Run payroll in less than 5 minutes2

Worry-free taxes

We’ll calculate, file, and pay your payroll taxes for you so you’re never caught off guard.**

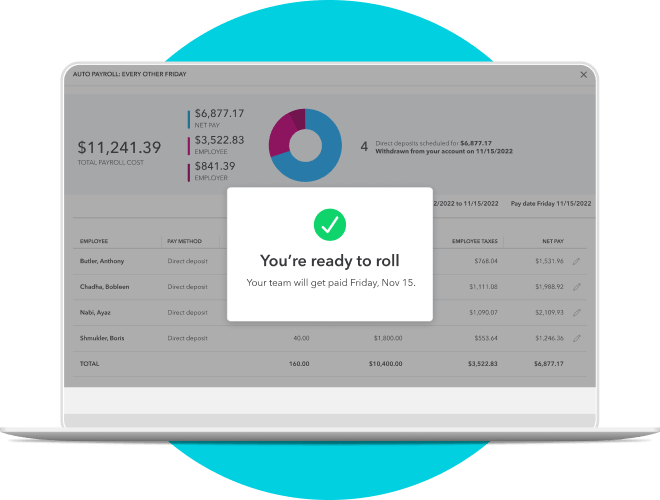

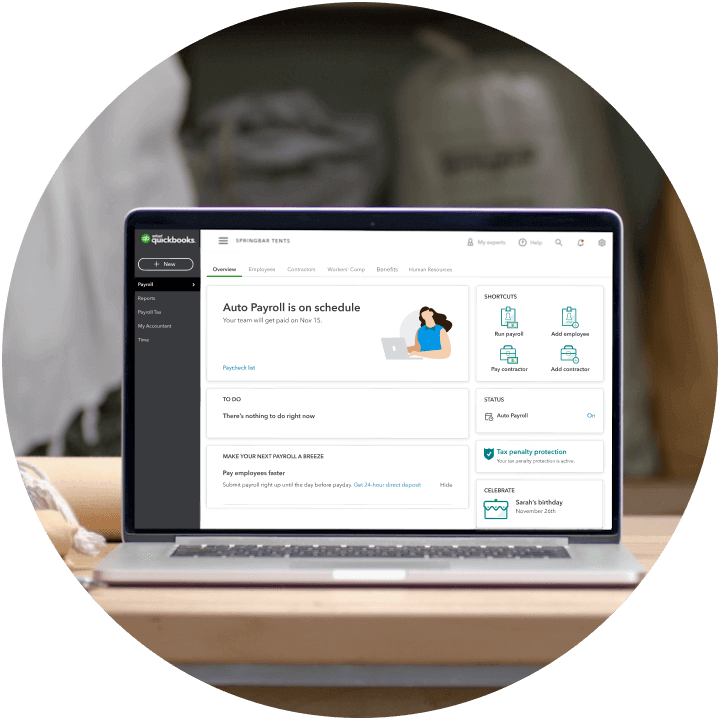

Auto Payroll

Set payroll to run automatically. You can review payroll before paychecks are sent.**

1099 E-File & Pay

Create and e-file 1099-MISC and 1099-NEC forms. Electronic copies will be automatically sent to contractors.**

Expert product support

Chat with a payroll expert for help, troubleshooting assistance, tips, and resources.**

Next-day direct deposit

Hold onto cash longer, keep your team happy, and run payroll on your schedule.**

Employee portal

Give your team access to their pay stubs, W-2s, and other important tax info anytime.**

How it works

Take a closer look at what comes with all our payroll plans so can simplify payday, retain top talent, and manage your team.

Choose a plan that’s right for you

Get payroll or bundle with accounting to help you manage your team and your business.