Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowDue to a glitch after upgrading to the latest qb version (desktop pro 2020), payroll taxes were not deducted from employees paychecks last pay period. We caught the error and two employees brought their paychecks back in and were adjusted and reissued. Our other employee had already deposited his.

For this pay period, will quickbooks automatically calculate and deduct the correct amount in taxes from this individual's check (including what should have been deducted in the prior paycheck), or do I need to adjust this manually?

Solved! Go to Solution.

Thanks for reaching out, @pawsit.

QuickBooks will automatically detect the missing withholding on the last payroll run and add it on to the next check. I recommend checking your payroll updates before running payroll to make sure you have the latest tax tables. It's super easy and only takes a moment. Check it out:

That's it! If you have any other questions, let me know by hitting the Reply button below. I'm here to help.

Thanks for reaching out, @pawsit.

QuickBooks will automatically detect the missing withholding on the last payroll run and add it on to the next check. I recommend checking your payroll updates before running payroll to make sure you have the latest tax tables. It's super easy and only takes a moment. Check it out:

That's it! If you have any other questions, let me know by hitting the Reply button below. I'm here to help.

Thank you!

Hello, @pawsit.

Thank you for following up with the Payroll Taxes not deducting correctly.

I'm glad you found the info you were looking for in Community. The Community has your back.

If you have any more questions or concerns, please don't hesitate to comment below. Have a safe and productive rest of your day!

I have desktop Pro 2019 and I recently had to update my payment method to update my payroll deductions. So i did that and went to verify and there is no deductions being recorded on my payroll checks that i print.

Please advice.

Thank you

Hector

Hello there, Hector3.

To resolve data integrity issues within the company file, we'll need to run the Verify and Rebuild data in your QuickBooks Desktop. Ensure to close all existing windows.

To verify the data here's how:

To rebuild the data:

You can click this article for detailed steps: Verify and Rebuild Data in QuickBooks Desktop.

Once completed, you can print the payroll checks again. For more information check out this article: Print paychecks in QuickBooks Desktop.

Also, you can browse our Help articles it provides tips on how to manage your account in QuickBooks.

Keep me posted if you have any other questions about QuickBooks. I'll be here to lend a hand. Take good care.

This solution simply does not work, have attempted it multiple times. Problem still exists, How do we get it corrected.

Unable to obtain the Original response as noted.

Thanks for joining this conversation, @Rainfree1987. I appreciate you for trying the resolution provided by my peers in this thread.

If you're running payroll using the paper check, let's check to see if your payroll status is active to make sure that your payroll taxes are calculating correctly. Here's how:

Once done, open the Payroll Account Management portal to check if the payroll service shows Active. You can now re-run the payroll if you're still on the processing stage. Otherwise, delete and recreate the paychecks.

If you're using the direct deposit in paying your employees, contact our Customer Care Support team.

Also, check out our available time through this article to ensure you get the assistance you need: Support hours and types.

Feel free to message again if you have additional questions. We're always delighted to help you more.

This solution simply does not work, have attempted it multiple times. Problem still exists, How do we get it corrected.Unable to obtain the Original response

Have another way to solve this issue?

I have one employee that did not have payroll deductions taken out. How do I fix this

for some reason, qb is not holding taxes out of the paychecks that I am trying to do. My subscription renews in a week but it should still be working at this point. Can someone help me with this?

Cindy Norris

Thanks for following on this thread @Rainfree1987, @sarah0485, @Cnorris25.

I appreciate you for following the resolution steps provided by my colleagues. I have some information to share why payroll taxes aren’t calculating.

The total annual salary exceeds the salary limit or the gross wages of the employees’ last payroll are too low.

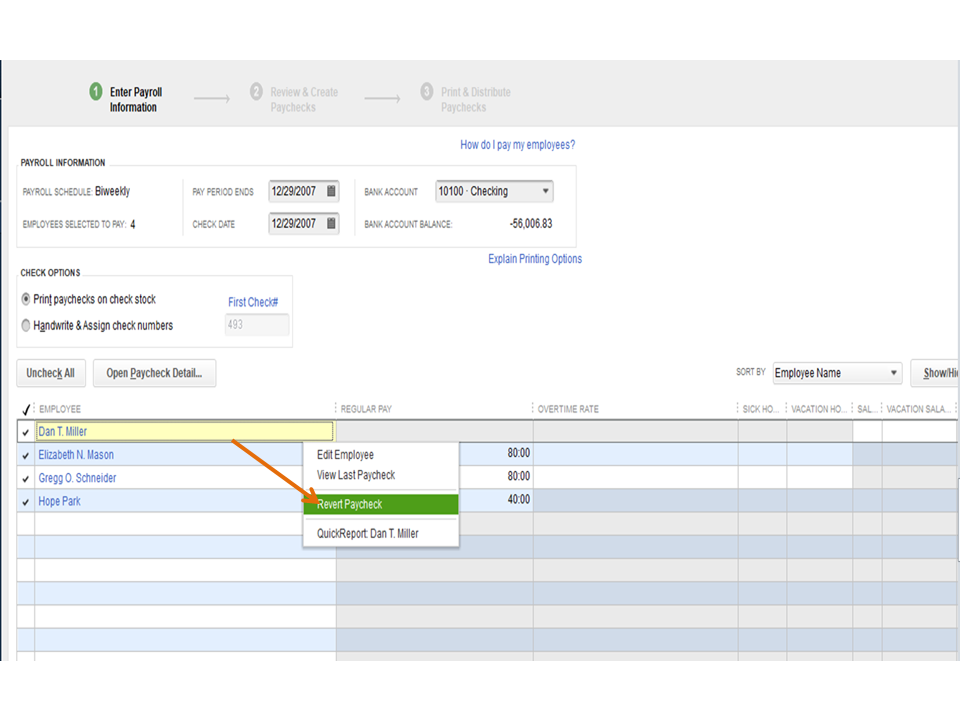

Let’s try performing another one to ensure taxes are deducted on the paycheck. We’ll have to revert the paycheck to refresh the payroll data and for the taxes to calculate.

If the issue persists, I recommend contacting our Payroll Support Team. They have tools to check why there are no deductions on the paycheck.

Once they’ve identified the cause, our specialists will walk you through the steps to resolve the issue. Here’s how:

I’m also adding a link that provides detailed information on why QuickBooks calculates wages and/or payroll taxes incorrectly. It includes instructions on how to fix the problem.

Reach out to me if you have any questions or other concerns. I’ll jump right back in to answer them for you. Have a good one.

I just tried this and it didn't work.

Thanks for joining the conversation and performing the troubleshooting steps suggested above to resolve the issue, @Karen108.

Since the issue persists, it'd be best to contact our Technical Support Team. They can investigate this issue and provide additional troubleshooting steps.

Here's how to reach them:

Moreover, I don’t want to leave you empty-handed, you'll want to visit our Community Help Articles hub in case you need some related articles in managing your account.

As always, you can get back to me if you have any additional questions. I'm here for you. Have a great day!

Hi!

So taxes are not being deducted at all from the employee paychecks on QuickBooks Desktop. I've already clicked on Update payroll, but no changes are happening when I make the paychecks. Please let me know if there is another solution I could try.

Thank you.

Let's get the taxes calculating, Snrogerson. Good work for updating the payroll.

Aside from updating the payroll, please follow katherinejoyceO and Rasa-LilaM steps to fix the issue.

Once done trying the recommended steps, try to create paychecks again. The taxes should be calculating already.

If taxes are still not calculating, I'd suggest reaching out to our customer care support. A payroll agent will investigate your issue further. Just follow MirriamM steps on how to get in touch with us.

We're just around if you have other concerns. You're always welcome to post anytime.

Ive tried to update the payroll taxes and it will not calculate the taxes on my computer but does on the other computers in our office

I appreciate you for updating your payroll tax table, @dmm19.

Let's ensure your computer meets the system requirements of QuickBooks Desktop (QBDT). This way, the software performs smoothly.

If you've and the issue persists. I recommend checking the additional troubleshooting steps provided by my colleagues Joesem M, katherinejoyceO, and Rasa-LilaM.

Once done, create a paycheck again to double-check if the issue resolves.

You can always get back to me if you have other questions. I'll be here to help you anytime. Stay safe.

After updating the payroll tax schedule, QB is not deducting any taxes from our employees paychecks.

Hi there, @LGibas.

I'd be glad to sort things out for you. First off, we can update your payroll tax table. These updates provide the most current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms, and e-file and payment options.

Then we'll have to revert paychecks. When you make changes to an employee's paycheck, click the Save & Close button to save your work.

I've added this article where you can learn information on the latest payroll updates.

Let me know if you have anything else in mind. I'll be here to help you out. Have a nice day.

@pawsit wrote:Due to a glitch after upgrading to the latest qb version (desktop pro 2020), payroll taxes were not deducted from employees paychecks last pay period. We caught the error and two employees brought their paychecks back in and were adjusted and reissued. Our other employee had already deposited his.

For this pay period, will quickbooks automatically calculate and deduct the correct amount in taxes from this individual's check (including what should have been deducted in the prior paycheck), or do I need to adjust this manually?

60000

Year to date

I have just experienced the same issue. Everything updated and added on previous checks deductions except for the federal withholding. How do I add it especially so that it shows for Q3 not Q4

There are a few reasons why taxes are deducted incorrectly, wondering2.

Possible reasons are the total annual salary exceeds the salary limit or the employees’ last payroll gross wages are too low. Good job for updating QuickBooks Desktop to its latest release and the payroll tax table. You can try reverting the paycheck and then recreate them.

If the same thing happens, I'd suggest reaching out to our Payroll Care Support. Just follow the steps provided above on how to get in touch with us.

For more details, feel free to check these references:

I'm just around if there's anything else that you need help with. Take care!

I have successfully been able to update the tax table to the most recent; however, I had already entered time to be processed in the bi-weekly payroll schedule. Everyone that hours were entered for are not showing taxes deducted; however, employees who I had not entered time for appear to be calculating correctly. Is there a way to reset this PRIOR to running payroll?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here