Did you know October is Financial Planning Month? Now is a perfect time to take control of your expenses, find out how to turn data into actionable insights, or learn to forecast your business’s revenue growth. Don’t forget to explore the latest ways QuickBooks helps with your financial planning.

Here's what's new in QuickBooks Online for October 2024

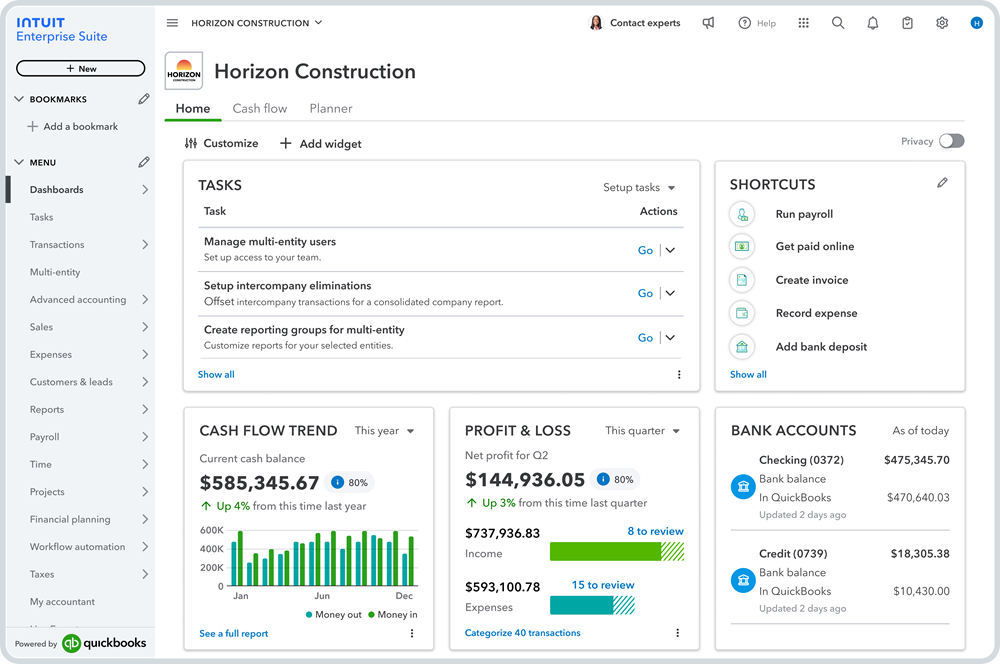

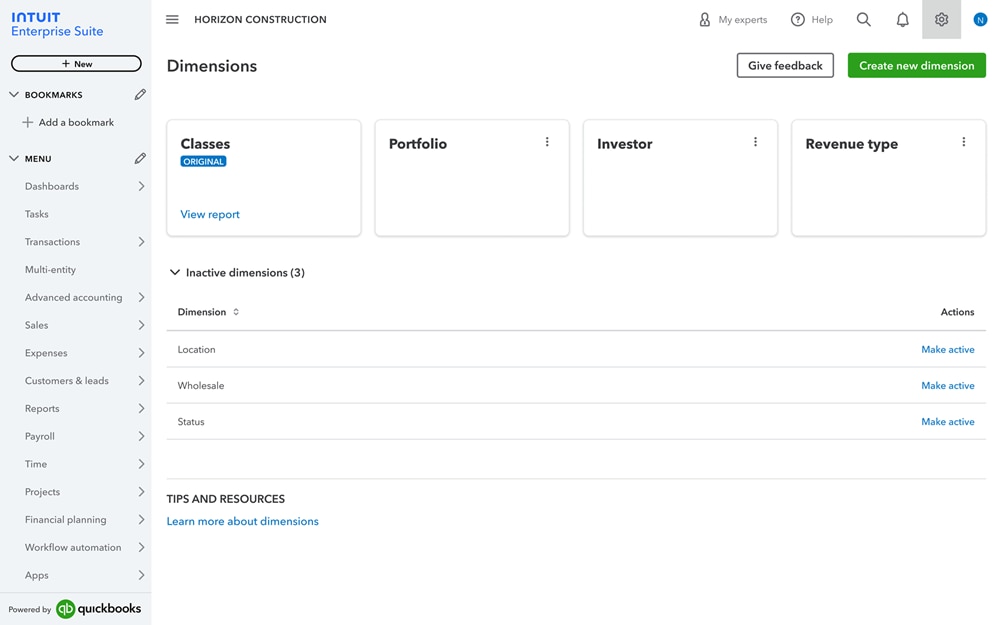

Power your business, not just your books, with Intuit Enterprise Suite

Intuit Enterprise Suite is a new cloud-based, multi-entity, and multi-dimensional platform that enhances productivity and profitability for businesses with complex needs.

Growing businesses need intuitive tools to help them manage powerful multi-entity accounting, workflows, and dimensional reporting—while streamlining operations to drive efficiencies and allow continued scaling. Intuit Enterprise Suite shows our investment in building seamless platform solutions that meet all these needs and goals.

With Intuit Enterprise Suite, you can:

- manage a multi-entity business from end-to-end in one place

- get seamless accounting that flows into cross-entity and P&L reports

- connect projects to profit with accurate labor costs and profit per employee

- drill down with multidimensional reports across user-defined hierarchies to make confident decisions about resources, performance, and upcoming projects

- streamline efficiency and cash flow by connecting data with AI-powered automation throughout and across entities

- access real-time KPI data with customizable dashboards

Your business will have the tools to keep growing—with custom roles and controls on user permissions, seamless third-party integration, and access to payroll and benefits to simplify compliance and retain a talented team.

You can configure an Intuit Enterprise Suite solution to power your business and grow beyond your books.

Register for the Introduction to Intuit Enterprise Suite webinar on October 16, 2024 at 10 AM PT to see product demonstrations and learn more.

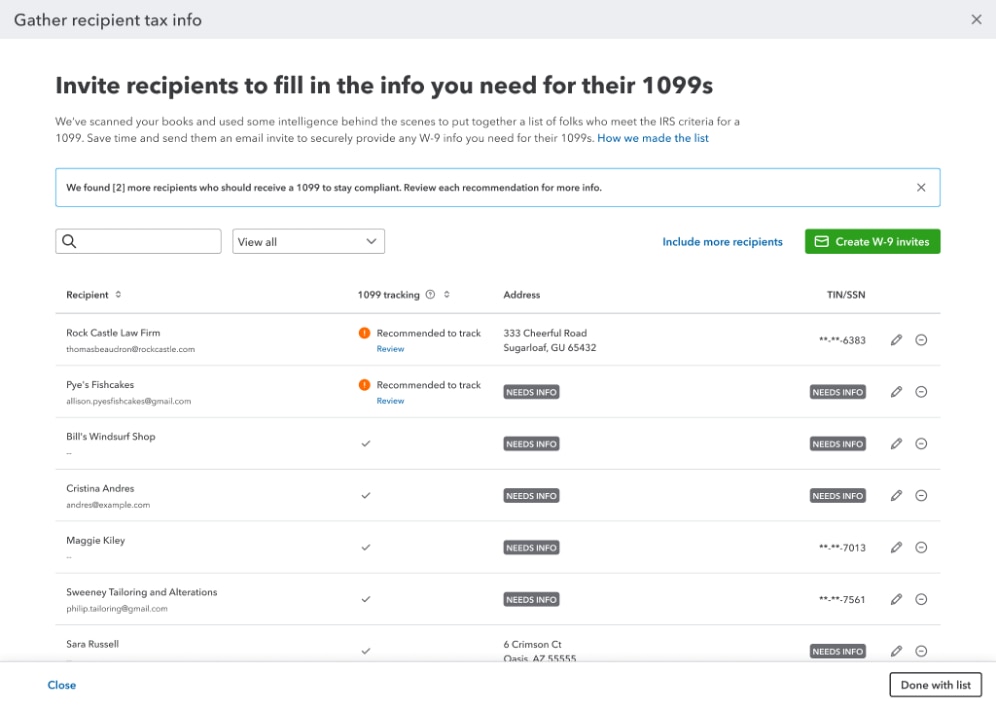

Get ready for tax season with a W-9 management tool

Stay compliant with the new W-9 management module in QuickBooks Online.

This new module allows you to see a list of vendors who are likely to require a Form 1099 and what info may still be needed to complete all 1099s. Send email invites to vendors who are missing W-9 info, like tax ID or address, in a single step.

Prep 1099s in less time using the new W-9 management tool.

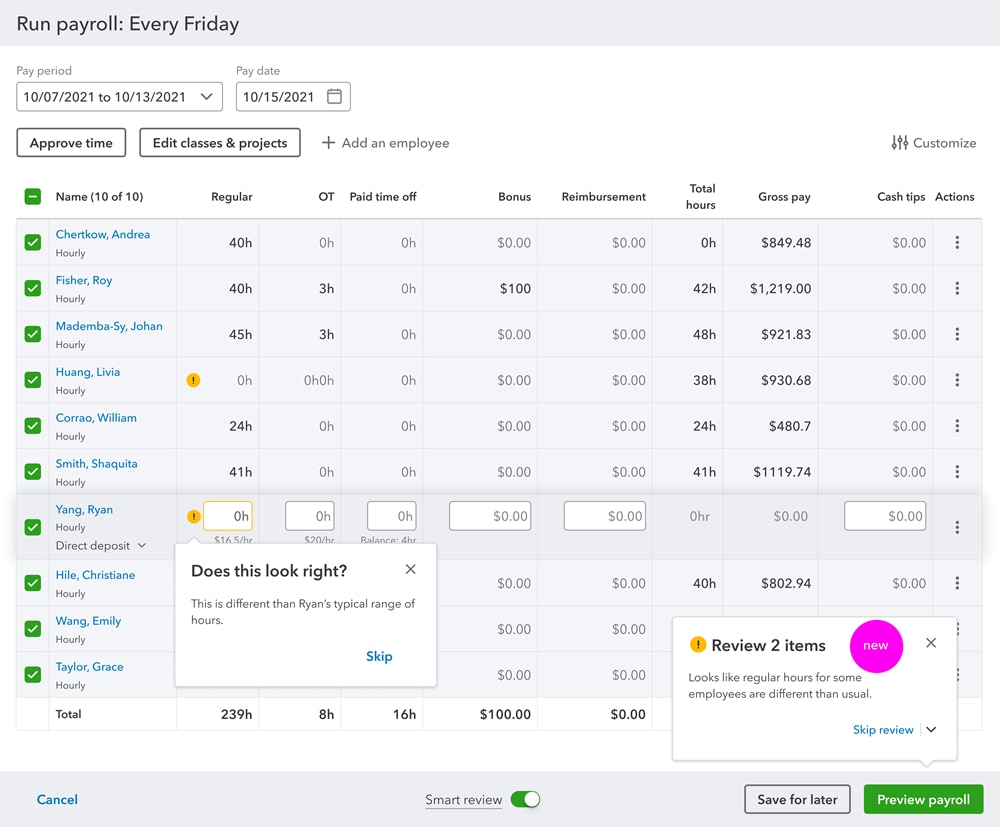

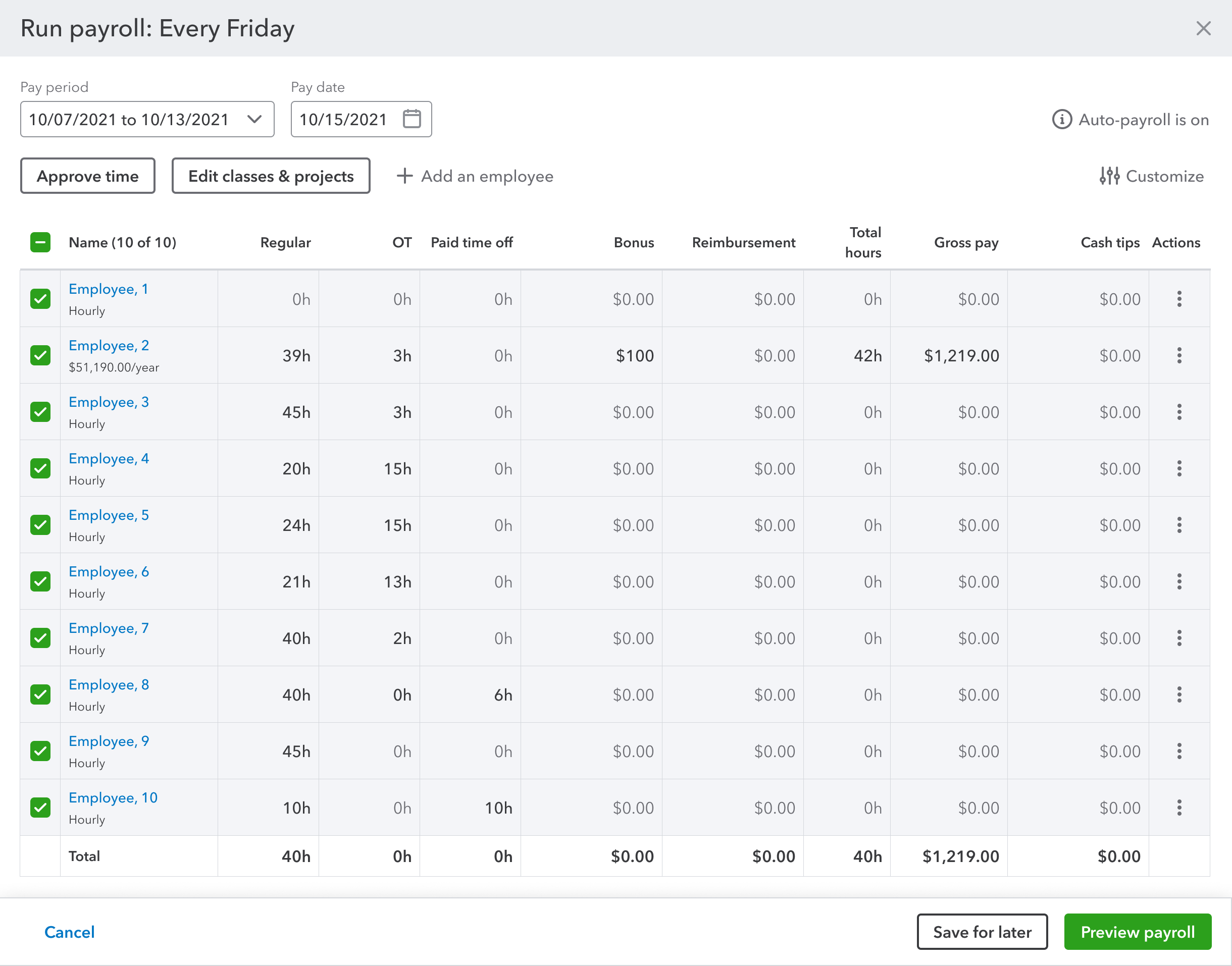

Flag mistakes before running payroll with anomaly detection

Running payroll is a crucial task. With QuickBooks Online Payroll, you now have the help of AI-powered anomaly detection, which uses AI to help flag payroll mistakes before payroll is run. This feature helps identify errors in hours-worked data inputs for regular, hourly pay types so mistakes can be detected and resolved in real time—keeping employees happy and avoiding lost time and money on inaccurate payments.

Anomaly detection is active in QuickBooks Online Payroll by default. However, you can turn it off at any time.

Note: This feature only applies to payroll payments made for pay type “regular hours.”

Important pricing details and product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

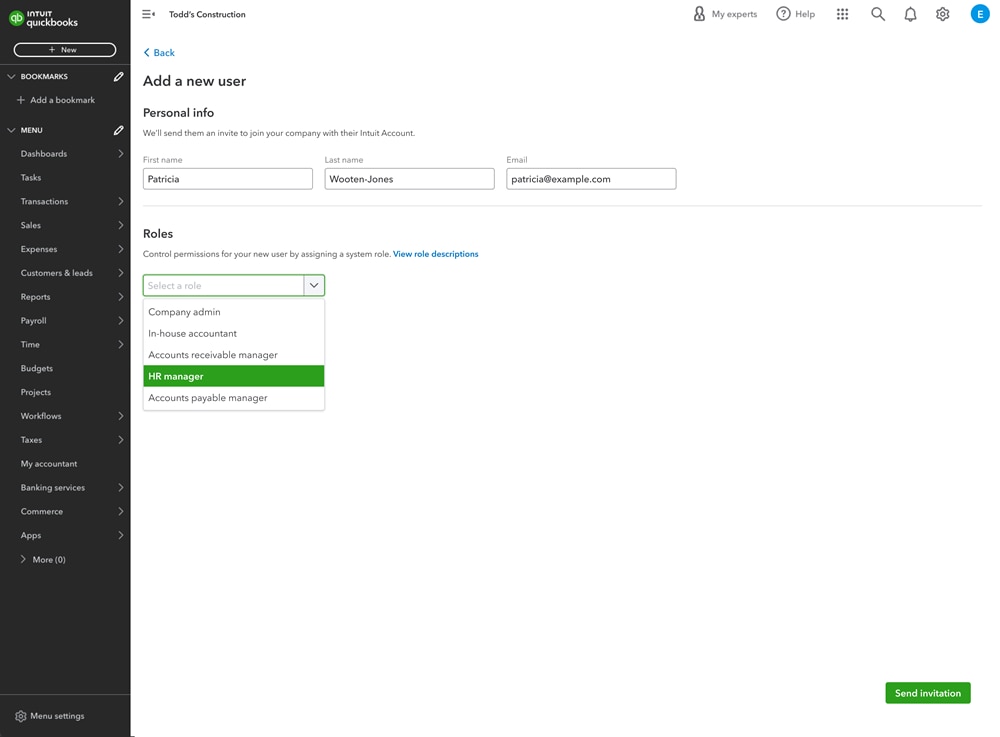

Assign an HR manager role for payroll-only access

If you use QuickBooks Online Payroll Premium or Elite, you’ll see a new role you can assign: HR manager.

The HR manager role has full access to HR, payroll, and time-tracking items in QuickBooks Online and QuickBooks Online Payroll but doesn’t have access to your company’s financial data. To avoid unauthorized access to financial data, you no longer need to rely on a primary admin to handle payroll tasks. Delegate these duties to an HR manager to free up higher-level team members and help ensure payroll runs on time.

Note: The HR manager role is available to QuickBooks Online Advanced, Plus, or Essentials subscribers who use QuickBooks Online Payroll Premium or Elite. It’s also available to standalone subscribers of Payroll Premium or Elite.

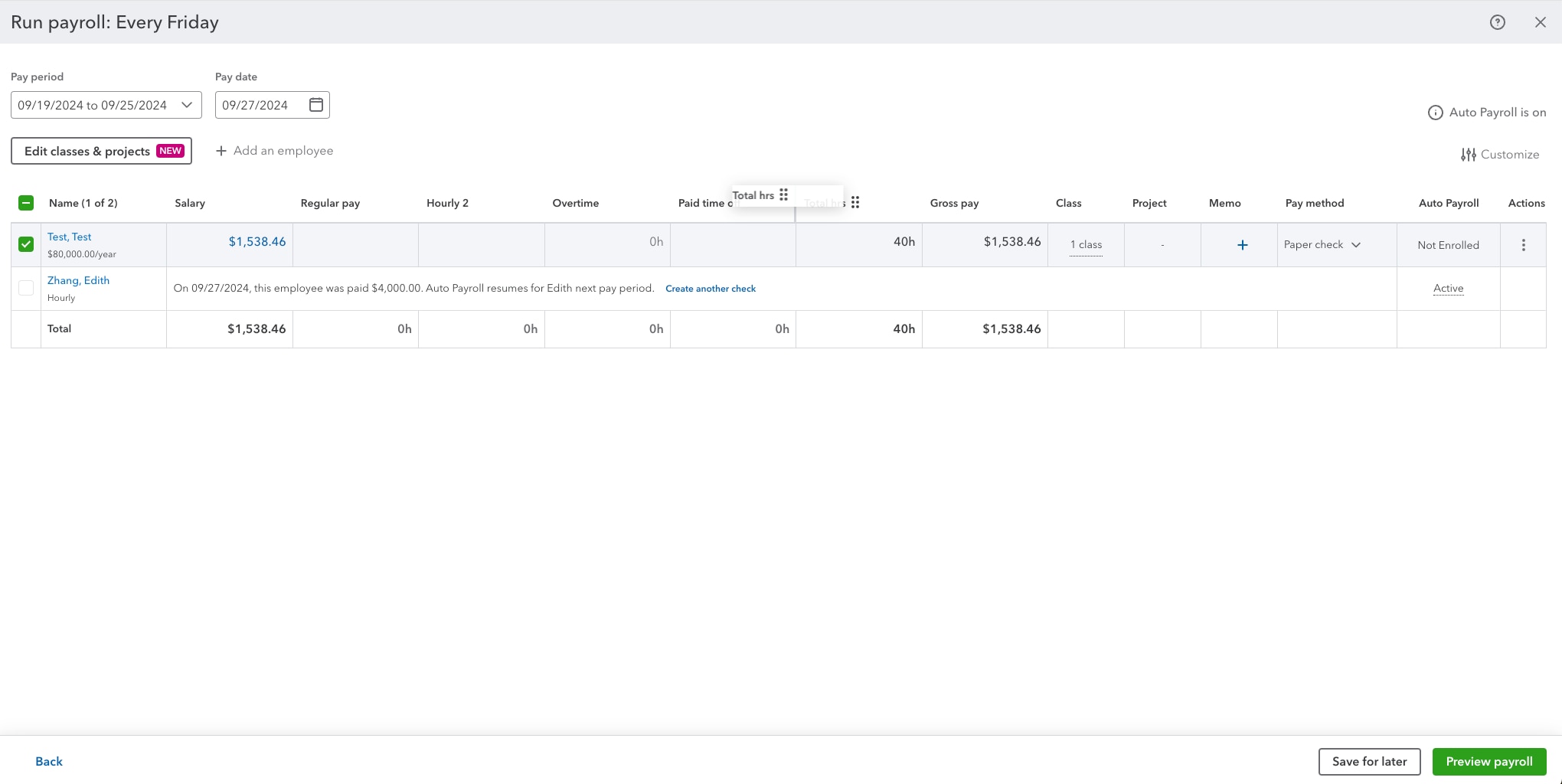

Customize column order and change payment type in QuickBooks Online Payroll

You can now customize the order of your columns when entering hours in QuickBooks Online Payroll.

In the table on the Run payroll page, you can reposition any column, like Total hours, Salary, or Reimbursement. Want the table to match your time-tracking data? Easily move any column to the order you prefer.

The table also includes a Pay method column. This lists how each team member will be paid. To change how a team member is paid, select the dropdown in the Pay method column.

Important pricing details and product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Allow employees to edit direct deposit info in QuickBooks Workforce

In QuickBooks Online Payroll, direct deposit info is now easier to manage.

Each of your employees paid with direct deposit can now edit their own direct deposit info in QuickBooks Workforce rather than having to ask you or the HR department to do it for them.

This option is active by default, but you can turn it off at any time.

Note: QuickBooks Workforce must be enabled for an employee to change their direct deposit info. At this time, employees can edit their information in QuickBooks Workforce on the web but not through the mobile app.

Get enhanced payroll cost allocation for robust profit and loss insights

If you use QuickBooks Online Plus or Advanced, you can track and allocate your payroll costs with precision using QuickBooks, QuickBooks Online Payroll Premium or Elite, and QuickBooks Time.* This detailed view of labor costs can help you make smarter business decisions.

During payroll processing, you can now track payroll costs by customer, project, or class, and split wages by multiple classes or projects within the same pay period. This enables you to run in-depth P&L reports by class, project, or customer, accurately reflecting your total labor costs. By implementing this tracking, you can split wages into multiple classes or projects, including hourly or salaried.

You will also save time when team members record hours with a specific class, project, or customer in QuickBooks Time. These hours will directly flow into payroll with this added info. You can also use this info to help identify mistakes while making paycheck corrections.

Also, payroll taxes and contributions will be automatically allocated to the correct project or class. This gives you better visibility on actual labor costs in P&L reports.

Important pricing details and product information

QuickBooks Time: Time tracking available in QuickBooks Online Payroll Premium and Elite only.

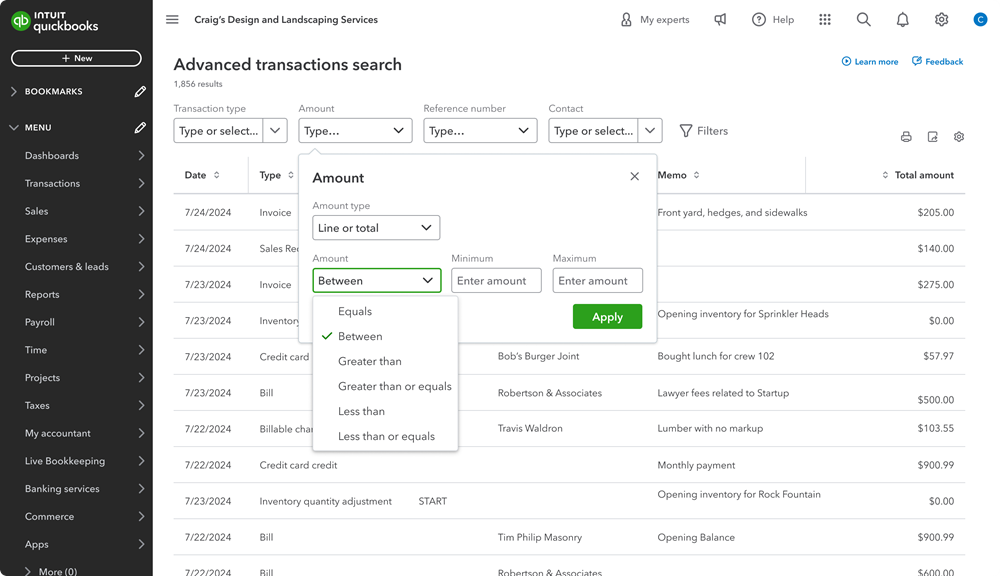

Explore an advanced search for transactions in QuickBooks Online

It’s now even simpler to find specific transaction data with a new, modern interface that makes it easy to carry out advanced searches.

Whether you’re finding a recent payroll expense or checking if an invoice has been paid, you can apply the filters you need to complete more detailed queries.

Search for line amount, total amount, or line or total amount with redesigned Filters. You can also use the improved memo, description, and tracking number filters to find these transactions more easily.

In addition to these enhanced filters, you can now resize, customize, hide, and sort table columns in the improved advanced search to find the data you need. You can also change the height of rows and alternate row colors to personalize your search experience.

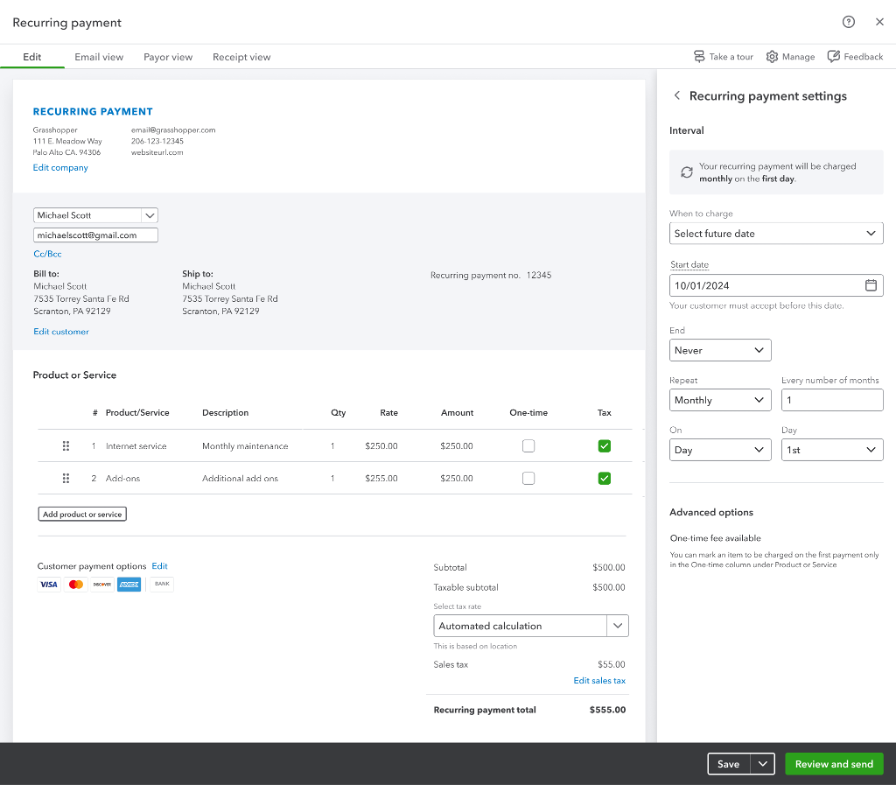

Get paid automatically with recurring payments

Have you been invoicing customers for the same products or services regularly? If so, you can now set up recurring payments using QuickBooks Payments.

You no longer need to wait for customers to pay invoices. When you set up recurring payments for a customer, QuickBooks will send the customer an email with a link to accept the terms and securely enter their ACH or credit card info. Then, the customer will be automatically charged each period, and the payments will be automatically matched in QuickBooks.

You have the flexibility to set up recurring payments that charge daily, weekly, monthly, or annually. One-time fees, like initial setup fees, can be added to the first charge.

Recurring payments make it easier for your business to get paid quickly and maintain a steady cash flow. Plus, your customers will appreciate the convenience of automatic payments, eliminating the need for manual invoices and follow-ups.

To access recurring payments, you must be a U.S.-based QuickBooks Payments merchant.

Important pricing details and product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Not available in U.S. territories or outside the U.S.

Table of contents

Table of contents