Giving small businesses a new way to access fast, flexible funding options

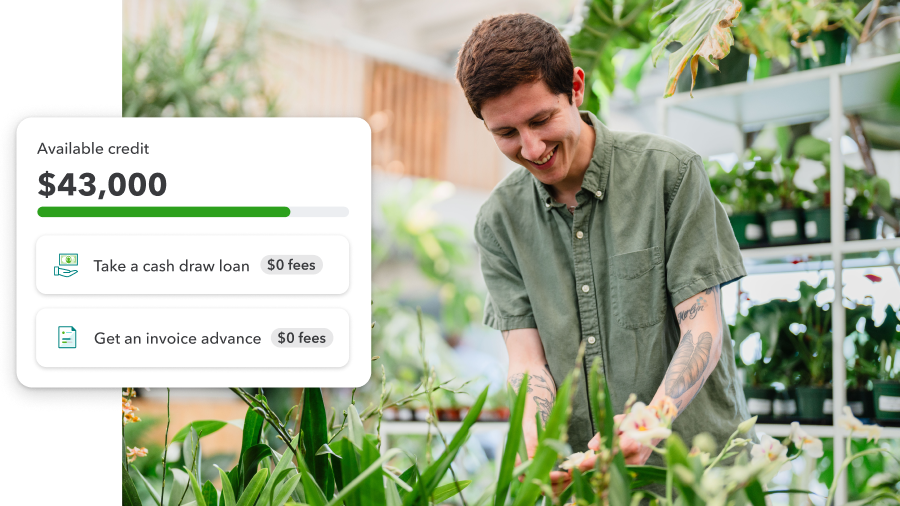

Intuit QuickBooks has expanded the small business lending options available through its platform with the launch of QuickBooks Line of Credit¹. QuickBooks Line of Credit gives small businesses a new way to access fast, flexible funding from $1,000 to $50,000, with loans issued by WebBank.

With QuickBooks Line of Credit, small businesses can tap into funding when and how they need, depending on their specific cash flow requirements. The line of credit is uniquely designed to provide business owners with the ability to draw from their available credit limit to support business growth, pay expenses, or get an advance on eligible unpaid invoices.

QuickBooks Line of Credit offers small- and mid-sized businesses:

- No fees. There are no origination or late fees, and no prepayment penalties. Small businesses only pay interest on the amount borrowed.²

- A simple application process. Eligible customers can apply in minutes for a credit limit from $1,000 to $50,000 right in QuickBooks with no extra documentation required. After applying for funding, businesses may receive a decision in as fast as 30 seconds.

- Faster access to funds. If approved, cash draws or invoice advances are typically deposited directly in the business’ bank account in 1 to 2 business days.³

- Easy Repayment. Once a small business receives funding, they can repay each loan over 12 monthly installments. For invoice advances, customer invoice payments are automatically applied to the business’ loan balance if the customer pays the invoice in full through QuickBooks Payments within 30 days of the advance, and any accrued interest will be waived.⁴

“QuickBooks delivers powerful money solutions that help small businesses manage their cash flow, which is critical to their survival and success,” said David Hahn, vice president of Product, QuickBooks Money. “Expanding lending options for small businesses to include a line of credit gives customers another seamless funding option integrated with the QuickBooks platform, simplifying access to capital so they can focus on what matters most: their business.”

Improving access to capital for small businesses is a key area of focus for QuickBooks, given the impact overall cash flow has on small business survival rates. In a 2024 QuickBooks Small Business Insights Survey⁵, 40% of small business owners said the cost and availability of financing has worsened in the last year. Late payments are also a concern, with 58% of small businesses indicating they have unpaid invoices and 46% having at least one overdue by 30 days or more.

Our customers tell us that the time it takes to just apply for a loan is the most time-consuming and anxiety-ridden part of the process, as banks and investors alike typically want two to three years of data for a successful loan approval. With QuickBooks’ near real-time insights on small businesses cash flow, customers benefit from the greater visibility into credit worthiness, especially the most underserved small businesses.

QuickBooks has partnered with WebBank to offer QuickBooks Line of Credit. With this addition to QuickBooks Capital, invoice financing and more traditional line of credit needs can now be conveniently met on the QuickBooks platform. With connected tools, expert services, and insights, QuickBooks helps businesses at every stage of growth manage their finances end-to-end including accounting, payments, payroll, and capital.

Visit here for more information on QuickBooks Line of Credit.