Sales tax calculator: How to calculate your sales tax

Easily calculate sales tax rates in your state with our free sales tax calculator. Simply plug in your business address and ZIP code to get your total estimated sales tax rate.

Easily calculate sales tax rates in your state with our free sales tax calculator. Simply plug in your business address and ZIP code to get your total estimated sales tax rate.

Sales tax is a tax businesses collect when selling certain goods or services. The buyer pays the sales tax, but you, as the seller, collect it. You then must remit the sales tax to the proper state or local tax agency.

States have their own sales tax laws, meaning the tax rate will vary by state. However, many counties, cities, or districts may have an additional sales tax that you need to include. The total sales tax rate is:

Total sales tax rate = State sales tax rate + any additional local sales tax rates

For example, the total sales tax rate for a business with a location of 2700 Coast Ave, Mountain View, California, is:

If you need to charge sales tax and manually calculate it, the sales tax formula for calculating sales tax is the sales price multiplied by the total sales tax rate.

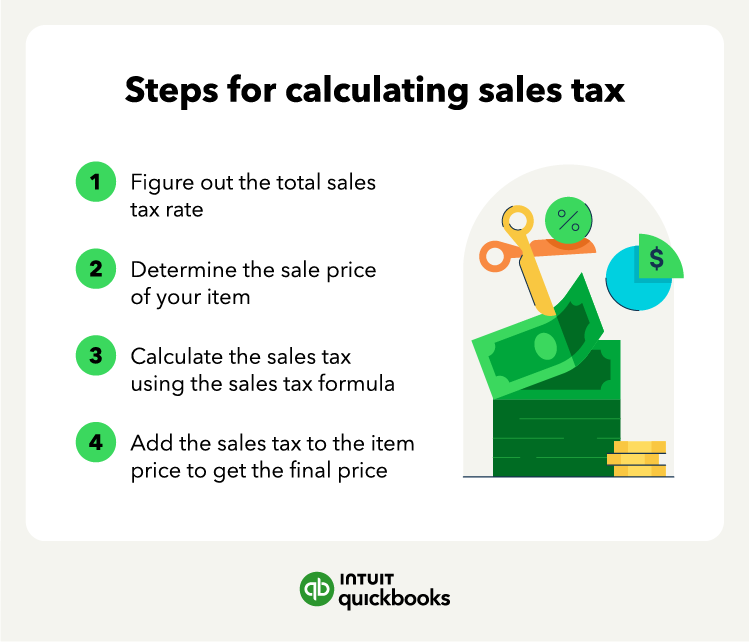

To calculate sales tax, you need to multiply the price of an item or service by the tax rate. Here's how to calculate sales tax:

Note that some adjustments can lower the retail price of your item, effectively lowering the sale tax. Some common adjustments include discounts, coupons, rebates, trade-ins, and returns. You’ll account for those adjustments before figuring your sales tax amount.

For our sales tax calculator above, please note:

With sales tax software like QuickBooks Online, you can automatically track sales and collect the necessary sales tax. The correct sales tax rates are calculated automatically for each transaction, saving you time so you can focus on your business.

Our free sales tax calculator makes it easy to calculate the sales tax rates in your state. Follow these simple steps to get started.

Since the sales tax amount can vary within the same ZIP code, we recommend entering a complete street address to calculate your total tax amount as accurately as possible.

The calculator will provide your total estimated tax rate, including your state and any applicable local tax rates. Sales tax rates can change over time, but the calculator provides estimates based on current available rates.

Keep in mind that the sales tax rate provided is an estimate based solely on the address entered into the sales tax calculator. Your product, service, customer type, and shipping address are other factors that may impact your rate.

With sales tax software like QuickBooks Online, you can automatically track sales and collect the necessary sales tax. The correct sales tax rates are calculated automatically for each transaction, saving you time so you can focus on your business.

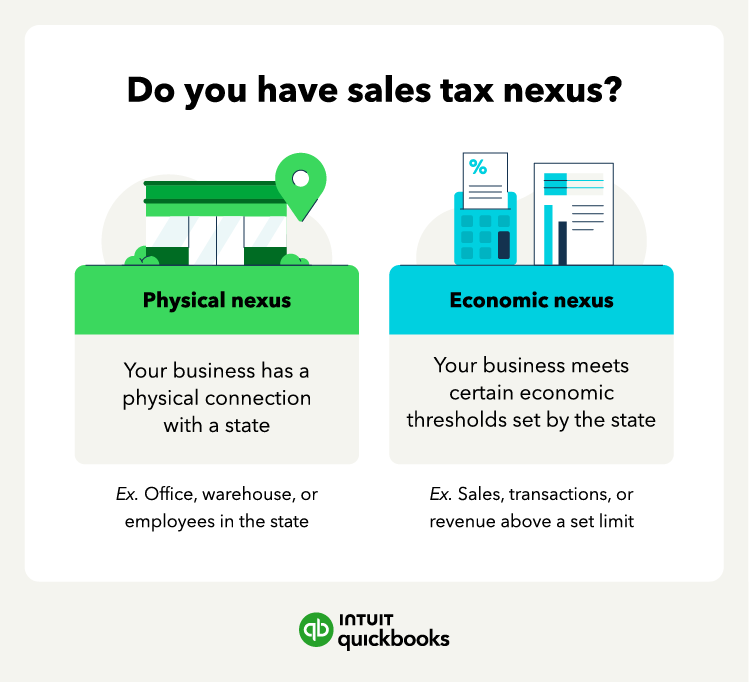

Businesses that sell taxable goods or services must get a sales tax license from the appropriate state and charge sales tax. As a small business seller, it’s your responsibility to ensure you collect the correct tax amount and pay it to the state. A business is liable for remitting sales tax in any tax jurisdiction in which it has nexus, whether it’s a physical or economic one.

Generally, if a business has a physical presence or nexus in a particular state, such as a store, office, or warehouse, it must collect sales tax on taxable transactions made in that state.

Additionally, some states have economic nexus laws that require businesses to collect sales tax if they have a certain level of sales or transactions in the state, regardless of physical presence.

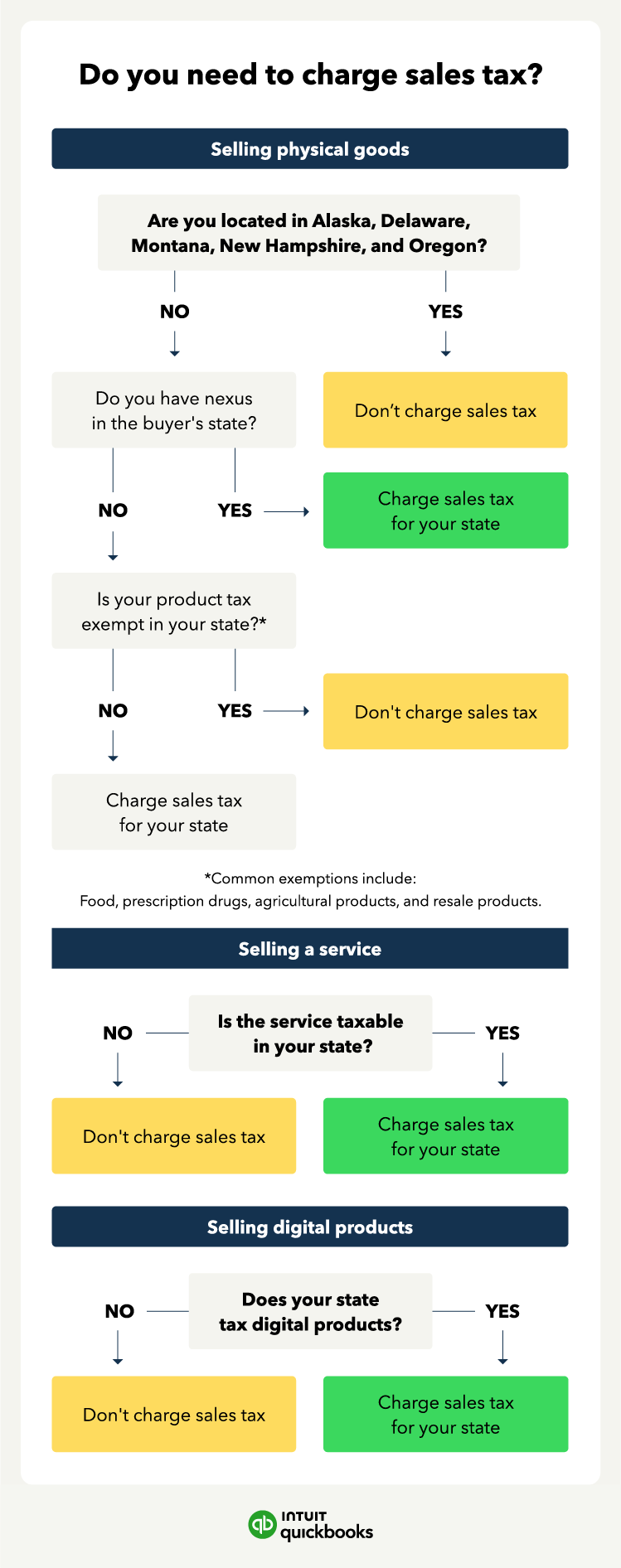

For tangible goods, the requirement to collect sales tax is straightforward. Businesses collect sales tax on the sale of physical products. On the other hand, the requirement to collect sales tax for services varies based on state laws.

Some states consider certain services as taxable and require businesses to collect sales tax on those services. For example, states might tax services like repair and maintenance, professional consulting, or personal care services.

When selling online, businesses may still need to charge sales tax, also known as internet sales tax. If a business has nexus in a state, regardless of whether it operates online or through physical locations, it may be required to collect and remit sales tax on sales made to customers in that state.

While the specific items subject to sales tax may vary from one jurisdiction to another, certain goods are commonly subjected to this tax.

In general, items that require sales tax include tangible goods that are sold for personal or business use, including:

However, certain states or localities may impose sales tax on additional items such as:

Typically, sales tax does not apply to groceries. It’s important to check the specific rules and regulations in your jurisdiction as the items subject to sales tax can vary.

Wholesale purchases and raw materials you buy for use in your business are typically exempt from sales tax.

Sales tax rates vary by state, with some states imposing higher rates than others, while some states have no sales tax at all. Below is a list of the sales tax rates by state:

Note that there are some states without sales tax, including Alaska, Delaware, Montana, New Hampshire, and Oregon.

When you need to pay and file sales tax returns, it will depend on the state and your sales volume or revenue. However, most states require you to file a sales tax return and pay taxes you collect every month. The due date is generally the 20th or later in the month following the reporting period.

For example, for the sales tax you collect in April, the due date for filing and paying sales tax will likely be around May 20th. Depending on the amount of taxes you owe, your filing and paying frequency might be less frequent.

When paying and filing your sales taxes, ensure you’re keeping up with sales tax rates and obligations and set reminders for when you need to file.

Businesses can significantly streamline their accounting operations and save valuable time by utilizing tax software and incorporating a sales tax calculator into their processes. A calculator takes into account the various tax rates applicable to specific locations and eliminates the risk of errors.

Accounting software like QuickBooks Online provides several benefits that enhance efficiency and accuracy. Automating tasks such as sales tax rate updates and manual calculations allows businesses to reduce time spent on tax-related activities.