Why track overhead and operating costs?

Understanding the difference between overhead costs and operating expenses, and tracking them separately, is crucial for a clear picture of your company's financial health. These two types of costs behave differently and impact distinct areas of your business, from product pricing to overall profitability. Keeping them separate provides the detailed insight needed for accurate accounting, effective budgeting, and informed decision-making.

Accurate cost accounting

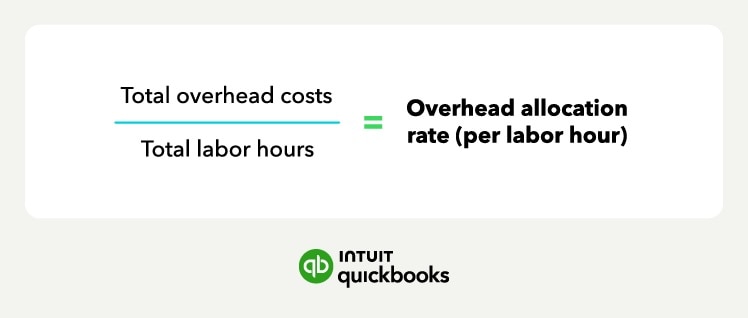

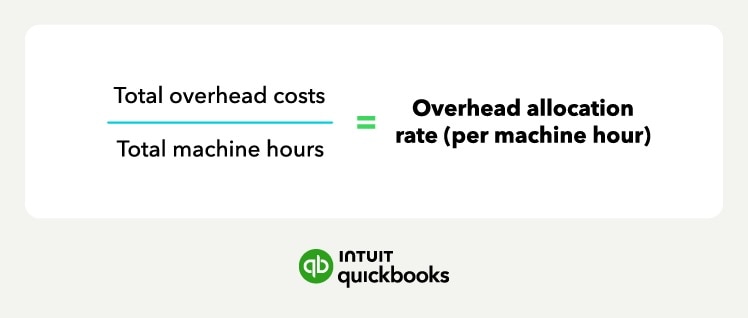

Companies use cost accounting internally to figure out the true cost of production. That includes every last component that goes into producing the product, freight, labor hours per unit, etc. For total accuracy, some percentage of overhead expense has to go toward each unit of production.

Understanding your true costs gives your business more overhead and helps you figure out where you can save money. It also helps you identify the most profitable products and services, leading to more informed decisions.

Profitable pricing

When you price your products or services, you consider the cost of inventory or the labor and materials that go into them. Usually, it’s pretty clear what those are. But it would be a mistake to just look at those costs and add markup.

You also have to include your overhead costs in your pricing. Not knowing your overhead costs could result in you pricing your products too low and not making a profit. Or, you might price them too high, resulting in unsold inventory and a hit to your bottom line.

Compliance with financial accounting rules

Companies use financial accounting to report externally to shareholders (if your company has them) and tax authorities on the income, expenses, and profitability of the business. Overhead costs appear on the company’s financial statements, specifically on the income statement, where they are deducted from profit.

In a manufacturing business, generally accepted accounting principles (GAAP) require overhead to be included on your balance sheet as part of inventory. It also must be included in the cost of goods sold on the income statement.

Don't overlook the "

Don't overlook the "

Don't just calculate your overhead allocation rate—use it. Analyze the results to identify areas where you can reduce costs, improve efficiency, and make more informed pricing and operational decisions.

Don't just calculate your overhead allocation rate—use it. Analyze the results to identify areas where you can reduce costs, improve efficiency, and make more informed pricing and operational decisions.