New! Receipt Capture simplifies tax season, and saves clients time all year

In a nutshell: Nothing says “tax time” like a shoebox overflowing with your crumpled receipts. That’s something we’re determined to change—starting with new Receipt Capture in QuickBooks Online.

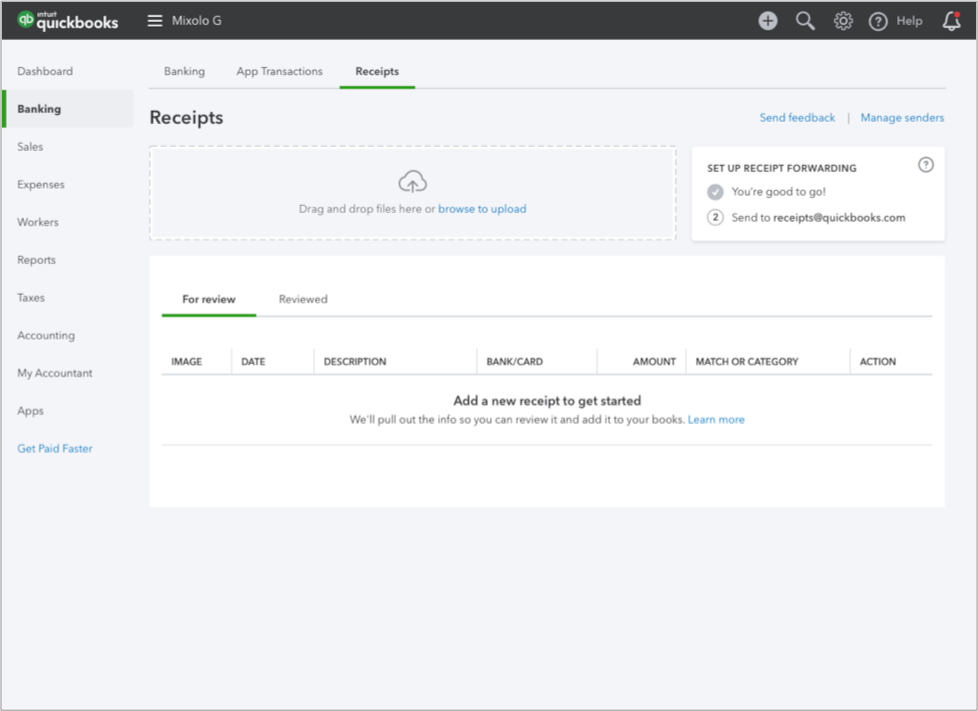

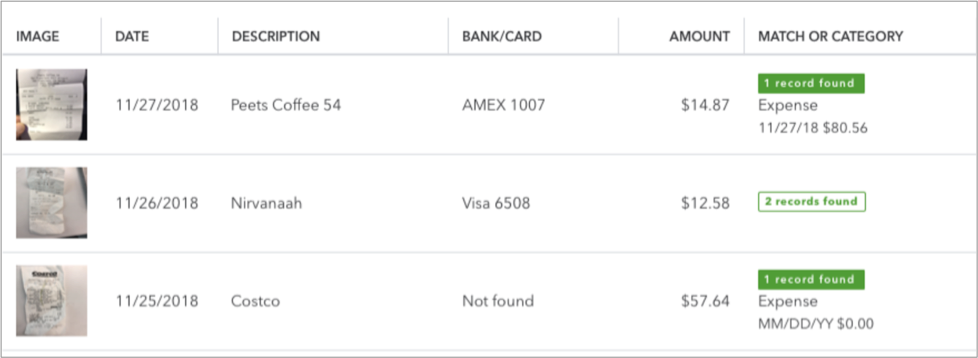

You can now snap and store receipts digitally to save hours of labor throughout the year. Receipts are automatically categorized and matched to transactions, so everything’s organized and ready at tax time.

How it works: Snap receipt photos on their phone, then add them to QuickBooks Online in one of three ways:

- Scanning directly through the mobile app.

- Uploading, then dragging and dropping.

- Forwarding by email.

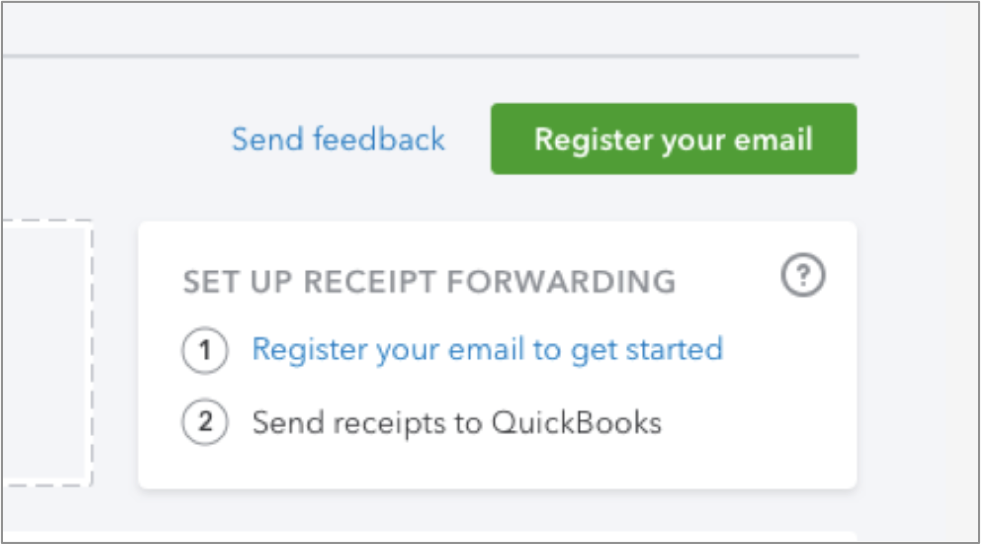

Email forwarding can be set up by selecting the Register your email button in the Banking tab.