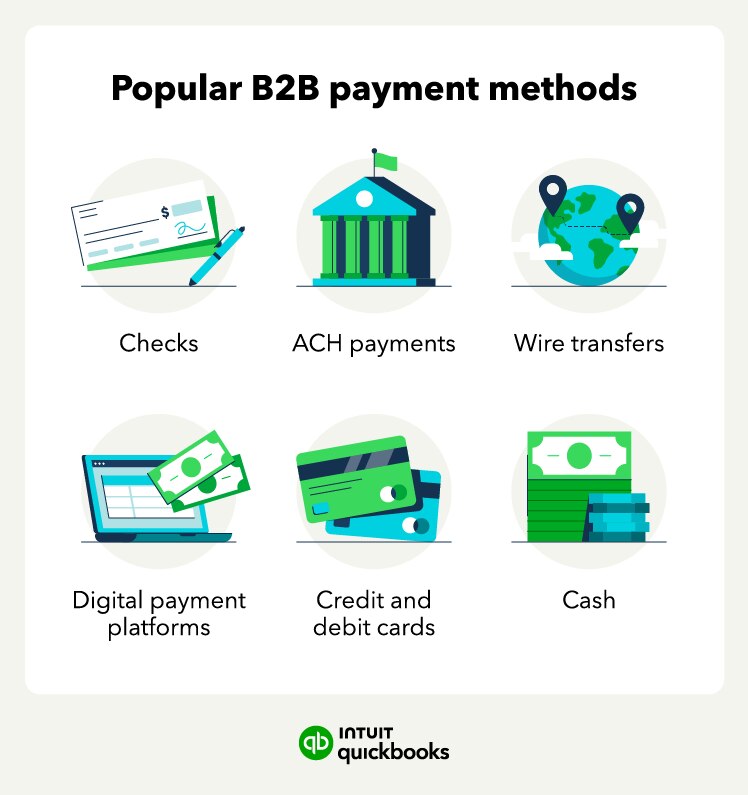

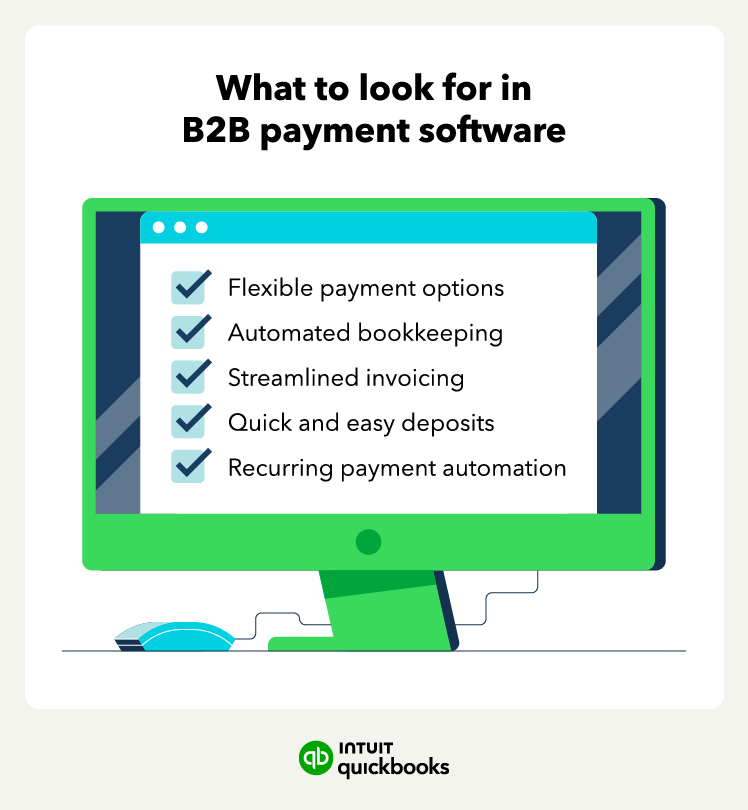

Flexible payment options

As you know, there are many B2B payment methods. From digital payment platforms like PayPal, Venmo, and Apple Pay, to debit and credit cards, B2B payment software allows you to manage all of your payments in one place.

Automated bookkeeping

Another benefit of using a B2B payment platform is automated bookkeeping. As payments come in, the payment system works with accounting software, like QuickBooks, to automatically record each transaction, saving you time and minimizing the risk of human error.

Streamlined invoicing

B2B payment software also allows you to create customizable invoices that your customers can easily pay online, allowing for a much quicker payment process than traditional paper invoicing.

In addition, you can also track your invoices to ensure no payments fall through the cracks. Not only will you be able to see when businesses pay your invoices, but you’ll also be able to see when they view them.

Quick and easy deposits

With B2B payment software, you can access your payments quickly and easily. You may even be able to access your payments instantly, eliminating the wait time that usually comes with paper checks or ACH transfers.

Recurring payment automation

If any of your B2B transactions are recurring payments, you can use B2B payment software to schedule recurring invoices automatically. B2B payment automation can also help save you and your employees time while reducing the risk of human error or a forgotten payment.

QuickBooks can help automate recording bills and paying them using QuickBooks Bill Pay — a built-in Accounts Payable automation solution for businesses that use QuickBooks.