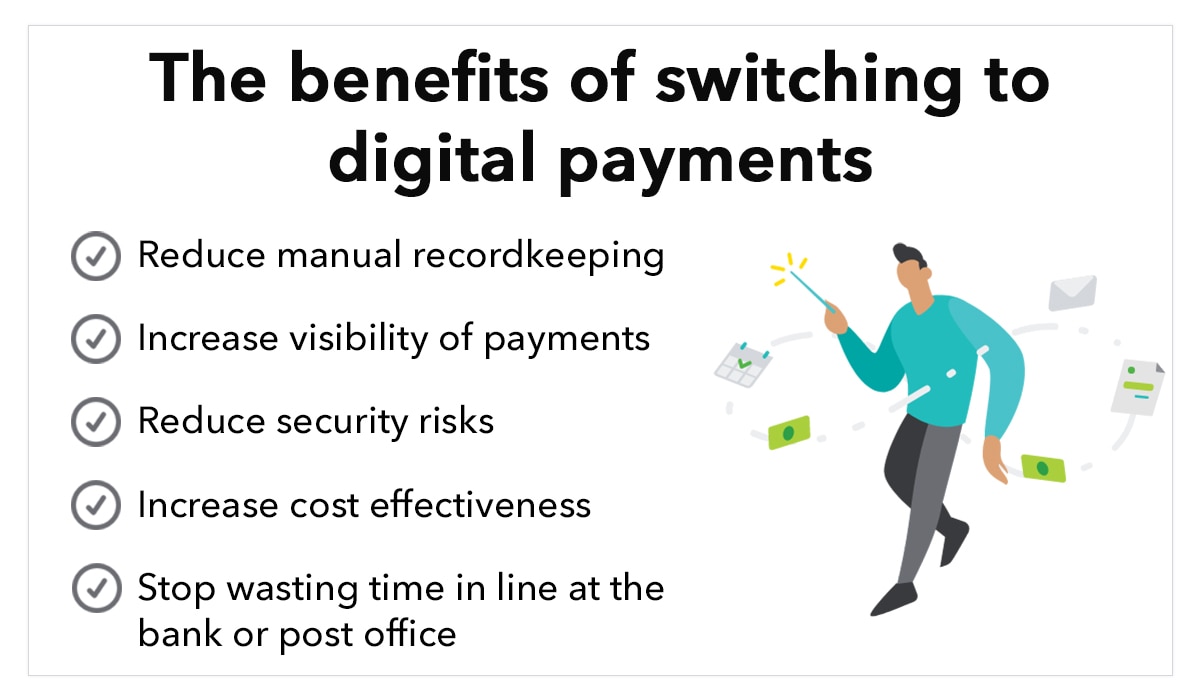

1. Reduce manual recordkeeping

For you: When customers pay using a check, you have to deposit that check to get the money. Mobile deposits can save you a trip to the bank, but they can cost you a small fee or increase check processing time. You also need to manually log that check payment in your books.

But when customers use digital payments, you see that money right away. For QuickBooks Payments customers, payments are automatically tracked and reconciled in your books. No manual recordkeeping is required.

For your customers: It’s important for customers to keep track of check payments. Checks can take longer to process than most other payment types. Sometimes, checks aren’t properly accounted for (usually in a checkbook ledger). The lapsed time between when a check is written and when it’s processed can lead to unwelcome cash flow surprises for customers.

When customers use digital payment methods, they always know how much they’ve spent. They don’t need to manually track their spending in a checkbook or waste time adding up how much they have left.

Say this: “We’re switching to paperless payments to help us save time and avoid manual recordkeeping. We want to make this easy for you, too—here are some options you can use to pay this bill online.”