local regulations

- Payroll is processed on schedule

Whoever you hire to fill the accounting position will need:

- Strong calculation skills

- Reliable data entry skills

- Intermediate to advanced Excel skills

- Knowledge of payroll, accounting, and the Human resources information system (HRIS)

Step 2: Obtain the necessary paperwork

Before a payroll professional can help you, you must provide all of the forms and paperwork they need. Some information they will need to do their job includes:

- Employee information. When hiring a new accountant, verify that all employee tax withholding and personal information is correct so they can send out accurate W-2s and 1099-MISCs at the end of the year. You should also include details about worker classification, hire dates, and any wage garnishment orders.

- Company information. Provide your payroll specialist with your FEIN and state tax ID if applicable. They will need this to file your taxes for you. You should also notify them if your company must adhere to any specific state or federal tax regulations.

- Form I-9: You must complete this employment eligibility verification and authorization form on or before a new hire’s first day

- Form W-4: The federal employee withholding certificate determines how much federal income tax to withhold from each paycheck by taking personal information like jobs, dependents, and filing status into account.

- State withholding form: If you own a business in a U.S. state that isn’t Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, or Wyoming, your employees may need to submit a state withholding certificate. This is essentially a W-4 at a state level.

You may need to update these documents manually if employee circumstances change.

Report anyone who is authorized to manage your payroll

The IRS requires business owners to report third-party payroll providers using Form 8655. Once you notify the IRS, they can legally:

- Pay your employees

- Prepare and deliver Form W-2

- File Forms 940 and 941

- Receive payroll and tax deposit communications

- Pay the federal government the money you owe

Step 3: Let your accountant do their job

From there, your accounting professional will calculate employee gross pay and make adjustments based on their employee classification. They will also handle all of the taxes and deductions.

Step 4: Verify that all of the information is correct

Working with a professional will likely save you a lot of headaches and reduce errors. It’s smart to check in regularly—especially when you’re first trying a service—to ensure nothing happens that could put you at risk.

Regardless of whether a third-party payroll service or a staff accountant makes a payroll error—the employer is liable for any wage loss penalties.

How does payroll work?

The payroll process includes calculating gross and net wages for each employee and gross wages for independent contractors.

You will also need to withhold any required taxes, benefits, and garnishments from employee paychecks. Once you complete those steps, you must issue timely payments by mail or direct deposit.

3 best payroll methods for businesses

Your employees depends on timely paychecks to cover essential expenses like rent or mortgages, utilities, loans, food, medications, and more. With an efficient payroll processing system, you can ensure on time payment to your employees.

This is precisely why having a reliable payroll system in place is vital to all businesses. Learning how to run payroll for your small business is crucial to help your business succeed.

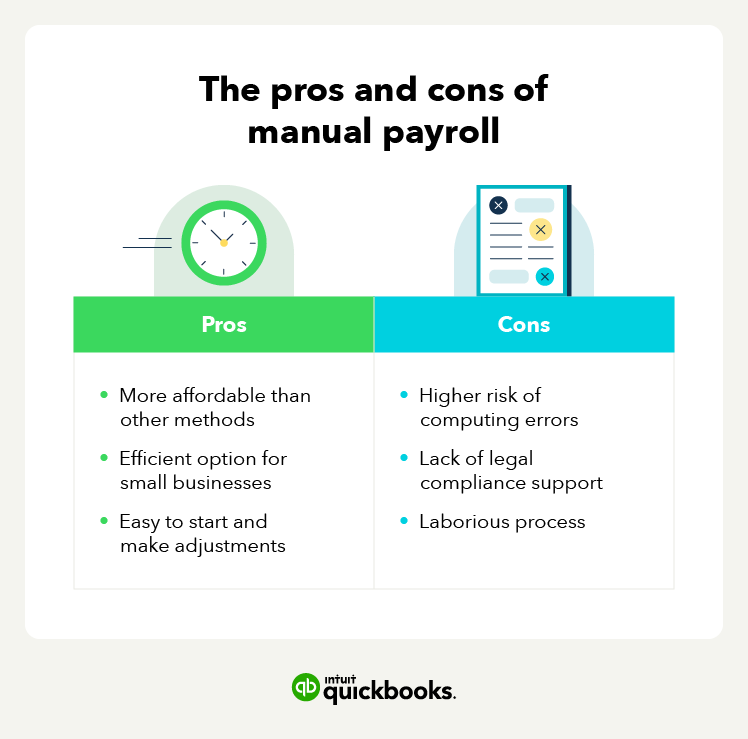

1. Manual payroll system

If you prefer to use a manual payroll system, you will need to complete the entire payroll process by hand each pay period.

“Manual payroll gives you direct oversight over your timesheets and calculations, but it’s time-consuming and there’s a good chance you can make a mistake in the process,” says Hector Garcia, who currently works as a CPA and Quickbooks consultant.

Business owners that choose to do manual payroll should ensure that employees accurately document the time they work. You will need complete and precise time cards before you can perform the necessary pay and tax calculations and hand write checks for your workers.

Pros:

- More affordable than other methods

- Efficient option for businesses with small staffs

- Easy to start and make adjustments

Cons:

- Higher risk of computing errors

- Lack of legal compliance support

- Laborious process

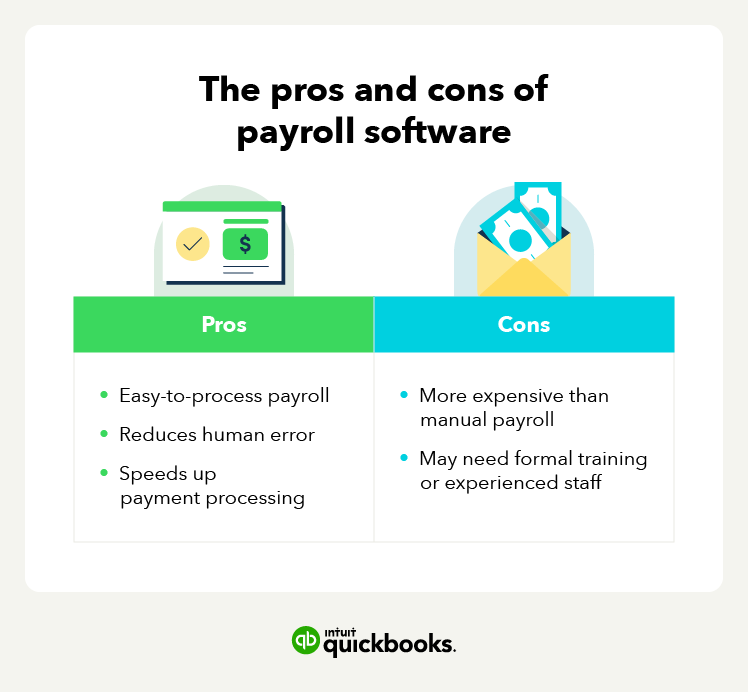

2. Payroll software

If you want to speed up the payroll process and increase accuracy, we recommend investing in payroll software.

Payroll software, like QuickBooks payroll, is designed to accurately calculate the amount you owe each employee and the government. You might experience a learning curve when you start using a new bookkeeping program, but most business owners still consider the convenience of time tracking and employee compensation automations to be a significant asset.

It’s also a good idea to utilize these programs if you need to comply with several regulations, you need to save time on payroll, or you want to speed up the process.

Pros:

- Easy-to-process payroll

- Reduces human error

- Speeds up payment processing

Cons:

- Cost investment vs manual payroll

- Time to learn how to use and run payroll solution

3. Payroll professional

Hiring a payroll company or accountant is generally the most expensive method, but professionals can be more flexible with your unique needs and can offer advice.

Working with a payroll specialist relieves some of the burden on your shoulders, allowing you to focus on tasks that you’re passionate about or need your assistance. Many payroll professionals can handle anything from collecting employee tax withholding information and setting up direct deposit to distributing pay stubs and filing taxes.

The downside to outsourcing payroll to an individual or a small company is that if staff members have concerns, they may need to wait slightly longer to get an answer.

Pros:

- Little to no payroll work for you

- Reduces incorrect calculations

- Additional knowledge about tax regulations

Cons:

- Cost investment vs manual payroll systems

- May require formal training

6 Common payroll mistakes and how to avoid them

The payroll process has a lot of moving parts and it’s easy to make mistakes. Unfortunately, since a single misstep can be detrimental to your company, it’s crucial that you are aware of common mistakes so you can deftly maneuver around them.

Problem #1: Not keeping payroll records for at least 3 years

Messy, incomplete, or missing payroll records are unacceptable to the IRS.

The FLSA mandates that employers must keep employee records for a minimum of 3 years after the individual stops working with the company. These records must include payroll information like wages, run dates, and hours worked.

Solution: Develop a recordkeeping system that works for you, whether it's paper or digital, and don’t stray from it. Organize employee files in a way that feels intuitive to you, and set aside time during the first month of each year to cull any unnecessary files.

Problem #2: Missing federal deposit deadlines

While there are specific federal tax deposit deadlines, they are generally influenced by Form 941. This form is an IRS document employers must use to report the income, medicare, and social security taxes they withheld from their staff’s paychecks.

As an employer, you will need to make either monthly or semiweekly federal payroll tax deposits. If you make monthly deposits, you must send the federal income tax, Social Security, and Medicare taxes to the government by the 15th day of each month for the previous month. For example, any taxes you owe for the month of July must be deposited by August 15th.

Solution: If you’re not using bookkeeping software or working with a professional, set up deadline reminders each month and work with a CPA to make sure everything is in order for your year-end taxes.

Problem #3: Setting up payroll incorrectly or misclassifying employees

It’s important to classify employees correctly whether they’re independent contractors, exempt employees, or non-exempt salaried staff. You need to document this correctly so the government can monitor potential violations according to the Fair Labor Standards Act (FLSA). Classification guidelines.

Solution: Verify that the correct designation and employee information is demarcated on payroll documentation before submitting. If you’re unsure, review the hiring contract to determine your agreed-upon status.

Problem #4: Miscalculating pay and overtime

Withholding the wrong amount from employee checks or paying the wrong amount altogether isn’t unheard of, especially among companies with less than 20 employees, but these errors do bring major consequences with them.

Aside from facing monetary penalties, one-fourth of all workers that receive a paycheck with errors, will start looking for a new job. Even if they don’t, when employees see the wrong amount on their paychecks, it can cause them to become disenfranchised with your company and put less effort into their daily tasks.

Common payroll miscalculations include:

- Overpaying or underpaying staff

- Missing a new hire’s first paycheck

- Taking out the wrong amount for payroll deductions

Solution: Always review employee tax withholding forms and verify timesheet and payment information before running payroll. You should also check for things that could affect pay like break times and overtime.

Problem #5: Running payroll late

If you run payroll late, your company may be penalized and you could be charged interest on the missing payments. Interest rates usually range from 3 to 6%. Unless you’re completely tapped out, do everything you can to avoid the Form 941 late filing penalty.

Solution: Start reviewing timesheets for the previous week as soon as you can to give yourself enough time to approve hours and fix mistakes, especially if you run payroll mid-week. If you can’t remember to prioritize this, set up alerts on your phone and calendar.

Problem #6: Inaccurately reporting taxable compensation

Fringe benefits are becoming increasingly popular and may include things like employee stock purchasing, discounts, and travel rewards—which are all taxable forms of compensation. If you fail to report these benefits, the IRS may fine you.

Solution: Avoid unpaid payroll tax penalties by sending in complete wage and tax reporting forms well before the deadline to avoid financial penalties, back taxes interest, property liens, civil sanctions, or jail. The government considers taxable compensation to include wages, Social security, Medicare, FICA, and any pre-tax or statutory benefits.

Payroll software solutions and tips to reduce payroll costs

Payroll expenses have historically been one of the highest costs to business owners. Fortunately, if you follow these steps, you can reduce your expenses, even if you’re currently overstaffed.

- Avoid payroll tax penalties

- Pay for time worked, not time scheduled

- Cross-train employees to minimize overstaffing

- Use an accountable plan to reimburse employees

- Offer fringe benefits

- Automate payroll

- Outsource menial tasks

- Implement a professional software solution

“Payroll software that integrates with your accounting system, typically, is the best of both worlds, giving you complete control over the process and the ability to automate some or most of the compliance components,” says Garcia.

Staying on top of your payroll is one of the greatest favors you can do for yourself and your business. Whether you choose to do it manually, with smart software like QuickBooks, or with an outsourced professional, tackle your payroll with confidence. For more helpful information like this, visit QuickBooks’ YouTube channel.