Hispanics are starting businesses at a faster rate than the national average across several industries, growing 34 percent over the last ten years compared to just one percent for all other small businesses. Addressing the barriers that exist for Hispanic small businesses is the first step in understanding what financial resources and tools are necessary for them to achieve solvency. This is critical for the long-term prosperity and overall economic empowerment of this community. From lack of access to funding to limited awareness of business financial tools and resources, what stands in the way of success for Hispanic small businesses is clearly outlined in a recent Small Business Insights report by Intuit® QuickBooks®.

Hispanic business owners reveal their top challenges in new QuickBooks survey

Lack of access to financing and loans

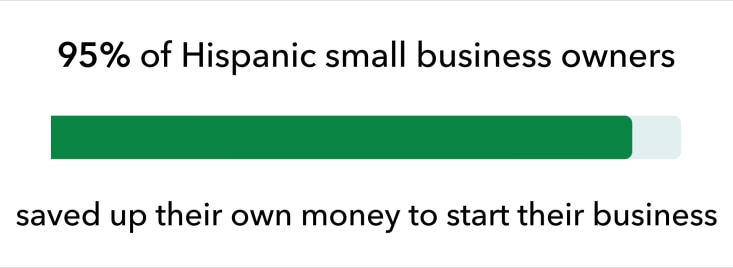

Hispanic small business owners typically tap into their own savings or obtain financial support from friends or family to start their businesses. According to the report, 95% of Hispanic small business owners said it was important to save up their own money before starting a business as a safety-net for business and personal expenses. Almost 62% had financial support from friends or family.

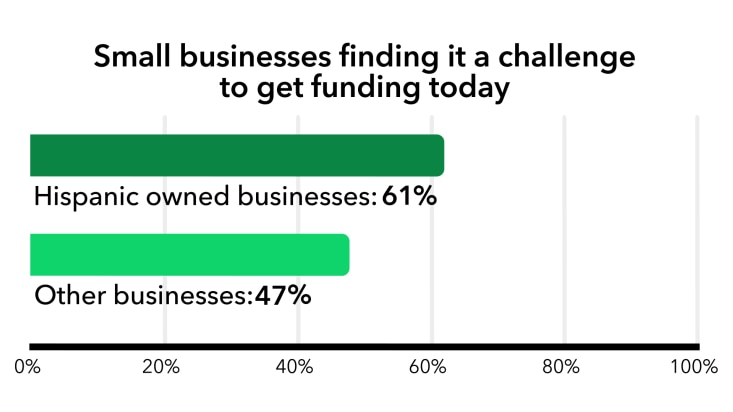

Leveraging traditional forms of financing is often harder for Hispanic-owned businesses. Almost 61% of those surveyed said it’s a challenge to get loans or financing right now, compared to less than 47% of non-Hispanic businesses. Of these, almost 19% describe it as “extremely challenging.”

“What we’ve observed is that more funding is being made available to minority-owned businesses in 2021 than in 2020,” said Jon Fasoli, vice president of Intuit QuickBooks Small Business & Self-Employed Segment. “Our hope is that with a combination of more options and more awareness and education, Hispanic businesses can truly start to benefit from outside support and resources.”

This echoes other recent research published by QuickBooks earlier this year, which found that Hispanic-owned businesses were more likely to have loan applications rejected during the COVID pandemic.

Limited familiarity with managing business finances and cash flow

Critical financial tasks such as invoicing, getting paid, paying bills, and managing taxes are a challenge for almost 74% of Hispanic-owned businesses. More than 21% describe these tasks as “extremely challenging.”

“Not only is it an issue of inadequate business literacy among Hispanics, but in some cases there is also a language barrier,” said Mariette Martinez, co-founder of TusTresMaestras, founder of MasterYourBooks and Intuit QuickBooks trainer and writer. “It is important for business tools to be intuitive so that regardless of your experience or preferred language they can provide tremendous value.”

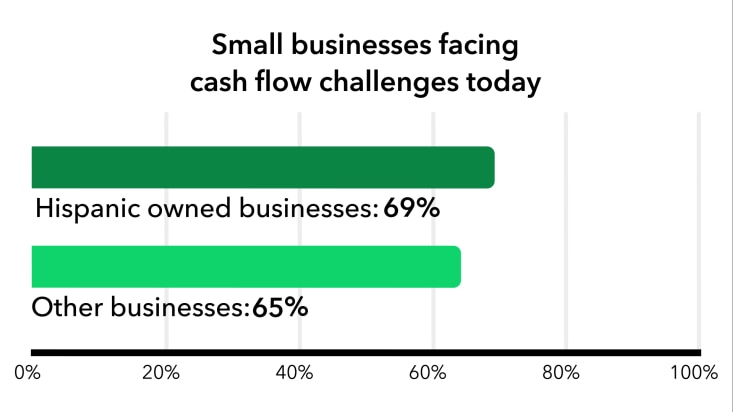

Additionally, more than 69% of Hispanic-owned businesses noted cash flow as a challenge. A comprehensive view of cash flow can show the true health of a company. Without a way to know where a business stands, it is impossible to make strategic decisions about the future – such as investing in equipment or paying certain debts.

“Cash is the lifeblood of a start up – being able to clearly keep track of each dollar of our spending is critical,” said Alison Velazquez, founder and CEO of Skinny Souping. “Especially during the pandemic, with all of the uncertainties, understanding our cash flow was vital to staying afloat.”

Sparse use of banking services and credit cards

Having a business bank account keeps business and personal expenses separate, allowing for more effective tracking of business cash flow. Additionally, with a business credit card, business owners can benefit from easy expense tracking, potentially higher credit limits and the perks of building a business credit history when it comes to applying for a loan.

“Ever since I became an entrepreneur 15 years ago, I realized the importance of keeping my personal and business finances separate,” said Gaby Natale, founder of the hair extensions line, Welcome All Beauty and president of the EMMY-winning company, SuperLatina-AGANARmedia. “Not only did it make the day-to-day financial management of my business easier but it gave me peace of mind when it came to filing taxes.”

Still, compared to non-Hispanic small businesses, Hispanic small businesses use each of these resources less than other groups. Only 25% have a business credit card, compared to 41% of non-Hispanic small businesses. Around 51% have a business bank account, compared to 59% of non-Hispanic small businesses.

Why it matters

It is impossible to ignore the impact that this community has on both a local and national level. “Latino businesses are a major asset to our economy and helping them reach their potential is important work,” said Brittney Castro, Certified Financial Planner and owner of FinanciallyWiseInc. “I see firsthand the challenges that this business community faces and how awareness and the use of tools and services helps to address those barriers.”

Fortunately, 76% of Hispanic business owners are open to using tools and resources that can help address their unique obstacles – and this is where QuickBooks can provide the most value. QuickBooks is in the business of creating smart, indispensable financial tools that help small businesses grow and achieve prosperity. The connected platform allows businesses to automate and streamline their accounting processes, pay employees, get paid fast and gain access to capital. By leveraging tools like QuickBooks, Hispanic business owners have a true source of truth on the financial health of their business, enabling them to grow and prosper.

Additional report highlights

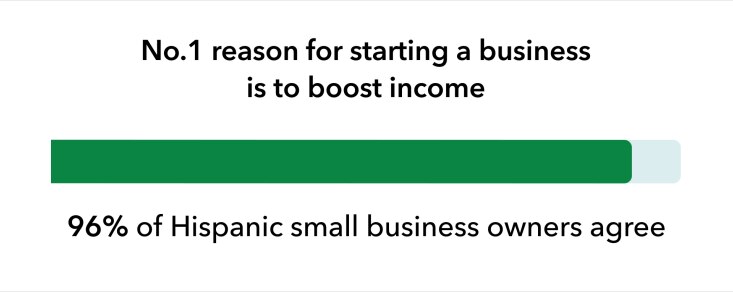

- 96% of Hispanic small business owners agree that the number one reason for starting a business is to boost income.

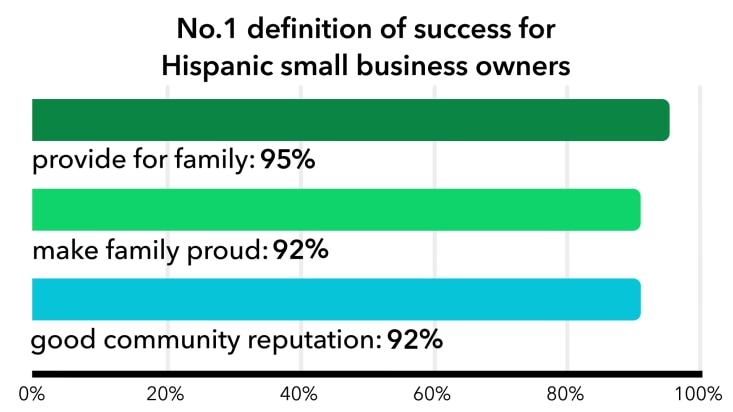

- 95% of Hispanic small business owners agree that providing for family is their number one definition of success.

- The top five challenges identified by Hispanic-owned businesses today are:

- Adjusting the business to COVID (77% agree)

- Getting more customers (77% agree)

- Surviving during COVID (76% agree)

- Taking care of financial tasks (74% agree)

- Growing sales/revenue (74% agree)

To view the full Small Business Insights report by Intuit QuickBooks from August 2021 and learn more about the sample, data, and methodology, please visit https://quickbooks.intuit.com/r/inspiration/hispanic-small-business-survey