for 3 months.*

Ends May 31st.

Know the ins and outs of your business

No more manual entry

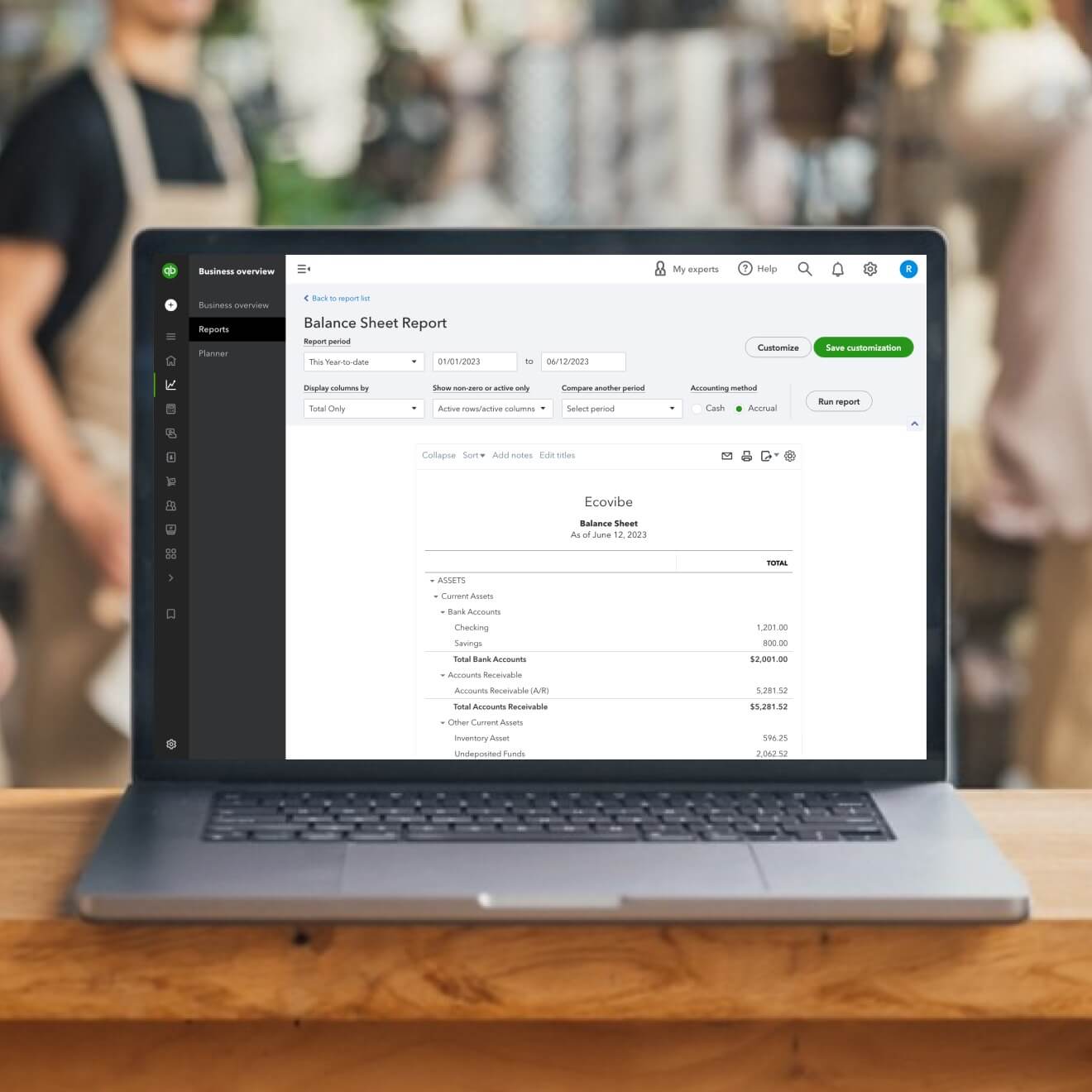

Spend less time crunching the numbers and more time on the things that matter. QuickBooks tracks and organizes all of your business’s accounting data, making it easy to access your balance sheet and other financial statements.

Make better business decisions

The balance sheet provides insights on what the business owns (its assets), what the business owes (its liabilities), and how much the business is worth. It helps you spot the strengths and weaknesses in your business, helping you make smart decisions about how to invest and grow in the future.

Custom financial statements

Access and customize over 50 accounting reports and financial statements. It’s easy to share reports with your business partners, investors, or colleagues. You can even schedule them to be automatically generated and sent daily, weekly, or monthly.

Balance sheets: everything you need to know

By Kathryn Pomroy

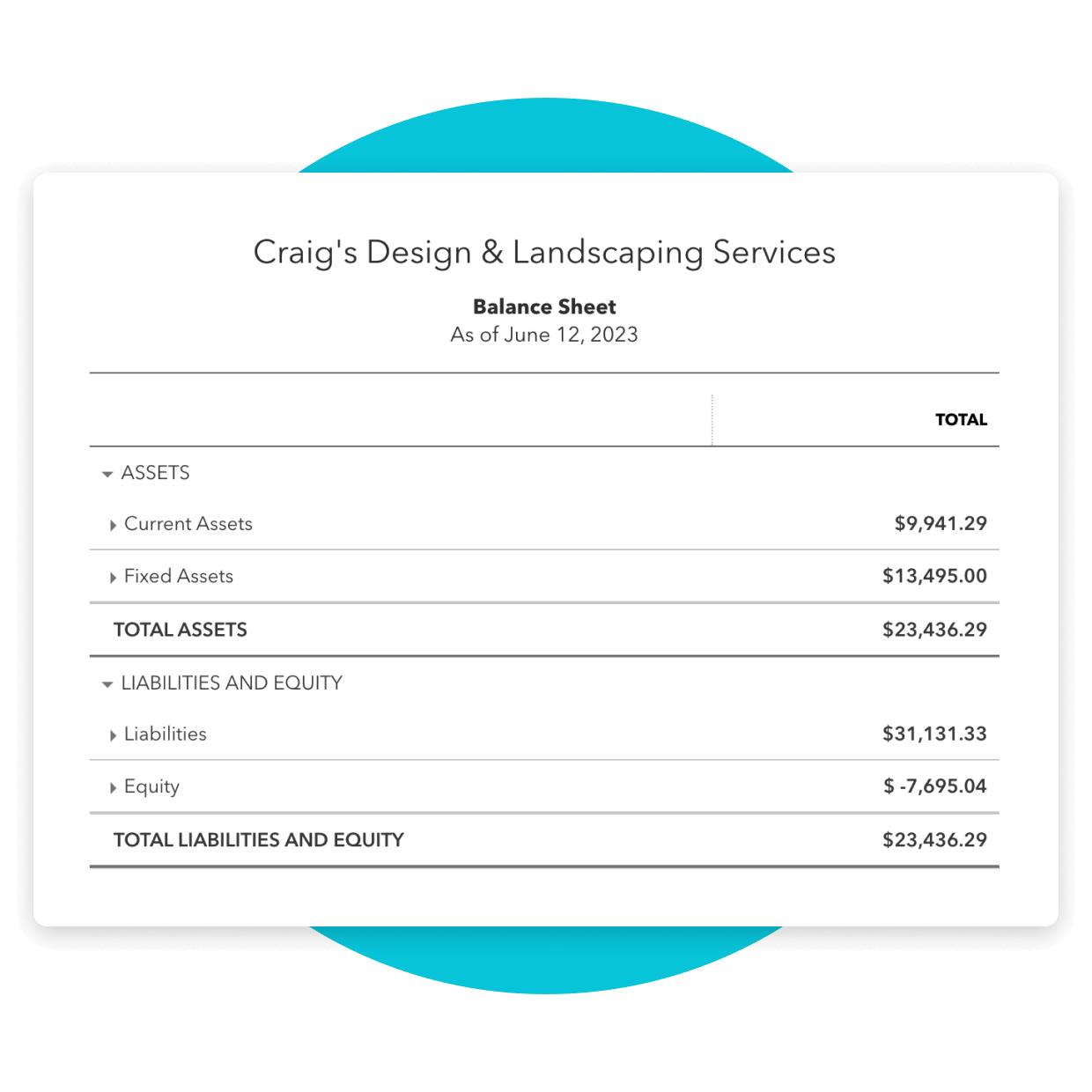

The balance sheet details what a business owns (current assets), what it owes (total liabilities), and its worth (shareholder or owner’s equity) at a specific point in time, such as the start date or end date of a fiscal year. In the simplest terms, the balance sheet subtracts what you owe from what you own to calculate your business’s net worth.

The balance sheet, together with the income statement and cash flow statement, are key financial reports for any business. The balance sheet provides a snapshot of information that is linked to both the cash flow and income statements. For example, the cash balance that appears on the balance sheet is the ending balance used in the cash flow statement. Business owners use financial statements to monitor the financial performance of the company and communicate this to potential investors. They are used in order to make smart business decisions for both short-term and long-term success.

When you use a balance sheet to track your finances, you are better able to find hidden costs or roadblocks, reduce expenses, and maximize profits. The balance sheet can help you easily identify patterns, especially in accounts receivable and accounts payable. Are your customers paying your invoices? Do you have enough to cover your bills and repay debts? The balance sheet can help you understand all of this.

Download the free balance sheet template

The balance sheet plays a vital role in understanding the financial position of your company at a specific point in time. Our excel template summarizes assets, liabilities, and equity to easily compare your company’s value over time. The template also provides a sample balance sheet so you can see what a completed balance sheet report looks like.

Get a complete view of your business finances by downloading our cash flow and income statement Excel templates.

If you’re launching a small business and just getting started, Excel templates can be a useful solution. As your business grows, it gets harder to track everything in Excel. QuickBooks organizes your accounting data so you can easily run up-to-date balance sheet reports whenever you need them. Print the reports you need, or save them as a PDF to send to your accountant. Save time and track your finances in one place—let QuickBooks accounting software do the hard work for you.