The tools you need to run and manage payroll for healthcare employees

Track time and create schedules

Manage multiple timesheets, approve time when you’re ready, and edit, publish, and share schedules with with your team.

Auto Payroll

Set payroll to run automatically and get notifications so you're always in control.**

Tax penalty protection

If you’re a QuickBooks Online Payroll Elite customer, we’ll resolve filing errors and pay tax penalties up to $25,000. We work directly with the IRS so that you don’t have to.

Shift-differential pay

Customize the way you pay. Set up multiple hourly rates in QuickBooks and select up to 8 rates for your team.

Workers’ comp

Help protect your team with workers’ comp powered by Next. Stay compliant and never miss a payment with automated, pay-as-you-go premiums.**

Setup made simple

Get an expert to review your payroll or have them set it up for you.** Questions? Call or access 24/7 online chat support.**

Track time and create schedules

Manage multiple timesheets, approve time when you’re ready, and edit, publish, and share schedules with with your team.

Auto Payroll

Set payroll to run automatically and get notifications so you're always in control.**

Tax penalty protection

If you’re a QuickBooks Online Payroll Elite customer, we’ll resolve filing errors and pay tax penalties up to $25,000. We work directly with the IRS so that you don’t have to.

Shift-differential pay

Customize the way you pay. Set up multiple hourly rates in QuickBooks and select up to 8 rates for your team.

Workers’ comp

Help protect your team with workers’ comp powered by Next. Stay compliant and never miss a payment with automated, pay-as-you-go premiums.**

Setup made simple

Get an expert to review your payroll or have them set it up for you.** Questions? Call or access 24/7 online chat support.**

Run and manage health care payroll

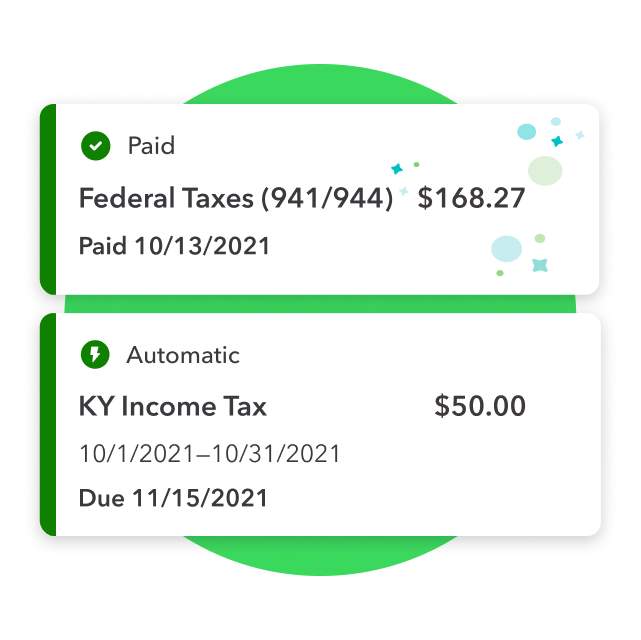

When you’re managing home health services or a doctor’s office, you need a reliable payroll system. With QuickBooks, you can run payroll when you’re ready and get accurate paychecks every time. Take advantage of automated tax payments, and we’ll file your payroll taxes for you.**

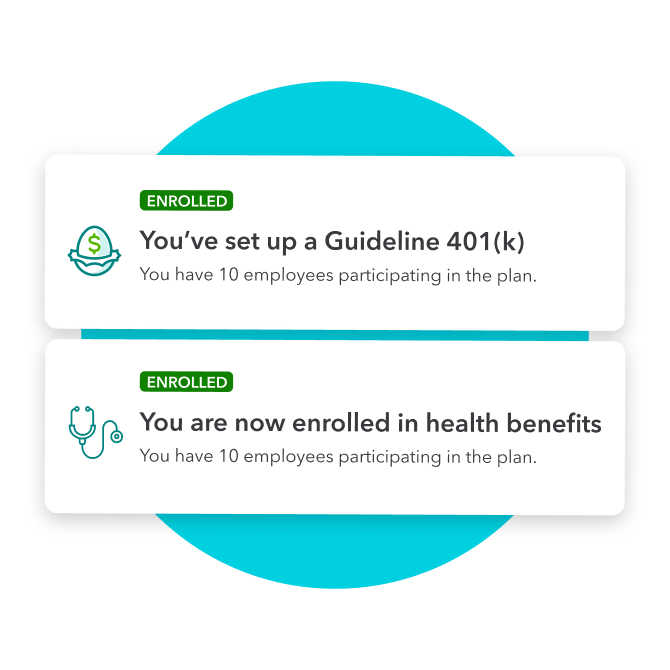

Health benefits for every budget

We’ve got you covered with affordable health and wellness benefits for your team, powered by Allstate Health Solutions. Company contributions and employee deductions are made automatically when you run payroll.**

Why use QuickBooks Payroll for health care?

Whether it’s hospice or a hospital, QuickBooks keeps your payroll on track by calculating, filing, and paying your state and federal payroll taxes automatically.** And with tax penalty protection, you can say goodbye to penalties and filing errors.