Effective cashflow management is key to business success. Operating working capital needs to be kept as low as possible, even down into negative values, in order to improve the cash position. To control the stock level, the purchasing volume needs be fine tuned to the latest sales trend and forecast.

The optimal supplier chain should be able to meet all your customer demands, while maintaining the lowest cost and possible inventory level. A low inventory level helps you to save on inventory costs, but it comes with the risk of stockouts. Stockouts are primarily caused by the following reasons:

- Late shipment from supplier (on top of a delayed order from your side)

- Higher customer demand than anticipated

Assuming you’re not selling in a niche segment where scarcity is part of the business concept, a stockout will always hurt your business. In the best case, an out-of-stock situation will only cause you to miss a sales opportunity, but most cases will result in disappointed customers that could turn to a competitor.

When dealing with the risks of a stockout, you have essentially two options:

- Take precautions to reduce the possibility that a stockout is happening (risk prevention)Reduce the potential impact in case a risk is materializing (risk mitigation)

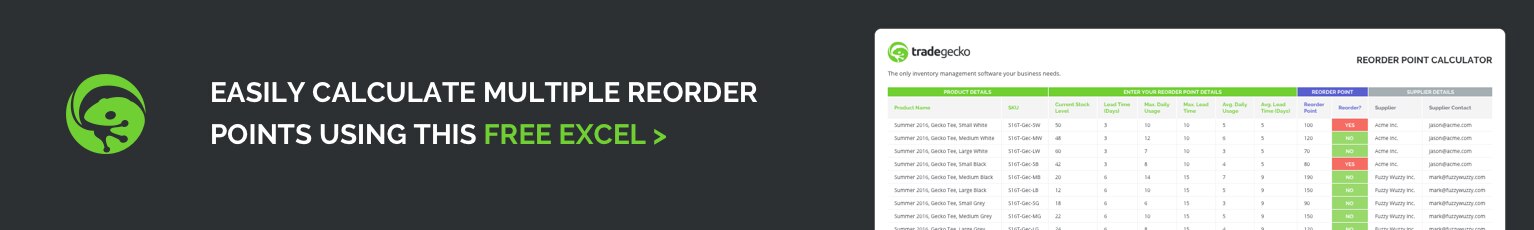

Ideally, you should prepare for both and make your business resilient in the face of any event. With inventory management software like TradeGecko , you’ll always stay in control of your inventory levels. You can run detailed reports that show your total stock on hand, along with filters by location, product type, available stock, and committed units. Moreover, you’ll also be able to run reorder reports so you can check for products and variants that have fallen below the reorder point so you can take measures to replenish your stock.