All the features you need to manage payroll

Track time and create schedules

Manage multiple timesheets, approve time when you’re ready, and edit, publish, and share schedules with with your team.

Payroll support

Get step-by-step help, troubleshooting assistance, and tips from a payroll specialist.

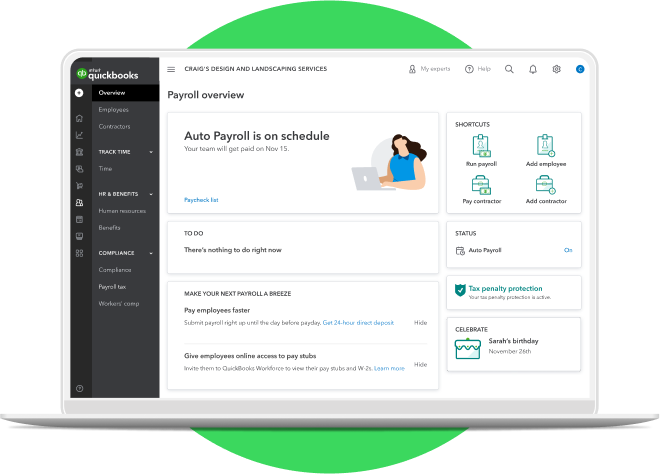

Auto Payroll

Set payroll to run automatically and get notifications so you're always in control.**

Payroll reports

Get you real-time data on everything from payroll tax liabilities to total employee pay.

Auto taxes and forms

We’ll calculate, file, and pay your payroll taxes for you.**

Track time and create schedules

Manage multiple timesheets, approve time when you’re ready, and edit, publish, and share schedules with with your team.

Payroll support

Get step-by-step help, troubleshooting assistance, and tips from a payroll specialist.

Auto Payroll

Set payroll to run automatically and get notifications so you're always in control.**

Payroll reports

Get you real-time data on everything from payroll tax liabilities to total employee pay.

Auto taxes and forms

We’ll calculate, file, and pay your payroll taxes for you.**

Do less and get more

When you’re responsible for everything from hiring to payroll and taxes, it's important to find a payroll system that does the work for you. With QuickBooks Payroll you can automate repetitive tasks and run payroll in less than 5 minutes.2

Why use QuickBooks Payroll for Mac?

QuickBooks Payroll prioritizes security and comes with multi-factor authentication and state-of-the-art encryption technologies. You can also stay in control of your finances with robust reporting dashboards.