1. Gather financial data

To prepare your financial statements, start by collecting all relevant financial data. This includes:

Ensure that all transactions are accurately recorded and classified in the right accounts. With accounting software, like QuickBooks, you can automatically pull data from your transactions, reducing manual entry errors.

Additionally, using the original or historical cost principle ensures that assets are recorded at their purchase price, preventing inflated values and discrepancies in your financials.

2. Choose an accounting method

Your financial statements are based on personal judgments and estimates to avoid overstating assets and liabilities. You can maintain accurate financial statements by choosing your accounting conventions and sticking to them over time.

Ultimately, the best way to create an accurate, dependable financial statement is to automate the process wherever possible. Using accounting software, for example, leverages technology to handle all the number crunching and avoid manual accounting errors.

3. Organize income and statements

Use your best organizational skills when preparing your financial statements. Start by:

- Categorizing your revenue sources, including product sales, service income, or any other form of revenue your business generates.

- List all your business expenses, separating between fixed and variable costs. Fixed costs might include rent or salaries, while variable costs could be raw materials or sales commissions.

Accurate classification will help you assess your company’s cost structure and identify potential areas to reduce expenses.

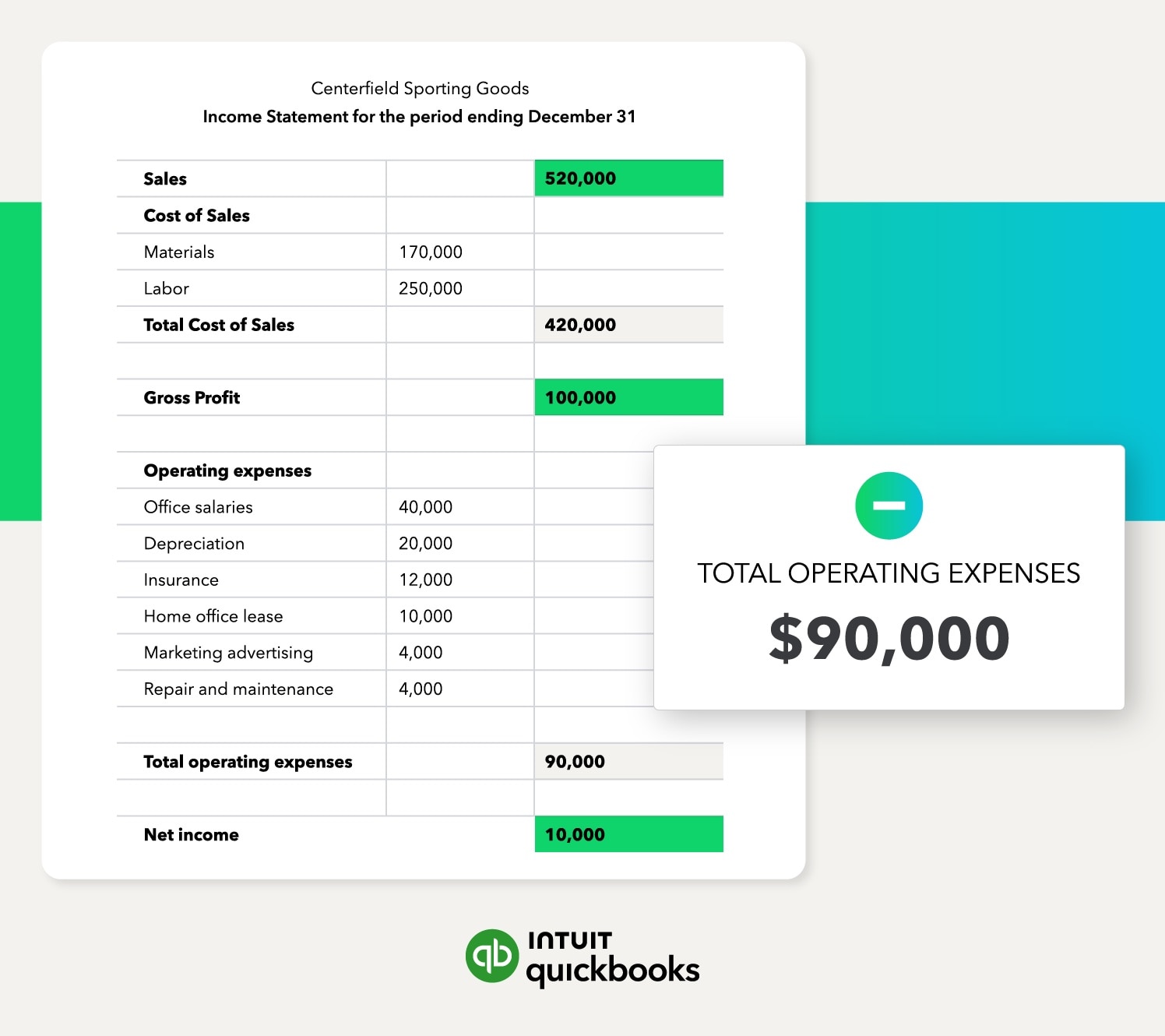

4. Prepare the income statement

The income statement reveals a company's profitability over a specific period. It calculates net income to provide a clear picture of financial performance by outlining revenues, expenses, gains, and losses.

To determine your net profit or loss, subtract total expenses (both fixed and variable) from total revenue. If revenue exceeds expenses, you have a profit; if expenses surpass revenue, you incur a loss.

The income statement is essential for evaluating your business's financial health and identifying trends over time.

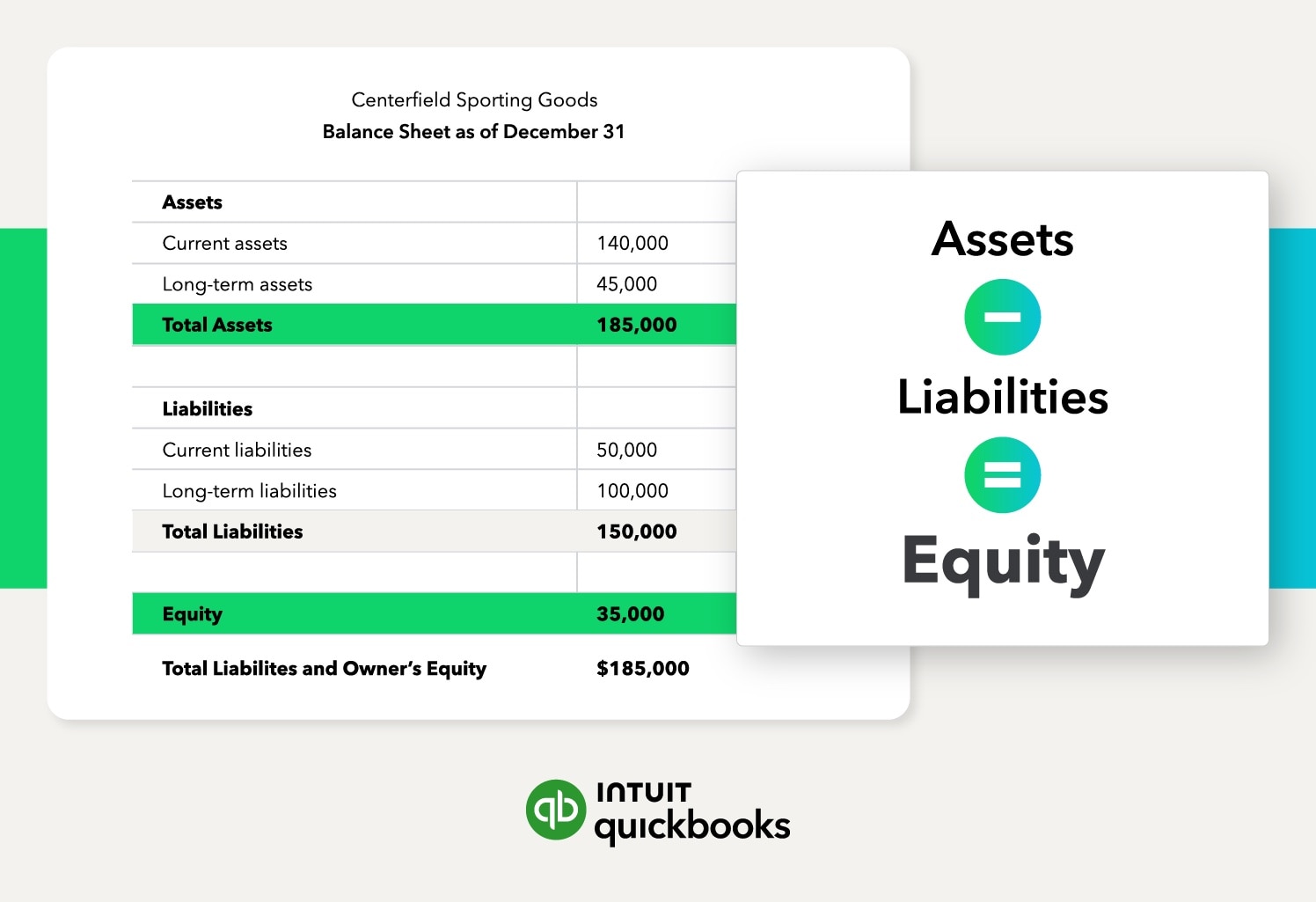

5. Create the balance sheet

The balance sheet outlines your company's financial position at a specific point in time. To prepare it, you need to list your assets and liabilities and determine your owner’s equity.

- Assets refer to cash, accounts receivable, and inventory, as well as long-term assets like equipment and real estate.

- Liabilities include any debts, including short-term liabilities (accounts payable) and long-term liabilities (loans, mortgages).

- Owner’s equity represents the net value of the business, calculated by subtracting liabilities from assets.

A well-prepared balance sheet helps you assess financial stability, track changes over time, and make informed business decisions.

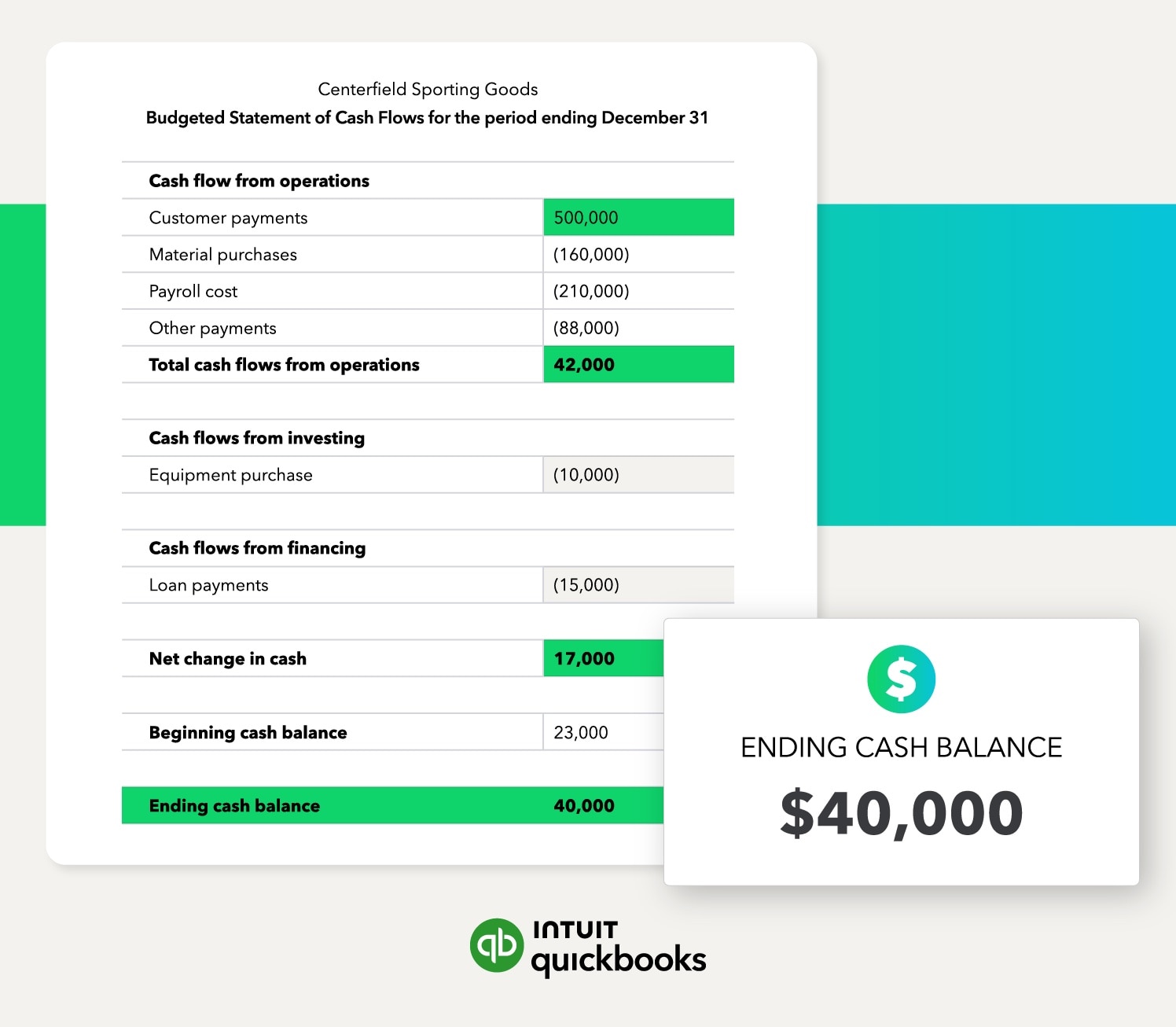

6. Compile the cash flow statement

The cash flow statement is essential for tracking inflows and outflows across three main activities. To properly pull this information into your cash flow statement:

- Begin by categorizing each transaction under the appropriate activity

- Record daily operational transactions under operating Activities

- Document purchases or sales of assets under Investing Activities

- Track financing transactions like loan repayments or stock issuance under Financing Activities

This approach provides a comprehensive view of how cash flows through your business, helping you meet financial obligations and plan for growth.

7. Review and finalize

Before finalizing your financial statements, review them for accuracy and completeness. Double-check all calculations and ensure the data reflects your records accurately.

Using accounting conventions makes your financial statements comparable and realistic. For example, the principle of consistency requires accountants to apply standards consistently year after year.

Carefully reviewing your financial statements ensures they accurately represent your business. Compare your finalized statements with previous periods to identify trends, which can offer valuable insights into your business's performance.

.gif)