This is part of a series on 65 small business ideas in 7 categories with 3 questions to help you decide. I wanted to identify businesses that people can start from home, with little or no upfront money needed.

Last time, I showed you QuickBooks® Online for a personal shopper. Today, I want to show you how to set up QuickBooks Online for a pet sitter or dog walker.

In both cases, we want a database of our clients and their pets. In fact, there is other information we want to track about this.

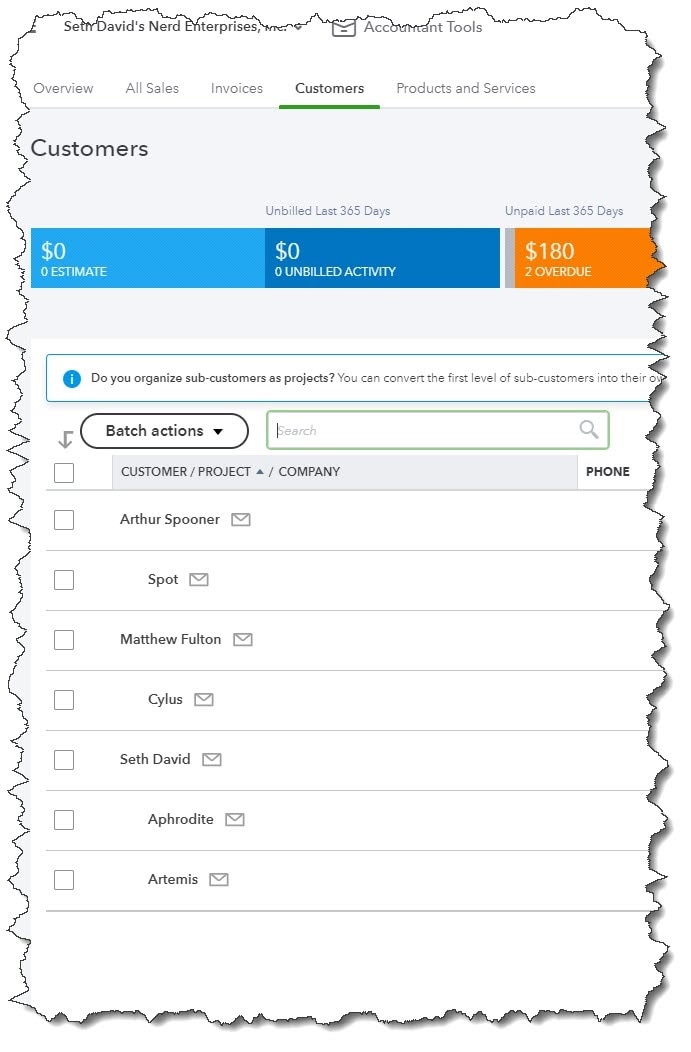

One thing you have to decide first is how you want to track the pets. My suggestion is to make the pets a sub-customer of the customer. This means that you will have to bill separately for each pet. If you want to use a single customer for all pets, there is no way to track the pets, other than in the notes, and then you can enter the pet you are billing for in the description.

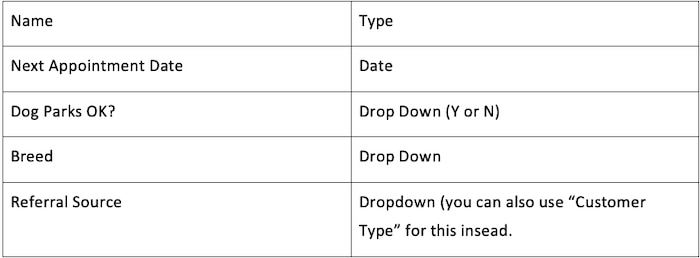

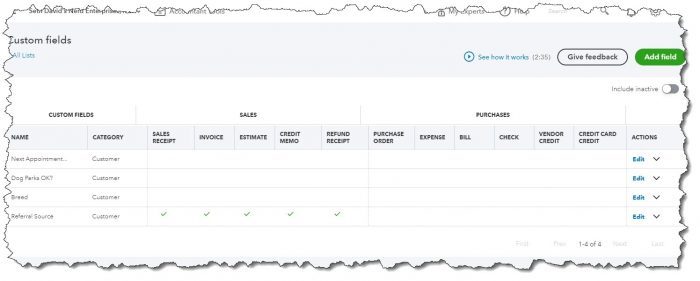

Any other list you could use in QuickBooks Online is a global list, such as classes, or even a drop-down list as a custom field will be global.

If you set up each pet as a sub-customer, you can track good, detailed information about each pet, and that can be really useful for anyone who wants to use QuickBooks Online Advanced for their pet sitting business.

So, let’s focus on a few lists in QuickBooks Online, and I will show you how to set this up.

We have the following lists to focus on:

- Customers

- Custom fields (only available in QBO Advanced)

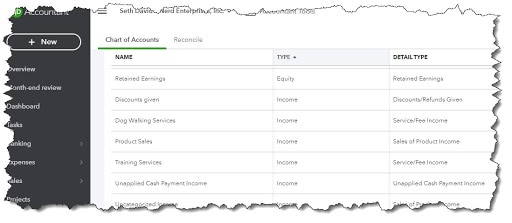

- Your chart of accounts

- Products and services

- Reports

Once you understand the components of how these lists come together, you will be able to see why QuickBooks Online Advanced makes this so much easier.