Reduce tasks with team hub

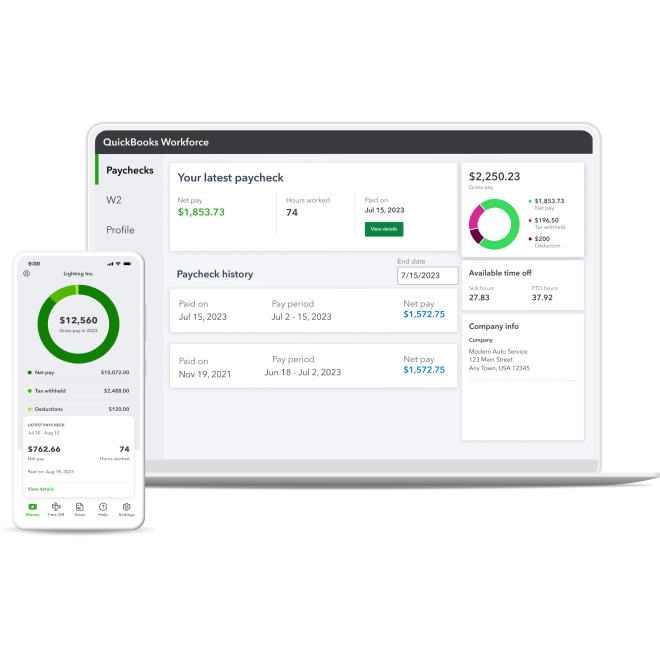

With QuickBooks Workforce, your team can view pay details and track time with a tap.**

WORKFORCE PORTAL

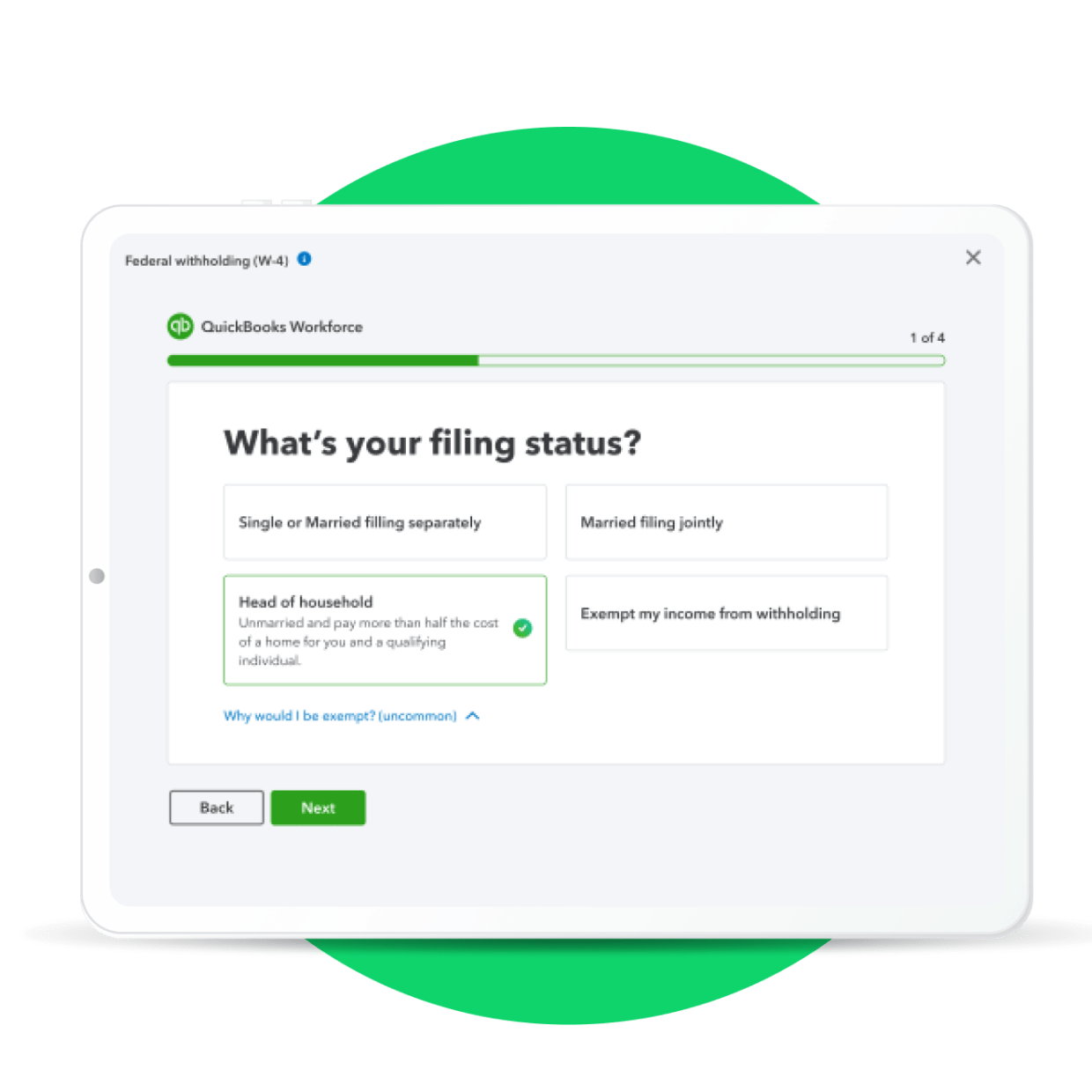

Streamline payroll setup

Employees can submit their own pay preferences, personal details, and tax info, so you can add them to your payroll without the hassle. Once set up, they can view their pay details whenever they want.

One centralized app for your team

Whether you manage payroll, time tracking, or both—see how the QuickBooks Workforce app can help you and your team increase accuracy and efficiency.

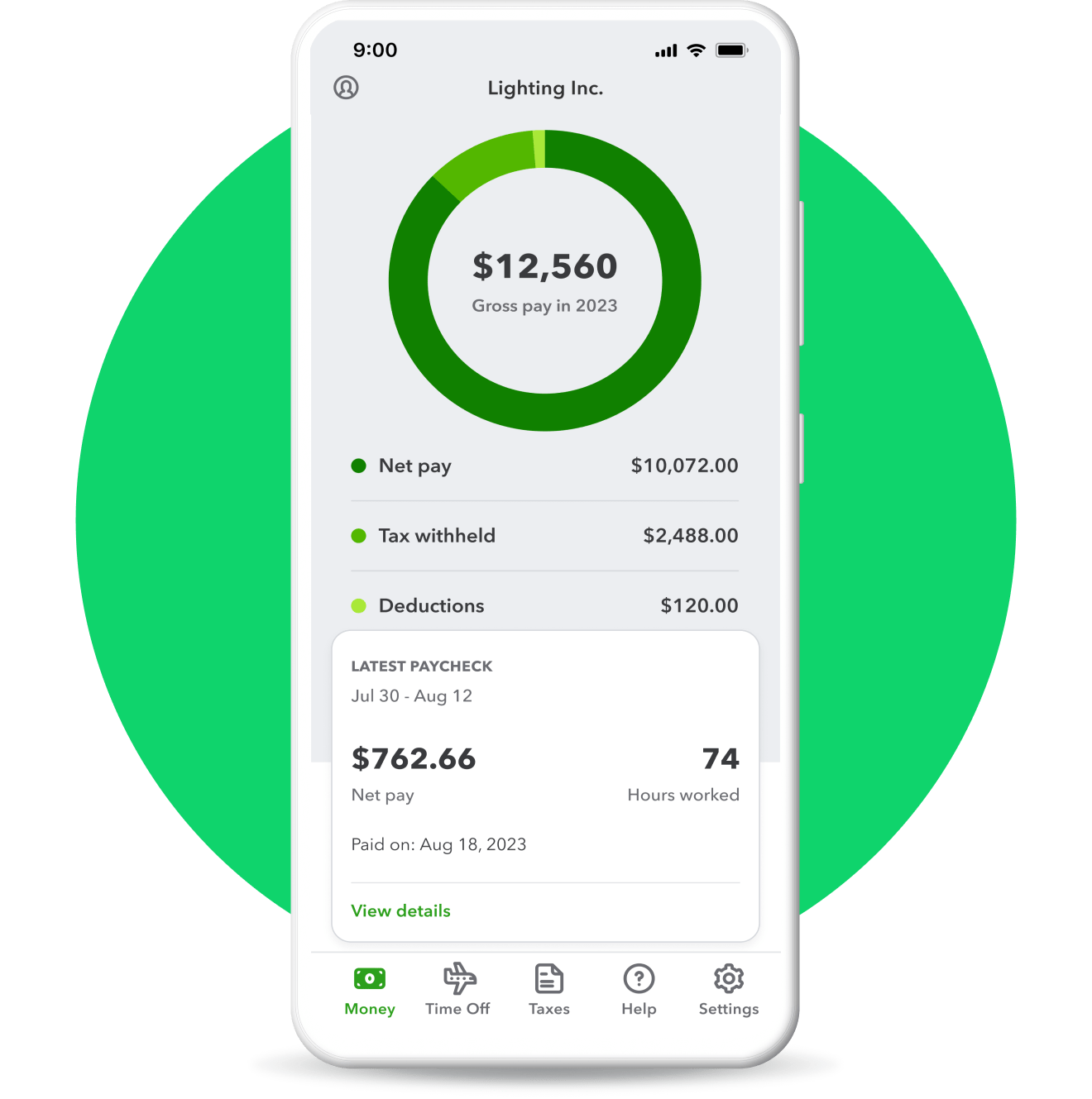

WORKFORCE MOBILE APP

Provide access to pay details

Employees can access their pay stubs, W-2s, total earnings, time off, and year-to-date pay—including deductions, withholdings, and taxes—at no cost.

Available with all QuickBooks Payroll plans.

Build your knowledge

Invite your team to add their own info in QuickBooks Workforce

Let your team to set up their account so they can view pay details, time off balances, and more.

The QuickBooks Time app is now called QuickBooks Workforce

The QuickBooks Workforce app allows your team to track time and access pay details in one place.

Frequently asked questions

The QuickBooks Workforce portal lets employees:

- Submit pay preferences, personal, and tax info, so you can quickly add them to your payroll

- Access pay stubs, W-2s, total earnings, time off, and year-to-date pay—including deductions, withholdings, and taxes

With the QuickBooks Workforce app, employees and contractors can also clock in and out, manage time off, edit timesheets, and more.**

Learn more about the QuickBooks Workforce app (formerly QuickBooks Time app), here.

See detailed instructions on how to invite your employees, here.

Employees can edit their name, address, and tax withholding. Employees won't be able to edit their bank account info, social security number, or change their address to a state that isn’t already set up in your payroll account. When an employee makes an update, we’ll send you an email so you know if there’s any action needed.

Your employees will have access for 12 months after canceling your payroll subscription. After that, access is no longer available, so be sure to tell your employees to print their documents.

Yes! QuickBooks Workforce is provided to you and your employees for free as part of your QuickBooks Payroll or QuickBooks Time subscription.

If you don't want an employee to have access any longer, visit their employee profile and select Actions. Then, select Turn off Workforce access.

Guarantees

Accuracy Guaranteed: Available with QuickBooks Online Payroll Core, Premium, and Elite. We assume responsibility for federal and state payroll filings and payments directly from your account(s) based on the data you supply. As long as the information you provide us is correct and on time, and you have sufficient funds in your account, we’ll file your tax forms and payments accurately and on time or we’ll pay the resulting payroll tax penalties. Guarantee terms and conditions are subject to change at any time without notice.

Tax penalty protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. Only QuickBooks Online Payroll Elite users are eligible to receive tax penalty protection.

*Offer terms

QuickBooks Online Free 30-day Trial Offer Terms: First thirty (30) days of subscription to the QuickBooks Products, starting from the date of enrollment is free. At the end of the free trial, you’ll automatically be charged and you’ll be charged on a monthly basis thereafter at the then-current price for the service(s) you’ve selected until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QBO customer and sign up for the monthly plan using the "Free 30-Day Trial" option. This offer can't be combined with any other QuickBooks offers. Offer available for a limited time only. To cancel your subscription at any time go to Account & Settings in QBO and select "Cancel." Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Discount Offer Terms: Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. If you upgrade or downgrade to a different subscription, the price will change to the then current list price for such relevant subscription. Sales tax may be applied where applicable. This offer can’t be combined with any other QuickBooks offers. Offer only available for a limited time and to new QuickBooks customers.

QuickBooks Online Payroll terms: Each employee (active or on paid leave) is an additional $6.50/month for Core, $10/month for Premium, and $12/month for Elite. Contractor payments via direct deposit are $6.50/month for Core, $10/month for Premium, and $12/month for Elite. The service includes 1 state filing. If your business requires tax calculation and/or filing in more than one state, each additional state is $12/month for Core and Premium. There is no charge for state tax calculation or filing for Elite. The discounts do not apply to additional employees and state tax filing fees.

Cancellation: To cancel your QuickBooks Products subscription at any time go to Account & Settings in QuickBooks and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period.

**Features

HR services: HR support is provided by experts at Mineral, Inc. Requires acceptance of Mineral’s Privacy Policy and Terms of Service . HR support center is available only to QuickBooks Online Premium and Elite subscriptions. HR advisor support is only available in QuickBooks Online Payroll Elite. HR support is not available to accountants who are calling on behalf of their clients.

Same-day direct deposit: Available to QuickBooks Online Payroll Premium and Elite users only. Payroll processed before 7 AM PT shall arrive the same business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. May be subject to eligibility criteria. Deposit delays may vary because of third party delays, risk reviews, or issues beyond Intuit’s control. Available only for employees, not available for contractors.

Automated tax payments and filings: Automated tax payments and filing available for state and federal taxes. Enrollment in e-services is required for tax payments and filings only. Automated tax payments and filings for local taxes available in QuickBooks Online Payroll Premium and Elite only.

Auto Payroll: Available if setup for the company is complete. At least one employee has completed setup and has consistent payroll that qualifies for automation (i.e. salaried or hourly with default). Company must complete bank verification if an employee has direct deposit as the payment method, and the first payroll must run successfully. The account must not have a hold.

QuickBooks Time: Time tracking included in the QuickBooks Online Payroll Premium and Elite subscription services. Features vary. The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Expert setup: Available to QuickBooks Online Payroll Elite users only.

Automated 1099 e-file & delivery: Prepare your 1099s in QuickBooks at no extra charge. If you choose the 1099 E-File Service, Intuit will e-file your Federal 1099 information with the IRS, and then print and mail a copy directly to your contractors; fees apply. As part of the paid 1099 E-File Service, we also give your contractors online access to their 1099s. State filing not included. You should check with your state agency on any state filing requirements.

Workers’ comp administration: Benefits are powered by NEXT Insurance and require acceptance of NEXT Insurance's Privacy Policy and Terms of Use. Additional fees will apply. There is a monthly fee (currently, $5 per month) for QuickBooks Online Payroll Core users for the QuickBooks Workers' Comp Payment Service. This non-refundable fee will be automatically added to each monthly Intuit invoice at the then-current price until you cancel. The fee is separate from any workers’ comp insurance policy premium by NEXT Insurance. Workers’ Compensation Service requires an active and paid QuickBooks payroll subscription. Eligibility criteria applies to transfer active insurance policy broker of record, including insurance carrier, policy renewal date, and payment method. Workers compensation insurance is not available in OH, ND, WA and WY.

Health benefits: Health Insurance benefits are provided by Intuit Insurance Services Inc., a licensed insurance broker, through a partnership with Allstate Health Solutions. Requires acceptance of Allstate's Terms of use and privacy policy. Intuit Insurance Services is owned and operated by Intuit Inc. and is paid a percentage fee of insurance policy premiums by Allstate Health Solutions in connection with the services described on this page.

#Claims

1 QuickBooks Payroll is the #1 online payroll service provider for small businesses: Based on the overall number of customers for QuickBooks payroll products as of 06/2025.

2 We help 1.4 million businesses do payroll and file taxes: Based on overall number of customers for QuickBooks Payroll products as of 8/2021.

Run payroll in 5 minutes: 5 minute time period based on median time spent by Payroll users reviewing and approving payroll as of September 2021.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Call Sales: 1-888-857-3710

© 2026 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For details about our money transmission licenses, or for Texas customers with complaints about our service, please click here.

By accessing and using this page you agree to the Website Terms of Service.