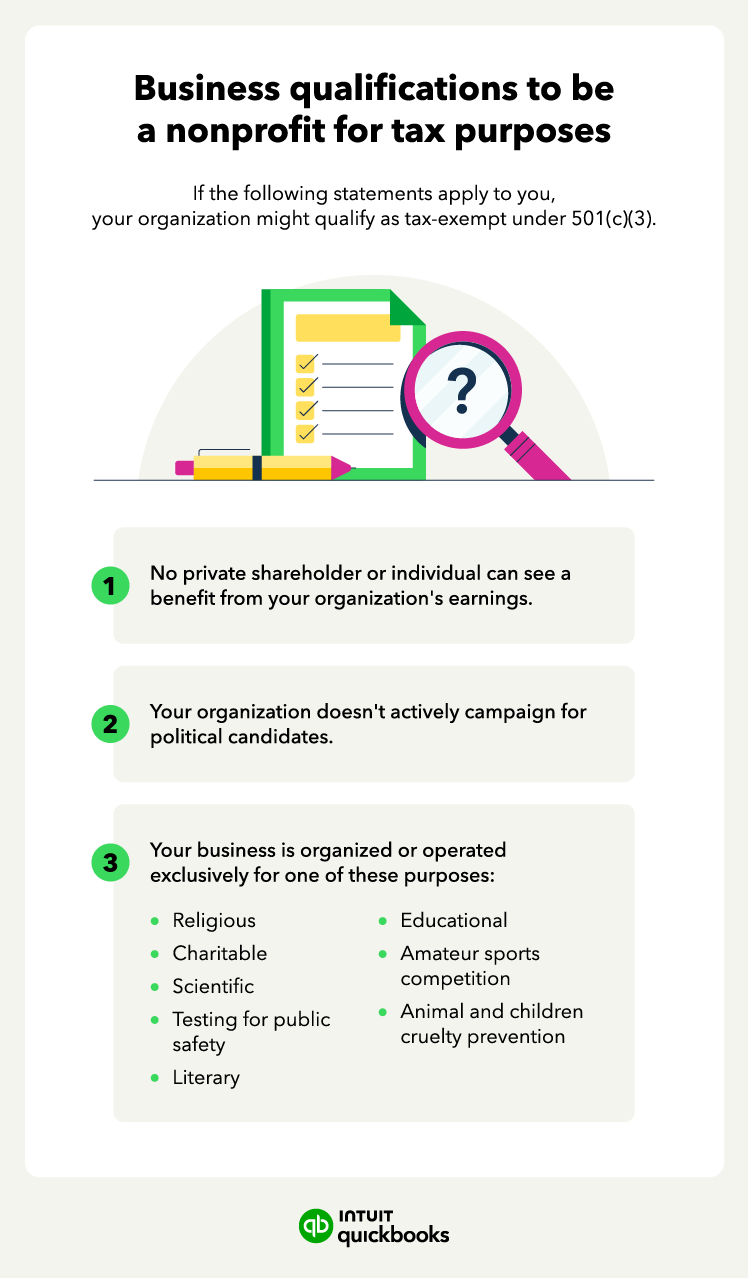

As a small business owner or entrepreneur, you are more than likely aware that for-profit and non-profit organizations are held to different governmental tax regulations. In broad terms, a for-profit organization is responsible for paying taxes to federal, state and local governments. A non-profit organization is tax-exempt.

As a result, everyone would love to declare his or her business a non-profit, but there are very strict rules regulating that designation. We’ll examine these rules and the different types of non-profit entities below.