Manage time and projects in one place

Manage timesheets, collaborate with your team, and keep projects on track with QuickBooks Time Elite.

Boost profits with smart technology

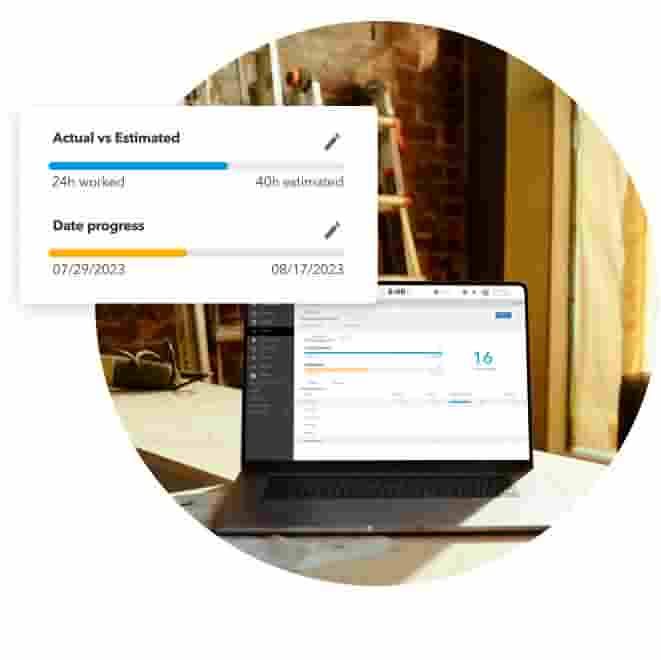

Oversee team productivity and project status, adjust budgets, deadlines, and resources, and increase billable time by over 10%.¹

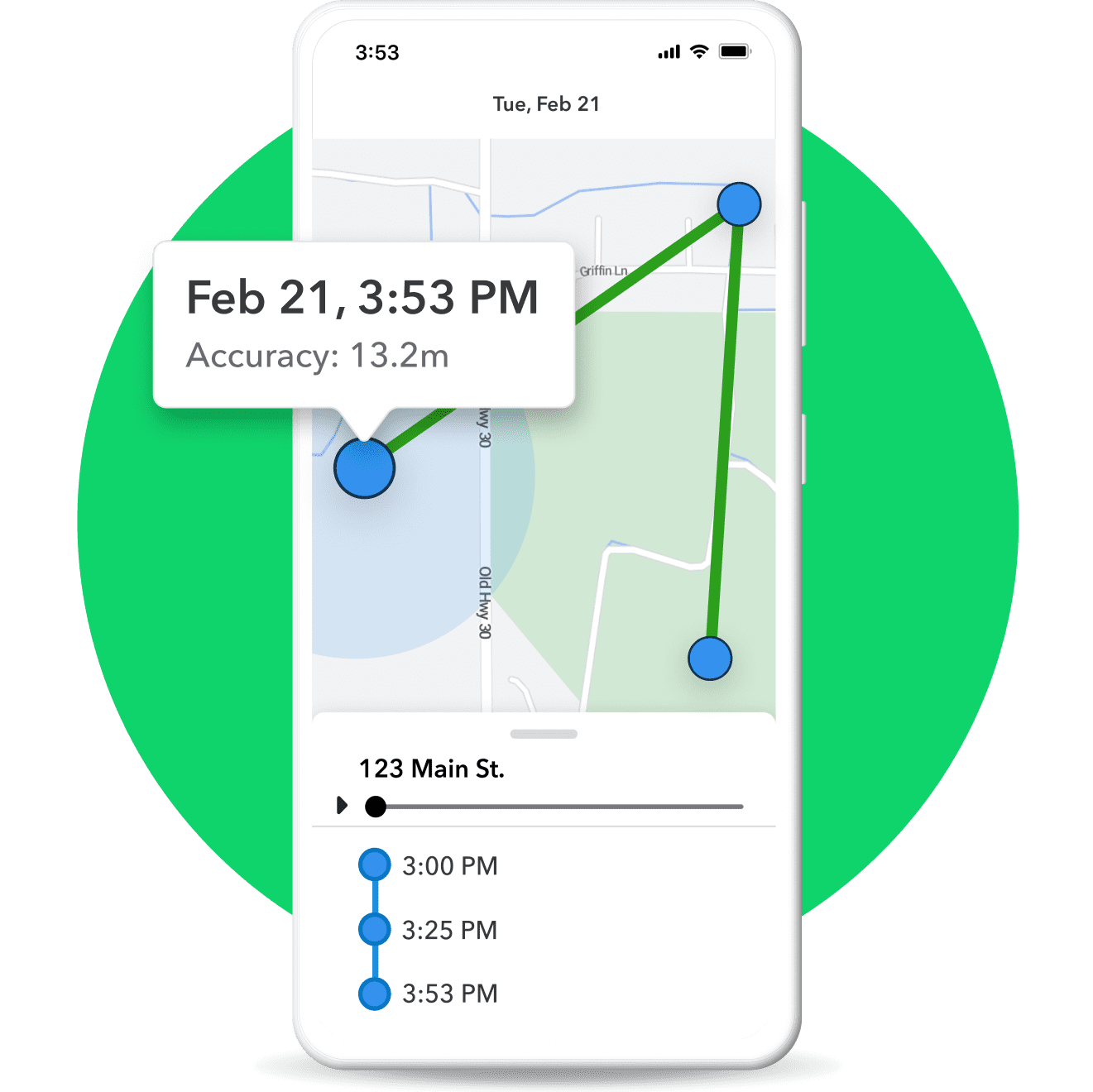

Employees will get a reminder to clock in or out every time they enter or leave a job site, minimizing timesheet errors and edits. You’ll also be able to see who’s working and where.**

Always know what’s going on with a clear view of project progress. Share next steps, add photos and updates to an activity feed, and get updates from your team as projects progress.**

Your team can track mileage right from their phone, plus GPS technology shows you how far they travel while on the clock. Accurate mileage helps simplify tax filing and expense management.**

Find the plan that's right for you

A QuickBooks Online account is required to use QuickBooks Time. New to QuickBooks? See plans & pricing

Time Elite

Payroll Elite

Guarantees

Accuracy Guaranteed: Available with QuickBooks Online Payroll Core, Premium, and Elite. We assume responsibility for federal and state payroll filings and payments directly from your account(s) based on the data you supply. As long as the information you provide us is correct and on time, and you have sufficient funds in your account, we’ll file your tax forms and payments accurately and on time or we’ll pay the resulting payroll tax penalties. Guarantee terms and conditions are subject to change at any time without notice.

Tax penalty protection: Only QuickBooks Online Payroll Elite users are eligible to receive the tax penalty protection. If you receive a tax notice and send it to us within 15 days of the tax notice, we will cover the payroll tax penalty, up to $25,000. Intuit cannot help resolve notices for customers in Collections with the IRS because IRS Collections will only work with businesses directly. Additional conditions and restrictions apply. Learn more about tax penalty protection.

*Limited time offer terms

QuickBooks products: Offer available for QuickBooks Online and/or QuickBooks Online Payroll Core, Premium, or Elite (collectively, the “QuickBooks Products”). The offer includes either a free trial for 30 days (“Free Trial for 30 Days”) or a discount for 3 months of service (“Discount”) (collectively, the “QuickBooks Offer”). QuickBooks Live Bookkeeping is not included in the QuickBooks Offer.

QuickBooks Live Expert Assisted Free 30-day Trial Offer Terms: Access an expert when you add the thirty (30) day trial of QuickBooks Live Expert Assisted services (“Live Expert Assisted”) to your purchase of QuickBooks Online Simple Start, Essentials, Plus, or Advanced (“QBO”) subscription. You must be a new QBO customer to be eligible. To continue using Expert Assisted after your 30-day trial, you’ll be asked to present a valid credit card for authorization, and you’ll be charged on a monthly basis at the then-current fee until you cancel. Sales tax may be applied where applicable. To cancel your Expert Assisted subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a prorated refund; your access and subscription benefits will continue for the remainder of the billing period.

Expert Assisted is a monthly subscription service that requires a QBO subscription and provides expert help to answer your questions related to the books that you maintain full ownership and control. An expert can guide you through QBO setup and answer questions based on the information you provide; some bookkeeping services may not be included and determined by the expert. For more information about Expert Assisted, refer to the QuickBooks Terms of Service.

QuickBooks Online Live Expert Assisted Discount Offer Terms: Discount applied to the first 3 months of Expert Assisted, starting from the date of enrollment, followed by the then-current monthly Expert Assisted list price with your QuickBooks Online Simple Start, Essentials, Plus or Advanced (“QBO”) subscription. Your account will automatically be charged on a monthly basis until you cancel. Sales tax may be applied where applicable. To be eligible for this offer you must be an active QBO customer, new to Expert Assisted and sign up for the Expert Assisted monthly plan by calling sales at 1-800-816-4611. Offer available for a limited time only. To cancel your Live Expert Assisted subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Online Free 30-day Trial Offer Terms: First thirty (30) days of subscription to the QuickBooks Products, starting from the date of enrollment is free. At the end of the free trial, you’ll automatically be charged and you’ll be charged on a monthly basis thereafter at the then-current price for the service(s) you’ve selected until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QBO customer and sign up for the monthly plan using the "Free 30-Day Trial" option. This offer can't be combined with any other QuickBooks offers. Offer available for a limited time only. To cancel your subscription at any time go to Account & Settings in QBO and select "Cancel." Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Discount offer: Discount applied to the monthly price for the QuickBooks Products is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly list price. To be eligible for this offer you must be a new QuickBooks customer and sign up for the monthly plan using the “Buy Now” option.

*Offer terms

Offer terms: Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. This offer can’t be combined with any other QuickBooks offers. Offer only available for a limited time and to new QuickBooks customers. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Cancellation: To cancel your QuickBooks Products subscription at any time go to Account & Settings in QuickBooks and select “Cancel.” Your QuickBooks Online cancellation will become effective at the end of the monthly billing period. The QuickBooks Online Payroll subscription will terminate immediately upon cancellation.You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period.

QuickBooks Online Payroll terms: Each employee is an additional $6.50 /month for Core, $10 /month for Premium, and $12 /month for Elite. Contractor payments via direct deposit are $6.50 /month for Core, $10 /month for Premium, and $12 /month for Elite. The service includes 1 state filing. If you file taxes in more than one state, each additional state is $12/month for only Core and Premium. There is no additional charge for additional state tax filings in Elite. The discounts do not apply to additional employees and state tax filing fees.

QuickBooks Live Expert Guided Setup: The QuickBooks Live Expert Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Expert Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Expert Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

**Features

Project estimates vs actuals reporting: Available in QuickBooks Time Elite only.

Project activity feed: Available in QuickBooks Time Elite only.

Track project progress: Available in QuickBooks Time Elite only.

Timesheet signatures: Available in QuickBooks Time Elite only.

Mileage tracking: Available in QuickBooks Time Elite only. Optional feature. User must be clocked-in on a mobile device. Location settings must be enabled and set to "Precise Location" or "High Accuracy." GPS and turn by turn navigation required for accuracy purposes.

GPS tracking: QuickBooks Workforce Time mobile app allows users to share their location data while they are on the clock. Cell service required for GPS points accuracy. The QuickBooks Workforce mobile app Time does not save GPS points for users when they are off the clock. Account admins may require users to set their location settings to “Always” in order to clock-in and track time using the QuickBooks Workforce mobile app.

Geofencing: Available in QuickBooks Time Elite only. Optional feature. Account admins may require users to set their location settings to “Always” in order to clock-in and track time using the QuickBooks WorkforceTime mobile app. Pre-set up required. QuickBooks Time requests GPS points for users when they are off the clock to determine if users have entered a geofence. The QuickBooks Workforce mobile appTime does not save GPS points on its servers and they remain on the user's device. Admins do not have access to employee location data when workers are off the clock. Additional terms and fees may apply.

Unlimited live customer support: Phone and chat support is included with your paid subscription to QuickBooks Time Premium and Elite. Your subscription must be current. Time and days vary based on subscription. Intuit reserves the right to limit the length of the call. Terms conditions, features, pricing, service and support availability are subject to change without notice.

QuickBooks integration: QuickBooks Time integrates with QuickBooks Online ("QBO"), QuickBooks Online Payroll ("Payroll") and QuickBooks Desktop ("Desktop"). Requires an active QBO, Payroll or Desktop account. Additional terms, conditions and fees may apply.

Track time on any device: QuickBooks Workforce can be used on any device that has an internet connection and a web browser. QuickBooks Workforce is also available in the Apple App Store and Google Play Store.

Time Clock Kiosk: QuickBooks Time punch time clock works on any tablet, desktop, or laptop with an internet connection. Not designed to work on mobile devices.

QuickBooks Time integration: Additional fees may apply. Time tracking included in the QuickBooks Online Payroll Premium and Elite subscription services. Features vary. The QuickBooks WorkforceTime mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Streamlined payroll and invoicing: QuickBooks Time directly integrates with several payroll software platforms. Additional fees apply.

Export data efficiently: QuickBooks Time directly integrates with several payroll software platforms. Additional fees apply.

Time-off management: Compliance with applicable laws is the responsibility of the business. This feature is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business.

DCAA Compliance: Compliance with applicable laws is the responsibility of the business. This feature is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business.

Overtime alerts: Automated overtime identifies potentially incorrect overtime hours based on current laws and regulations; business owners have full control and can decline this suggestion in product. Compliance with application laws is the responsibility of the business. This feature is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business.

Workforce mobile app: The QuickBooks Workforce mobile companion apps work with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Workforce mobile access is included with your QuickBooks Time subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

QuickBooks Live Expert Assisted: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live bookkeeper. The Live bookkeeper will provide help based on the information you provide.

QuickBooks Live Expert Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Expert Cleanup and QuickBooks Live Expert Full-Service Bookkeeping.

Automated tax payments and filings: Automated tax payments and filing available for state and federal taxes. Enrollment in e-services is required for tax payments and filings only. Automated tax payments and filings for local taxes available in QuickBooks Online Payroll Premium and Elite only.

Health benefits: Health Insurance benefits are provided by Intuit Insurance Services Inc., a licensed insurance broker, through a partnership with Allstate Health Solutions. Requires acceptance of Allstate's Terms of Use and Privacy Policy. Intuit Insurance Services is owned and operated by Intuit Inc. and is paid a percentage fee of insurance policy premiums by Allstate Health Solutions in connection with the services described on this page.

Unlimited 1099 e-file: Create and e-file unlimited 1099-MISC and 1099-NEC forms in QuickBooks. 1099 forms are e-filed only for the current filing year and for payments recorded in QuickBooks to your vendors or contractors. Includes state filings for eligible states participating in IRS Combined Federal/State Filing program; please check with your state agency on any additional state filing requirements. Additional fees may apply to print and mail a copy to your vendors and contractors and to other upgrades or add-on services.

Expert product support: Included with your paid subscription to QuickBooks Online Payroll. Chat support available 24/7. U.S. based phone support is available Monday through Friday 6 AM to 6 PM PT and Saturday 6 AM to 3 PM PT. Your subscription must be current. Get more information on how to contact support. Intuit reserves the right to limit the length of the call. Terms, conditions, features, pricing, service and support are subject to change without notice.

Next-day direct deposit: Payroll processed before 5 PM PT the day before shall arrive the next business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. May be subject to eligibility criteria. Deposit delays may occur because of third party delays, risk reviews, or issues beyond Intuit’s control. Available for contractors for an additional fee.

Same-day direct deposit: Available to QuickBooks Online Payroll Premium and Elite users. Payroll processed before 7 AM PT shall arrive the same business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. Same-day direct deposit may be subject to eligibility criteria. Deposit delays may vary because of third party delays, risk reviews, or issues beyond Intuit’s control. Same-day direct deposit available only for employees.

Workers’ comp administration: Benefits are powered by NEXT Insurance and require acceptance of NEXT Insurance's Privacy Policy and Terms of Use. Additional fees will apply. There is a monthly fee (currently, $5 per month) for QuickBooks Online Payroll Core users for the QuickBooks Workers' Comp Payment Service. This non-refundable fee will be automatically added to each monthly Intuit invoice at the then-current price until you cancel. The fee is separate from any workers’ comp insurance policy premium by NEXT Insurance. Workers’ Compensation Service requires an active and paid QuickBooks payroll subscription. Eligibility criteria applies to transfer active insurance policy broker of record, including insurance carrier, policy renewal date, and payment method. Workers compensation insurance is not available in OH, ND, WA and WY.

HR services: HR support is provided by experts at Mineral, Inc. Requires acceptance of Mineral’s Privacy Policy and Terms of Service. HR support center is available only to QuickBooks Online Premium and Elite subscriptions. HR advisor support is only available in QuickBooks Online Payroll Elite. HR support is not available to accountants who are calling on behalf of their clients.

Expert review: Available upon request for QuickBooks Online Payroll Premium and Elite.

QuickBooks Time Mobile: The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Expert setup: Available to QuickBooks Online Payroll Elite users only.

24/7 expert product support: 24/7 customer support is included with your paid subscription to QuickBooks Online Payroll Premium and Elite. Chat support available 24/7. U.S. based phone support is available Monday through Friday 6 AM to 6 PM PT and Saturday 6 AM to 3 PM PT. Non-US based phone support is available Monday through Friday 6 PM to 6 AM PT, on Saturday 3 PM to 6 AM PT and on Sundays. Your subscription must be current. Intuit reserves the right to limit the length of the call. Terms, conditions, features, pricing, service, and support are subject to change without notice.

Garnishments and deductions: Available for employees only. User is responsible for setting the garnishment amount and making the garnishment payment to the appropriate entity.

QuickBooks Workforce: Available to employees. Requires an Intuit Account and acceptance of the Intuit Terms of Service and Privacy Statement.

**Product information

Phone support: For hours of support and how to contact support, see here.

System Requirement: The QuickBooks Workforce mobile app requires a computer or a device with a supported Internet browser and an Internet connection (a high-speed connection is recommended). The QuickBooks Workforce mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. The QuickBooks Workforce mobile access is included with your QuickBooks Time subscription.

#Claims

1 Add over 10% more billable time to your invoices with QuickBooks Time: Based on a survey of 595 customers in the U.S. in January 2023. On average, businesses that report an increase in billable time added 10.06%.

2 Over 100,000 5-star reviews: Based on number of reviews collected in December 2022 across IOS and Android for time tracking.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Need a plan that also includes payroll?

See which payroll plans come with time tracking.

Frequently asked questions

Yes. QuickBooks Time Elite is included with QuickBooks Payroll Elite. See all plans

Tracking projects can help you save time and add over 10% more billable time to your invoices.¹

Talk to sales

Give us a call if you need help picking a QuickBooks product.

Call 1-888-836-2720

Mon-Fri, 5 AM to 6 PM PT

Visit our support hub

Find help articles, video tutorials, and connect with other businesses in our online community.

Get time tracking with over 100,000 five-star reviews²

Guarantees

Accuracy Guaranteed: Available with QuickBooks Online Payroll Core, Premium, and Elite. We assume responsibility for federal and state payroll filings and payments directly from your account(s) based on the data you supply. As long as the information you provide us is correct and on time, and you have sufficient funds in your account, we’ll file your tax forms and payments accurately and on time or we’ll pay the resulting payroll tax penalties. Guarantee terms and conditions are subject to change at any time without notice.

Tax penalty protection: Only QuickBooks Online Payroll Elite users are eligible to receive the tax penalty protection. If you receive a tax notice and send it to us within 15 days of the tax notice, we will cover the payroll tax penalty, up to $25,000. Intuit cannot help resolve notices for customers in Collections with the IRS because IRS Collections will only work with businesses directly. Additional conditions and restrictions apply. Learn more about tax penalty protection.

*Limited time offer terms

QuickBooks Online Discount Offer Terms: Discount applied to the monthly price for QuickBooks Online (“QBO”) is for the first 3 months of service, starting from the date of enrollment, followed by the then-current [monthly/annual] list price. Available only for QuickBooks Online, QuickBooks Payroll, QuickBooks Time, and QuickBooks Solopreneur (all tiers). Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QBO customer and sign up for the monthly plan using the “Buy Now” option. This offer can't be combined with any other QuickBooks offers. Offer available for a limited time only. To cancel your subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Live Expert Assisted Free 30-day Trial Offer Terms: Access an expert when you add the thirty (30) day trial of QuickBooks Live Expert Assisted services (“Live Expert Assisted”) to your purchase of QuickBooks Online Simple Start, Essentials, Plus, or Advanced (“QBO”) subscription. You must be a new QBO customer to be eligible. To continue using Expert Assisted after your 30-day trial, you’ll be asked to present a valid credit card for authorization, and you’ll be charged on a monthly basis at the then-current fee until you cancel. Sales tax may be applied where applicable. To cancel your Expert Assisted subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a prorated refund; your access and subscription benefits will continue for the remainder of the billing period.

Expert Assisted is a monthly subscription service that requires a QBO subscription and provides expert help to answer your questions related to the books that you maintain full ownership and control. An expert can guide you through QBO setup and answer questions based on the information you provide; some bookkeeping services may not be included and determined by the expert. For more information about Expert Assisted, refer to the QuickBooks Terms of Service.

QuickBooks Online Live Expert Assisted Discount Offer Terms: Discount applied to the first 3 months of Expert Assisted, starting from the date of enrollment, followed by the then-current monthly Expert Assisted list price with your QuickBooks Online Simple Start, Essentials, Plus or Advanced (“QBO”) subscription. Your account will automatically be charged on a monthly basis until you cancel. Sales tax may be applied where applicable. To be eligible for this offer you must be an active QBO customer, new to Expert Assisted and sign up for the Expert Assisted monthly plan by calling sales at 1-800-816-4611. Offer available for a limited time only. To cancel your Live Expert Assisted subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Online Free 30-day Trial Offer Terms: First thirty (30) days of subscription to the QuickBooks Products, starting from the date of enrollment is free. At the end of the free trial, you’ll automatically be charged and you’ll be charged on a monthly basis thereafter at the then-current price for the service(s) you’ve selected until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QBO customer and sign up for the monthly plan using the "Free 30-Day Trial" option. This offer can't be combined with any other QuickBooks offers. Offer available for a limited time only. To cancel your subscription at any time go to Account & Settings in QBO and select "Cancel." Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Discount offer: Discount applied to the monthly price for the QuickBooks Products is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly list price. To be eligible for this offer you must be a new QuickBooks customer and sign up for the monthly plan using the “Buy Now” option.

*Offer terms

Offer terms: Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. This offer can’t be combined with any other QuickBooks offers. Offer only available for a limited time and to new QuickBooks customers. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Cancellation: To cancel your QuickBooks Products subscription at any time go to Account & Settings in QuickBooks and select “Cancel.” Your QuickBooks Online cancellation will become effective at the end of the monthly billing period. The QuickBooks Online Payroll subscription will terminate immediately upon cancellation.You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period.

QuickBooks Online Payroll terms: Each employee is an additional $6.50 /month for Core, $10 /month for Premium, and $12 /month for Elite. Contractor payments via direct deposit are $6.50 /month for Core, $10 /month for Premium, and $12 /month for Elite. The service includes 1 state filing. If you file taxes in more than one state, each additional state is $12/month for only Core and Premium. There is no additional charge for additional state tax filings in Elite. The discounts do not apply to additional employees and state tax filing fees.

QuickBooks Live Expert Guided Setup: The QuickBooks Live Expert Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Expert Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Expert Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

**Features

Project estimates vs actuals reporting: Available in QuickBooks Time Elite only.

Project activity feed: Available in QuickBooks Time Elite only.

Track project progress: Available in QuickBooks Time Elite only.

Timesheet signatures: Available in QuickBooks Time Elite only.

Mileage tracking: Available in QuickBooks Time Elite only. Optional feature. User must be clocked-in on a mobile device. Location settings must be enabled and set to "Precise Location" or "High Accuracy." GPS and turn by turn navigation required for accuracy purposes.

GPS tracking: QuickBooks Workforce Time mobile app allows users to share their location data while they are on the clock. Cell service required for GPS points accuracy. The QuickBooks Workforce mobile app Time does not save GPS points for users when they are off the clock. Account admins may require users to set their location settings to “Always” in order to clock-in and track time using the QuickBooks Workforce mobile app.

Geofencing: Available in QuickBooks Time Elite only. Optional feature. Account admins may require users to set their location settings to “Always” in order to clock-in and track time using the QuickBooks WorkforceTime mobile app. Pre-set up required. QuickBooks Time requests GPS points for users when they are off the clock to determine if users have entered a geofence. The QuickBooks Workforce mobile AppTime does not save GPS points on its servers and they remain on the user's device. Admins do not have access to employee location data when workers are off the clock. Additional terms and fees may apply.

Unlimited live customer support: Phone and chat support is included with your paid subscription to QuickBooks Time Premium and Elite. Your subscription must be current. Time and days vary based on subscription. Intuit reserves the right to limit the length of the call. Terms conditions, features, pricing, service and support availability are subject to change without notice.

QuickBooks integration: QuickBooks Time integrates with QuickBooks Online ("QBO"), QuickBooks Online Payroll ("Payroll") and QuickBooks Desktop ("Desktop"). Requires an active QBO, Payroll or Desktop account. Additional terms, conditions and fees may apply.

Track time on any device: QuickBooks Workforce can be used on any device that has an internet connection and a web browser. QuickBooks Workforce is also available in the Apple App Store and Google Play Store.

Time Clock Kiosk: QuickBooks Time punch time clock works on any tablet, desktop, or laptop with an internet connection. Not designed to work on mobile devices.

QuickBooks Time integration: Additional fees may apply. Time tracking included in the QuickBooks Online Payroll Premium and Elite subscription services. Features vary. The QuickBooks WorkforceTime mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Streamlined payroll and invoicing: QuickBooks Time directly integrates with several payroll software platforms. Additional fees apply.

Export data efficiently: QuickBooks Time directly integrates with several payroll software platforms. Additional fees apply.

Time-off management: Compliance with applicable laws is the responsibility of the business. This feature is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business.

DCAA Compliance: Compliance with applicable laws is the responsibility of the business. This feature is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business.

Overtime alerts: Automated overtime identifies potentially incorrect overtime hours based on current laws and regulations; business owners have full control and can decline this suggestion in product. Compliance with application laws is the responsibility of the business. This feature is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business.

Workforce mobile app: The QuickBooks Workforce mobile companion apps work with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Workforce mobile access is included with your QuickBooks Time subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

QuickBooks Live Expert Assisted: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live bookkeeper. The Live bookkeeper will provide help based on the information you provide.

QuickBooks Live Expert Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Expert Cleanup and QuickBooks Live Expert Full-Service Bookkeeping.

Automated tax payments and filings: Automated tax payments and filing available for state and federal taxes. Enrollment in e-services is required for tax payments and filings only. Automated tax payments and filings for local taxes available in QuickBooks Online Payroll Premium and Elite only.

Health benefits: Health Insurance benefits are provided by Intuit Insurance Services Inc., a licensed insurance broker, through a partnership with Allstate Health Solutions. Requires acceptance of Allstate's Terms of Use and Privacy Policy. Intuit Insurance Services is owned and operated by Intuit Inc. and is paid a percentage fee of insurance policy premiums by Allstate Health Solutions in connection with the services described on this page.

Unlimited 1099 e-file: Create and e-file unlimited 1099-MISC and 1099-NEC forms in QuickBooks. 1099 forms are e-filed only for the current filing year and for payments recorded in QuickBooks to your vendors or contractors. Includes state filings for eligible states participating in IRS Combined Federal/State Filing program; please check with your state agency on any additional state filing requirements. Additional fees may apply to print and mail a copy to your vendors and contractors and to other upgrades or add-on services.

Next-day direct deposit: Payroll processed before 5 PM PT the day before shall arrive the next business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. May be subject to eligibility criteria. Deposit delays may occur because of third party delays, risk reviews, or issues beyond Intuit’s control. Available for contractors for an additional fee.

Same-day direct deposit: Available to QuickBooks Online Payroll Premium and Elite users. Payroll processed before 7 AM PT shall arrive the same business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. Same-day direct deposit may be subject to eligibility criteria. Deposit delays may vary because of third party delays, risk reviews, or issues beyond Intuit’s control. Same-day direct deposit available only for employees.

Workers’ comp administration: Benefits are powered by NEXT Insurance and require acceptance of NEXT Insurance's Privacy Policy and Terms of Use. Additional fees will apply. There is a monthly fee (currently, $5 per month) for QuickBooks Online Payroll Core users for the QuickBooks Workers' Comp Payment Service. This non-refundable fee will be automatically added to each monthly Intuit invoice at the then-current price until you cancel. The fee is separate from any workers’ comp insurance policy premium by NEXT Insurance. Workers’ Compensation Service requires an active and paid QuickBooks payroll subscription. Eligibility criteria applies to transfer active insurance policy broker of record, including insurance carrier, policy renewal date, and payment method. Workers compensation insurance is not available in OH, ND, WA and WY.

HR services: HR support is provided by experts at Mineral, Inc. Requires acceptance of Mineral’s Privacy Policy and Terms of Service. HR support center is available only to QuickBooks Online Premium and Elite subscriptions. HR advisor support is only available in QuickBooks Online Payroll Elite. HR support is not available to accountants who are calling on behalf of their clients.

Expert review: Available upon request for QuickBooks Online Payroll Premium and Elite.

QuickBooks Time Mobile: The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Expert setup: Available to QuickBooks Online Payroll Elite users only.

Garnishments and deductions: Available for employees only. User is responsible for setting the garnishment amount and making the garnishment payment to the appropriate entity.

QuickBooks Workforce: Available to employees. Requires an Intuit Account and acceptance of the Intuit Terms of Service and Privacy Statement.

**Product information

Phone support: For hours of support and how to contact support, see here.

System Requirement: The QuickBooks Workforce mobile app requires a computer or a device with a supported Internet browser and an Internet connection (a high-speed connection is recommended). The QuickBooks Workforce mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. The QuickBooks Workforce mobile access is included with your QuickBooks Time subscription.

#Claims

1 Add over 10% more billable time to your invoices with QuickBooks Time: Based on a survey of 595 customers in the U.S. in January 2023. On average, businesses that report an increase in billable time added 10.06%.

2 Over 100,000 5-star reviews: Based on number of reviews collected in December 2022 across IOS and Android for time tracking.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Call Sales: 1-888-836-2720

© 2026 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For details about our money transmission licenses, or for Texas customers with complaints about our service, please click here.

By accessing and using this page you agree to the Website Terms of Service.