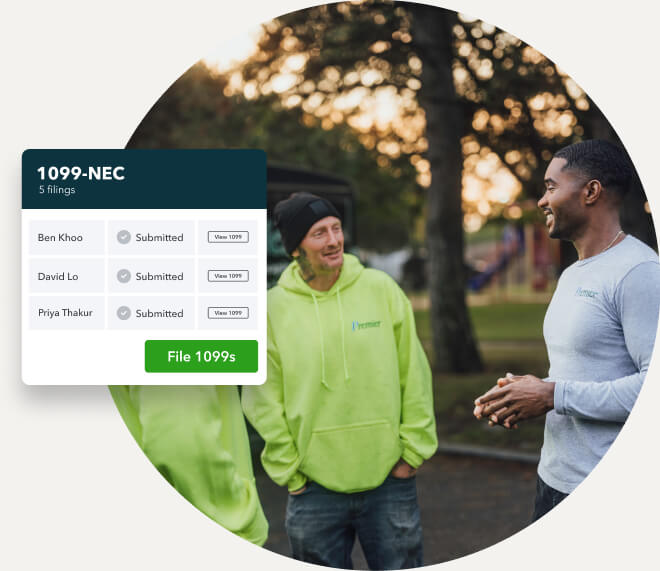

Stay ready for tax time

Hands-off tax prep

We’ll automatically generate and e-file 1099s to the IRS for you.

Send unlimited 1099s

E-file as many 1099-NEC or 1099-MISC forms as you want.**

Stay organized

Your 1099s are recorded and easy to categorize.

How to file 1099's online

Pick a QuickBooks plan

Explore our plans to find the right solution for your business: Contractor Payments, Contractor Payments + Simple Start, or Payroll Core.

We’ll help complete current 1099s

QuickBooks automatically completes 1099s and sends digital copies to your team.

E-file with the IRS

When it’s time to file, your 1099 will be ready to e-file in only a few steps.

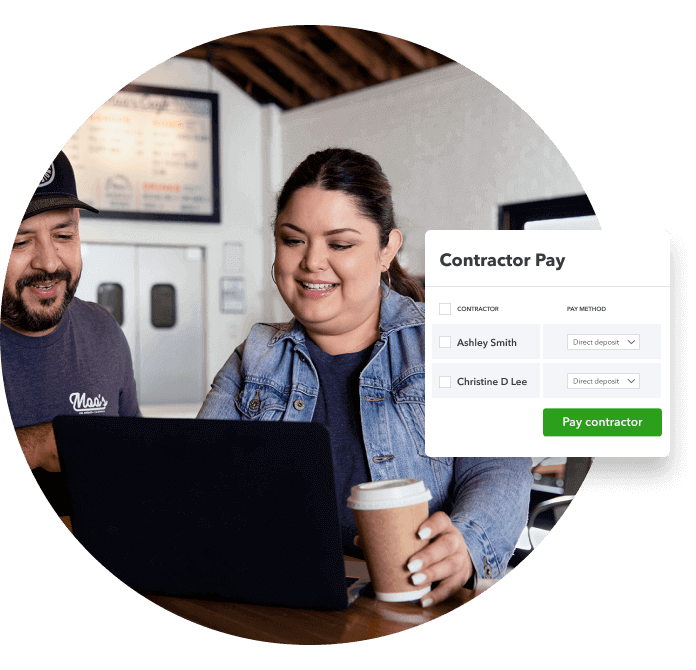

Pay contractors and e-file 1099s

With QuickBooks Contractor Payments, you can create and e-file 1099s and pay contractors with next-day direct deposit.**

Need to pay employees, too?

Pay your whole team, e-file 1099s, get payroll taxes done for you, and offer employee benefits with QuickBooks Payroll.

Pick the plan that’s right for you

Pay contractors and e-file 1099s

Pay employees, too

Contractor Payments

Pay contractors fast, e-file 1099s, and stay ready for tax time.

Take care of payday

Pay contractors

Send unlimited payments to your contractors.

Next-day direct deposit

Pay contractors with next-day direct deposit.

E-file unlimited 1099s

Create and e-file unlimited 1099s for contractors.

Contractor self-setup

Contractors can set up a free account and complete W-9s online.

Contractor Payments + Simple Start

Pay contractors fast, e-file 1099s, and manage your books in one place.

Take care of payday

Pay contractors

Send unlimited payments to your contractors.

Next-day direct deposit

Pay contractors with next-day direct deposit.

E-file unlimited 1099s

Create and e-file unlimited 1099s for contractors.

Contractor self-setup

Contractors can set up a free account and complete W-9s online.

Take care of your business

Track income & expenses

Securely import transactions and organize your finances automatically.

Capture & organize receipts

Snap photos of your receipts and categorize them on the go.**

Maximize tax deductions

Share your books with your accountant or export important documents.**

Invoice & accept payments

Accept credit cards and bank transfers in the invoice with QuickBooks Payments, get status updates and reminders.**

Track miles

Automatically track miles, categorize trips, and get sharable reports.**

Run general reports

Run and export reports including profit & loss, expenses, and balance sheets.*

Send estimates

Customize estimates, accept mobile signatures, see estimate status, and convert estimates into invoices.**

Track sales & sales tax

Accept credit cards anywhere, connect to e-commerce tools, and calculate taxes automatically.**

Manage 1099 contractors

Assign vendor payments to 1099 categories, see payment history, prepare and file 1099s from QuickBooks.**

Connect 1 sales channel

Connect 1 online sales channel and automatically sync with QuickBooks.

Free guided setup

A QuickBooks expert can help you set up your chart of accounts, connect your banks, and show you best practices.

NEW

OR

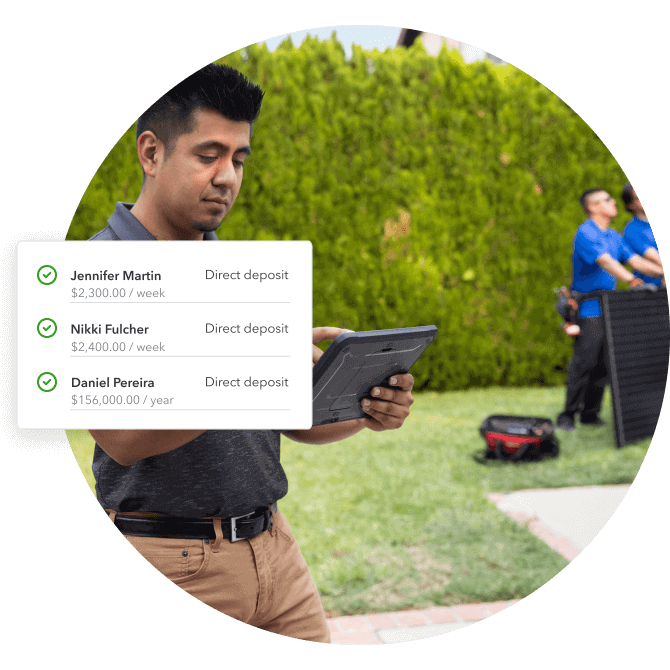

Payroll Core

Pay contractors and employees, e-file 1099s, and get payroll taxes done.

Take care of payday

Full-service payroll

We’ll calculate, file, and pay your payroll taxes for you and more.

Includes automated taxes & forms

1099 E-File & Pay

Create and e-file unlimited 1099-MISC and 1099-NEC forms.

Auto Payroll

Run Auto Payroll for salaried employees on direct deposit. Review, approve, or edit payroll before payday.**

Expert product support

Call or chat with a payroll product expert for help.

Next-day direct deposit

Offer fast direct deposit for your team.

Take care of your team

Employee financial portal

Your team can view pay stubs and W-2s in one place.

Health benefits for your team

Offer affordable medical, dental, and vision insurance packages by Allstate Health Solutions.**

401(k) plans

Access affordable retirement plans by Guideline that sync with QuickBooks Payroll.**