We hope you have everything you need to feel confident and accomplished this month, which includes Tax Day. April also happens to be Stress Awareness Month, so best wishes for those of you feeling a little more of it than usual. See below for the latest updates.

What's new in QuickBooks Online: April 2023

Set automatic deductions and contributions for union members in QuickBooks Payroll

In a nutshell: With every payroll run, QuickBooks Payroll can automatically calculate a payroll deduction or contribution for employees based on their hours worked.

Rather than making tedious, error-prone manual calculations to figure deductions (like union dues) and contributions, you can calculate them automatically for employees paid hourly, or on salary, commission, overtime, or double overtime.

Here’s how it works: In the employee profile, you can set up and assign a deduction or contribution to be calculated as “Per hour worked.” Then, those deductions and contributions will be calculated automatically in Run Payroll.

A new partnership between Shopify POS and QuickBooks Desktop

In a nutshell: On Oct. 3, 2023, QuickBooks Desktop Point of Sale will be discontinued and there will be no future versions. If you use this system, you may be concerned about how to continue managing your retail store. We’re happy to share that Intuit has teamed up with Shopify, our preferred POS provider, to offer a Point of Sale option that integrates with QuickBooks Desktop.

Shopify POS includes remote access, enhanced reporting, a modern user interface, and multi-channel selling. And, to help you migrate and get up and running with this new system, Shopify will provide a free migration tool, premium, guided onboarding, and free 24/7 support.

Plus, if you use QuickBooks Point of Sale and migrate to Shopify, you’ll get 50% off POS software and select hardware with Shopify Payments plus a free tap & chip card reader and free e-commerce.

As a Shopify POS merchant, you’ll also enjoy:

• Unlimited registers per location.

• Local pickup and local delivery.

• The ability to redeem gift cards online and in-store.

• Integrated customer order history.

• Social media selling.

• In-store return or exchange of online purchases.

Intuit developer growth program expands pilot

In a nutshell: We launched a developer growth pilot program last fall designed to help app developers succeed with millions of small businesses around the world that run on the QuickBooks platform. The pilot is a 9-month initiative in which each participating developer works hand-in-hand with Intuit to identify and test growth opportunities designed to maximize their marketing impact, help them connect with more customers, and increase their app revenue. In March, we added three new developers to our pilot cohort.

Meet our new cohort of app developers:

What’s next: Throughout March and April, our cohort has been engaged with Intuit solution architects and go-to-market managers, as well as experts from our accountant community. The app developers will take in feedback and iterate to deliver a great user experience for QuickBooks customers. We look forward to our next milestones of engaging with Intuit UX experts and providing our app developers with valuable app insights. These insights will include monthly reports with analyses of app performance within the QuickBooks ecosystem and marketplace.

For more information about the pilot, our latest cohort, and our accountant experts, please see our latest post.

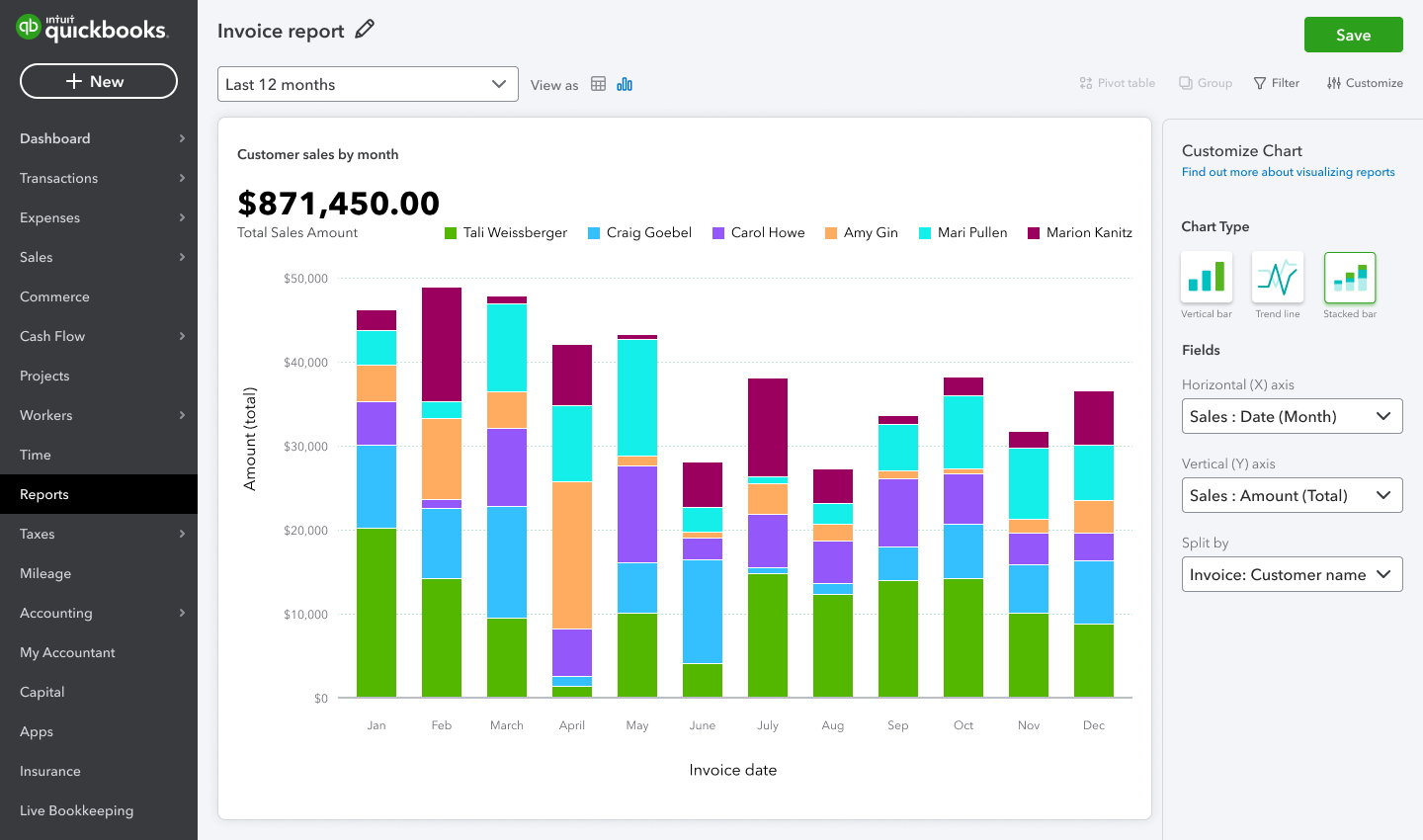

Make comparison charts in QuickBooks Online Advanced

In a nutshell: If you use QuickBooks Online Advanced, you can now build clear, high-quality charts that compare data sets—with no need for separate programs or tedious manual steps.

With the newly upgraded chart view data visualization tool, you can now create 3 distinct types of comparison charts in the custom report builder:

● Vertical bar charts

● Trend line charts

● Stacked bar charts

Comparison charts can help you better understand what drives your business by helping you spot trends or discrepancies early among customers, products, locations, or whatever aspects of their company you find most important to measure.

For example, you may want to build a chart that compares your sales from Amazon, Shopify, and Etsy. Or, compare invoicing among your customers to better understand which ones drive more revenue. In fact, you can use and compare up to 27 data fields in your comparison charts.