How to create a cash reserve

If your eyes grew wide at the thought of saving money for up to six months of expenses, we don’t blame you. It’s tough to set money aside as a business owner. Now that you have a handle on the total amount you need, let’s discuss some strategies to build up your cash reserve funds.

1. Set a monthly savings goal

Trying to save a huge amount of money overnight feels overwhelming. You won’t stock your emergency fund in one swoop, but you can make this process more manageable by setting a smaller monthly goal for yourself.

Do you want to set aside a certain percentage of your profits each month? Or do you want to set a monthly dollar amount to target?

Breaking down your desired cash reserve business goal this way is far less intimidating, and you’ll feel motivated to keep going when you see the number growing in your savings account.

2. Select a dedicated bank account

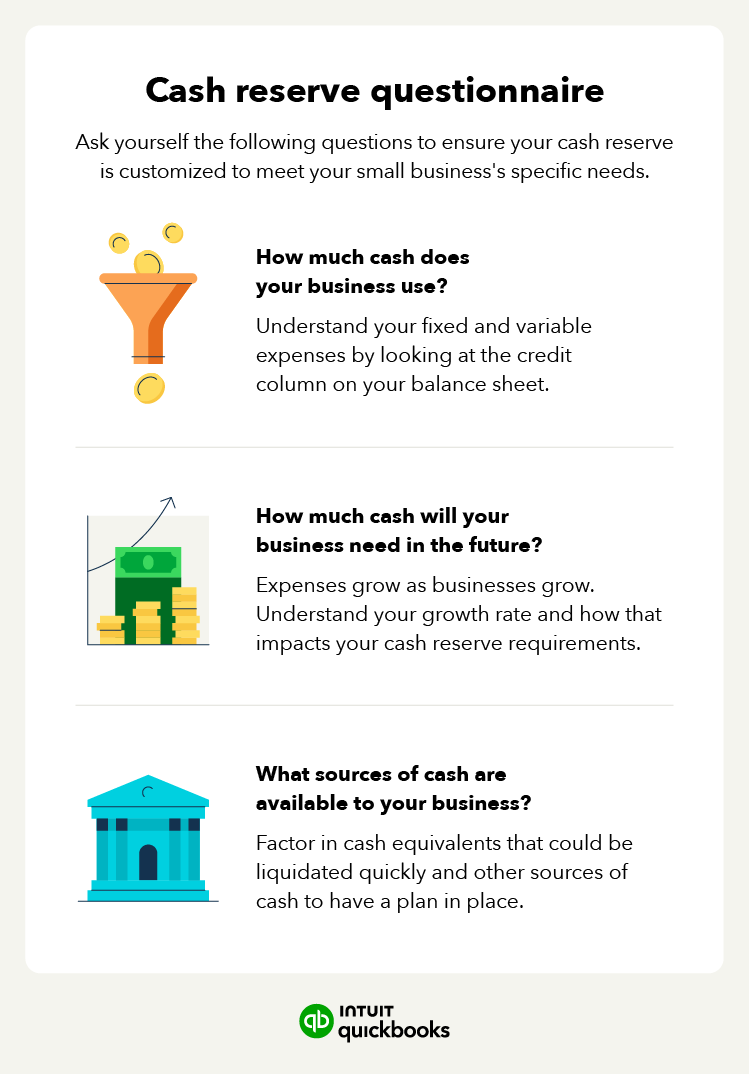

Once you’ve set a monthly savings goal, you may want to set up a dedicated small business checking account for your cash reserve fund. That way, you can easily separate your cash reserve from other funds without having to worry about monthly fees. Keep in mind that this may require extra bookkeeping hours and effort if you use manual accounting methods.

A cash reserve isn't always just money in a checking or savings account. Some businesses may also supplement their cash reserves with three-month Treasury bills or other short-term assets.

No matter what your cash reserve consists of, keeping it separated from the rest of your money can help you reduce the temptation to spend it. With a QuickBooks Checking account, earn APY on savings you set aside in envelopes that are tailored to your goals—from a rainy day fund to equipment.

3. Treat your cash reserves as nonnegotiable

Would you not pay your employees? Or skip your electric bill? We didn’t think so. These fixed expenses are part of your business budget, and your cash reserves should be too.

Until you’ve stocked your emergency fund with enough cash, treat it as a fixed expense. This will keep you accountable for filling it up rather than treating it as something to do when you feel you have extra money to throw at it.

If you find it challenging to keep track of your budget, using software to automate your savings or trying techniques like envelope budgeting may help you build your emergency fund.

In addition, you’ll also want to prioritize replenishing your cash reserve whenever you take money out. That way, you’re still prepared if other unexpected expenses arise.