All the features you need to manage payroll

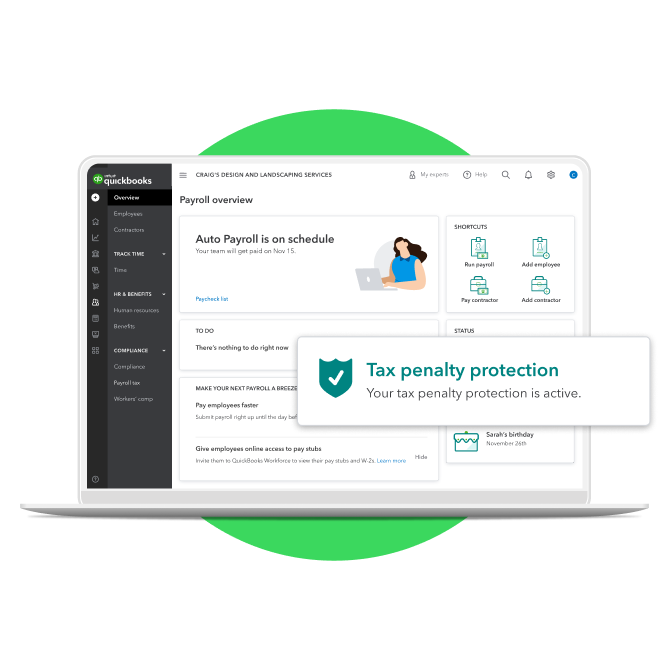

Auto Payroll

Set payroll to run automatically and get notifications so you're always in control.**

Tax penalty protection

Payroll Elite subscribers get tax penalty protection. We’ll work with the IRS to resolve filing errors and pay penalties up to $25,000. That’s coverage you won’t find anywhere else.

Payroll support

Need help, troubleshooting assistance, or tips? Call a payroll specialist or chat online.**

Payroll reports

Take a closer look at your company’s finances with over 15 customizable payroll reports. Create and download reports for cash flow, timesheet activity, and more—all from your PC.

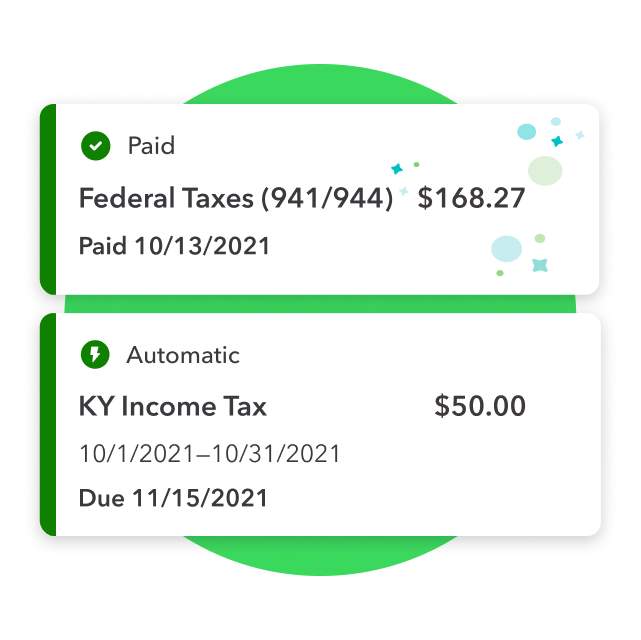

Automated taxes and forms

QuickBooks generates automatic payroll tax calculations on every paycheck and monitors and updates federal and state taxes for you. File payroll taxes yourself, or we’ll file them for you at no extra cost.

Auto Payroll

Set payroll to run automatically and get notifications so you're always in control.**

Tax penalty protection

Payroll Elite subscribers get tax penalty protection. We’ll work with the IRS to resolve filing errors and pay penalties up to $25,000. That’s coverage you won’t find anywhere else.

Payroll support

Need help, troubleshooting assistance, or tips? Call a payroll specialist or chat online.**

Payroll reports

Take a closer look at your company’s finances with over 15 customizable payroll reports. Create and download reports for cash flow, timesheet activity, and more—all from your PC.

Automated taxes and forms

QuickBooks generates automatic payroll tax calculations on every paycheck and monitors and updates federal and state taxes for you. File payroll taxes yourself, or we’ll file them for you at no extra cost.

Payroll that’s perfect for you

Small businesses face a lot of challenges. Running payroll doesn’t have to be one of them.Our payroll software for PCs saves you time by automating repetitive tasks and ensuring your payroll and taxes are accurate. QuickBooks Payroll also helps you manage timesheets, pay your team, and more.

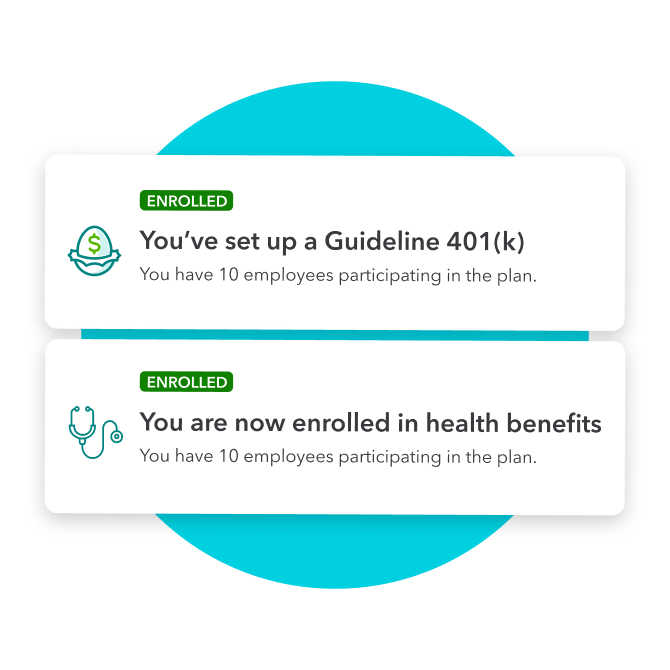

Offer employee benefits that matter

Get access to a full suite of employee services that you can manage from your account. Offer workers’ comp through Next, or access affordable health benefits through our partner, Allstate Health Solutions. Payments auto deduct with each payroll run, so you know you’re always covered.**

Why use QuickBooks Payroll for PC?

QuickBooks makes PC and Windows security number one whether you use our desktop payroll software or online payroll solution. Get multi-factor authentication and state-of-the-art encryption technologies. Avoid surprises and use powerful reporting dashboards to monitor your bank account transactions.