Checking, Payments, and Web enhancements to QuickBooks Money

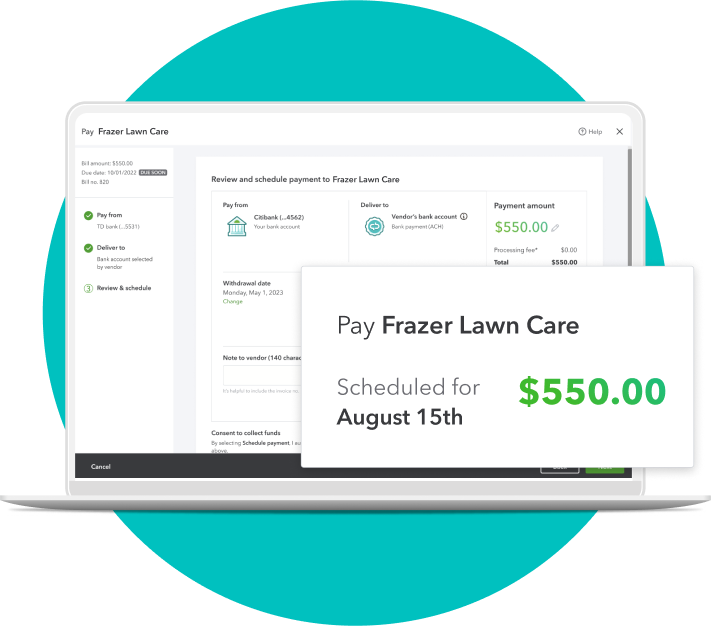

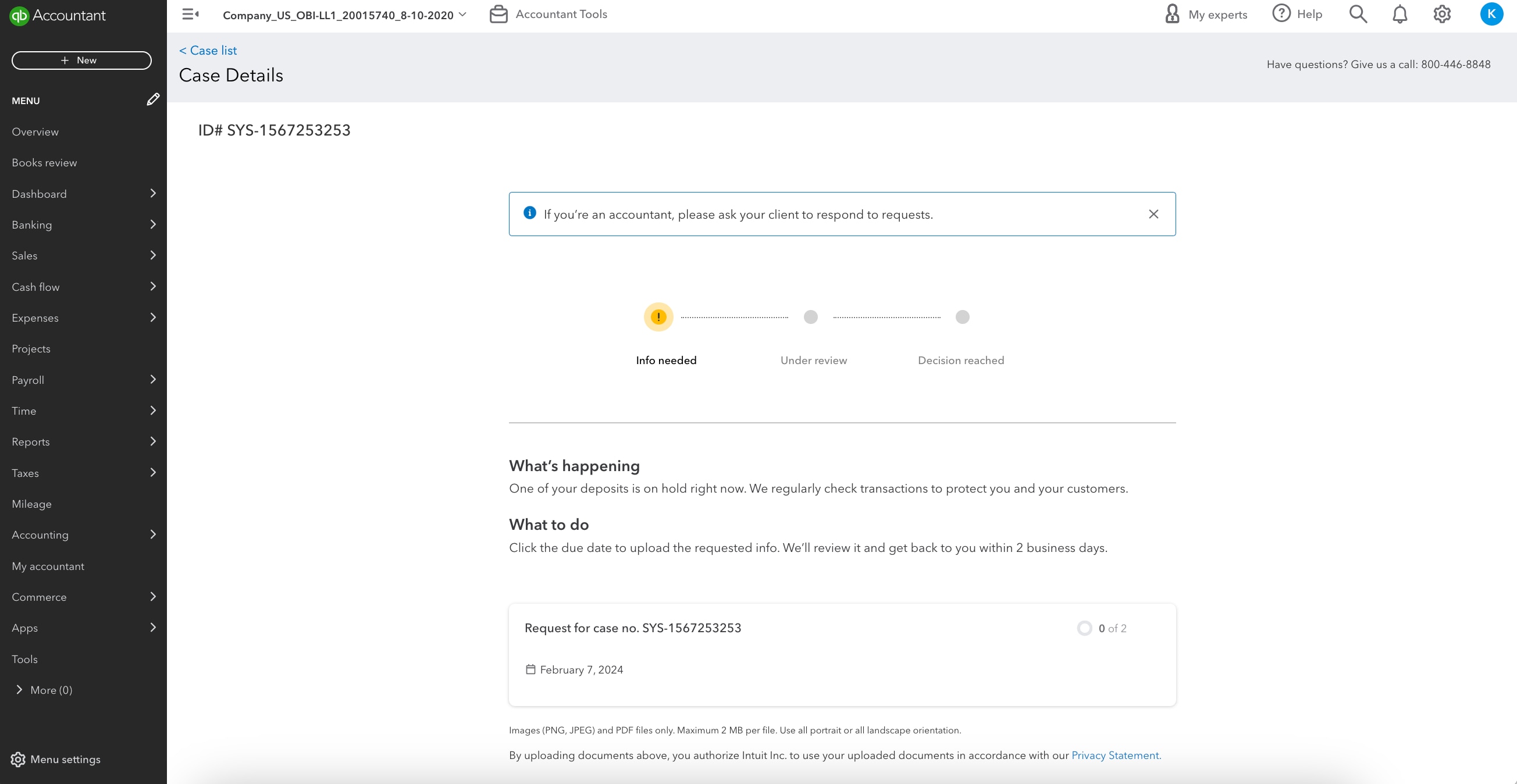

In a nutshell: Previously, customers could only access robust banking and payments solutions if they signed up for a QuickBooks Online subscription. As of August 2023, QuickBooks Checking is available in QuickBooks Money, Intuit’s subscription-free money management tool.

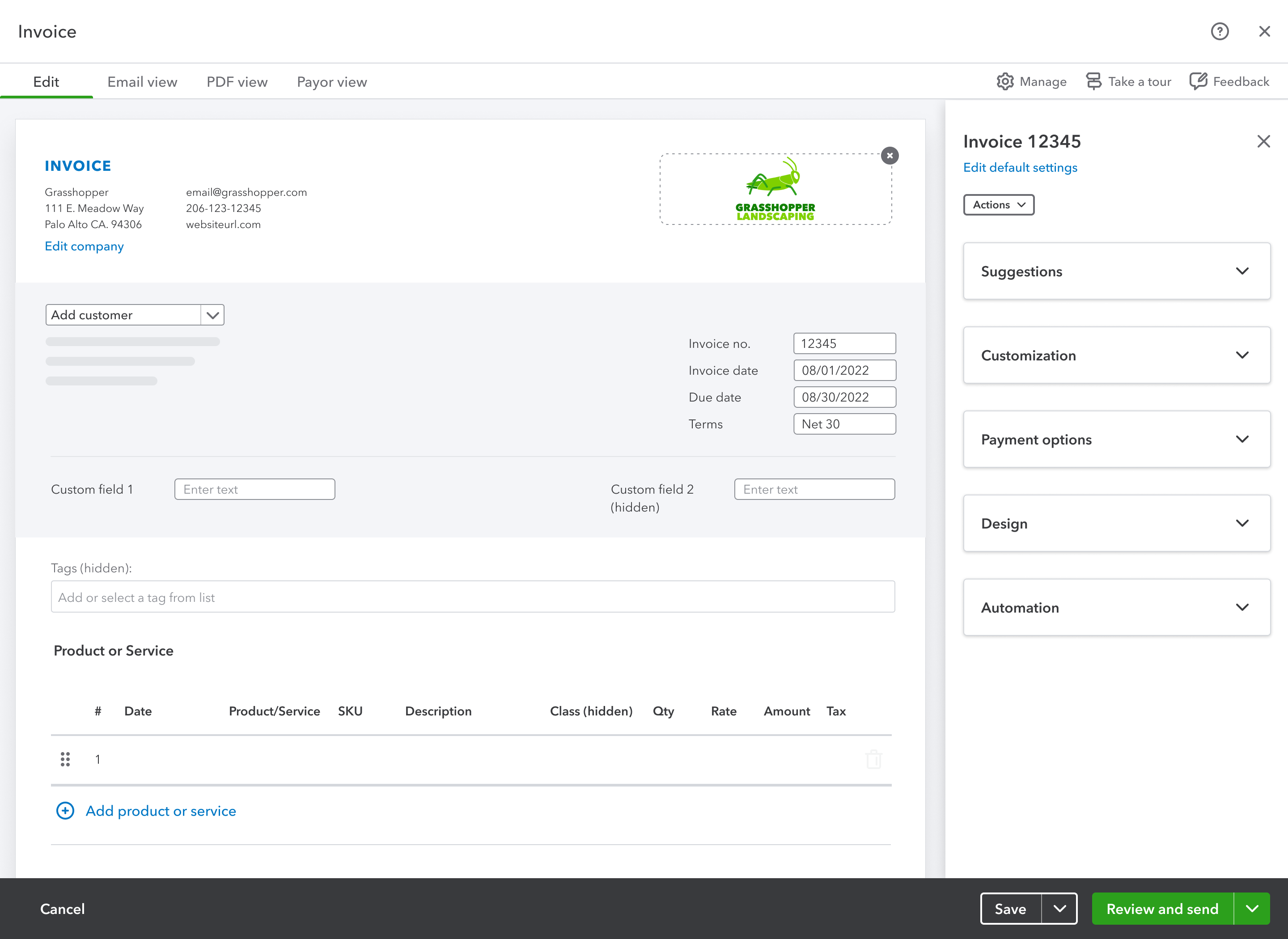

With this change, QuickBooks Money customers can now earn competitive APY and set aside money in envelopes in QuickBooks Checking without a subscription. Additionally, QuickBooks Money customers can send pay-enabled invoices that offer automated sales tax calculation, automatic reminders, PayPal and Venmo as payment options, partial payments, and payment links.

QuickBooks Money was also only accessible via a Money app for Android and iPhone. Now, Money offers access via the web, giving you the flexibility to access banking and payments information from virtually any device connected to the internet.

Keep in mind—while you can now access a majority of the QuickBooks Checking features in QuickBooks Online and QuickBooks Money, QuickBooks Money doesn’t connect with QuickBooks Online. However, you can easily upgrade to QuickBooks Online and move your QuickBooks Money banking and payments transaction history whenever you’re ready.

Learn more