Black History Month Survey: Innovation thriving, but signs of economic uncertainty

Introduction

Black-owned small businesses are at the forefront of innovation and new data highlights why. In honor of Black History Month, Intuit QuickBooks commissioned a survey of 2,069 Black business owners with 0-100 employees*. The survey, in support of the national Black History Month theme “African Americans and the Arts,” investigates how Black entrepreneurs are driving change in their small businesses with innovation and support for the artistic community. Whether leveraging technology or trailblazing in their families and communities with entrepreneurship, Black small business owners are advancing the small business industry at large — but not without barriers. Too often, they are undervalued for their work. Data from this year and last year reveal that the innovative advances of Black small business owners are threatened by biases, stereotypes, racial disparities, and the ripple effect of uncertain economic times.

Helping to ease the challenges of entrepreneurship for Black small business owners can make space for more to innovate and have a significant impact on the economy and culture.

Small, but mighty innovators

Small businesses play a pivotal role in the economy as drivers of innovation and job creation and Black-owned small businesses are leading the charge. Black-owned small businesses are adopting new technologies, innovating in management, and creating intellectual property at extraordinary levels.

A wave of innovation

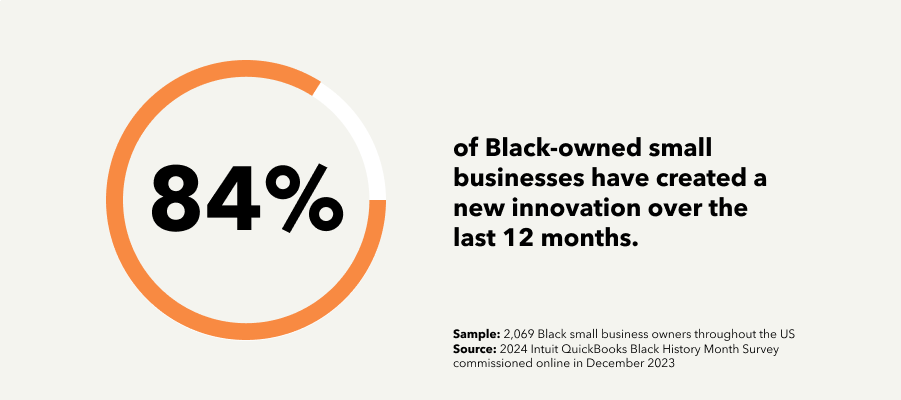

Survey results show that most Black-owned small businesses are innovating. Overall, 84% of Black-owned small businesses have created a new innovation for their business over the last 12 months.

New innovations from Black-owned businesses include new products/services (43%), new management processes (38%), and new money-saving techniques (34%).

Protecting valuable assets

Safeguarding innovative solutions with intellectual property protects small businesses in competitive markets. Black-owned small businesses aren’t just advancing innovation — they’re legitimizing it too. Eight in 10 (82%) Black small businesses own a trademark, copyright, or patent and more than 8 in 10 (84%) plan to register for one over the next 12 months.

Making information about intellectual property easily accessible and widespread could pave the way for more Black small business owners to create and protect their innovations. Nearly 3 in 10 (29%) Black small business owners who don’t own a trademark, copyright, or patent report they do not have one because they’re unfamiliar with the process. Black small business owners are also more likely than their non-Black peers (19%) to flag lack of knowledge as the reason why they don’t have intellectual property.

Embracing the power of AI

Black-owned small businesses are championing innovation in different ways — including embracing AI. Data shows small businesses are leveraging AI to boost productivity and efficiency. Black small business owners are taking advances in AI and making their businesses more resourceful and responsive.

More than 8 in 10 (84%) Black business owners say they’re using AI to help them manage their business with 39% using it to help generate ideas or spark inspiration, 36% using it to help with customer support, and 35% using it to help analyze data.

Black small business owners are embracing AI, but not without reservations. Nine in 10 (90%) report they have concerns about the advancement of AI. Privacy risks (17%) top the list of Black small business owners’ biggest worries when it comes to AI. Not far behind is the concern that AI could replace jobs (16%).

Black small businesses as trailblazers

Black-owned small businesses aren’t just innovating. They’re trailblazing too. Black business owners are taking risks and paving the way for other Black entrepreneurs in their local communities and their industries.

Paving the way for others

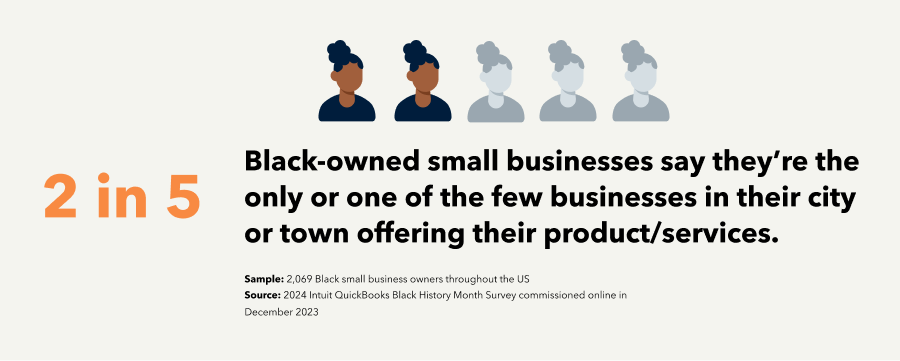

Prevailing in spaces where Black-owned businesses are one of a few or the first highlights the resilience and drive of Black small business owners. More than 2 in 5 (46%) Black-owned small businesses say they’re the only or one of the few businesses in their city or town offering their product/services.

Navigating entrepreneurship can be difficult without the right resources and support, leading to a survival rate that puts half of new businesses failing by year five. Despite the challenges, Black business owners are forging new paths in entrepreneurship for their families. Seven in 10 (70%) Black small business owners report they’re the first in their immediate or extended family to own a business.

Creation, credit & change

In honor of this year’s theme, the 2024 Intuit QuickBooks Black History Month survey explores Black small business owners’ views on the value Black entrepreneurs and consumers bring to the economy and the parallels between creatives and entrepreneurs.

Economy boosters

Black small business owners rank economic growth as the top contribution of Black businesses. Nearly 1 in 3 (32%) Black small business owners say the most significant contribution of Black-owned small businesses is the money they bring into the economy — double the share of those who said mentorship for other Black business owners (14%), wealth creation for Black individuals (15%), and creating jobs for their communities (16%).

Impact isn’t just being driven by Black-owned small businesses. It’s being pushed by Black consumers as well. And according to Black small business owners, the value of Black consumers isn’t being taken for granted. Nearly 9 in 10 (88%) say small businesses recognize Black consumers’ buying power — more than large corporations (83%).

Bridging the entrepreneurial and the creative

Black small business owners are looking to Black artists for inspiration and see parallels between each other's work, successes, and challenges. Second only to other Black entrepreneurs, Black artists inspire a significant number of Black small businesses owners. More than 1 in 2 (53%) look to Black artists as community leaders.

An even larger share of Black small business owners (97%) see strong connections between artists and business owners with nearly 3 in 10 (29%) viewing the passion they have for their work as the biggest similarity with artists.

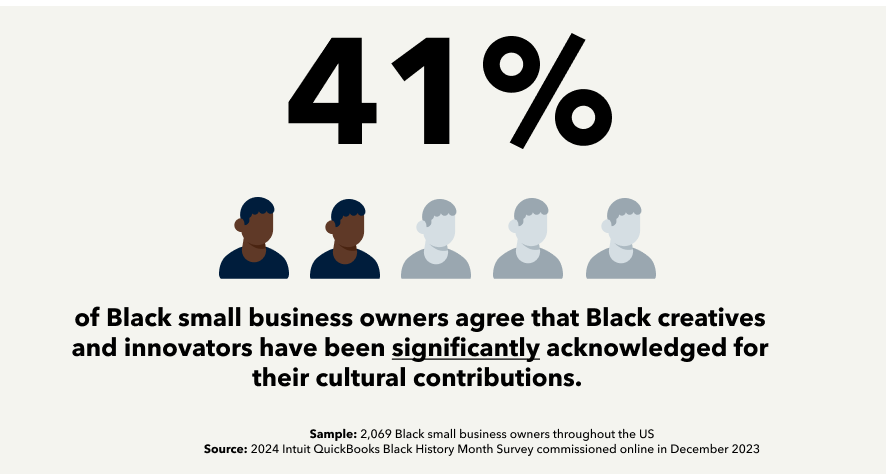

Despite the parallels, Black business owners see the overall appreciation for Black creatives and innovators as an area for growth. Only 2 in 5 (41%) agree that Black creatives and innovators have been significantly acknowledged for their cultural contributions.

Navigating bias, uplifting community

Although Black-owned small businesses are prolific innovators, they continue to face unique challenges in the form of biases and stereotypes that threaten their success. Despite these challenges, Black entrepreneurs remain committed to their communities and determined to succeed.

Unequal challenges

Data shows that nearly 8 in 10 (79%) Black small business owners say they’ve experienced racism from a customer. And it’s hindering business. More than 2 in 5 (44%) Black small business owners report having to turn away a customer due to racially charged statements at least once in the last year.

Black business owners often feel their businesses are judged more critically than others — and the pressure is threatening the momentum behind Black entrepreneurship. More than 2 in 5 (45%) Black small business owners say the fear of having to overcome racial stereotypes almost stopped them from starting their business.

Support in community

In the face of inequities and unique challenges, community support is strong among Black small business owners. Nearly all (96%) say they have bought from another Black-owned business at least once this year.

Now, four years from the start of the pandemic and the swell of advocacy for Black-owned businesses that followed, fears of dwindling support run high. But Black small business owners report a surprising reversal. While waning support since 2020 is a real threat to the success of Black-owned businesses, more than half (56%) say they’ve received more support over the last 12 months compared to 2020.

Financial literacy and innovation

Small business entrepreneurs make informed decisions to benefit business every day. Financial literacy is a key part of understanding where to take risks and where to invest for better business success. One in 2 (49%) Black small business owners rate their financial literacy prior to entrepreneurship as high or very high — leaving half with room to benefit from more support and resources.

Financial literacy can empower innovation

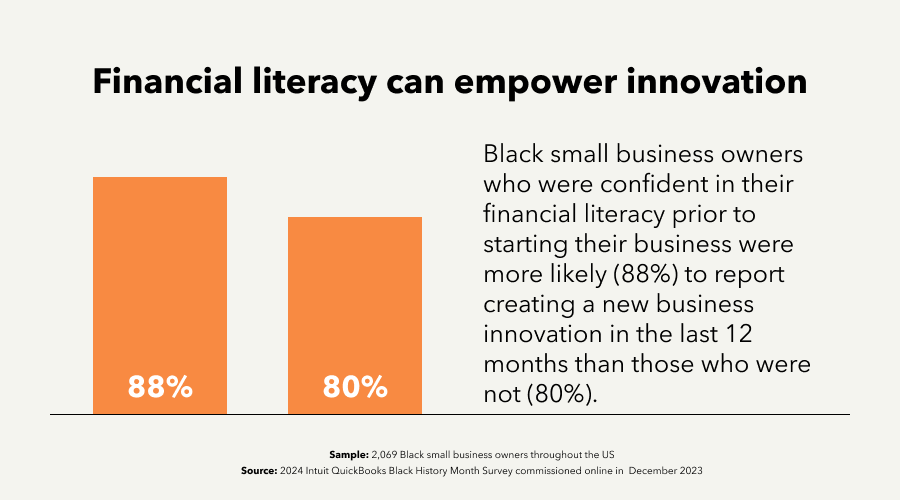

Small businesses have to get a lot of financial concepts right for success. Between budgeting, cash flow management, financial statement analysis, taxation, and financing, there are plenty of potential pitfalls — even with help. And starting off insecure in financial literacy skills can put small business owners at a disadvantage. One in 2 (49%) Black small business owners say they did not have high financial literacy skills before starting their business.

High financial literacy can inform better financial decisions, which in turn can yield more resources to invest in innovation, create new products and services, and improve business operations. Data from this year’s survey further links the connection between financial literacy and innovation. Among Black small business owners, those who were highly confident in their financial literacy prior to starting their business were more likely (88%) to report creating a new business innovation in the last 12 months than those who were not (80%).

High literacy for better security

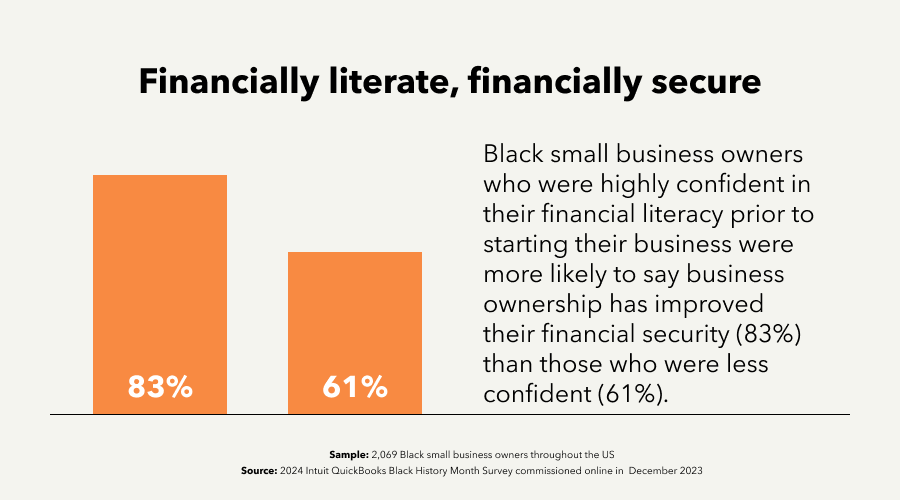

Entrepreneurship is delivering a significant benefit for Black small business owners — better financial security. Seven in 10 (72%) say business ownership has improved their financial security.

The impact of financial literacy strikes again when it comes to financial security. Black small business owners who were highly confident in their financial literacy prior to starting their business were more likely to say business ownership has improved their financial security (83%) than those who were less confident (61%).

Employment boom

Innovation is an important driver of employment and economic growth. At a time when small businesses are lagging in employment, Black-owned small businesses are reporting a surge despite accounting for only 3% of US employer firms.

Uptick in hiring

Data shows that small businesses are significant engines of employment in the US — responsible for a third (36%) of the country’s workforce. Black-owned small businesses are demonstrating their significant contribution by reporting employment gains. Over the last year, 71% of Black-owned small businesses report hiring additional full-time or part-time staff.

Black entrepreneurship is also benefiting employment at large. On average, Black employees make up 49% of Black-owned small businesses’ staff.

Although employment at Black-owned small businesses is surging, 92% Black small business owners still face challenges in the hiring process. Finding qualified candidates (26%) and inability to offer competitive benefits (22%) top the list of difficulties they face when hiring.

This year’s US national Black History Month theme celebrates the many contributions Black North Americans have made to visual arts, music, cultural movements, and more. And data reveals that Black-owned small businesses aren’t just incubators for Black employment — they’re also a support system for Black creatives. Black-owned small businesses report more than 1 in 3 (37%) staff members, on average, are artists or pursue creative endeavors on the side.

Financial health

Celebrating the innovation of Black-owned small businesses requires acknowledging the hurdles that hold these businesses back from realizing their fullest potential. Data shows that the financing challenges small businesses face are even more of a threat to underrepresented racial groups. Championing Black entrepreneurship and Black innovation means understanding their specific pain points to create a better way forward.

Pinching personal funds — and dreams

While Black business health is strong for many, a sizable portion is still struggling. Only 4 in 10 (40%) Black-owned small businesses report good financial health.

Cash flow plays a large role in positive business health for small businesses. Cash-strapped businesses can find themselves in the precarious position of having to rely on extra cash injections to mend the gaps. More than 8 in 10 (85%) Black small business owners have used personal funds to cover businesses expenses over the last 12 months. On average, Black small business owners have dipped into their personal accounts 10 times in the last year to help their business.

Black small business owners are using personal funds to cover business expenses and postponing their dreams as a result. One in 2 (51%) Black small business owners say using their money to help their business has delayed building personal wealth. Roughly a third delayed starting another business (36%) or buying a home (31%).

Inflation and undercharging

Key findings from the 2023 Intuit QuickBooks Small Business Index Annual Report highlight how small businesses are particularly sensitive to the strain of inflationary pressure and subsequent interest rate hikes. Data from this year’s Black History Month survey, commissioned by Intuit QuickBooks, shows there’s a significant impact for Black-owned businesses.

Inflation remains top challenge

Inflation tops the list of challenges for Black small business owners with 30% saying it’s their greatest hurdle — double the number who flagged competition from larger businesses (16%) and attracting customers (15%) as their greatest challenge. And while the rate of inflation is showing signs of slowing, small businesses rebounding from the recent peak in summer 2022 are signaling the long-term effects.

Charging less than value

Worsening the impact of inflation, a significant number of Black-owned small businesses aren’t charging what they’re worth. More than 1 in 2 (57%) report undercharging for their products and services.

Inflation is holding back right-pricing

Despite inflationary pressure, 29% of Black small business owners are not planning to increase their prices within the next year or aren’t yet sure if they will. Of those Black-owned businesses not planning a price increase in the next year, 44% say customer sensitivity to inflation is the primary reason — compared to 32% of their non-Black peers.

Credit card spending on the rise

Data from the 2023 Intuit QuickBooks Small Business Index Annual Report reveals that one of the effects of higher inflation and interest rates has been an increased dependency on credit cards. Among small businesses nationwide, average monthly credit card expenditure is up by an average of 20% compared to pre-pandemic levels — creating potential vulnerabilities. Again, this is reflected in the findings of Intuit QuickBooks’ Black History Month Survey.

Credit card spending is up — and not for business growth

More than 1 in 2 (57%) Black-owned small businesses report an increased use of business credit cards over the last year.

On average, Black-owned small businesses report carrying a $3,700 credit card balance. And nearly 7 in 10 (69%) won’t be able to pay off their balance within the next month. Black-owned small businesses estimate needing an average of 3 months to pay off their balance, leaving them exposed to the threat of accruing interest.

Driving the surge in credit card spending among Black-owned small businesses? Emergency funding. Nearly 2 in 5 (39%) Black-owned small businesses report the leading reason behind higher credit card usage has been emergency funding for immediate business costs — compared to 32% of their non-Black peers. And a higher percentage of non-Black-owned small businesses (41%) report higher use of credit cards to help fund investments for future business growth — compared to 30% of Black-owned small businesses.

Methodology

*Intuit QuickBooks Black History Month 2024 Survey Methodology

Intuit QuickBooks commissioned an online survey completed in January 2024 by 2,069 Black small business owners and 3,440 non-Black small business owners (adults aged 18+) throughout the US. Eight in 10 (79%) Black business owners surveyed had 1-100 employees and 21% had no employees. Overall, 51% of Black respondents were male while 49% were female. Nearly 1 in 5 (18%) Black respondents were Gen Z, 54% were Millennial, 16% were Gen X, and 12% were Baby Boomers. Percentages have been rounded to the nearest decimal place so values shown in data report charts and graphics may not add up to 100%. Responses were collected using Pollfish audience pools and partner networks with double opt-ins, random device engagement sampling, and post-stratification based on census data to ensure accurate targeting and results. Respondents received remuneration.

Recommended for you

Get the latest data insights in your inbox

Sign up to get the latest insights from the Small Business Index as soon as they are published each month.

Thanks for subscribing.

We'll send you the latest insights from the Small Business Index as soon as they are published each month.