Switch to QuickBooks Online and Payroll with integrated access to time tracking, HR, and employee benefits.

Move to QuickBooks Online and Payroll for more efficient workflows

Payroll and taxes done right

We’ll calculate, file, and pay your payroll taxes for you.** Set up and calculate deductions from each paycheck, and create and download reports.

Time is money—get more of both

Reduce manual entry, increase accuracy, and manage timesheets with QuickBooks Time.** Online Payroll and time tracking data seamlessly connect,** so you can cut payroll costs by over 4%.¹

Manage your payroll and HR needs

QuickBooks Online Payroll streamlines human capital management with integrated access to payroll, time tracking, HR, and employee benefits.

Simplify employee tasks with the Workforce app

Your team can clock in and out, and access pay stubs, W-2s, and other pay details with the QuickBooks Workforce app.**

Save time with automated payroll

With QuickBooks Online Payroll, run automated payroll for salaried employees on direct deposit. Review, approve, or edit payroll before payday.**

Stop worrying about the "what-ifs"

With data no longer stored on a local server or hard drive, you don't have to worry about losing everything in a fire or a natural disaster at the office.

Migrate with confidence

Join over 500K QuickBooks Desktop customers who made the switch to Online Payroll.²

8 out of 10 customers agree onboarding new employees with Online Payroll is faster and easier than their previous solution.³

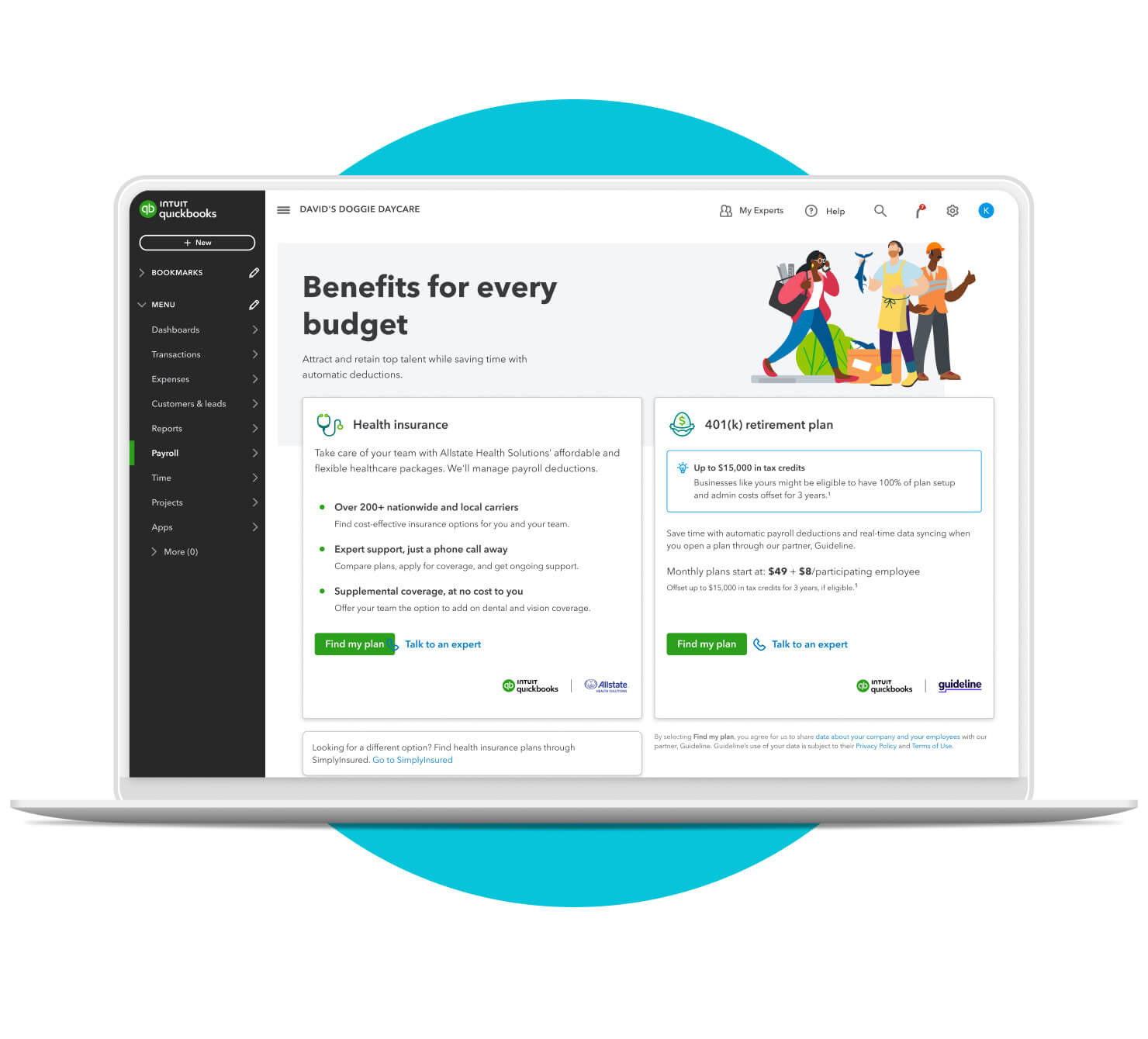

Payroll services that go beyond a paycheck

Invest in your team by offering affordable 401(k) retirement plans by Guideline that integrate with QuickBooks.**

QuickBooks Online Payroll streamlines human capital management with integrated access to payroll, time tracking, HR, and employee benefits.

Prioritize your team’s health. Find affordable healthcare packages by Allstate Health Solutions— browse 200+ local and national carriers.**

Conserve cash flow and simplify annual audits. Get quotes inside QuickBooks—our broker NEXT will compare plans and pricing for you.**

Let us teach you QuickBooks Online

Once your data is online, hop on a free 1-hour personalized setup call.* We'll review your migration, show you around QuickBooks Online and Payroll, and make sure you can tackle your everyday tasks with confidence.

Ready to move to QuickBooks Online Payroll?

Call us at 833-207-5470 Mon-Fri 6am to 6pm PT

Get Desktop Payroll with QuickBooks Enterprise

If you’re not ready to switch to QuickBooks Online, consider Desktop Enterprise. It comes with Desktop Payroll built right in.

Frequently asked questions

Learn more about the benefits of moving your accounting and payroll to the cloud.

QuickBooks Online Payroll allows for remote online access to your data anytime, anywhere, and real-time collaboration. It will automatically calculate, file, and pay your federal, state, and local payroll taxes—accuracy guaranteed.* Move online to take advantage of automatic data backups, the option to set payroll to automatically pay your employees,** and more.

QuickBooks Online with QuickBooks Online Payroll is great if you work with customers, get paid, and manage employees collaboratively—anytime, anywhere.** Move your accounting and payroll online to take advantage of automatic data backup, live insights from your accountant, automated workflows to reduce errors and increase efficiency, and reports tailored to your business.

When you move to QuickBooks Online, you'll create a new account and sign in. You can migrate your business and payroll data to QuickBooks Online and keep a copy of the original file for your records.

If you’re only signing up for Online Payroll and will continue using Desktop for accounting, you can input your payroll data manually, or our onboarding specialists will do it for you as part of QuickBooks Online Payroll Elite.*

QuickBooks imports most employee details, including personal info, W-4 info, direct deposit info, and paycheck details. You will need to manually enter any custom employee fields you use in your QuickBooks Desktop product. Or, call us at 866-676-9670 to upgrade to QuickBooks Online Payroll Elite and we’ll do the setup for you.

Migrate your key desktop data with confidence. Do it yourself or let us help, with expert migration assistance, step-by-step guides, demos, and free phone and chat support. We offer free assisted migration and personalized setup from QuickBooks Desktop Pro, Premier, Mac, or Plus to QuickBooks Online, Payroll, Payments, or Time.* To learn more, call 866-676-9670.

With QuickBooks Online Payroll Premium, our experts will review your work after you transfer your data, giving you confidence and peace of mind that everything is correct. Or, call us at 866-676-9670 to upgrade to QuickBooks Online Payroll Elite and we’ll do the setup for you.*

Yes. QuickBooks Workforce comes with QuickBooks Online Payroll subscriptions.** It's an online portal for your employees where they can access pay stubs, W-2s, and safely view PTO balances & withholding allowances.

Monday - Friday, 5 AM to 6 PM PT

Need help choosing the right Payroll?

Call us at 833-207-5470 Mon-Fri 6am to 6pm PT

*Guarantees

Accuracy Guaranteed: Available with QuickBooks Online Payroll Core, Premium, and Elite. We assume responsibility for federal and state payroll filings and payments directly from your account(s) based on the data you supply. As long as the information you provide us is correct and on time, and you have sufficient funds in your account, we’ll file your tax forms and payments accurately and on time or we’ll pay the resulting payroll tax penalties. Guarantee terms and conditions are subject to change at any time without notice.

Tax penalty protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. Only QuickBooks Online Payroll Elite users are eligible to receive tax penalty protection.

*Offer terms

Try before you buy QuickBooks Online and/or QuickBooks Online Payroll: First thirty (30) days of subscription to QuickBooks Simple Start, Essentials, Plus or Advanced (QBO) and/or QuickBooks Online Payroll Core, Premium or Elite (QBOP) starting from the date of enrollment is free. To continue using either service after the 30-day trial, you’ll be asked to present a valid credit card for authorization, and you’ll be charged on a monthly basis at the then-current fee for the service(s) you’ve selected until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible, you must be a new QBO or QBOP customer and sign up for the monthly plan using the 'Free 30-Day Trial’ option. Offer available for a limited time only.

To cancel either QBO or QBOP at any time, go to Account and select "Cancel Subscription." Cancellation becomes effective at the end of the monthly billing period. No prorated refunds; access and subscription benefits continue through remainder of billing period. Trial cannot be combined with any other QBO or QBOP offer. Terms, conditions, pricing, features, services and support options subject to change without notice.

Free assisted migration and personalized setup from QuickBooks Desktop Pro, Premier, Mac, or Plus (“Desktop”) to QuickBooks Online Plus (“QuickBooks Online”), or QuickBooks Desktop Payroll, Payments, or Time to QuickBooks Online Payroll, Payments, or Time is available to small business users, and is subject to capacity. The Assisted Setup offer is eligible to Desktop customers that are migrating their data, as well as those customers who elect not to migrate their data, who are starting new QuickBooks Online accounts, and setting up QuickBooks Online. Personalized Setup is limited to a 1-hour session with a customer success product expert. Intuit reserves the right to limit the number of sessions and the length and scope of each session. Terms and conditions, features, support, pricing, and service options subject to change without notice.

QuickBooks Enterprise: Your subscription of QuickBooks Desktop Enterprise Silver, Gold or Platinum is valid for the first 12 months starting from purchase date. After 12 months, your credit/debit card account on file will automatically be charged on a monthly or annual basis at the then-current fee for the QuickBooks Desktop Enterprise product and plan you’ve selected until you cancel. You can cancel at any time by going to Account & Settings in QuickBooks and select “Cancel” or by calling 800-300-8179, prior to your renewal date.

Both the Annual and Monthly Option Plan commits you to a 12-month term; fees vary per plan. If you select the Monthly Option Plan then you will pay the then-current fee over the course of 12 months. Intuit will authorize your card to ensure prompt order processing, resulting in a temporary hold on your account. If you cancel inside the 60 day money back guarantee period you can opt to receive a refund (see: money back guarantee terms and conditions). If you cancel outside of the 60 day money back guarantee period you will have access to QuickBooks Enterprise for the remainder of the 12 month term in which you paid for. Upon expiration of your paid subscription you will no longer have access to the product or any of its connected services. See Subscription Terms & Conditions for details.

**QuickBooks Online Payroll Features

Payroll built into QuickBooks Online: QuickBooks Online integrates with QuickBooks Online Payroll and each service requires an active account. Additional terms, conditions and fees may apply.

Payroll and taxes done right: Automated tax payments and filing available for state and federal taxes. Enrollment in e-services is required for tax payments and filings only. Automated tax payments and filings for local taxes available in QuickBooks Online Payroll Premium and Elite only.

Collaborate your way: QuickBooks Online and QuickBooks Online Payroll requires a computer with a supported browser (see System Requirements for a list of supported browsers) and an Internet connection (high-speed recommended). User numbers vary based on plan type.

Run payroll automatically: Auto Payroll is available if setup for the company is complete. At least one employee has completed setup and has consistent payroll that qualifies for automation (i.e. salaried or hourly with default). Company must complete bank verification if Employee has direct deposit as the payment method, and the first payroll must run successfully. The account must not have a hold.

Direct deposit: Direct deposit service is included for W-2 employees with your Payroll subscription. Additional fees apply for 1099 contractors paid by direct deposit.

Money movement services: Money movement services, such as direct deposit, are provided by Intuit Payments Inc., a subsidiary of Intuit Inc. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Employee time tracking: Time tracking included in the QuickBooks Online Payroll Premium and Elite subscription services. Features vary. The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

HR services: HR support is provided by experts at Mineral, Inc. Requires acceptance of Mineral’s Privacy Policy and Terms of Service . HR support center is available only to QuickBooks Online Premium and Elite subscriptions. HR advisor support is only available in QuickBooks Online Payroll Elite. HR support is not available to accountants who are calling on behalf of their clients.

Workers’ comp administration: Benefits are powered by NEXT Insurance and require acceptance of NEXT Insurance's Privacy Policy and Terms of Use. Additional fees will apply. There is a monthly fee (currently, $5 per month) for QuickBooks Online Payroll Core users for the QuickBooks Workers' Comp Payment Service. This non-refundable fee will be automatically added to each monthly Intuit invoice at the then-current price until you cancel. The fee is separate from any workers’ comp insurance policy premium by NEXT Insurance. Workers’ Compensation Service requires an active and paid QuickBooks payroll subscription. Eligibility criteria applies to transfer active insurance policy broker of record, including insurance carrier, policy renewal date, and payment method. Workers compensation insurance is not available in OH, ND, WA and WY.

Health benefits: Health Insurance benefits are provided by Intuit Insurance Services Inc., a licensed insurance broker, through a partnership with Allstate Health Solutions. Requires acceptance of Allstate's Privacy Policy and Terms of Use. Intuit Insurance Services is owned and operated by Intuit Inc. and is paid a percentage fee of insurance policy premiums by Allstate Health Solutions in connection with the services described on this page.

401(k) plans: 401(k) offerings are provided and administered by Guideline, an independent third party and not provided by Intuit. Intuit is not a 401(k) plan administrator, fiduciary or other provider. Requires acceptance of Guideline's Client Relationship Summary and Privacy Policy. Additional 401(k) plan fees will apply. Employees may manage their contributions directly with Guideline. Admin and payroll access required to sign up for a 401(k) plan with Guideline.

QuickBooks Workforce: QuickBooks Payroll (“Payroll”) and/or QuickBooks Time (“Time”) subscription required. Feature availability may vary based on company subscription, settings, and employment type. Registration required. Certain features are available only through the Workforce web portal or through the Workforce mobile app.

QuickBooks Workforce mobile app: The QuickBooks Workforce mobile companion app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile app and mobile browser. QuickBooks Workforce mobile access is included with your QuickBooks Time subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

**QuickBooks Enterprise

QuickBooks Desktop Enhanced Payroll subscription is included in Enterprise Gold and Platinum. Standard Enhanced Payroll subscription fees apply when adding to Enterprise Silver. Enhanced Payroll included in Enterprise Gold or Platinum does not charge additional monthly per employee fees, additional fees may apply when paying 1099 contractors by direct deposit. Enhanced Payroll does not limit the number of payrolls scheduled per month. Terms, conditions, features, service and support options are subject to change without notice. Active subscription, Internet access, Federal Employer Identification Number (FEIN), and U.S. billing address required. Check stock sold separately. Plus sales tax where applicable.

Online backup and data protection: Requires internet access for backup, restore and setup changes and comes bundled with Enterprise (as well as Pro Standard, Premier Standard, Pro Plus, and Premier Plus subscriptions). Standalone Intuit Data Backup MSRP $99.95 per year or MSRP $9.95 per month for a-la-carte purchases. Entire PC is limited to 100GB total storage which includes up to the last 45 days of successful back-ups. Data encrypted using AES 256-bit encryption. Not available to QuickBooks for Mac or QuickBooks Online users. Backup can only occur if Intuit Data Protect is correctly set up by user and should only be set up on a single computer. Latest available version of Intuit Data Protect for your version of QuickBooks is required to ensure proper functioning. Not intended as a file transfer, remote access solution for your QuickBooks file. Intuit Data Protect is not intended as a HIPAA solution and its use will not assist with or ensure HIPAA compliance. Hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. Holidays and events beyond our control. Subject to change at any time without notice.

Advanced Reporting is included in all QuickBooks Desktop Enterprise subscriptions. Requires an internet connection.

Priority Circle: Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

Hosting / Cloud Access: The Cloud access service is a monthly subscription. Each month, your account will be automatically charged the agreed-upon price of the service unless and until you cancel. Cancel at any time by calling Intuit at 800-300-8179, prior to your monthly renewal date. When a customer calls to cancel, it is canceled and refunded at the date through the end of the current billing period. The QuickBooks Desktop Enterprise software portion of the QuickBooks Desktop Enterprise with cloud access bundle is an annual subscription.

If you choose to purchase a QuickBooks Desktop Enterprise subscription using the Monthly Payment Plan or QuickBooks Desktop Enterprise with cloud access, you elect to pay your annual subscription in equal payments over the course of 12 months. Purchasing an annual subscription for QuickBooks Desktop Enterprise commits you to a 12 month term. You must pay for all 12 months of the subscription in full based on the then current rate of QuickBooks Desktop Enterprise. If you choose to cancel inside the first 60 days, you can opt to receive a refund per the 60 day money back guarantee (see https://quickbooks.intuit.com/software-licenses/ for details). However, if you choose to cancel after the first 60 days and prior to the end of month 12 you will be subject to a termination fee equal to the amount of monthly payments left on your annual subscription. For purpose of clarity, if you pay for 6 months and have 6 months remaining on your annual subscription, which starts at date of enrollment, you will be charged a termination fee equal to the then current monthly fee of QuickBooks Desktop Enterprise multiplied by 6 months (remaining months left on annual subscription).

Support for QuickBooks Desktop Enterprise with cloud access is provided by Rightworks. A valid QuickBooks Desktop Enterprise license code must be provided to Rightworks to receive support. Rightworks performs backups of all cloud access data on a nightly basis and retains the back-ups for a rolling 90-day period in a protected offsite facility as an additional level of protection. There is no limitation to the size of a customer’s back-up. Customers are responsible for verifying the integrity of the hosted data at least every 90 days. Rightworks employs Snapshot technology to backup customer data. Snapshots are taken daily and then replicated to another physical Rightworks facility for Disaster Recovery. Rightworks uses top-tier data centers and multiple layers of redundancy within its infrastructure to provide 24×7 availability. However, availability can vary, is subject to occasional downtime and may change without notice. Rightworks encrypts all backup files and backup tapes. Virtual desktop connections are protected via TLS with a minimum of 128 bit encryption and authentication. Each customer has a unique Rightworks virtual desktop. Access to each QuickBooks company file is controlled at multiple layers including file access permissions. Access is locked out after multiple failed login attempts for the same user. Security features, functionality and access are subject to change without notice as deemed necessary by Rightworks. Availability can vary and are subject to occasional downtime and may change without notice. Rightworks may offer third party software, separate terms and fees may apply.

Internet connectivity required: Desktop Enterprise with cloud access is subject to availability of a reliable Internet connection. See detailed list of system requirements, and a list of what RDP clients work with the hosting service here.

Remote Desktop Services compliant: QuickBooks Desktop Enterprise is Remote Desktop Services compliant. Microsoft Server operating systems, Microsoft Windows Server software licenses, and Remote Desktop Services Server Client Access Licenses, are sold separately. For multiple cloud access users, a Remote Desktop Services Client Access License is required for each user. Additional fees may apply. Requires certain hardware.

#Claims

1. Based on an Intuit survey of 2040 QuickBooks Online Payroll customers in February 2023. On average, businesses that report gross payroll cost savings save 4.64%. Source: Approved Payroll claims.

2. Based on Intuit data consisting of unique businesses that completed migration from a QuickBooks Desktop product to QuickBooks Online Payroll from 2015 to 2023.

3. Based on Intuit survey November 2023, amongst remunerated QuickBooks Online Payroll users who expressed an opinion, when they compared QuickBooks Online to their prior QuickBooks Desktop Pro, Pro Plus, Premier, Premier Plus or Mac Plus products. Survey did not include Enterprise customers.

Call Sales: 1-877-202-0537

© 2025 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

By accessing and using this page you agree to the Website Terms of Service.