To create an accurate project estimate, outline the project scope and expectations and their likely costs. A good estimate that guides your project to a profitable completion should include cost categories like hourly wage, materials, equipment, risks, and indirect costs.

Hourly wage costs

Your human resources cost will be one of the project’s biggest expenses—and workers are arguably the most important input to successful project completion. Set hourly rates for labor training, general labor, specialty labor, and skilled tradesmen. Then, estimate how many workers you require in each category and the labor hours needed to complete the project.

Wage calculation costs should also include deducted federal and state taxes from paychecks. To align your compensation with industry standards, reference construction cost guides with wage data. Then, consider whether you will be hiring union or non-union workers.

The cost of material

Once you understand project details and scope, determine the cost of material for the project. This is known as material takeoff. Material takeoff should be a comprehensive list of material quantities and their expected costs. For a closer estimate of material costs, consider the following in your calculation:

- Could there be fluctuations in supply or demand for my required materials?

- Will there be delivery challenges that add to costs?

- Do I need customized materials?

- Will the installation of certain materials require special equipment or skill sets?

When performing the material takeoff estimation, get supplier quotes as soon as possible to understand lead times for orders, recommended materials with appropriate specs, and delivery timelines to match your build schedule.

Tool and equipment cost

Tools may be considered a direct or indirect expense depending on if the tools are purchased, rented, or previously owned. Determine if renting or owning the tools will generate more profit based on the project. Then allocate a tool use percentage to your project based on hours, days, weeks, or sale value of the contract to account for tool depreciation.

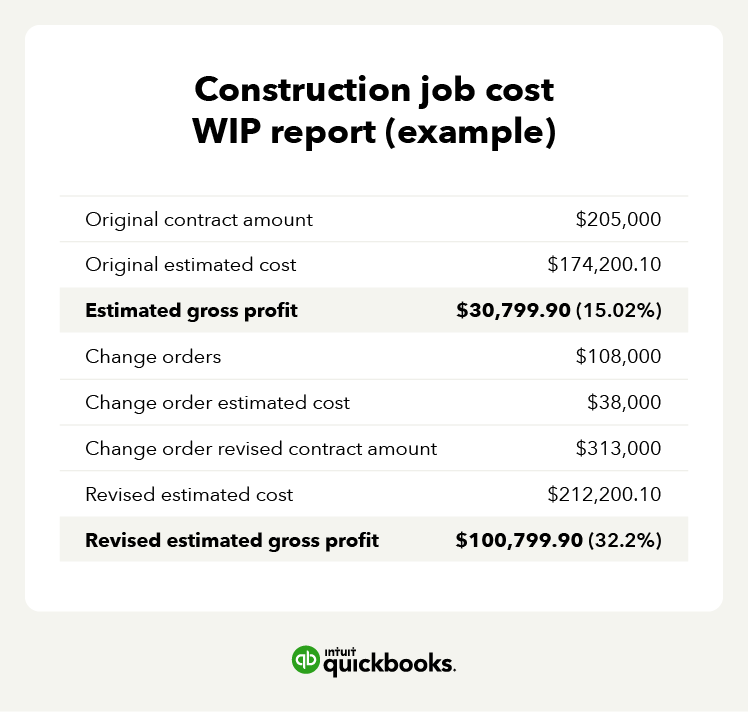

Project risk costs

Long projects are more susceptible to risks like rising material costs, inflation, or supply chain issues. Identify risk factors that could increase your costs or lengthen the project timeline such as:

- Change orders

- Supply bottlenecks

- Delays in the build schedule of subcontractors

- Bad weather

- Worker injuries

To compile a list of potential risk factors and their costs, review past projects and the source of unexpected costs that cut into margins. This process is easier with searchable job costing records in a construction accounting solution.

Indirect costs

While wages and materials are directly billable to projects, you may incur other indirect costs that you need to account for in the estimate. These can include office rent, utilities, vehicle maintenance, and project-specific costs like non-billable hours for project estimation and administration, transport of workers and equipment, and legal fees. Estimate and allocate indirect costs to projects on a pro-rata basis.

While these five categories can serve as a guide for general cost considerations, you should also include costs like permit fees, prep work, trash removal, and other non-material costs. Look at past projects or use a checklist to make sure you consider all potential costs in your estimates.