Here’s a summary of what to expect when filing:

- Determine eligibility: The IRS has a shortlist of requirements you must meet before applying for an EIN.

- Understand the application: This simply means you have to finish the application all in one session, and you can’t have more than 15 minutes of inactivity.

- Submit your application: Once you complete your application, you can then download, save, and print your EIN letter for your records.

You’ll need certain information to complete the EIN application, including:

- Your legal business name

- Address of the business

- Name and Social Security number of the responsible party

The responsible party is the person responsible for the company, which is also the person who will sign the application.

When you need to apply for a new EIN

If you make common changes to your business, like changing the name or address of your business, you won’t need a new EIN. However, if the ownership or structure of your business changes, you will need to apply for a new EIN.

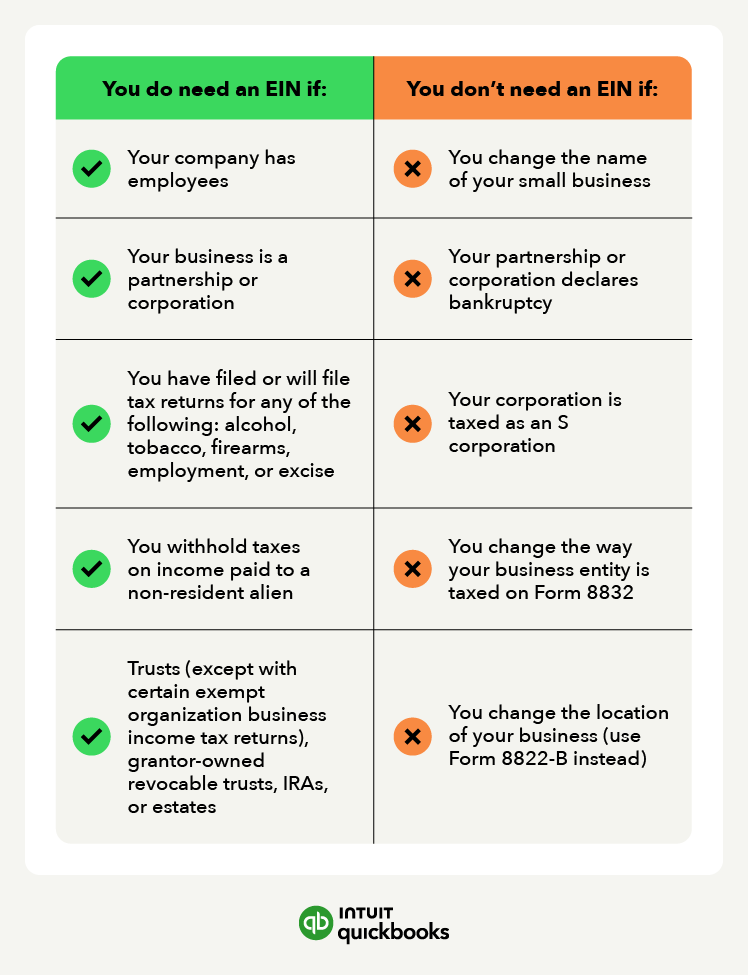

Depending on your business structure, here are some instances when you’ll need to get a new EIN:

- Sole proprietorships: You hire employees or contractors or decide to open a business bank account.

- Partnerships: You will need a new EIN if you change the structure or one of the partners buys the partnership and plans to operate it as a sole proprietorship.

- Corporations: You’ll need a new EIN if you change the structure of your business, become a subsidiary of a corporation, or form a new corporation following a merger.

- Limited liability companies (LLCs): You will apply for a new EIN if you add more members to a single-member LLC or convert an LLC to a corporation.

On the other hand, you do not need to apply for a new EIN if:

- You change the name or location of your business

- Your corporation or partnership declares bankruptcy

- You elect S-corp taxation

If you elect a different taxation for your business, you will instead use Form 8832 to update the IRS.

Next steps for self-employment success

Your EIN is a nine-digit number unique to your business. An EIN identifies your business in the same way your Social Security number identifies you. The online EIN application process is straightforward, making it quick and easy to get an EIN. Plus, with payroll software like QuickBooks Payroll, you can use your EIN to pay employees and contractors.

*Terms and conditions, features, support, pricing, and service options subject to change without notice.

QuickBooks Online Payroll & Contractor Payments: Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit and application approval. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/