Invest in yourself with the #1 payroll provider.1

Payroll that pays off

Stay organized with a reliable payroll system created for small businesses and the self-employed. With QuickBooks, you can run payroll when you’re ready and get accurate paychecks every time. We’ll even file your payroll taxes for you automatically at no extra cost.**

More time in your day

Automate repetitive payroll tasks and get more time back for the work only you can do. Turn on Auto Payroll,** and you’ll be done in just 5 minutes.2

Stay compliant

Rest easy, knowing your federal and state payroll taxes are calculated, filed, and deducted automatically.** There’s even tax penalty protection with QuickBooks Online Payroll Elite, so you won’t have to worry about penalties or filing errors.

Backed by experts

From HR best practices to clarity on common payroll questions, our expert support teams are here when you need them to keep you informed and on track.**

All the features you need to manage payroll

Tax penalty protection

Count on our Tax Resolution Team to help resolve tax issues and pay up to $25,000 per year for penalties. No matter who made the error, we’ll make it right.

Auto Payroll

Put Auto Payroll to work. Set up payroll, then turn on notifications to stay in the loop. Cut down on time spent crunching numbers, and focus on your freelance work.**

Fast direct deposit

Keep cash longer with same-day or next-day direct deposit. Run payroll and direct deposit as many times as you need each month at no extra cost.**

Expert review and setup

Get an expert to review your payroll or have them set it up for you.**

HR support

Access HR resources online or talk one-on-one with a personal HR advisor. Save time and stay compliant with HR support powered by Mineral, Inc.**

Health benefits

We’ve got you covered with access to affordable health benefits, powered by SimplyInsured. Premiums are deducted automatically when you run payroll.**

Tax penalty protection

Count on our Tax Resolution Team to help resolve tax issues and pay up to $25,000 per year for penalties. No matter who made the error, we’ll make it right.

Auto Payroll

Put Auto Payroll to work. Set up payroll, then turn on notifications to stay in the loop. Cut down on time spent crunching numbers, and focus on your freelance work.**

Fast direct deposit

Keep cash longer with same-day or next-day direct deposit. Run payroll and direct deposit as many times as you need each month at no extra cost.**

Expert review and setup

Get an expert to review your payroll or have them set it up for you.**

HR support

Access HR resources online or talk one-on-one with a personal HR advisor. Save time and stay compliant with HR support powered by Mineral, Inc.**

Health benefits

We’ve got you covered with access to affordable health benefits, powered by SimplyInsured. Premiums are deducted automatically when you run payroll.**

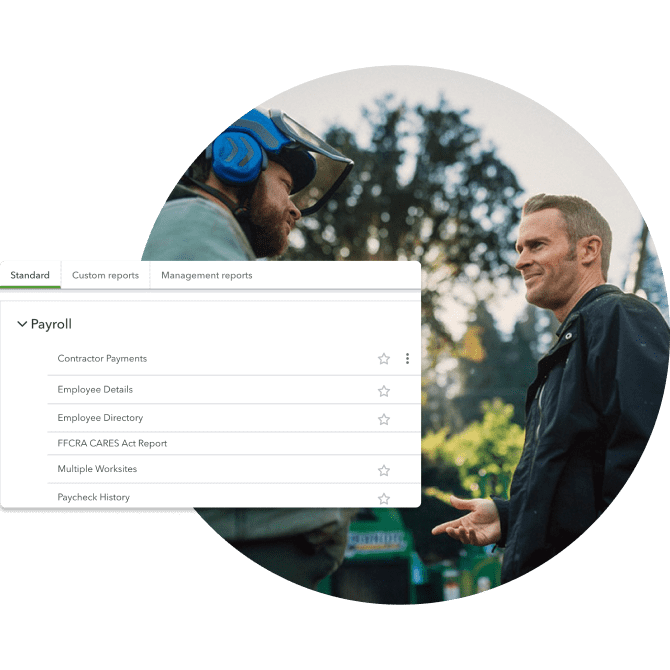

Payroll reports

QuickBooks Payroll helps you create and download detailed reports to get actionable insights about your freelance business.

- View your total payroll costs, tax liabilities, bank transactions, and more from your dashboard.

- Choose from over 15 customizable payroll reports to track your finances and see where your money’s going.

- Add repeat reports to your favorites to get data at your fingertips.

Payroll services for freelancers

When you’re a freelancer who bills by the hour, you need an online payroll system that gets things done. QuickBooks offers flexible plans to fit your business and your budget.Payroll Core helps you manage payroll, calculate taxes, and access expert product support.**

Payroll Premium adds powerful tools, including same-day direct deposit, mobile time tracking, and help with HR compliance.**

Payroll Elite is there every step of the way with customized setup, a personal HR advisor, tax penalty protection, and 24/7 support.**

All plans come with full-service payroll, including automated taxes and forms.**