As a small business owner, you have a lot on your plate, especially when it comes to finances. Rent, utilities, payroll, inventory—these are just some of the expenses you’ll find yourself handling. With all of these expenses, it’s important to stay on top of billing, whether you’re paying employees or collecting payments.

The two most popular types of billing processes conducted by small businesses are billing in advance and billing in arrears. Simply put, billing in advance is collecting payments before delivering a product or service. Billing in arrears is collecting payments after providing a product or service.

But there’s more to arrears billing and payments than meets the eye. To give you a better understanding of what it means to be paid in arrears and how arrears billing works, we’ve created this guide. Read through to learn more about arrears billing, or use the links below to navigate throughout the post.

- What is paid in arrears?

- Billing in arrears

- Using arrears billing vs. advance payments: Benefits and disadvantages

- Benefits of paid in arrears billing

- Disadvantages of billing in arrears

- Best practices for billing in arrears

- Arrears payments

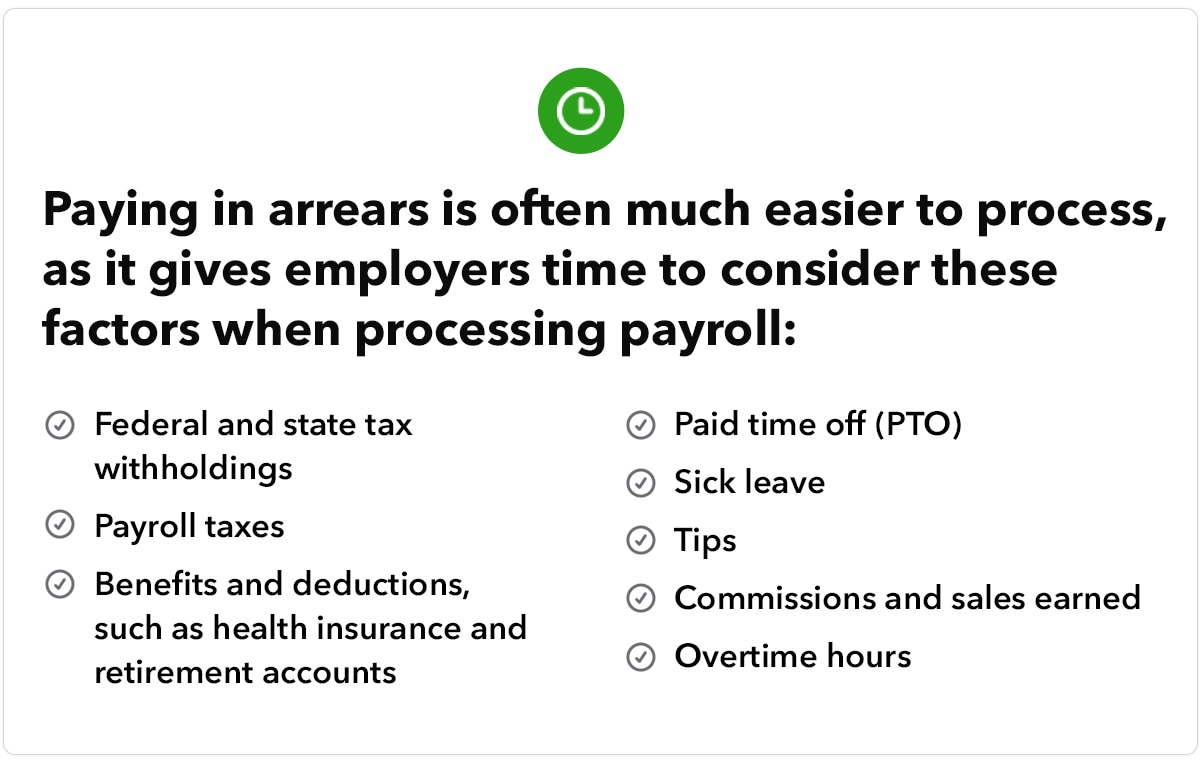

- Why do companies pay in arrears?

- “Arrears” in the context of overdue payments

- Paying in arrears on accounts payable: Consequences of late payments

- How to manage payments in arrears