With taxes out of the way, it’s time to give your business a boost. With our latest QuickBooks® Online updates, you’ll get time-saving features to help simplify your clients’ workflow and employee management, plus expert help to support your growth.

What’s new in QuickBooks Online: April 2019

New! Free third accountant user in QuickBooks Online Advanced

In a nutshell:

Accounting pros aren’t superheroes. When it comes to helping your fast-growing small business, one person isn’t always enough.

We’ve now made it possible for you to add not two, but three accountant users to your QuickBooks Online Advanced subscription—all for free.

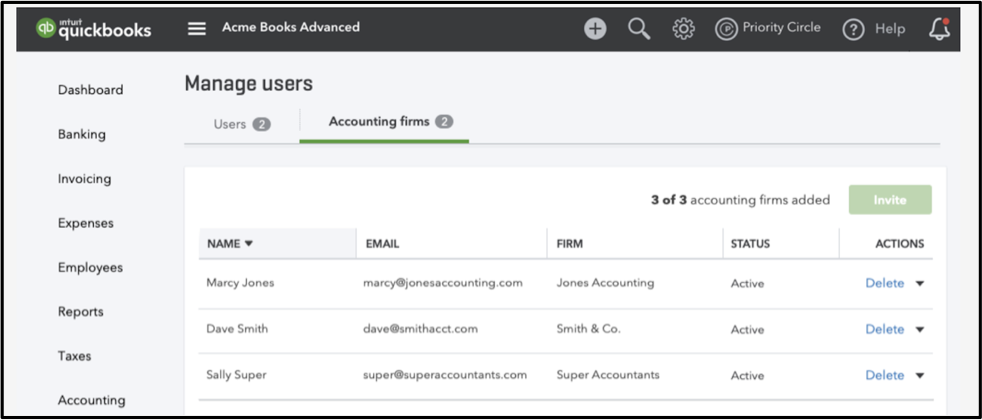

How it works: To add accounting pros, select the Gear icon, then Manage users.

Under the Accounting firms tab, you’ll see a list of the accounting pros who have access to your QuickBooks Online Advanced.

Select the Invite button to add a new accounting firm (up to 3). Or remove users in the Actions column on the right.

With these added resources, you’ll get the help you need to spur your growth—such as seasonal tax support, temporary consultants, external CFOs, and more.

New! Track what’s most important to business with custom fields

In a nutshell: The more you know about your customers, the more you can cater business to their needs.

With our new custom fields in QuickBooks Online Advanced, you can track more granular data than ever across sales reports, purchase orders, customer profiles, and more. Plus use custom fields to organize and filter financial reports to easily surface the biggest details.

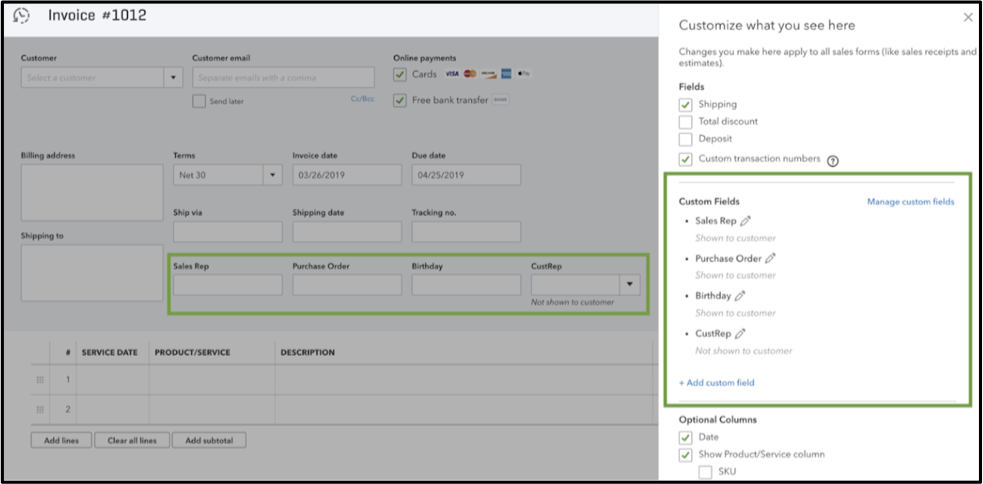

How it works: Create as many custom fields as you want, with up to 10 fields active at a time.

Custom fields are entirely up to you, and can be virtually anything that’s unique to your industry that you want to track. Get ideas on custom fields here.

Once you’ve created custom fields, you’ll be able to see and manage them on financial forms, like invoices, for example.

With enhanced data-tracking, you’ll get deeper insights into what matters most to your clients’ customers, and produce more impactful financial reports.

To get started, check out our step-by-step guide on how to use and manage custom fields.

New! Keep organized and compliant with paid and unpaid time-off tracking

In a nutshell: Taking time off is crucial to help employees reduce their stress—but tracking it shouldn’t increase yours.

With our two newest tracking options, you can easily track unpaid and paid time off within QuickBooks Online Payroll. Save time and hassle, and rest easy knowing you have the records needed to comply with paid leave laws.

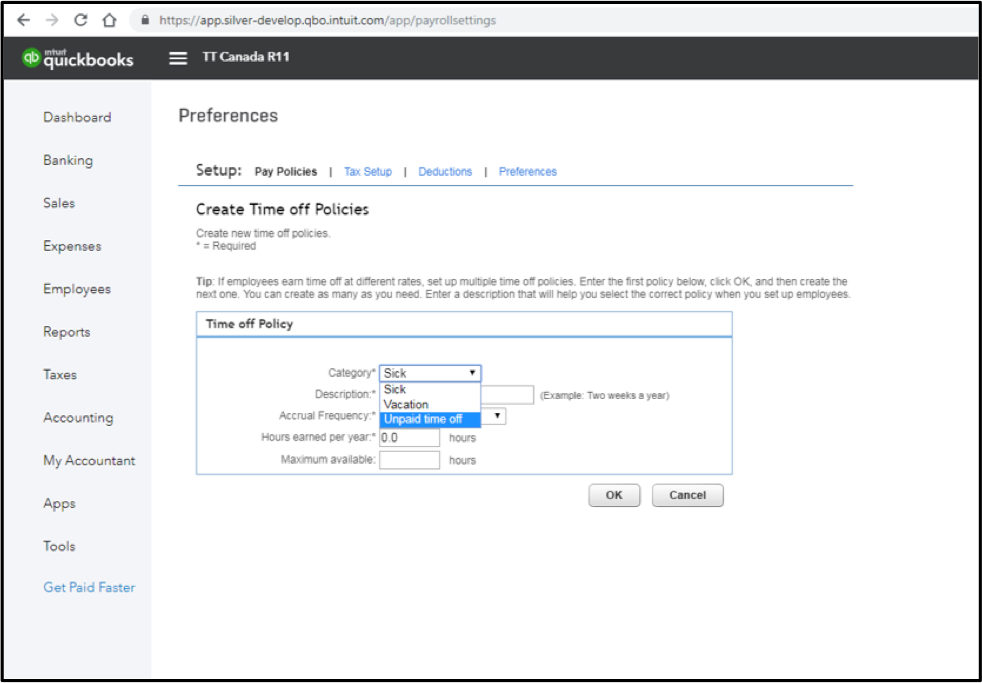

How it works: To set up paid or unpaid tracking for an employee, select the Gear icon, then Payroll settings.

Select the tracking option from the drop-down, as well as the accrual frequency, and the total hours allowed.

All paid and unpaid time off will be tracked automatically, with details stored in QuickBooks so you have all you need to report employee leave with confidence.

Get step-by-step directions on how to set up paid and unpaid time off policies.

New! Schedule contractor payments in advance for more efficient time management

In a nutshell: Picture this: It’s almost quitting time. You’re halfway out the door when suddenly you freeze, shoulders slumped, and trudge back to your desk. You forgot to log in to make a contractor payment due tomorrow. Sound familiar?

Leave situations like that behind with our new payment scheduling in QuickBooks Online Payroll. You can now set up contractor payments in advance, avoiding the need to log in on specific dates and reducing missed payments.

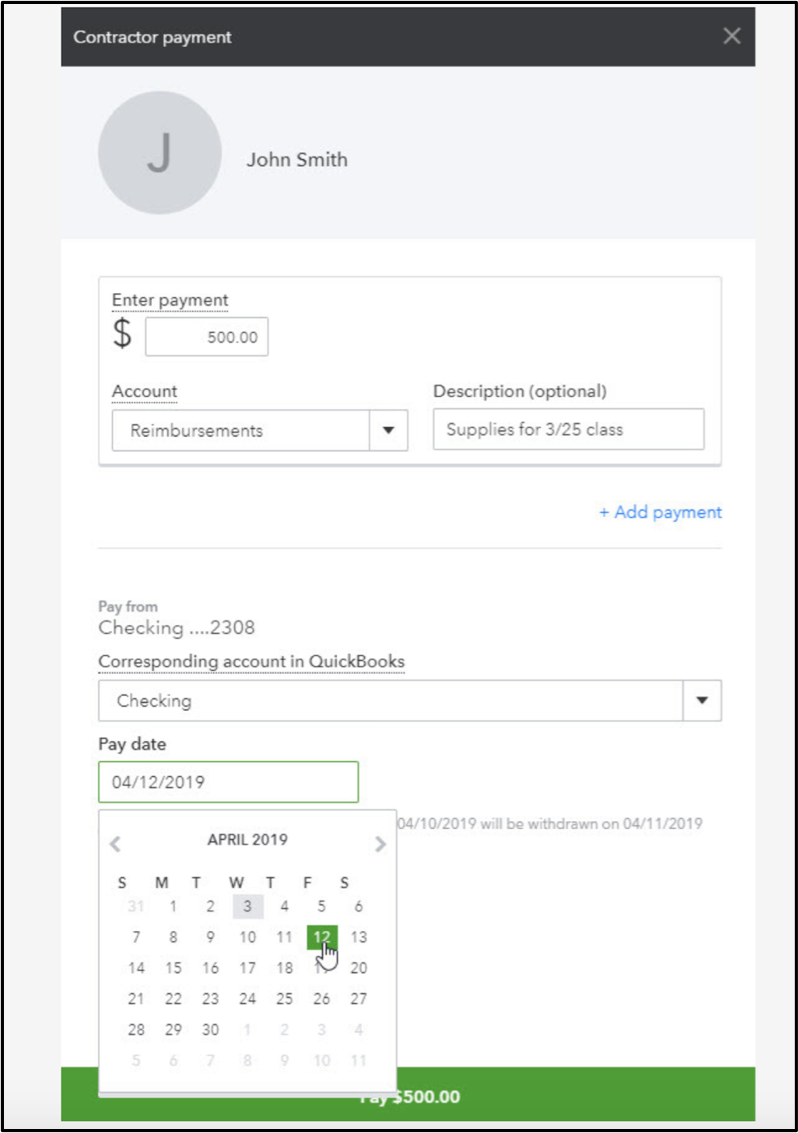

How it works: To schedule a contractor payment, simply select your preferred date from the calendar within the normal payment flow.

And that’s it! Contractors will get paid when they’re supposed to, and you’ll get home a bit earlier.

That’s all for now, folks.

Until next time, as always, keep your feet on the ground…and your books in the cloud.