2. Specify how your team can use the money

Take the time to explain how your employees can and can’t use these funds. Petty cash is often used to make change for customers and pay for small, erratic expenses that pop up, like office supplies, a small repair, and so on.

Put your petty cash policy in writing and offer some examples of appropriate expenses. You may want to include rules governing the use of petty cash in your employee handbook so your team can easily review the approved uses before using the fund. You can also mandate that all petty cash transactions be under a certain dollar amount, like $25.

3. Require employees to account for expenses

Petty cash doesn’t typically represent a big chunk of a business’s budget. However, your team still needs to account for expenses to reduce the risk of theft or inappropriate use of company resources.

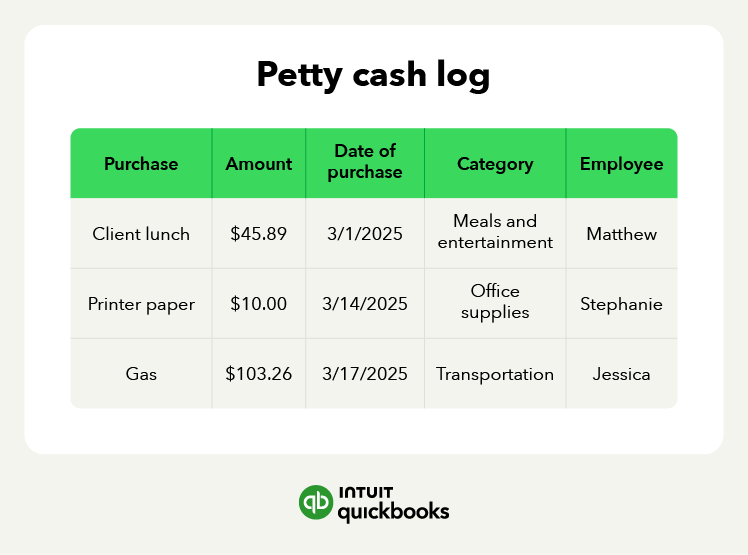

Require employees to maintain a running petty cash log for every transaction, including receipts. Each entry in the petty cash book should include the date, the amount, and what was purchased with the petty cash. Review your petty cash register before you replenish the fund.

You can also use a Microsoft Excel doc or other spreadsheets that track who spent what, when it was spent, and the total amount of spending for both the month and year to date. Not only will this help you hold employees accountable, but it will also ensure you’re more prepared at tax time.

If you need help getting a petty cash log started, look up some free petty cash log templates to do some of the work for you.

4. Distribute petty cash as needed

Though it might be tempting to give everyone access to the petty cash fund, doing so isn’t always the best move. Giving every employee access to petty cash often leads to poor or non-existent recordkeeping, which makes it hard to reconcile your accounts at tax time.

Appoint one employee to oversee the petty cash fund. That person, generally known as a petty cash custodian or petty cashier, will determine if an expense is appropriate, hand out the cash to employees who need it, and ensure the expense log is kept up-to-date.

If your company is growing rapidly or has a large number of employees, you may need to have more than one fund custodian. Make sure anyone acting as a custodian is trustworthy and responsible.

5. Track and record petty cash

Petty cash is a small amount of money, but it adds up quickly as it’s replenished. To track the cash, create a petty cash account in the asset section of your chart of accounts. When you’re ready to replenish the fund, record the expenses in your accounting software based on the petty cash expense log. Then, record the replenishment by debiting the petty cash account and crediting the bank account you used to refill the fund.

If you’re running a proper log as mentioned above, you’ll also be able to easily gather up your petty cash vouchers and cross-reference them with your books to ensure things are accurate. This will set you up for success, not a petty cash accounting nightmare.