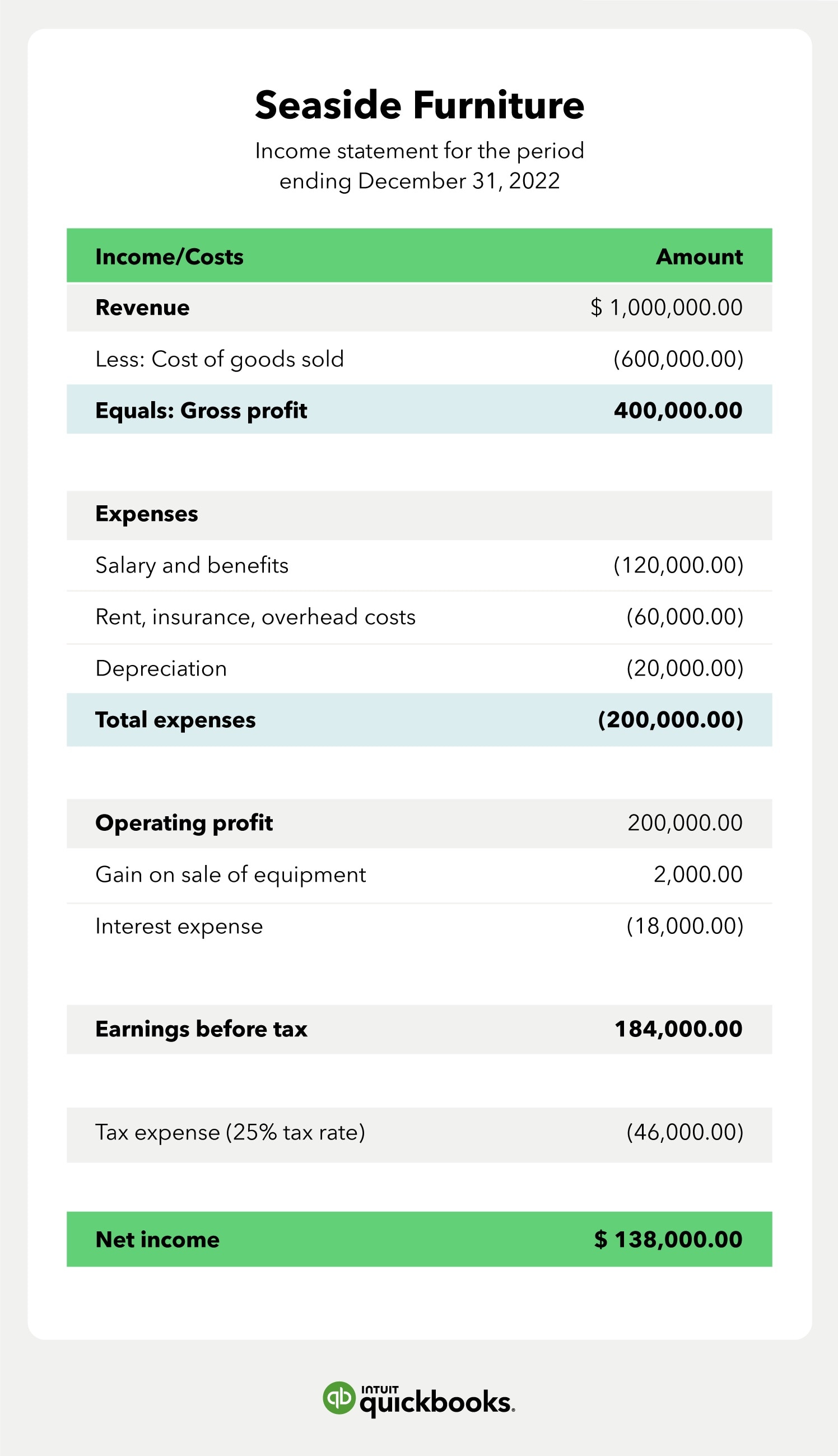

Note: The income statement above uses the term operating income, which also means operating profit. This discussion will use operating profit.

- Choose the right NOPAT formula: We can use the simple NOPAT formula for our calculations since we already have the operating profit listed on our income statement. However, for the sake of this example, we will walk you through the complex formula.

- Use the income statement to find operating profit: You’ll note that the operating profit (i.e. $200,000) is listed on the income statement. If you don’t see this on your income statement, you can calculate the operating profit on your own using this formula:

Revenue - cost of goods sold (COGS) - operating expenses - depreciation - amortization = Operating profit

If we were to calculate Seaside’s operating profit, it would look like this:

1,000,000 - 600,000 - 180,000 - 20,000 = 200,000

In this instance, there was no amortization so the final operating profit is $200,000.

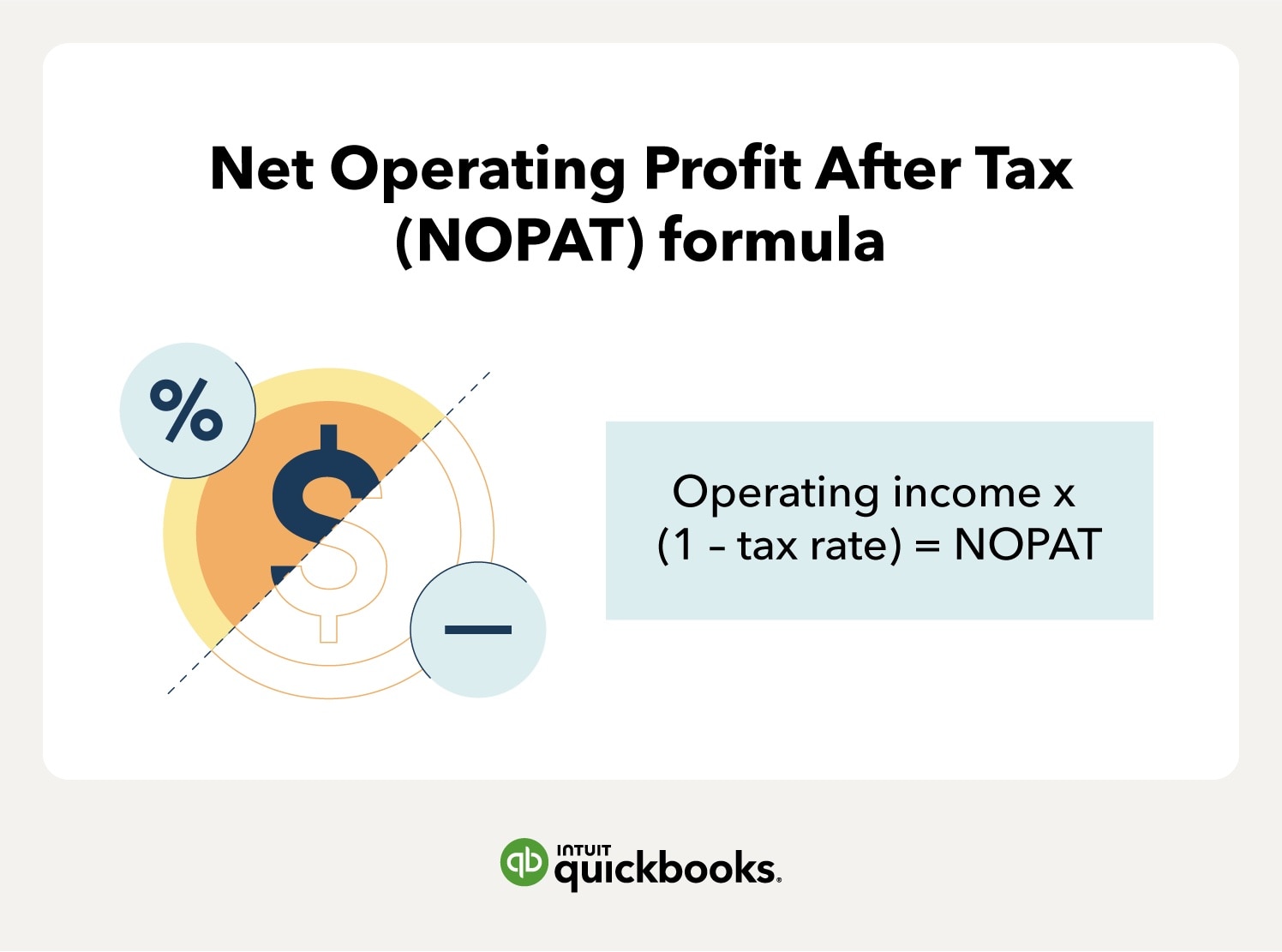

- Calculate the NOPAT: Now, we can plug Seaside’s operating profit into the simple NOPAT formula.

NOPAT = Operating profit x (1 – tax rate)

Assuming that Seaside’s tax rate is 25%, we can complete our calculation.

($200,000) x (1 - 25% tax rate), or $150,000

We can further break down this calculation to $200,000 x .75 which equals $150,000. That means that Seaside’s operating profit is $150,000.

How can the income statement and NOPAT calculation can be used:

After assessing Seaside’s income statement, we determined that they could potentially boost their operating profits in three key ways:

- Sale price: Increasing sale prices can increase profits.

- Reduce costs: The firm’s $600,000 cost of goods sold balance, for example, includes material and labor costs. If Seaside can negotiate lower material costs or pay a lower hourly labor rate, profits will increase.

- Gain efficiency: Businesses can work more efficiently by embracing technology. Accounting software can help a firm post accounting transactions and create invoices in far less time, which reduces costs.

NOPAT margin calculation example

Using the NOPAT we calculated earlier, we can calculate Seaside’s NOPAT margin to find a percentage that accurately represents how efficiently the business generates profits from daily operations without the burden of debts or taxes.

Some analysts prefer to use the NOPAT margin formula to calculate the profit associated with each dollar of sales. The NOPAT margin formula is:

(NOPAT) / (Total revenue) = NOPAT margin

When we plug in those numbers from Seaside’s 2022 income statement, we can determine that the NOPAT margin for Seaside is 15%.

($150,000) / ($1,000,000) = 15%

The margin calculates the amount of profit earned on each dollar of sales. If a business can increase its margin, the firm will be more profitable.

This formula is similar to profit margin, which is (net income) / (revenue). Seaside’s profit margin for 2022 was ($138,000) / ($1,000,00), or 13.8%. The profit margin ratio is lower because net income includes more expenses than operating profit.