Manage contractor payroll with confidence

Pay your team and simplify tax time with contractor payroll services.

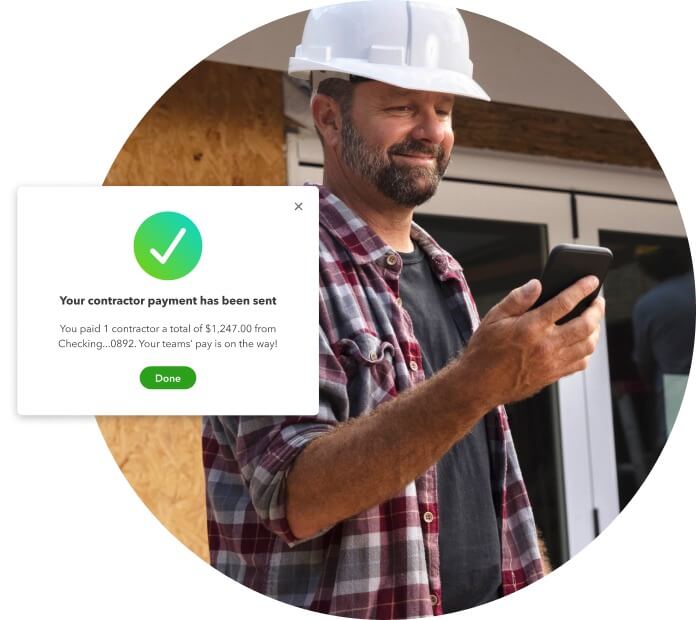

Make unlimited payments with next-day direct deposit. Payments automatically sync with QuickBooks Online, so your books are always up-to-date.**

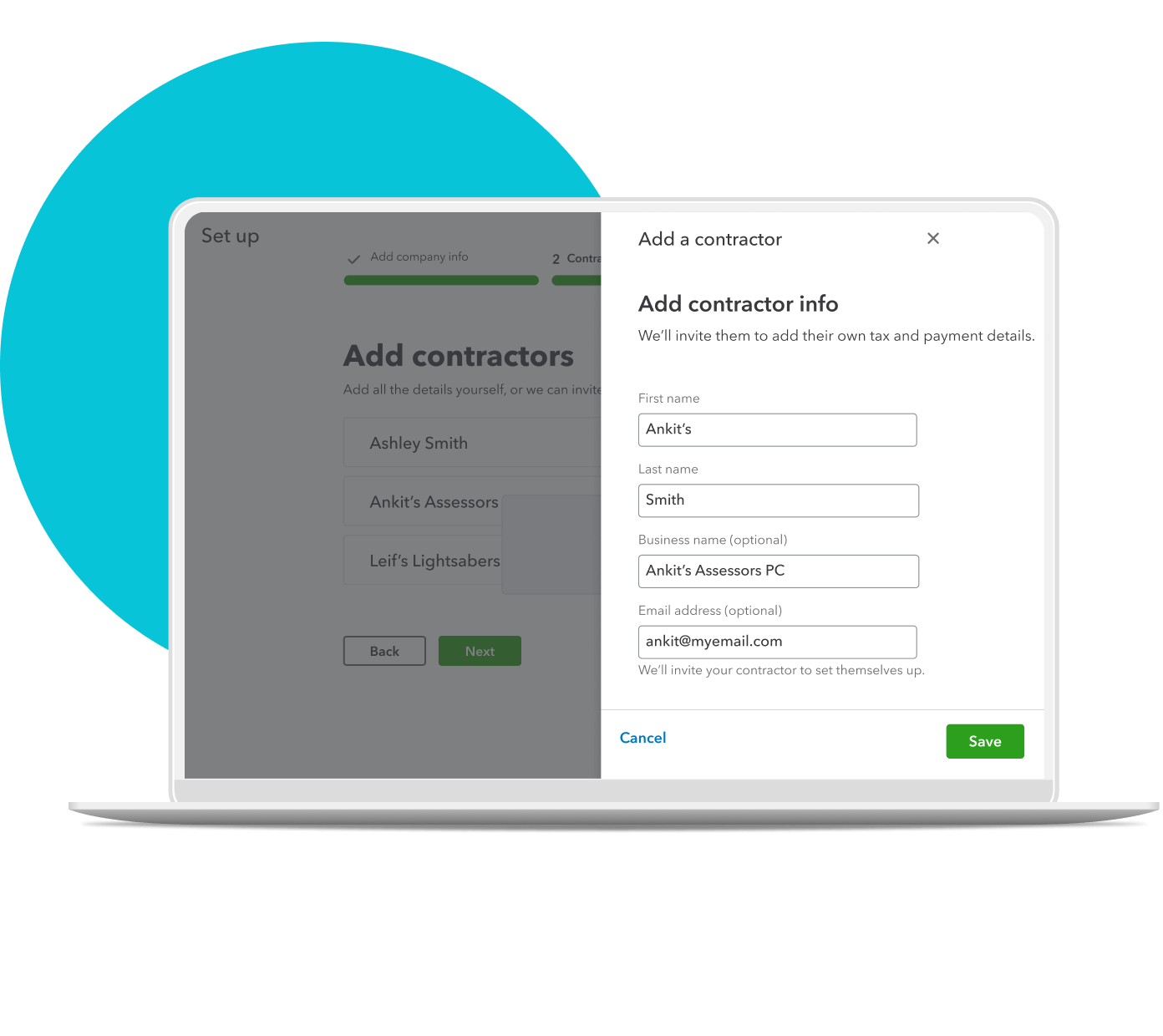

Invite contractors to set up a free account so they can complete their W-9s and provide bank deposit details.

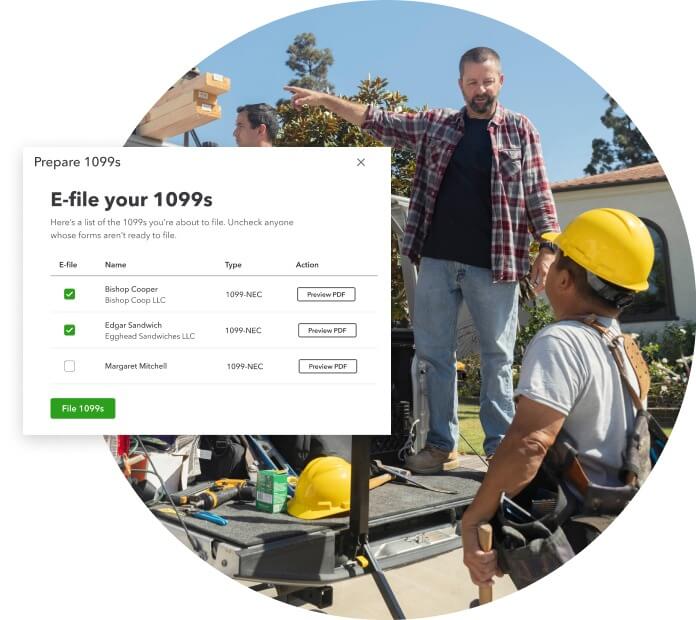

We’ll complete your 1099s so you can e-file to the IRS and send copies to contractors.

How to manage payroll for contractors

When you’re the boss, it’s your job to be ready for tax time. With QuickBooks Contractor Payments, we’ll complete your 1099s so you can e-file to the IRS and send copies to contractors.

Find the plan that’s right for you

Pay contractors and e-file 1099s

Pay employees, too

Contractor Payments

Pay contractors fast, e-file 1099s, and stay ready for tax time.

Take care of payday

Pay contractors

Send unlimited payments to your contractors.

Next-day direct deposit

Pay contractors with next-day direct deposit.

E-file unlimited 1099s

Create and e-file unlimited 1099s for contractors.

Contractor self-setup

Contractors can set up a free account and complete W-9s online.

Contractor Payments + Simple Start

Pay contractors fast, e-file 1099s, and manage your books in one place.

Take care of payday

Pay contractors

Send unlimited payments to your contractors.

Next-day direct deposit

Pay contractors with next-day direct deposit.

E-file unlimited 1099s

Create and e-file unlimited 1099s for contractors.

Contractor self-setup

Contractors can set up a free account and complete W-9s online.

Take care of your business

Track income & expenses

Securely import transactions and organize your finances automatically.

Capture & organize receipts

Snap photos of your receipts and categorize them on the go.**

Maximize tax deductions

Share your books with your accountant or export important documents.**

Invoice & accept payments

Accept credit cards and bank transfers in the invoice with QuickBooks Payments, get status updates and reminders.**

Track miles

Automatically track miles, categorize trips, and get sharable reports.**

Run general reports

Run and export reports including profit & loss, expenses, and balance sheets.*

Send estimates

Customize estimates, accept mobile signatures, see estimate status, and convert estimates into invoices.**

Track sales & sales tax

Accept credit cards anywhere, connect to e-commerce tools, and calculate taxes automatically.**

Manage 1099 contractors

Assign vendor payments to 1099 categories, see payment history, prepare and file 1099s from QuickBooks.**

Connect 1 sales channel

Connect 1 online sales channel and automatically sync with QuickBooks.

Free guided setup

A QuickBooks expert can help you set up your chart of accounts, connect your banks, and show you best practices.

NEW

OR

QuickBooks Payroll Core

Pay contractors and employees and get taxes done for you.

Take care of payday

Full-service payroll

We’ll calculate, file, and pay your payroll taxes for you and more.

Includes automated taxes & forms

1099 E-File & Pay

Create and e-file unlimited 1099-MISC and 1099-NEC forms.

Auto Payroll

Run Auto Payroll for salaried employees on direct deposit. Review, approve, or edit payroll before payday.**

Expert product support

Call or chat with a payroll product expert for help.

Next-day direct deposit

Offer fast direct deposit for your team.

Take care of your team

Employee financial portal

Your team can view pay stubs and W-2s in one place.

Health benefits for your team

Offer affordable medical, dental, and vision insurance packages by Allstate Health Solutions.**

401(k) plans

Access affordable retirement plans by Guideline that sync with QuickBooks Payroll.**

Payroll Core + Simple Start

Pay contractors and employees and manage your books.

Take care of payday

Full-service payroll

We’ll calculate, file, and pay your payroll taxes for you and more.

Includes automated taxes & forms

1099 E-File & Pay

Create and e-file unlimited 1099-MISC and 1099-NEC forms.

Auto Payroll

Run Auto Payroll for salaried employees on direct deposit. Review, approve, or edit payroll before payday.**

Expert product support

Call or chat with a payroll product expert for help.

Next-day direct deposit

Offer fast direct deposit for your team.

Take care of your team

Employee financial portal

Your team can view pay stubs and W-2s in one place.

Health benefits for your team

Offer affordable medical, dental, and vision insurance packages by Allstate Health Solutions.**

401(k) plans

Access affordable retirement plans by Guideline that sync with QuickBooks Payroll.**

Take care of your business

Track income & expenses

Securely import transactions and organize your finances automatically.

Capture & organize receipts

Snap photos of your receipts and categorize them on the go.**

Maximize tax deductions

Share your books with your accountant or export important documents.**

Invoice & accept payments

Accept credit cards and bank transfers in the invoice with QuickBooks Payments, get status updates and reminders.**

Track miles

Automatically track miles, categorize trips, and get sharable reports.**

Run general reports

Run and export reports including profit & loss, expenses, and balance sheets.*

Send estimates

Customize estimates, accept mobile signatures, see estimate status, and convert estimates into invoices.**

Track sales & sales tax

Accept credit cards anywhere, connect to e-commerce tools, and calculate taxes automatically.**

Manage 1099 contractors

Assign vendor payments to 1099 categories, see payment history, prepare and file 1099s from QuickBooks.**

Connect 1 sales channel

Connect 1 online sales channel and automatically sync with QuickBooks.

Free guided setup

A QuickBooks expert can help you set up your chart of accounts, connect your banks, and show you best practices.

NEW