There are more than 33 million small business owners across the United States, according to the Small Business Association, and their numbers are growing every year. Some of these business owners have endured a global pandemic, skyrocketing inflation, and funding challenges—and their businesses have come out stronger on the other side. Others have been inspired by these seemingly seismic shifts in the US economy to follow their entrepreneurial dreams—starting new small businesses within the last three years to power their local communities and fuel small business employment.

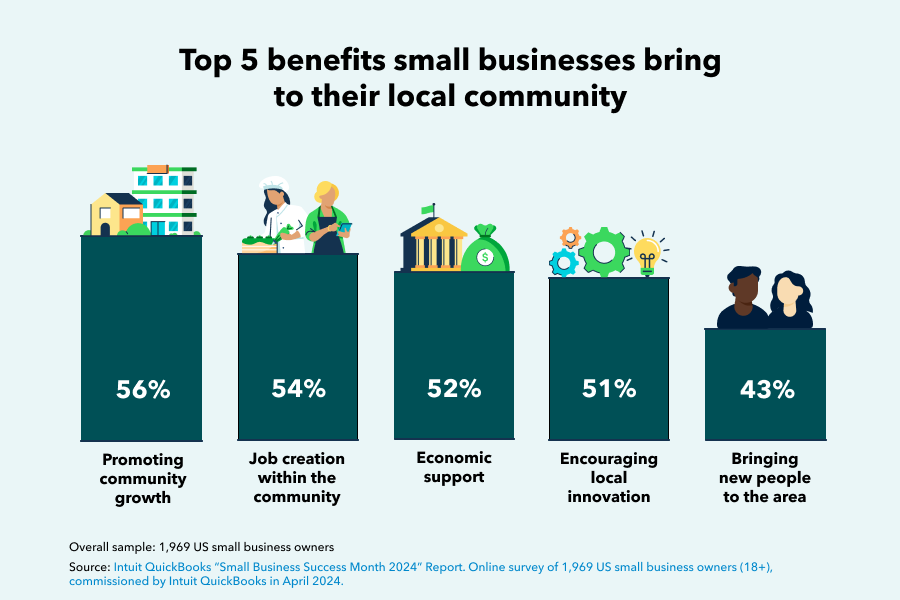

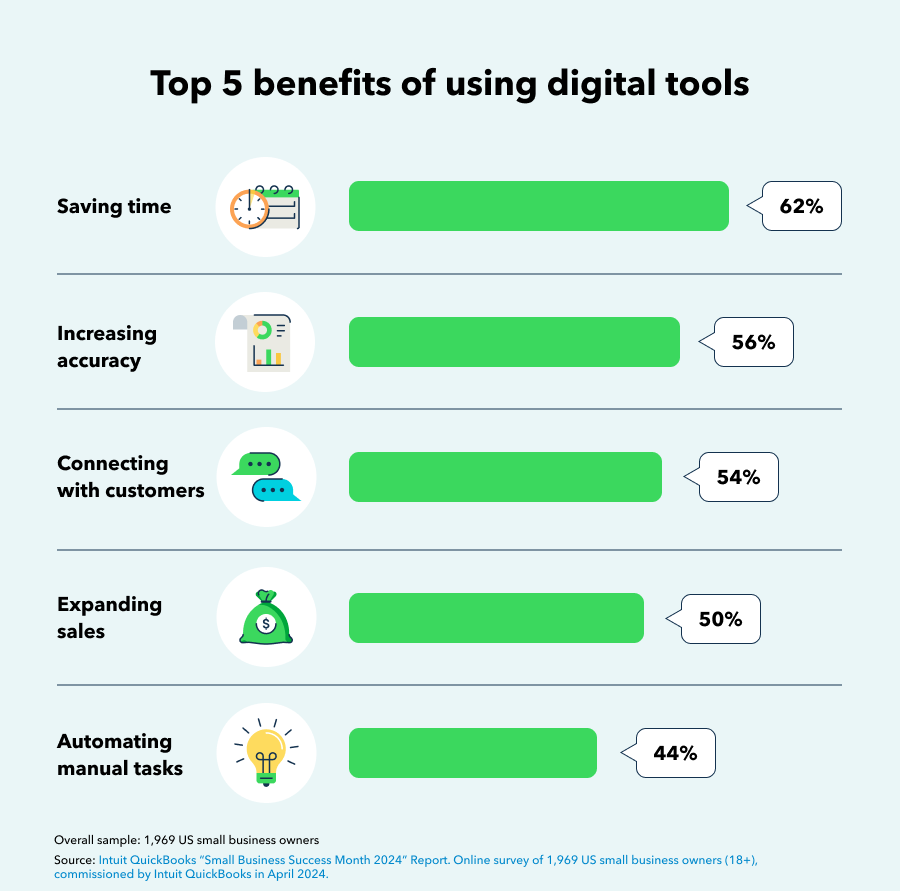

For today’s small business owners, there are many facets to success—and financial success is only one of them. New data from a QuickBooks-commissioned survey of 1,969 US small business owners for Small Business Success Month tells us more about how they define success and what they’re doing to achieve it. From supporting their local communities, to leveraging digital tools, to prioritizing their mental health and wellness, read on to find out what success looks like for small business owners in 2024.