2. Find the percentage of payments your customers make through digital methods, and determine which payment methods they use most.

Next, you’ll want to review your customer transactions to determine two things:

What percentage of your customers pay through digital payment methods that require you to pay fees to process?

To get a good understanding of this, you’ll want to use a time period that’s representative of trends in your customer’s transactions. For example, if your business has been open for 3 years but you only began taking digital payments 2 years ago, exclude the first year of your business from your calculation. The right time period to look at for your business will depend on factors such as any seasonal trends your business experiences, how many transactions your business processes, and if you anticipate any changes to your operations that could impact how your customers pay you going forward. Overall, you’ll want to look at a period of time that you feel is representative of your business.

Looking at your customers who pay through digital methods, which methods do those customers use?

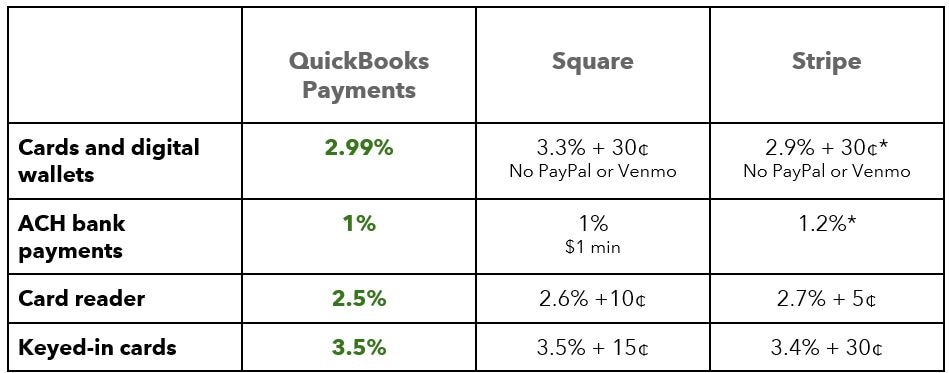

Do your customers primarily pay you online through card payments, or ACH transfers? Or do you take many payments with a card reader in person? Since these different types of transactions have different associated fees, you’ll want to take this into consideration to help you find your average payment processing expense.

If you use QuickBooks, you can find this information by reviewing past receipts from your customers.

3. Calculate the average expense of your payment processing fees.

Taking into account the factors in steps 1 and 2, let’s walk through how to calculate your business’s average payment processing expense using the following example:

Let’s say you are the owner of a construction company, and all of your customers pay you through pay-enabled invoices. These invoices give your customers the option to make payments with cards and digital wallets, or with ACH payments.

You decide that looking at customer transactions over the last year will give you a good representation of what methods your customers generally use to pay you. Reviewing those transactions, you find that 75% of your customers pay their invoices through card payments, and the remaining 25% pay through ACH payments.

You know that for each card payment processed, you are charged 2.99% of the total transaction fee. For each ACH payment, you are charged 1% of the total transaction fee.

To find the percentage you’d increase your overall prices, you can find the weighted average between these two rates, based on how often customers pay you with each payment method – here is a breakdown of that formula:

((The percentage of customers who pay you with card payments × the 2.99% rate you are charged for processing card payments)

+

(The percentage of customers who pay you with ACH payments × The 1% rate you are charged for processing ACH payments))

÷ 100

= The average payment processing fee you pay per transaction as a merchant

With the numbers from our example, this looks like:

((75 × 2.99) + (25 × 1)) ÷ 100 = 2.49

4. Apply your new prices to your products and services.

Now that you know the average fee you are paying for payment processing per transaction, you can apply that to your overall pricing to build your payment processing fees into your overall pricing strategy. To do so, you’ll raise your prices for all products and services you sell to your customers by that amount. In our example above, you’d raise your overall prices by 2.49 percent.

You may also want to consider that by raising your overall prices by that percentage, you’ll also increase your payment processing fees by a small amount as well.

Let’s walk through how to do so, using the same example. In the example we’ve outlined in this guide, your payment processing fees are 2.49%. If one of your products or services was originally priced at $1,000, after factoring in 2.49% of $1,000, you would add $24.90 to your original $1,000 price:

$1,000 + $24.90 = $1,024.90

Your new price with payment processing fees added would be $1,024.90. You would then find 2.49% of the added payment processing fee:

24.90 x 0.0249 = 0.62001

You would then add that to the amount you plan to increase your prices to account for payment processing fees:

$24.90 + $0.62 = $25.52

In this example, to fully build your payment processing fees into your original $1,000 price, your new price would be $1,025.52.

With your payment processing fees built into your pricing, you may also want to consider factors like psychological pricing strategies to help you maintain attractive prices for your customers and clients. For example, customers may find that a product or service priced at $1,025.99 appears more attractive than one priced $1,025.52. With your base pricing strategy determined, you can then apply psychological pricing strategies to ensure your prices are appealing to your customers.