June 21, 2023

June 21, 2023

Payroll system definition

A payroll system is a software application businesses used to manage and automate the process of paying employees. It calculates employee paychecks, salaries and taxes, tracks hours worked, and issues payments through direct deposit or check.

Most companies will need to set up a payroll system at some point—even if you only have one employee. And while it may not be the most glamorous part of running a business, it’s still essential.

Staying on top of your business payroll allows everyone on your team to get paid the correct amount on time. However, the payroll process can be repetitive, mundane, and time-consuming. The payroll process can also get complicated for companies with many employees. Let’s explore what a payroll system is, how payroll works, and how your business can benefit from a payroll process.

How does a payroll system work?

Running payroll is the process of paying employees for their work. Every pay period, an employer calculates and distributes employees’ wages. The employer is responsible for accurately adding up the hours an employee worked and calculating their gross wages.

Employers must also deduct local and federal taxes, Social Security, unemployment insurance, and more. Then the company must disburse paychecks to employees on payday. As you can imagine, this process can get messy quickly.

FYI: With more than one or two employees, running payroll can become extremely complicated and overwhelming.

For time and convenience, most business owners find ways to avoid running payroll themselves. They set up an in-house payroll system or outsource payroll to a different company.

Types of payroll systems

There are four key types of payroll systems:

- In-house payroll: Some companies set up an internal payroll process that they manually run each pay period. Either the business owner or a human resources employee is responsible for running the payroll. While this can be an economical option for small businesses, it can be hard to sustain once your team grows.

- Full-time accountant: An accountant is a financial expert that can run payroll and file tax forms on your behalf. Outsourcing payroll management to an accountant can provide helpful support. They can take care of the payroll process from start to finish and offer advice and insights.

- Payroll service: Payroll providers specialize in running payroll for other businesses. They offer various payroll services, from time tracking to filing your company's taxes. Generally, payroll providers charge a flat fee per month or payroll run.

- Payroll software: With specialized accounting software, you can automate payroll processing entirely. One benefit of software solutions is they minimize the chance of human error. Plus, most payroll and HR software programs can generate detailed payroll reports and pay stubs for each pay period.

Setting up a payroll management system helps ensure that payroll gets done accurately and on time.

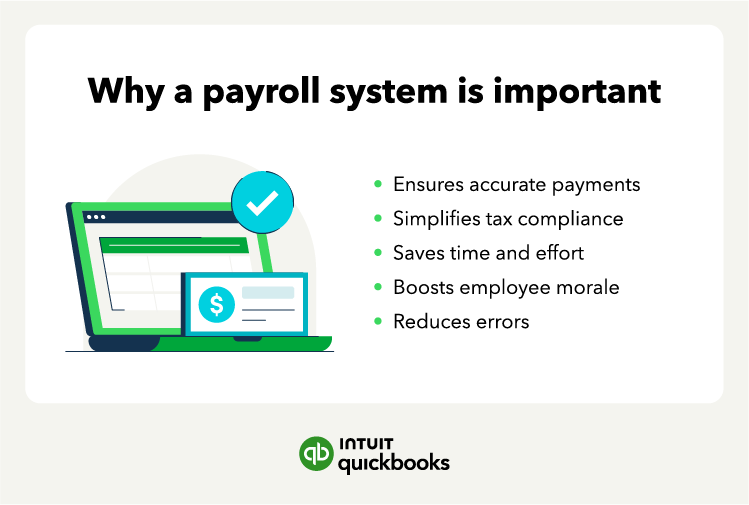

Why businesses use payroll systems

Companies can better manage payroll with a system in place. The last thing you want as an employer is for your team to have problems with their paychecks. Employees expect to receive the amount they earn and won't be happy with a late payment or a light paycheck.

Businesses often use a payroll system for several reasons; here are the two key ones:

- Saves time: An employee payroll system can help you streamline the payroll process. Manually adding figures, entering data, and calculating taxes can be extremely time-consuming. A payroll system allows you to spend less time on payroll and more time running your business.

- Boosts employee satisfaction: Your employees want to receive the wages they’re due on payday. As an employer, even making a single mistake with a paycheck can be damaging. If a paycheck arrives in an employee’s bank account late, this can prevent them from paying bills and hurt their trust in the company. A paycheck system helps to ensure employees get the correct amount on time.

Payroll is necessary for every business, at every size. An effective payroll management system can ensure everyone on the team gets the proper paycheck on time. And while a payroll system can benefit employees, it’s also a great asset for employers.

Pros and cons of a payroll system

Payroll systems, although very advantageous for employers and employees, can also have disadvantages. You’ll save money and hopefully reduce errors, but a payroll system also means increased compliance standards. Let’s start by looking at the key benefits:

Benefits of a payroll management system

Payroll software and systems offer unique advantages over other payroll solutions. Here are several benefits of these particular payroll services:

- Saves money: Pricing is one of the most important considerations for many small business owners. Hiring in-house payroll managers or an accountant can be expensive. You’ll have to pay for salaries, benefits, PTO, etc. However, with a payroll provider, you typically pay a flat monthly fee, making it a cost-effective option in the long run.

- Minimizes errors: When you run payroll manually, all sorts of human errors can occur. These errors can result in employee dissatisfaction or tax noncompliance. Payroll software can complete complex calculations quickly, saving you time and minimizing the chance of human error. Many payroll companies even offer penalty protection in case you incur a tax penalty.

- Access anywhere: Almost every payroll provider has a website or mobile app, so you can access payroll data no matter where you are. Many also offer employee self-service portals that allow your workers to track their hours and view HR data on the go.

Pains of a payroll system (and how to avoid them)

Despite the benefits of a payroll system, it does come with certain pain points you’ll want to consider:

- Inaccurate calculations: Your paycheck system is only as good as the inputs you enter. If you enter the wrong information, the systems' calculations will be wrong. To avoid this, double-check your entries.

- Compliance: While an employee payroll system can help keep you on the right track, it’s important to ensure you’re paying the right payroll tax rates and on the right payment schedule. You can improve this step by setting reminders and automating as much of the process as possible. Don’t forget to stay up-to-date on any legal or tax regulation changes.

- Growth limitations: If you have a growing business, you may outgrow your initial or current payroll system. You can avoid switching systems by starting with infrastructure that can expand as your workforce does.

A little research and due diligence can help you avoid these pain points. Choose a system that will help you today but can also scale to meet your future needs.

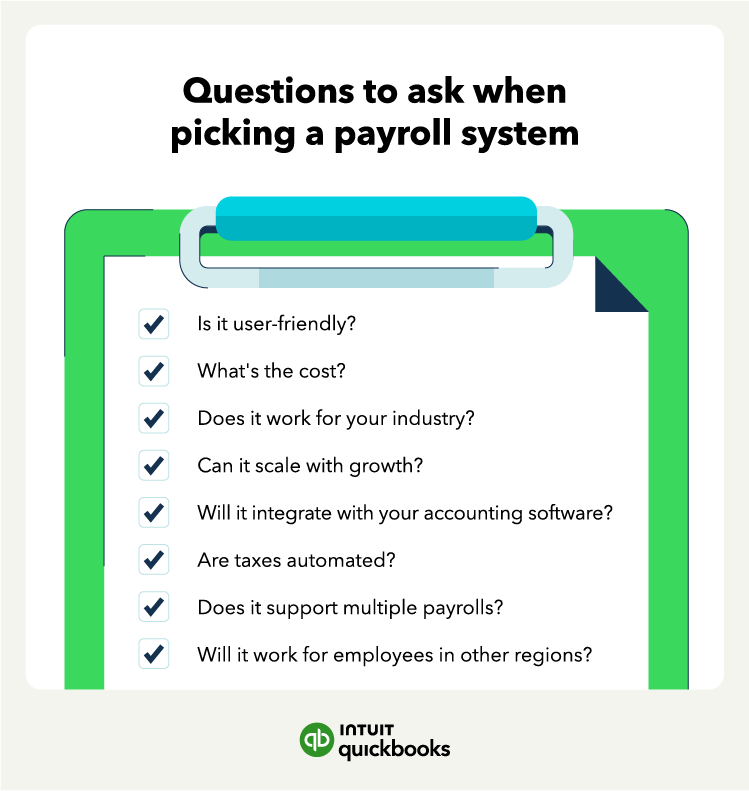

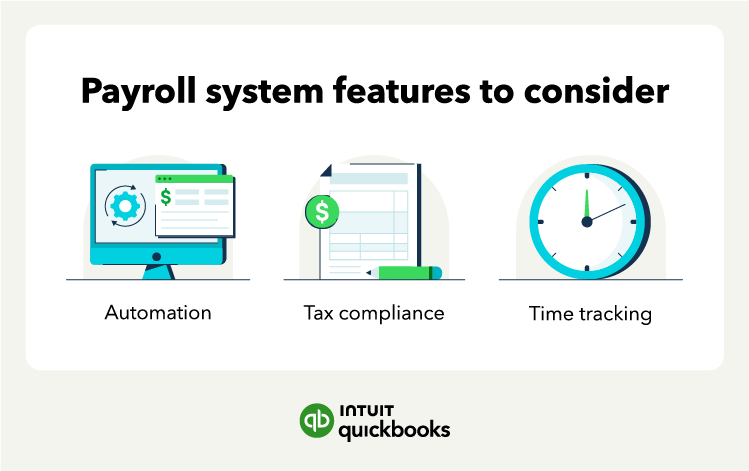

How to choose a payroll system: 3 features to consider

Automation

Automation is a great way to streamline your payroll—making it easier to manage. Automated payroll systems can cover payment processing, tax calculations, and report generation tasks.

When you use payroll software, you can automate most aspects of the payroll process. In this case, you’ll just have to do some initial setup, then you can run online payroll in a matter of clicks each pay period.

Automated payroll systems tend to be more secure and accurate than manual systems. They come with encryption technology and built-in calculators to prevent breaches and errors.

Tax compliance

One of the most difficult parts of processing payroll is accounting for tax withholdings. Each pay period, you deduct payroll taxes, federal and local taxes, Social Security, Medicare, and state unemployment taxes.

Failing to account for employment tax deductions can land your company in trouble with the IRS. A solid employee payroll system will make any necessary tax deductions or garnishments so that your company stays compliant.

Time tracking

Time tracking can be a game-changer for businesses—both big and small. A time tracking system ensures employee hours are accurate. It also helps boost productivity and saves time.

When you have a payroll system with time tracking, you can embrace a variety of tools, like mobile apps and punch-in clocks. You can ensure there’s a time-tracking system for everyone.

Beyond time tracking for payroll, such features can also help monitor employee performance, boosting efficiency.

Noteworthy payroll systems for 2023

Many payroll systems give you the power to outsource payroll or run it yourself. A few of the most popular choices include:

A payroll system like the ones above will enable you to run payroll quickly and efficiently. By spending less time and effort on payroll, you can focus on other, more pressing business needs.

Next steps for streamlining your payroll process

If you run a small business—or any business—setting up a payroll system is essential. A payroll system makes it easy to accurately compensate your team on time. And these days, more and more companies are beginning to automate the payroll process.

With payroll software like QuickBooks, you save time and minimize errors at an affordable price. You can set up auto payroll to run each pay period—and get automatic payroll tax filing and free direct deposit services.

How to pick a payroll system

Here’s why payroll systems are important and how to pick the best one for your business:

Payroll system FAQ

Navigating your payroll system can be tricky, but we're here to help. Let’s look at some common questions.

What are the four different pay systems?

There are four main types of pay systems: hourly, salary, commission, and piece rate. Hourly employees get paid for each hour they work. Salary employees receive a fixed amount, regardless of hours. Commission workers earn based on their sales, while piece rate workers get paid per item produced or task completed.

How does a payroll system help employees?

A payroll system benefits employees by ensuring they're paid accurately and on time. It also simplifies tax deductions, provides pay stubs, and allows employees access to payroll info—usually through online portals. Such features can help increase employee satisfaction and transparency.

Can you run a payroll system in Excel?

Yes, you can use Excel to manage a basic payroll system. However, it will lack advanced features like time tracking and direct deposit. While Excel is cost-effective for small businesses, a more advanced payroll system will help reduce errors and improve efficiency as your team grows.

Related: