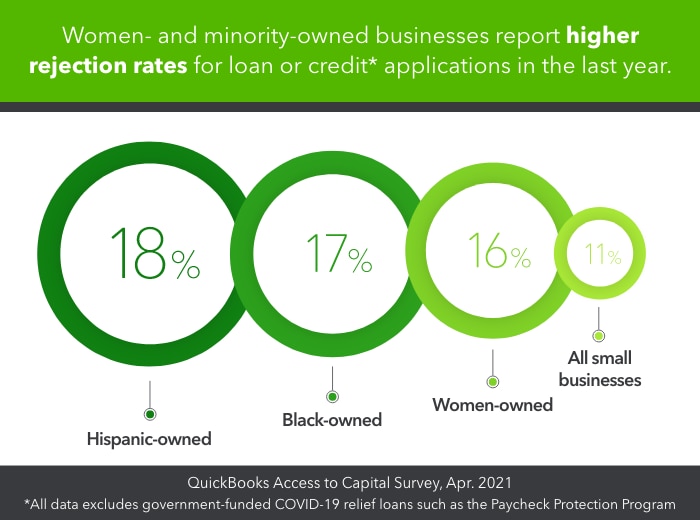

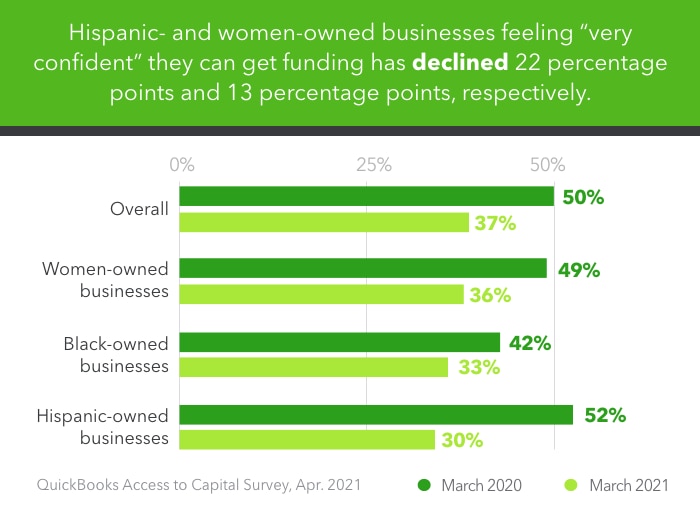

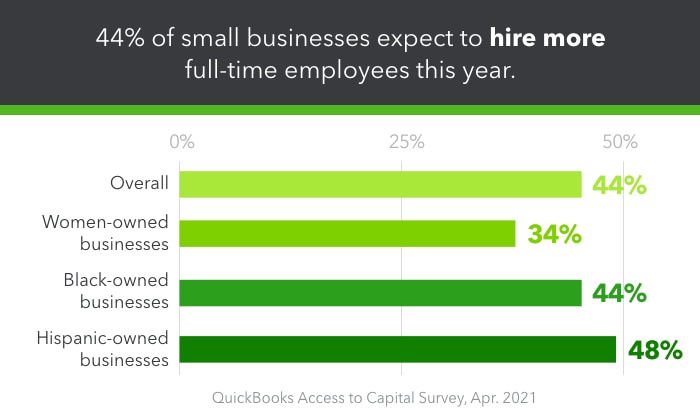

Women- and minority-owned businesses were more likely to report being rejected for loans or lines of credit in the last year – excluding government-funded COVID-19 relief loans – than the small business population as a whole. That’s a key finding in a new survey from Intuit® QuickBooks®. Although this COVID-19 “lending gap” has hampered many small businesses in the past year, there are signs of renewed confidence in 2021.

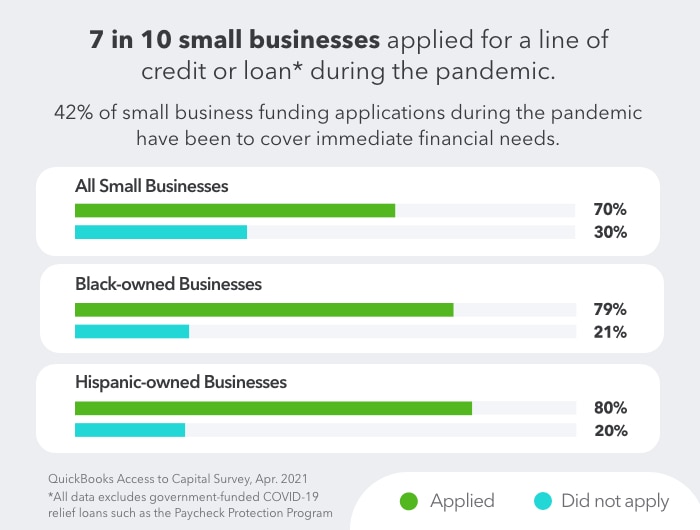

QuickBooks surveyed small businesses with fewer than 100 employees about their funding needs during the COVID-19 pandemic and how their borrowing confidence has been affected. Unsurprisingly, small businesses’ need for funding grew during the pandemic, especially in the last few months. Seven out of ten small businesses have applied for loans or lines of credit during the COVID-19 pandemic, excluding government-funded COVID-19 relief programs such as the Paycheck Protection Program. Black- and Hispanic-owned businesses have been the most likely to seek funding during the pandemic, with up to 80% applying for a line of credit or loan since March 2020.