From big jobs to small tasks, we've got your business covered.

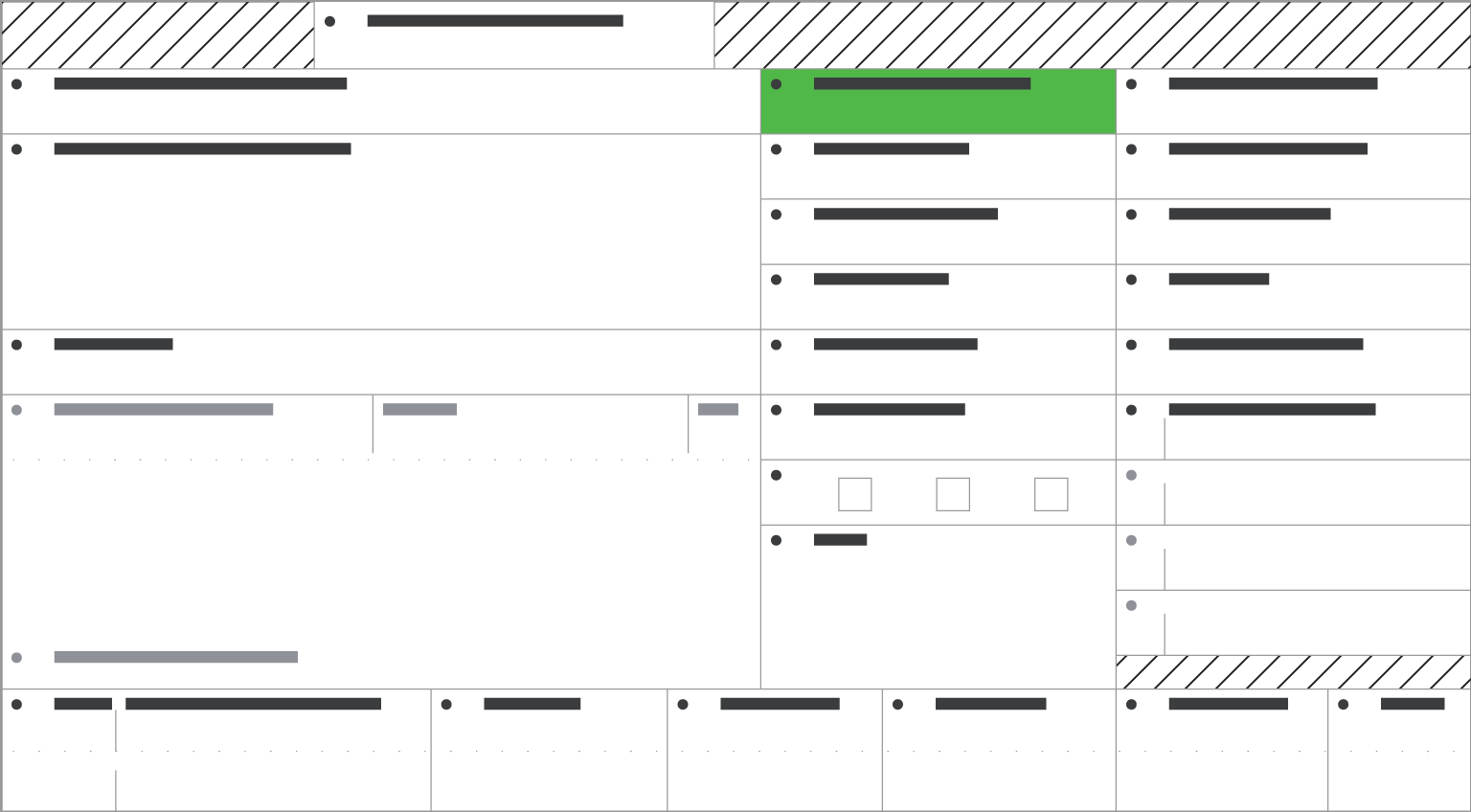

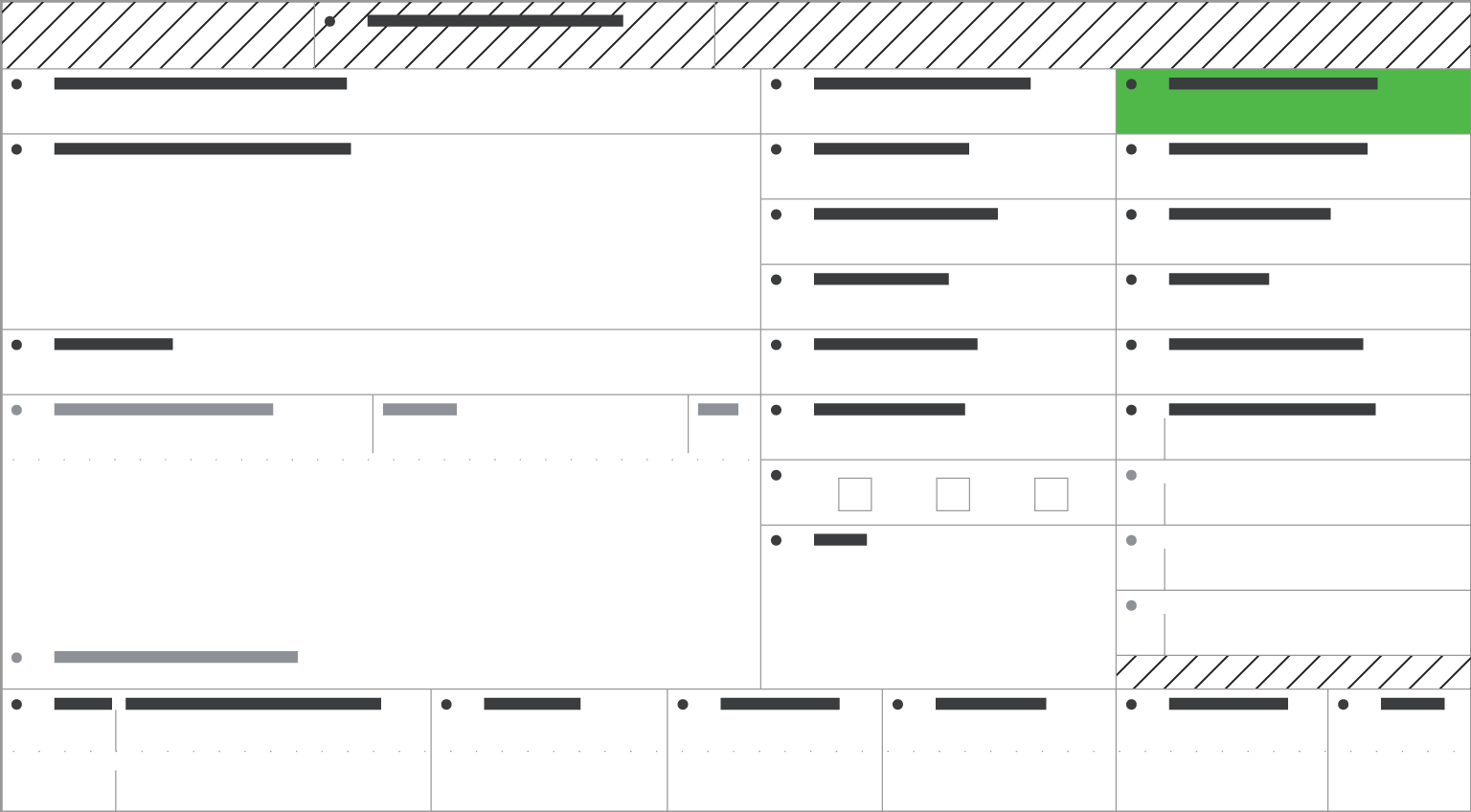

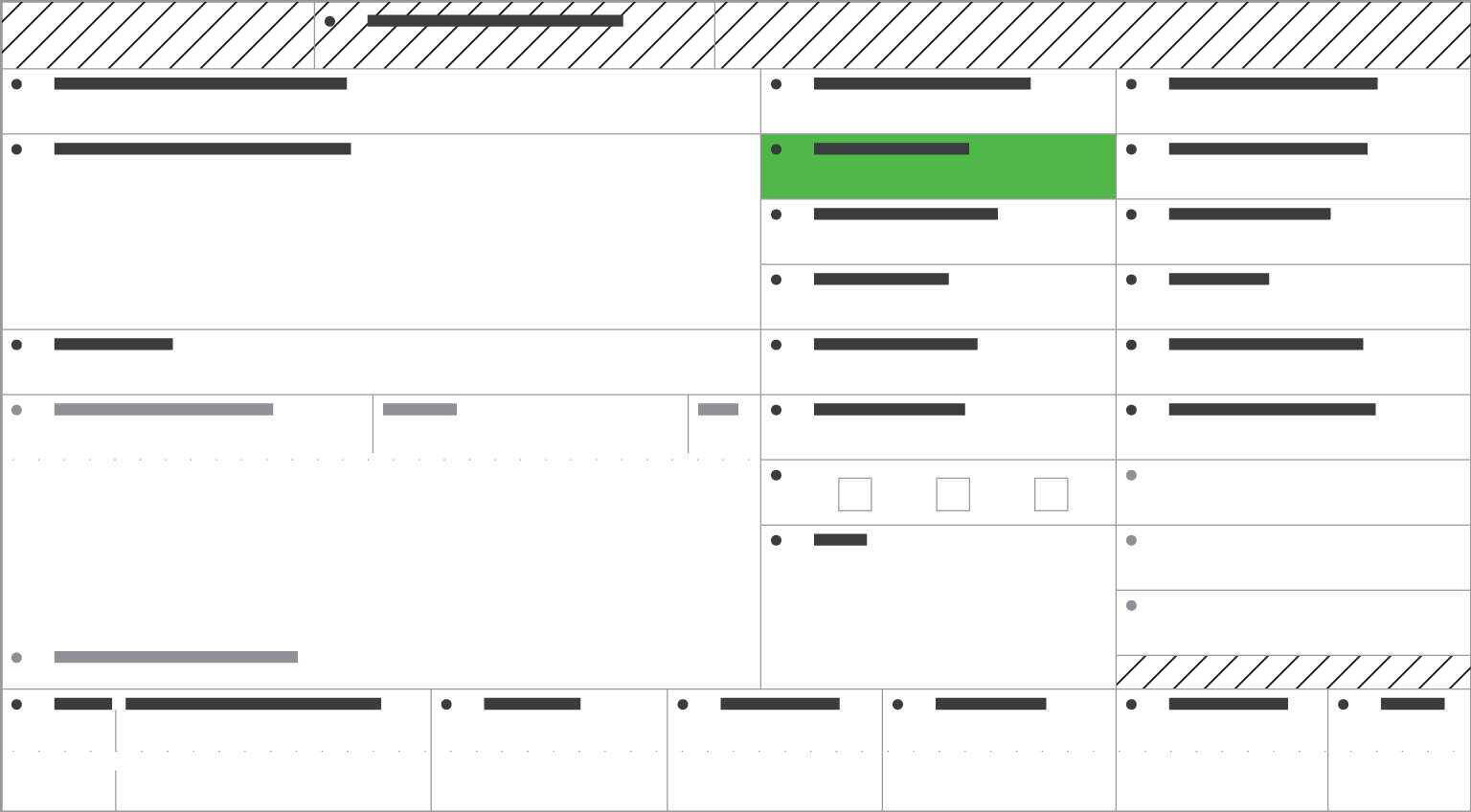

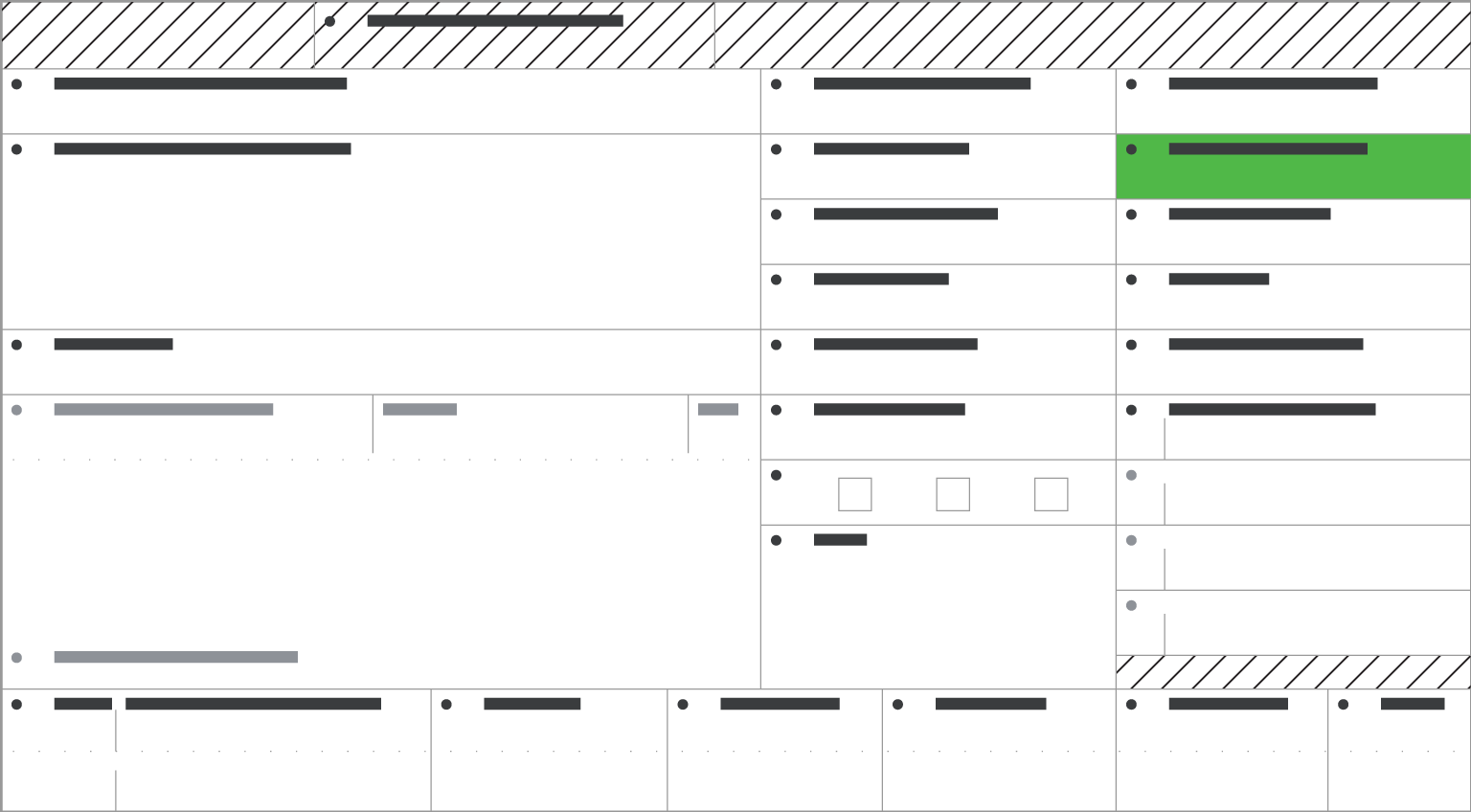

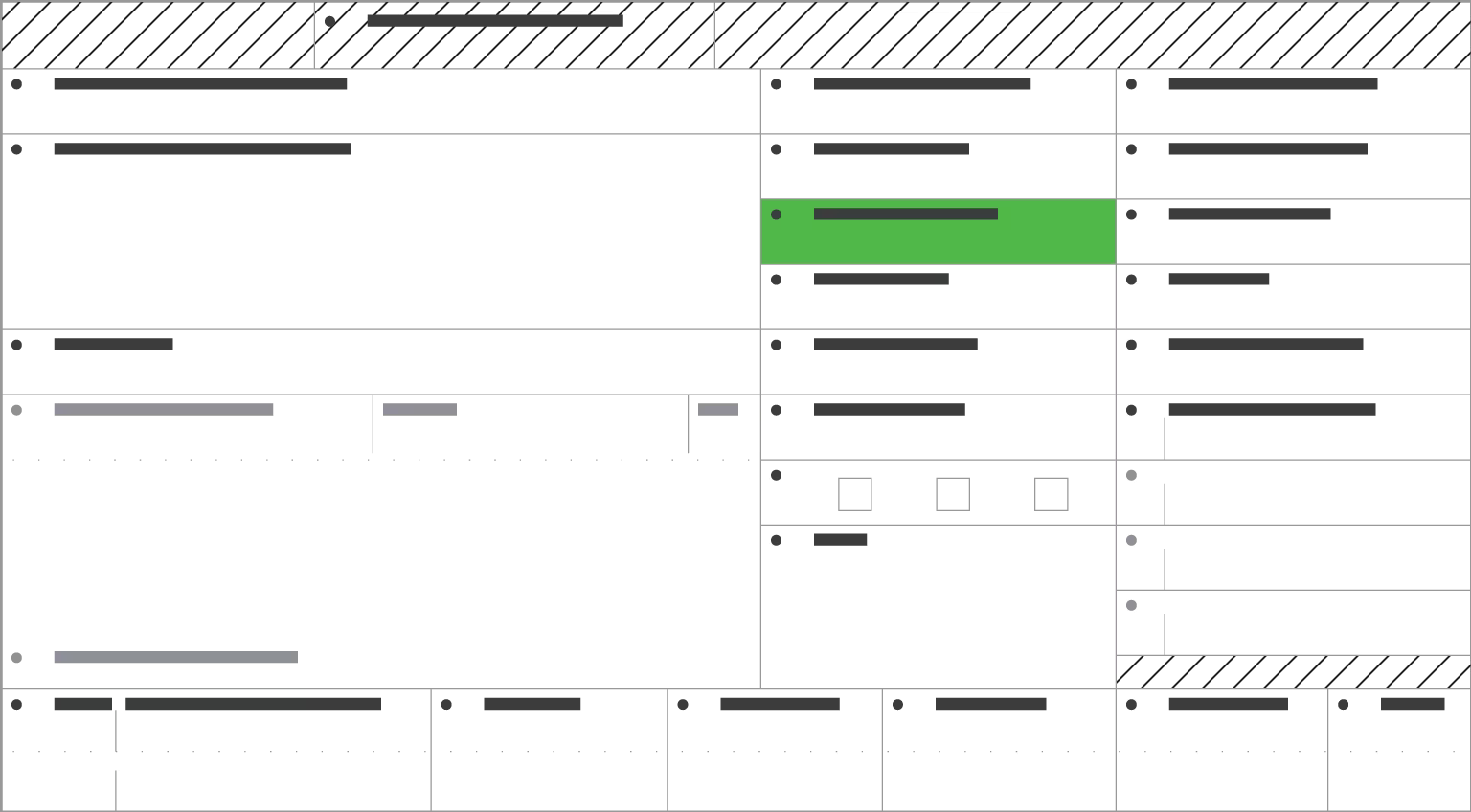

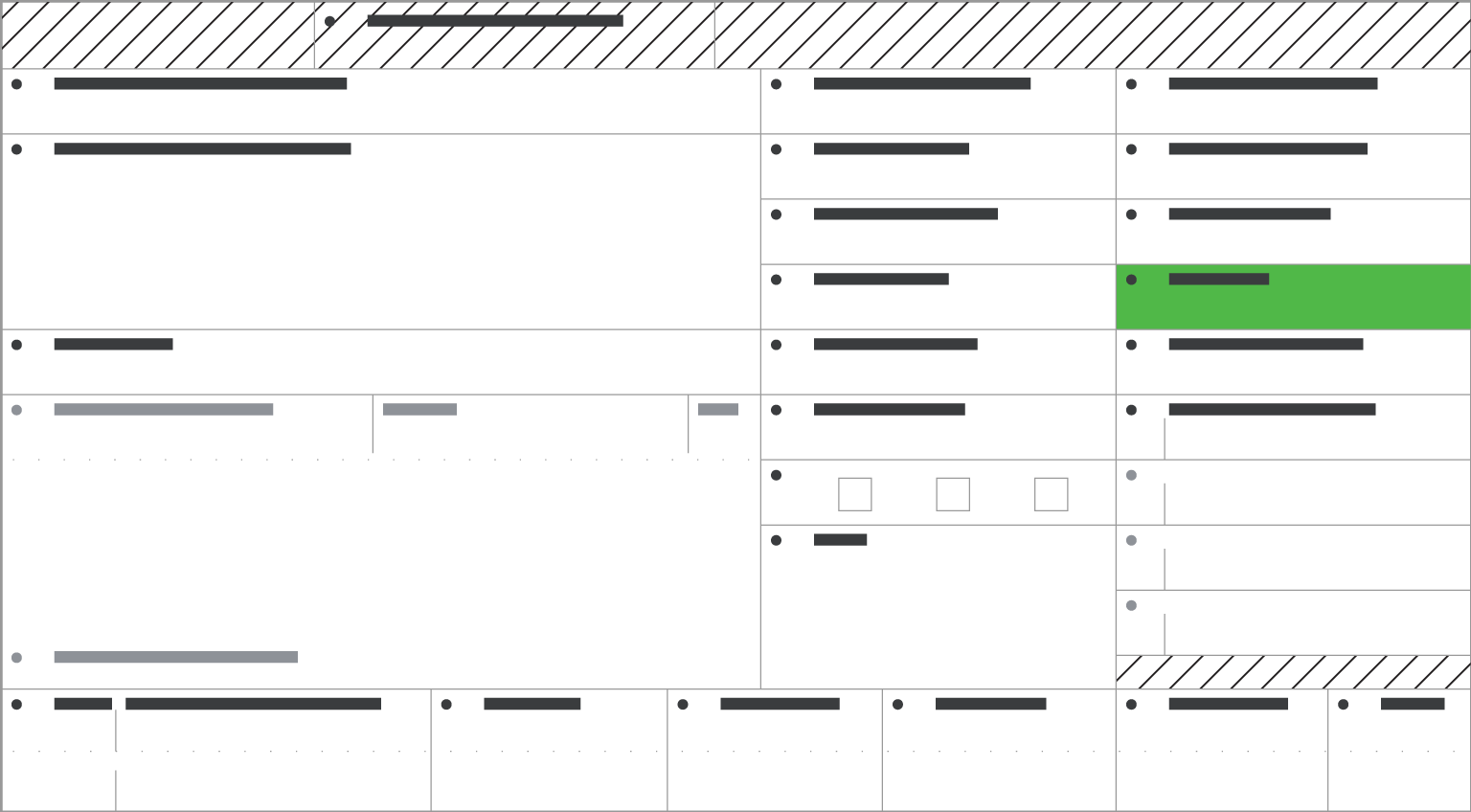

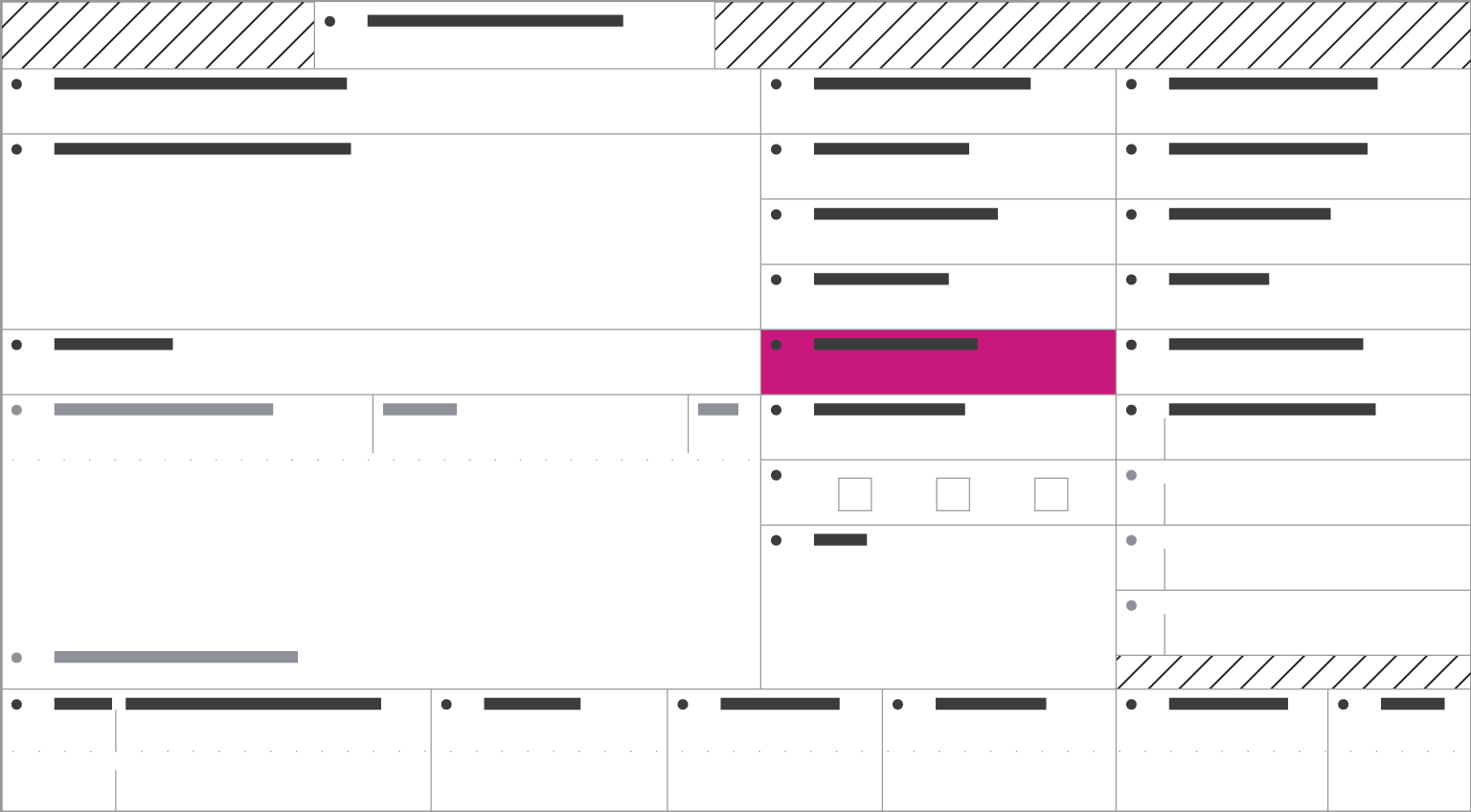

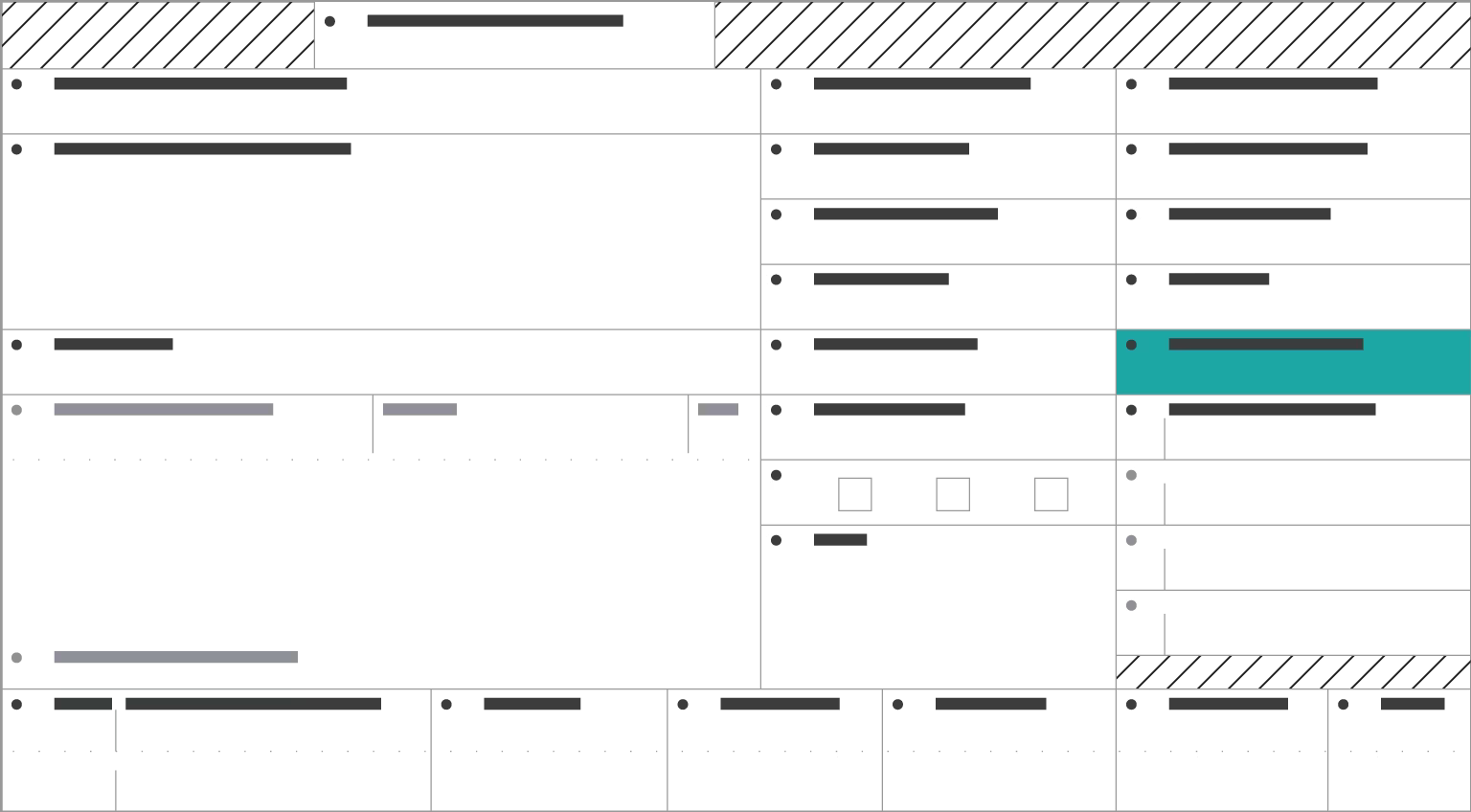

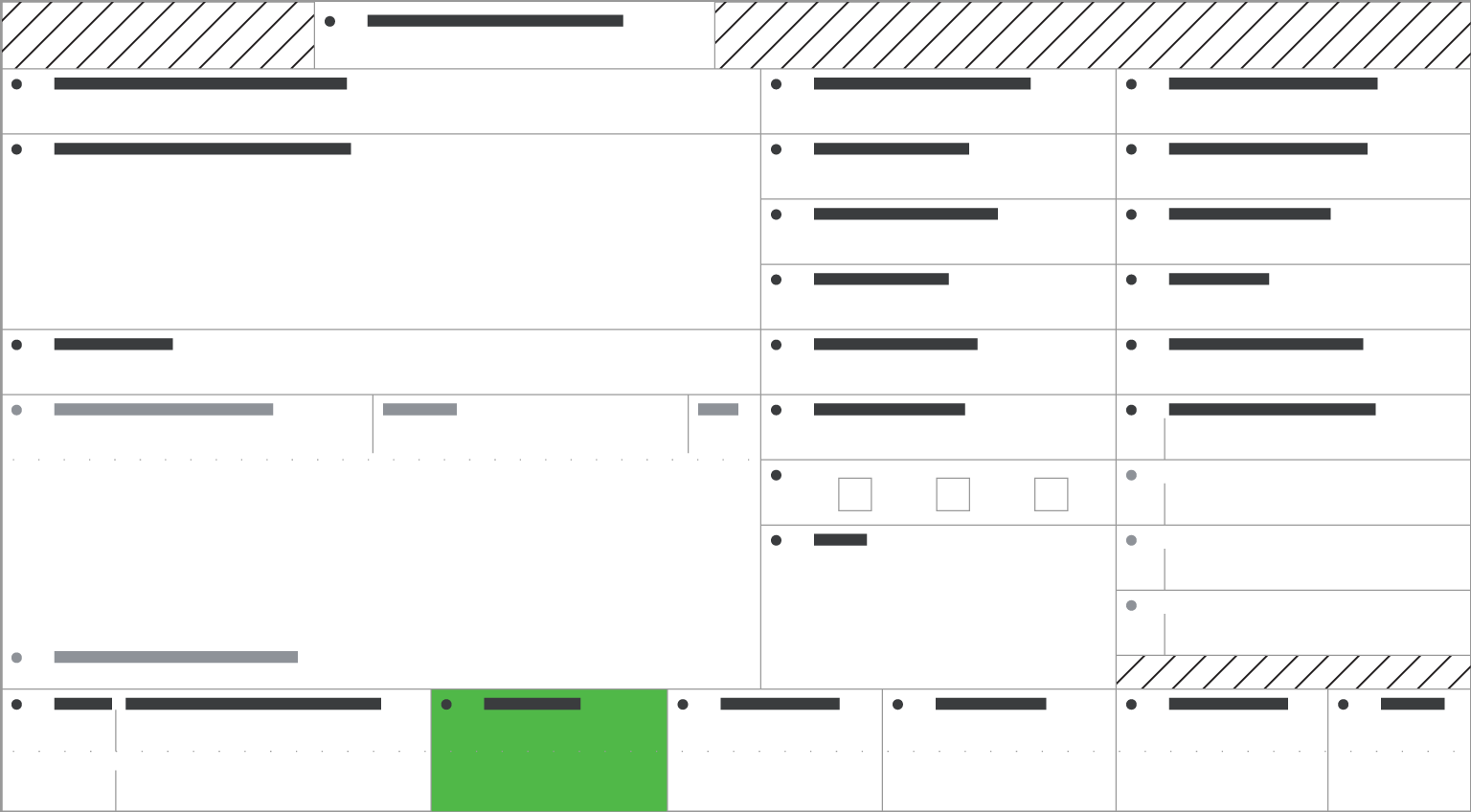

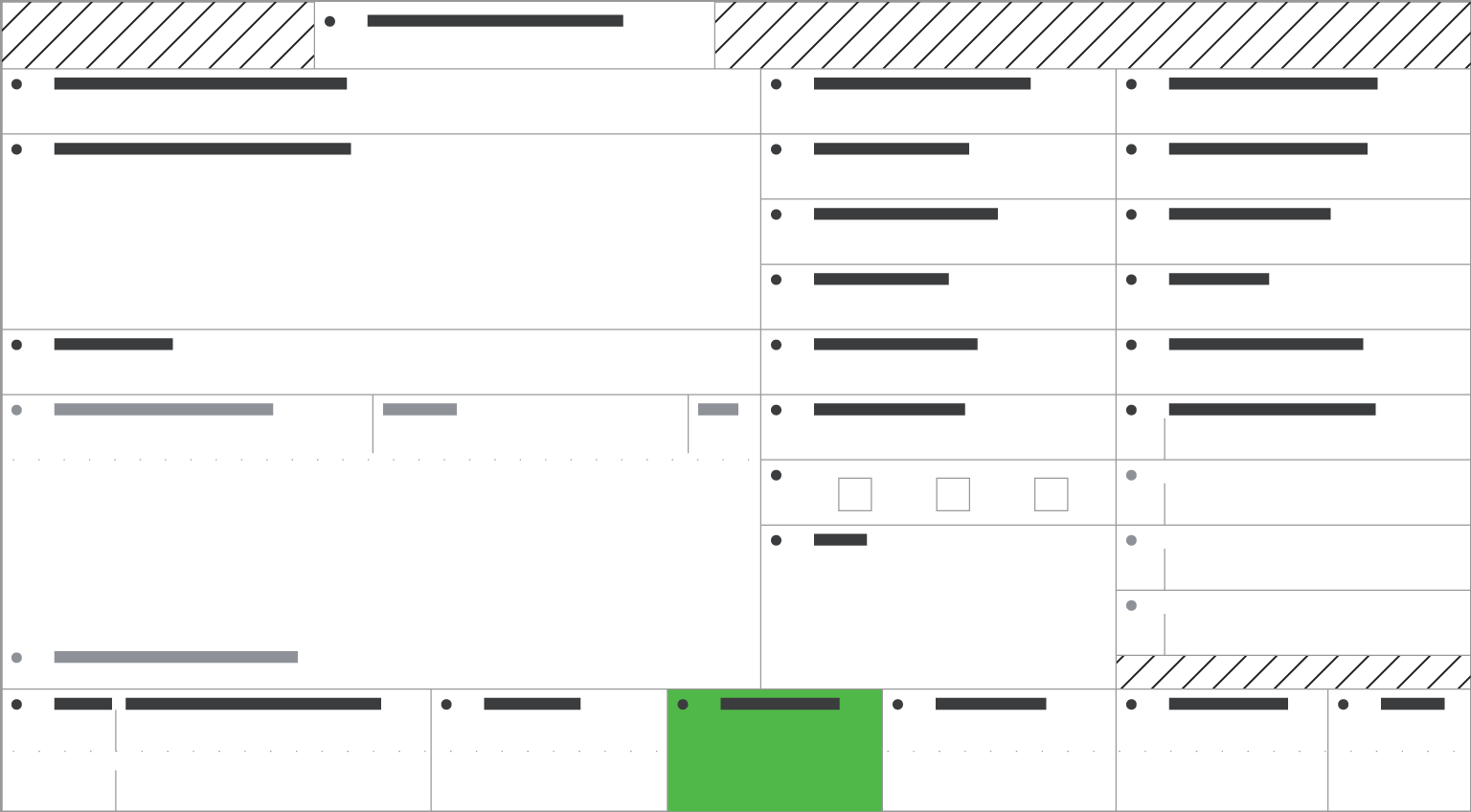

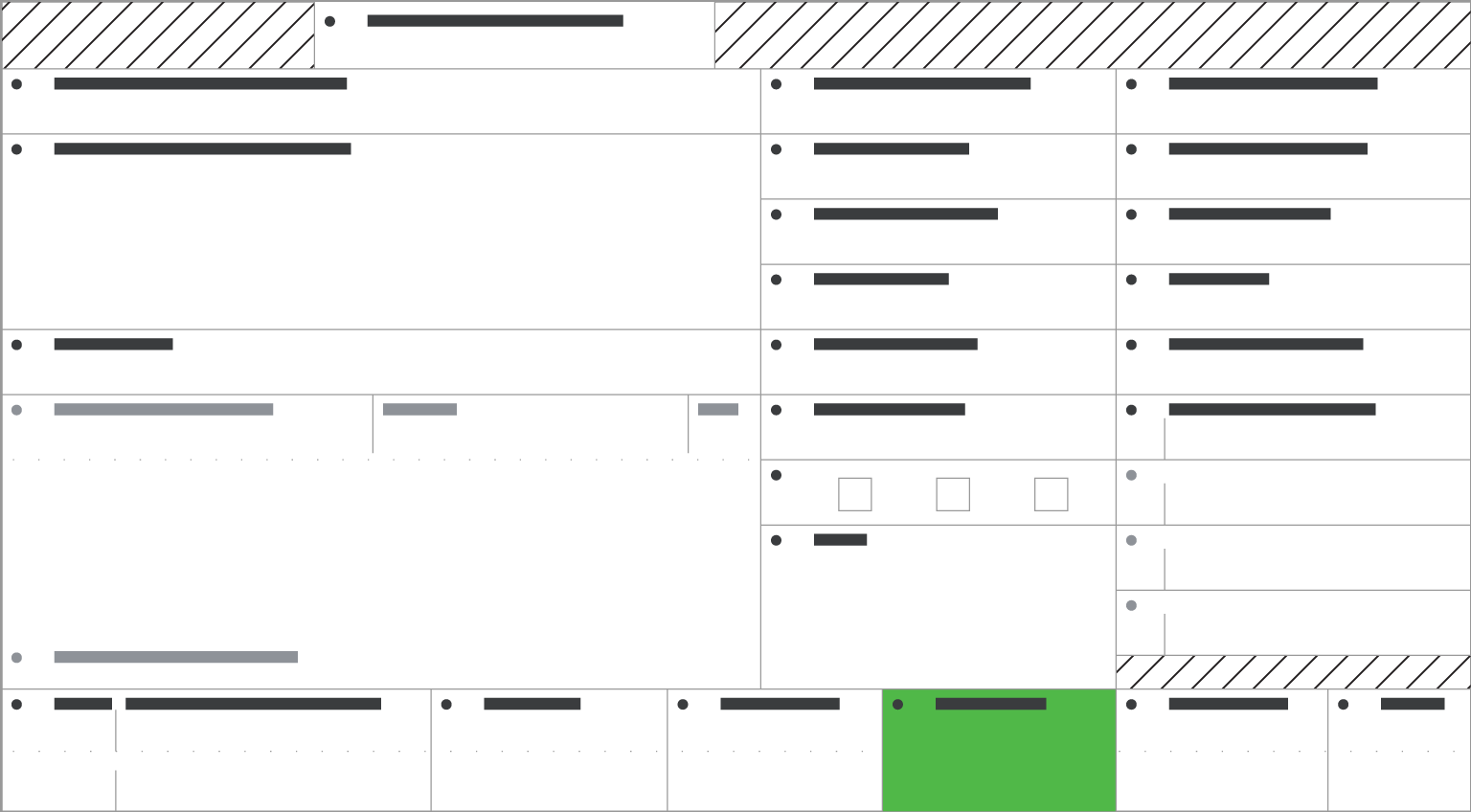

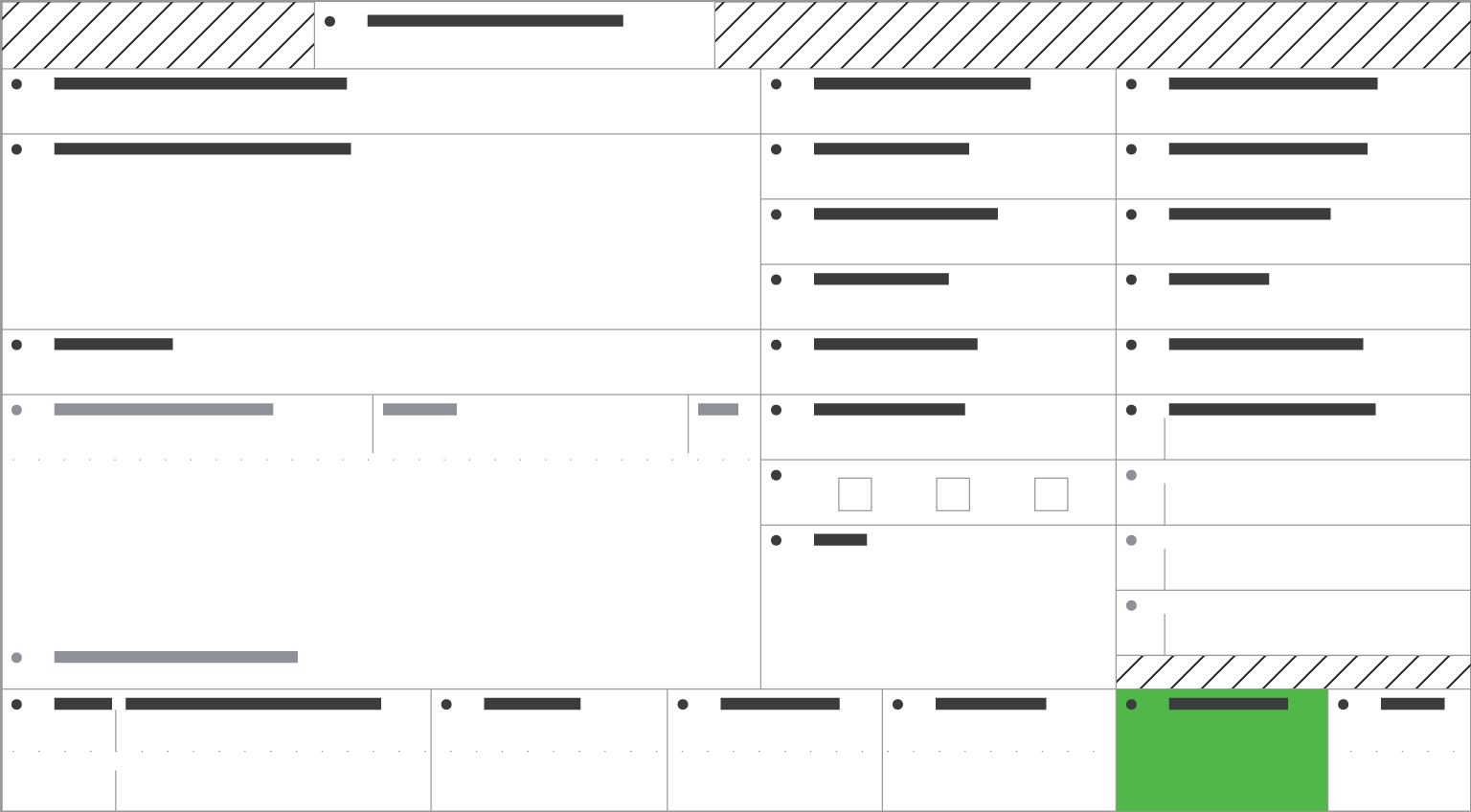

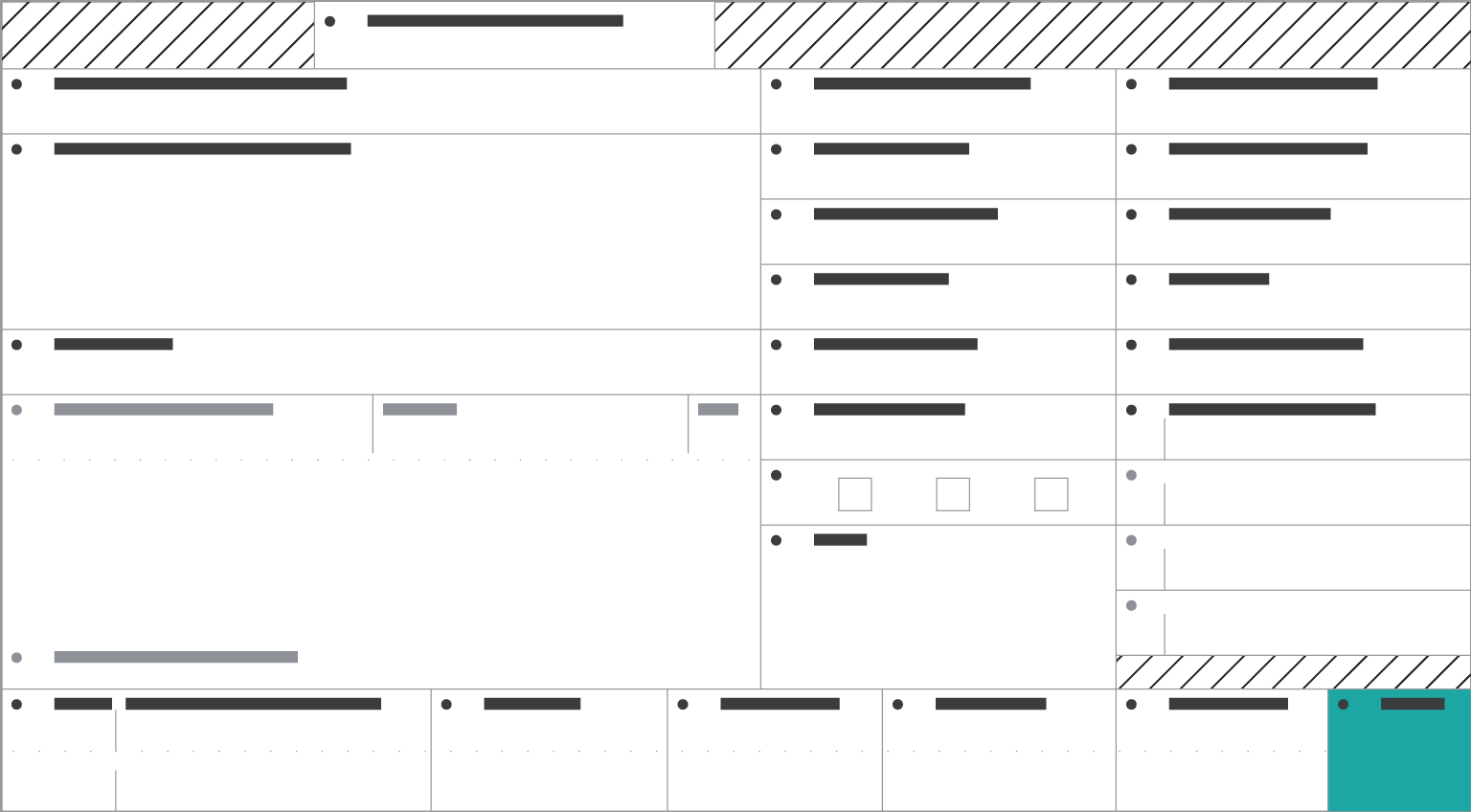

a. Employee’s social security number

Your employee’s social security number.

TIP:

The SSA lets you verify employee names and SSNs online or by phone.

Who gets a W-2? Any employee you've paid within the previous tax year, between January 1 and December 31. The W-2 form is important because it's how you report the total wages and compensation for the year to both your employee and the IRS. Your employees will use the W-2 form you provide as they prepare their own personal tax return for the year.

As an employer, it's your responsibility to make sure the form is accurate and delivered by the IRS deadline. Otherwise, you could face stiff penalties! A payroll service can help you get all the information you need to prepare your W-2s correctly and in plenty of time.

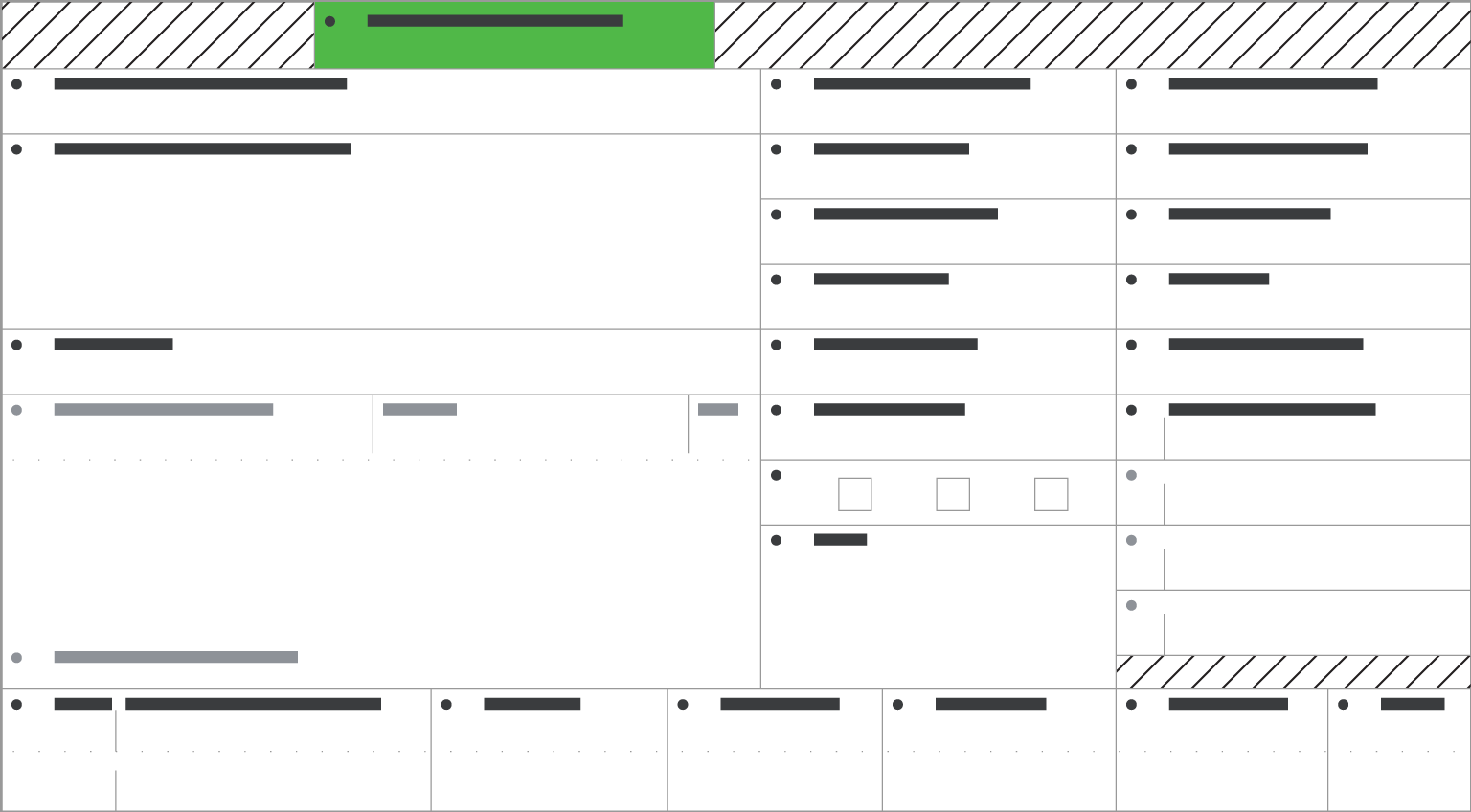

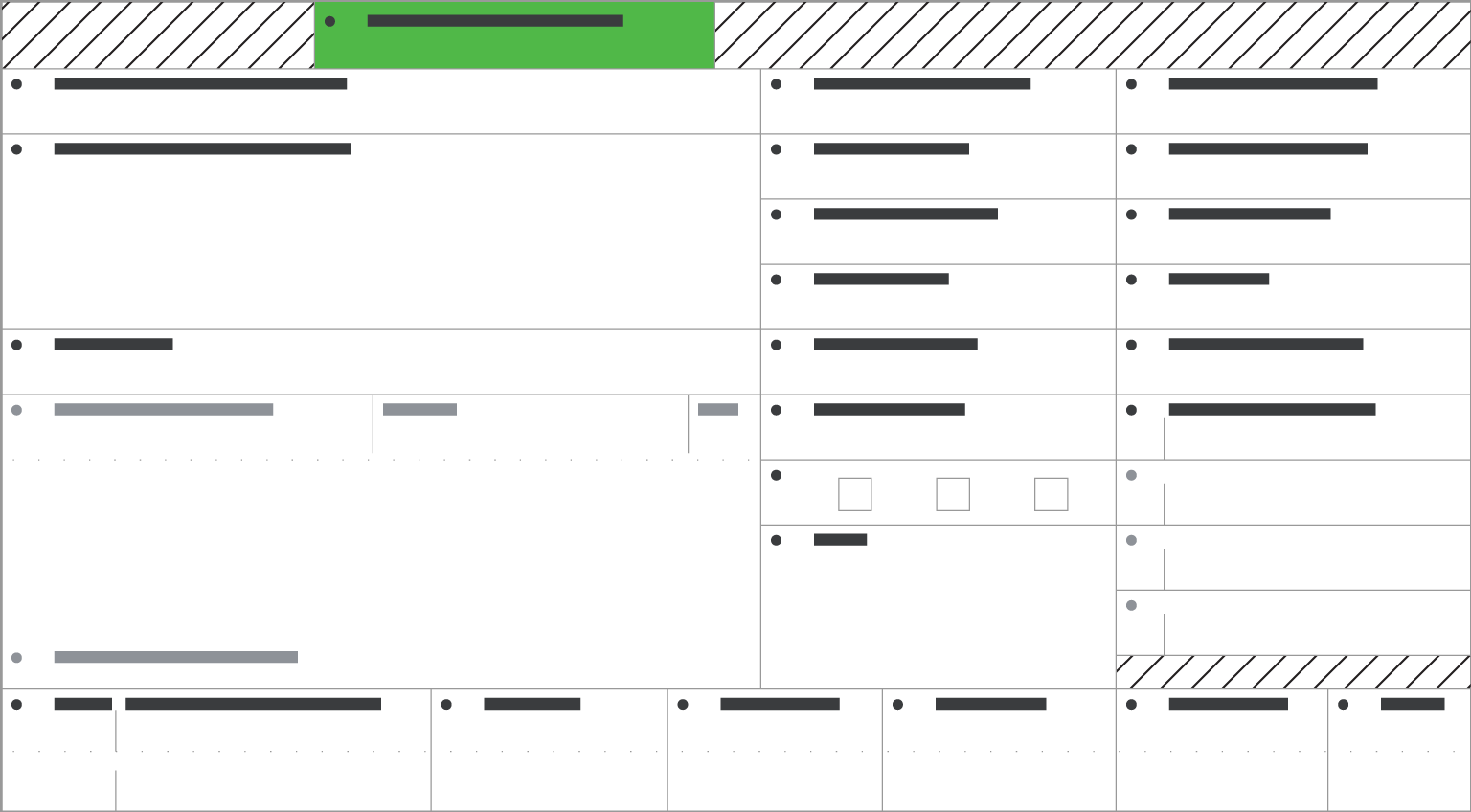

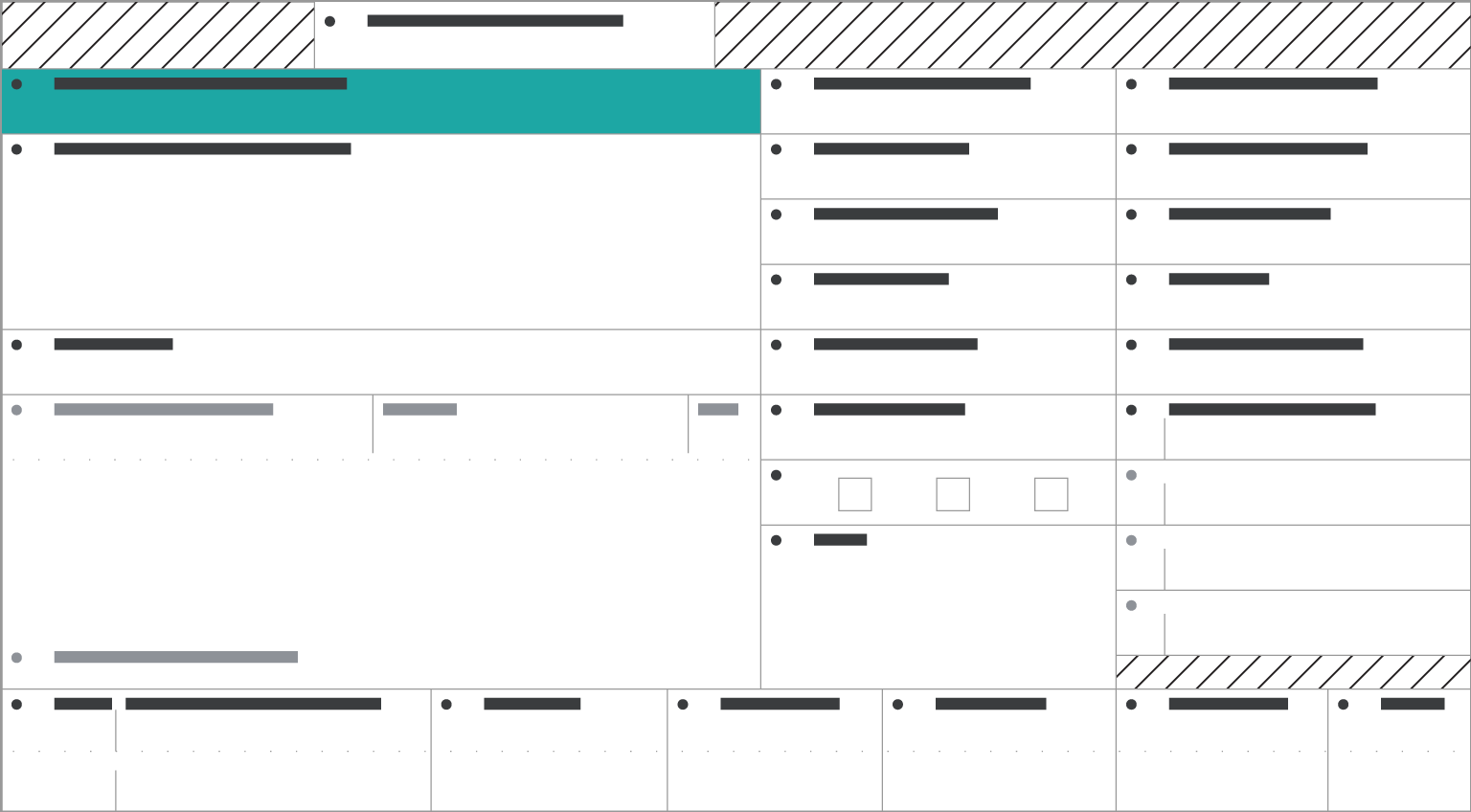

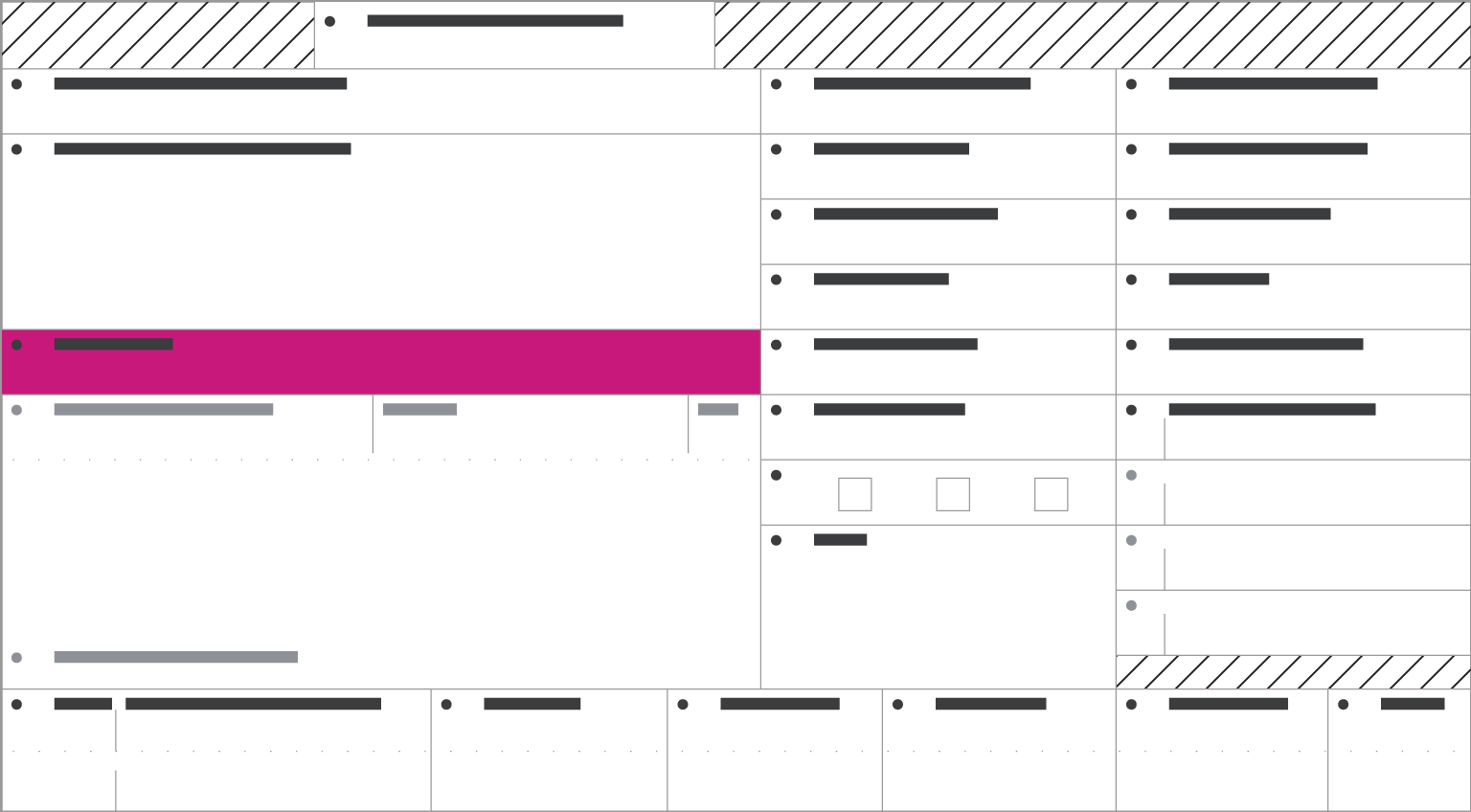

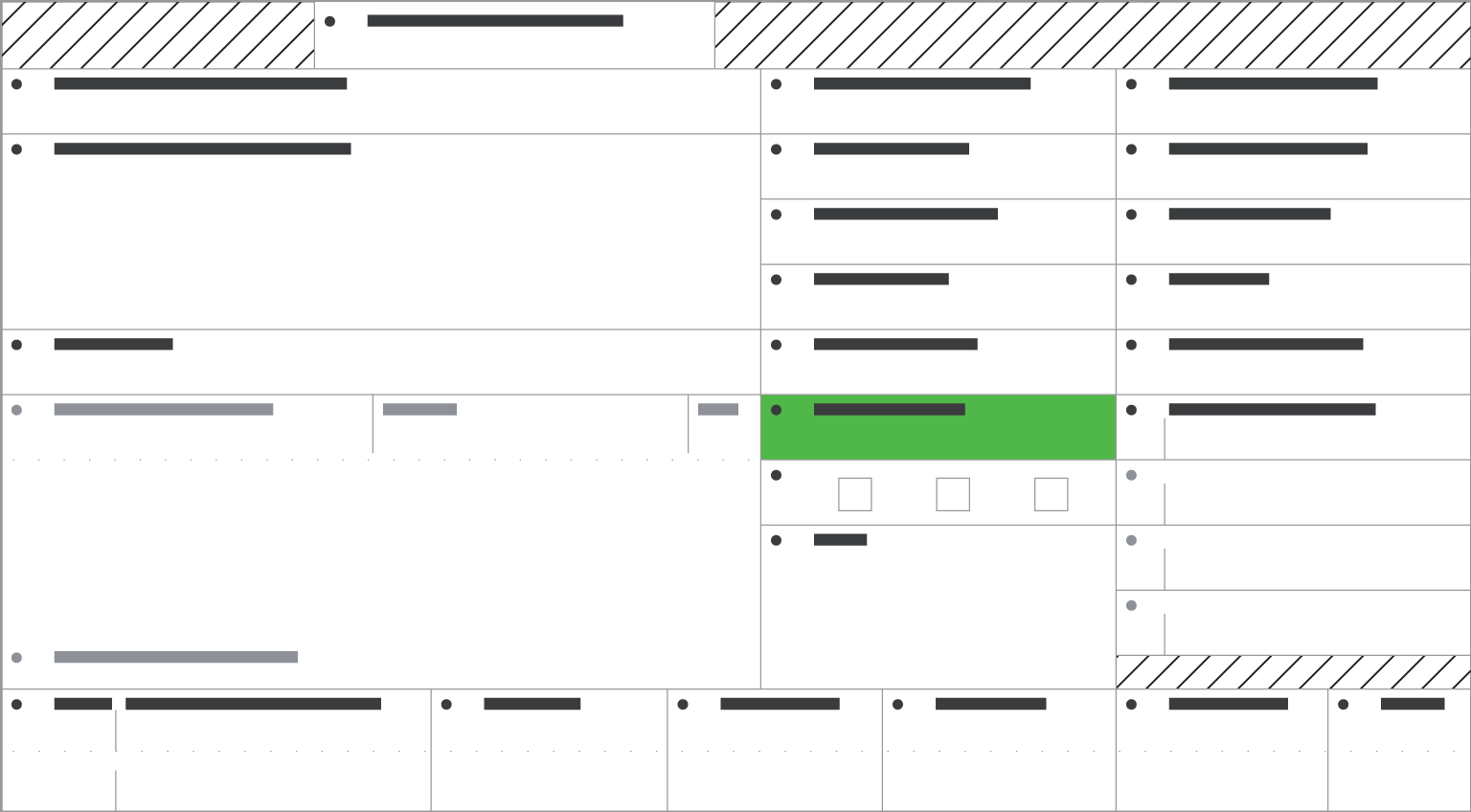

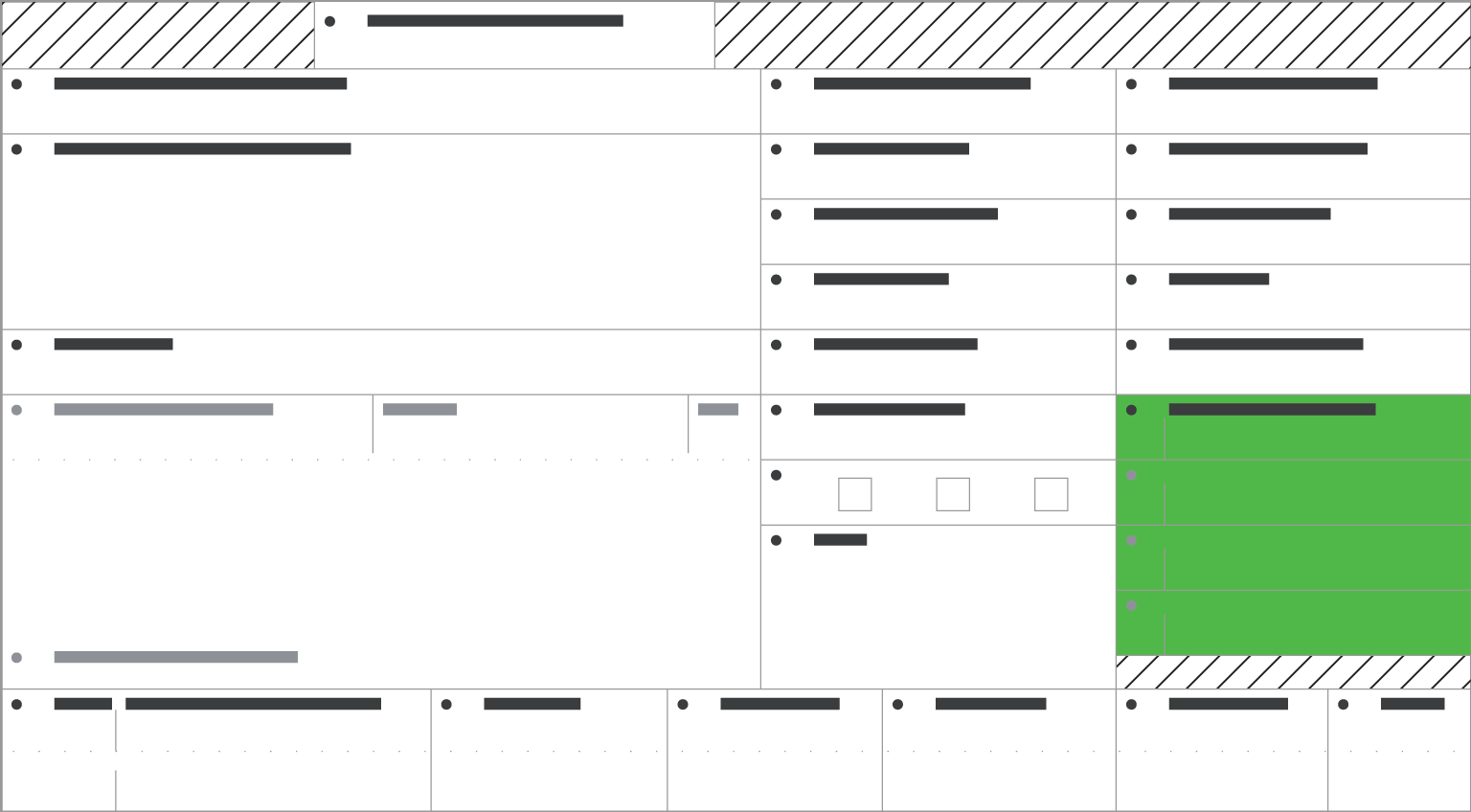

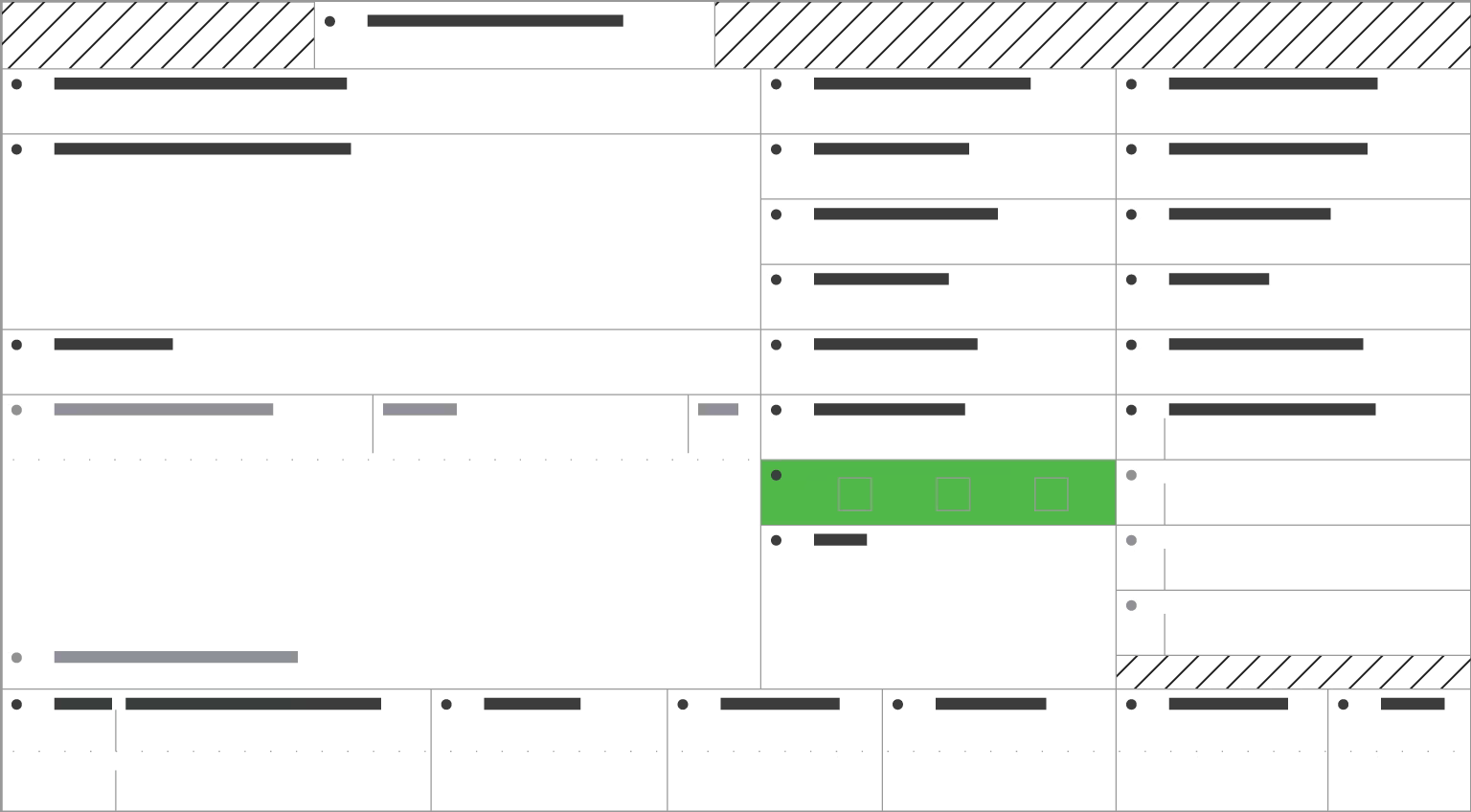

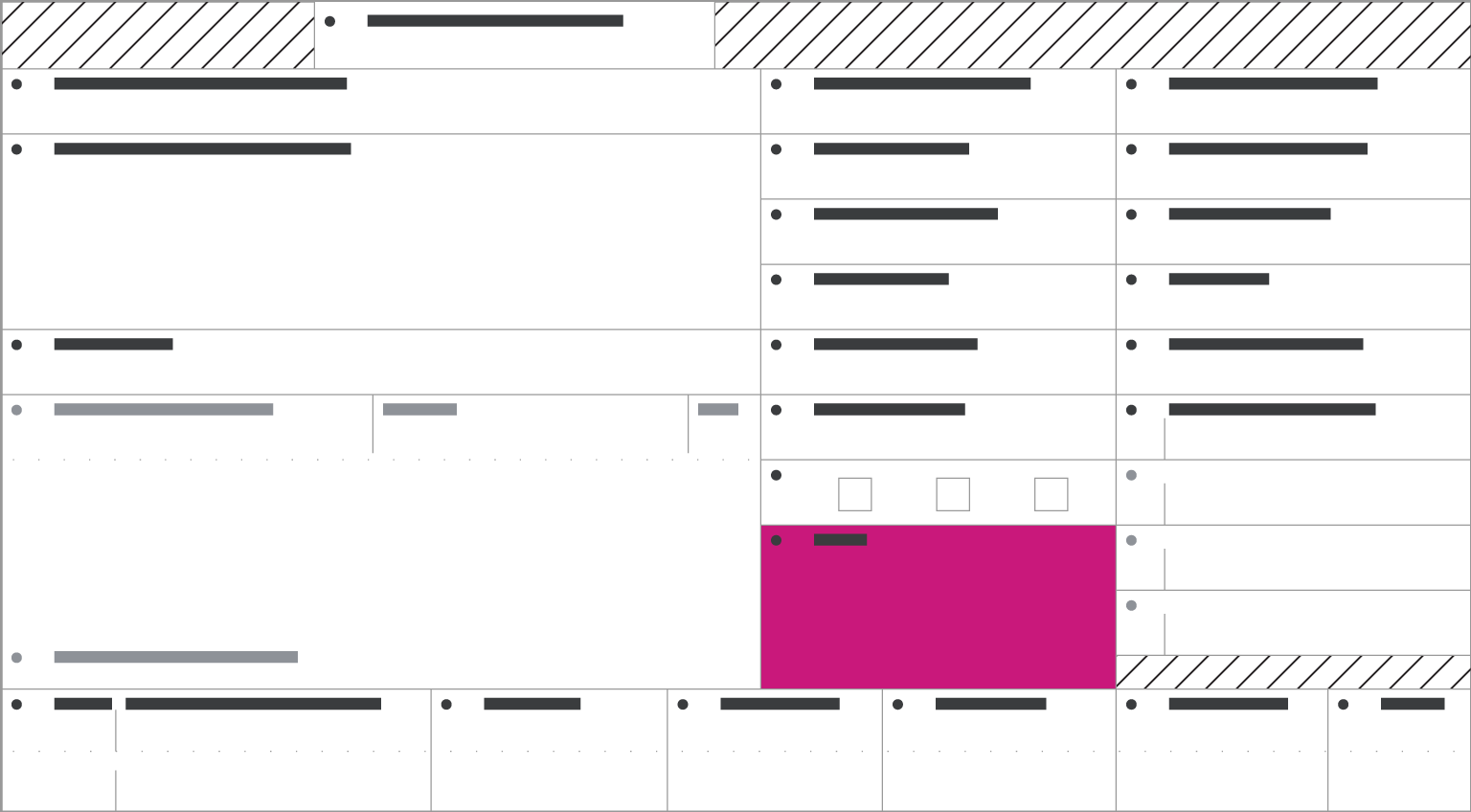

The W-2 form is how you report total annual wages to your employees and the IRS. It is the employer’s responsibility to fill out the form correctly and file it on time. This tool will explain each of the fields in a standard W-2 form. Click on a box below for more information.

Your employee’s social security number.

TIP:

The SSA lets you verify employee names and SSNs online or by phone.

This is your IRS-assigned Employer Identification Number (00-0000000), which you used on your federal employment tax returns.

TIP:

If you do not have an EIN when filing, write “Applied For” in box B. You can get an EIN online at www.irs.gov.

Be sure to only use this box to identify or archive individual W-2 forms.

TIP:

You do not have to use this box.

This amount is everything you paid your employees during the tax year (before payroll deductions), such as wages, tips, bonuses, and commissions.

TIP:

Remember: Do not include employee contributions to a section 401(k) or 403(b) plan.

This is the total federal income tax held from your employee's wages for the year.

This is all of your employee’s wages that are subject to employee social security tax, excluding tips.

TIP:

Keep in mind that social security wages top out at $113,700, so the total of boxes 3 and 7 should not be more than this amount.

Your employee’s portion of all social security tax withheld, including social security tax on tips.

TIP:

Remember that the tax rate for social security is 6.2%.

The same wages and tips in box 3 are also subject to Medicare taxes. The only difference is that there’s no wage base limit for Medicare tax.

TIP:

Remember to include any tips that employees reported, whether or not you have the employee funds to collect the Medicare taxes on them.

For this box, include all of your employee’s withheld Medicare tax, as well as any extra Medicare tax. Be sure to exclude your share.

This is the total amount of tips your employee reported to you, regardless of whether you have enough employee funds to collect the social security tax for the tips.

TIP:

Remember that social security wages top out at $113,700, so the total of boxes 3 and 7 shouldn’t exceed this amount.

If your business is in the food or beverage industry, show the tips allocated to the employee.

TIP:

Don’t include this amount in boxes 1, 3, 5, or 7.

If you are e-filing and there is a code in this box, enter it when prompted by your software. This code assists the IRS in validating the W-2 data submitted with your return. The code is not entered on paper-filed returns.

Complete this box only if you have paid for benefits, such as child care, to your employee.

TIP:

Include any amounts more than $5,000 in boxes 1, 3, and 5.

This box allows the SSA to decide if any of the amounts reported in boxes 1, 3, or 5 were earned in a prior year—just to make sure they have paid the right amount.

TIP:

This is where you should include distributions made to an employee from a nonqualified plan or nongovernmental section 457(b) plan in box 1. Leave out anything related to special wage payments, such as sick or vacation pay.

Use this box to record compensation with special tax qualifications, such as 401(k) contributions. Keep in mind that you must use the IRS code designated for that item.

TIP:

You should not write more than four items in this box. If you need more space to record more than four items, use a separate W-2 form.

Check all that apply:

Statutory employees: These are full-time employees who pay social security and Medicare taxes, but no federal income tax.

Third-party sick pay: Check this only if you are an employer reporting third-party sick pay payments.

Retirement plan: Check this only if an employee is participating in your retirement plan.

This is for additional taxes or deductions that are not covered elsewhere.

TIP:

These are things such as withheld state disability insurance taxes, union dues, nontaxable income, educational assistance payments, etc.

This is your state identification number.

TIP:

Don’t forget to keep information for each state and locality separated by the broken line. If you need to report more than two states or localities, you can always use a second W-2 form.

Your employee’s total state taxable pay, if it applies. This may or may not be the same as box 1.

Your employee’s total state income tax withheld.

Your employee’s total locally taxable gross pay, if it applies. This may or may not be the same as box 1 or 16.

The local tax withheld from your employee’s pay, if any.

The name or code from where the local area wages and/or tax is being reported.

Topical articles and news from top pros and Intuit product experts.

Get help with QuickBooks. Find articles, video tutorials, and more.

Call Sales: 1-800-285-4854

© 2026 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

By accessing and using this page you agree to the Website Terms of Service.