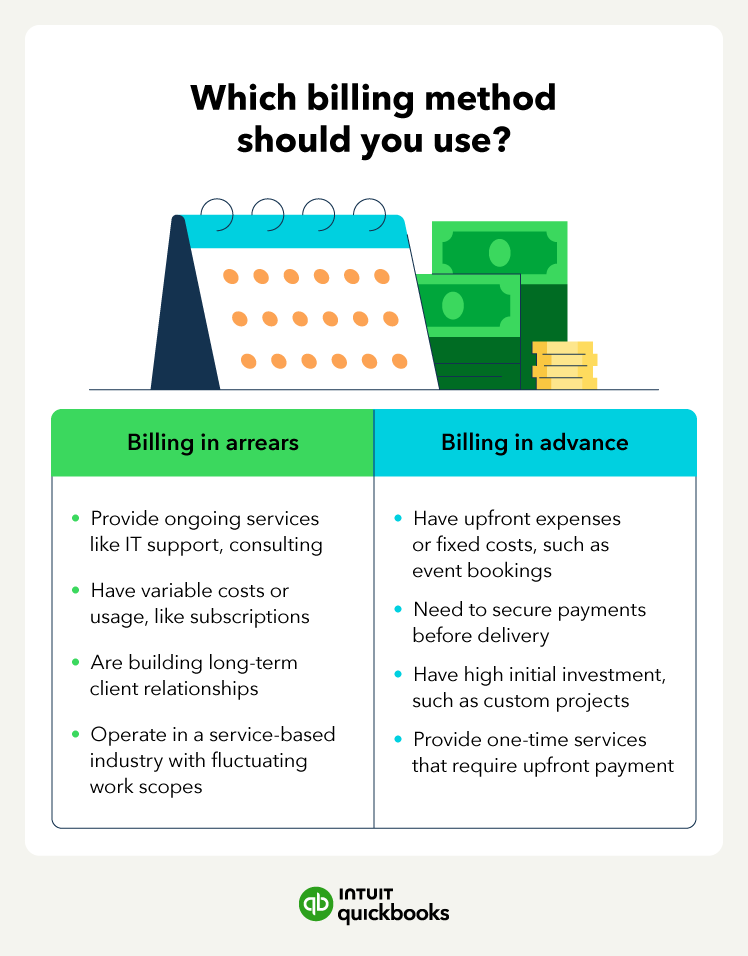

Running a business comes with its share of difficult decisions, like choosing the right billing method. Between upfront payments, installment plans for customers, and billing in arrears, the latter is the trickiest. But understanding how it works can make a big difference in keeping your operations running smoothly.

The flexibility of billing in arrears can be a lifesaver, especially when it comes to maintaining strong client relationships and ensuring your services align with client satisfaction. But how does it work, and when should you use it? Let's dive in to find out how this billing method could benefit your business.

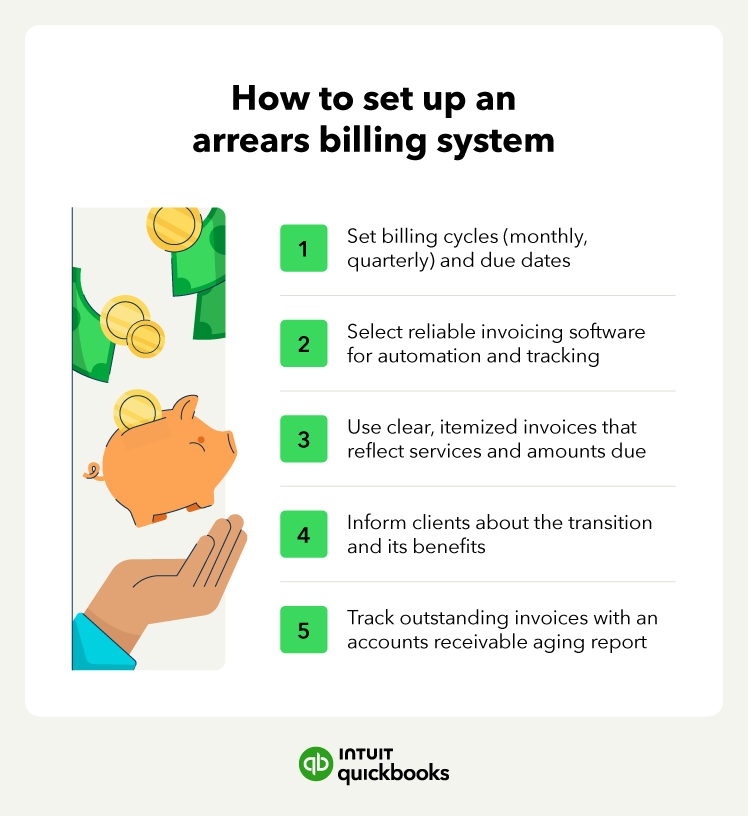

Set up scheduled payments, where clients pay at regular intervals for services to ensure consistent cash flow while allowing flexibility in service delivery.

Set up scheduled payments, where clients pay at regular intervals for services to ensure consistent cash flow while allowing flexibility in service delivery.