For small businesses, managing cash flow effectively is critical for running daily operations smoothly, receiving profits faster, keeping operations efficient, lowering total operating costs, and providing a better customer experience.

5 ways to optimize business cash flow

Unlike profit, cash flow tells you how much actual cash is available to a business at any given time and how much you can spend – and that’s why cash is king, as they say.

Here are five ways to master cash flow optimization.

1.Negotiate payment terms

Whether you’re a wholesaler or a B2C retailer, being paid promptly is crucial to keeping your cash flow healthy. Make sure that your payment terms and days payable are clearly communicated to customers, and follow up on overdue accounts. Also, consider structuring agreements to include discounts for early payment and charging interest for late payments by customers.

2.Improve the customer experience

It’s no secret that if you make it easy for customers to pay you, the likelier they’ll be to pay you on time! Using a B2B payment gateway like TradeGecko Payments not only makes it easy for you to bill customers but also offers a fast and convenient payment method for them – so you can expect prompt payments and steady cash flow.

3.Do cash flow forecasts

Taking the time to complete a monthly cash flow forecast will give you a good indication as to how much cash you’ll have available in future. With this information, you can start to budget for upcoming expenses and consider ways you can invest back into the business. Try our free cash flow tool to estimate revenues, orders, and cash over time.4

4. Reduce inventory holding costs by managing inventory effectively

Effective inventory forecasting and management is key to keeping inventory holding costs as low as possible and freeing up cash to spend in other areas. Consider using a dedicated inventory management system so that you can accurately monitor stock levels and make purchase orders only when you need to – reducing the chance of negative cash flow and issues such as dead stock.

5. Diversify your customer base

Variety is the spice of life, and the same goes for your customer base. Work towards a multi-channel or omnichannel sales approach so that you can be selling to multiple customers across multiple platforms simultaneously. By doing this, you won’t need to rely on a single source for revenues, and you’ll start to see cash flowing into the business at a steadier pace.

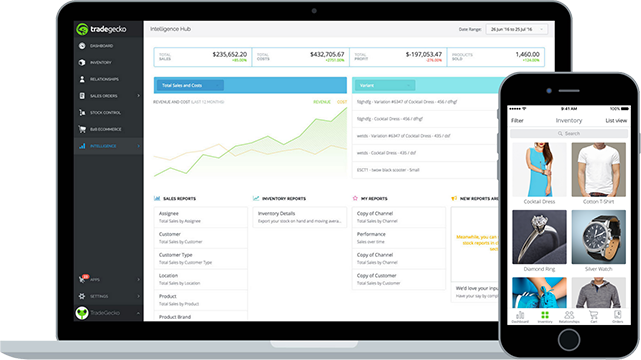

When it comes to optimizing business cash flow, TradeGecko can help with all of the points above by giving you the tools to manage your inventory effectively, facilitating fast and easy customer payments, selling across multiple channels, accessing sales and inventory reports, and managing crucial business operations from a single dashboard.

Plus, with our free cash flow model, you can also accurately track revenues, orders, and cash – giving you insights into what your cash flow will look like over time and allowing you to plan ahead.