1. Why you create them

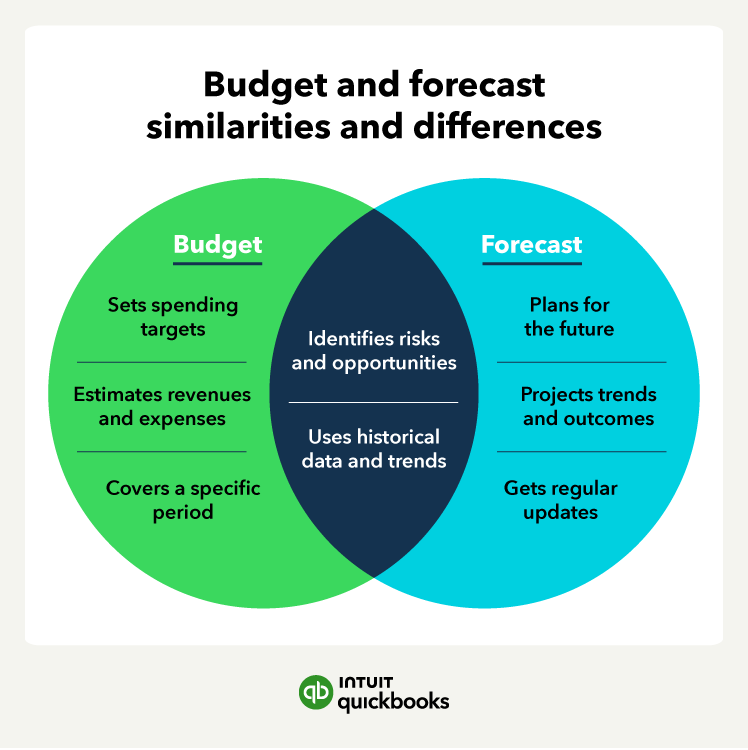

A budget and a forecast provide a roadmap for allocating resources and guide your operations and decision-making. But businesses tend to create:

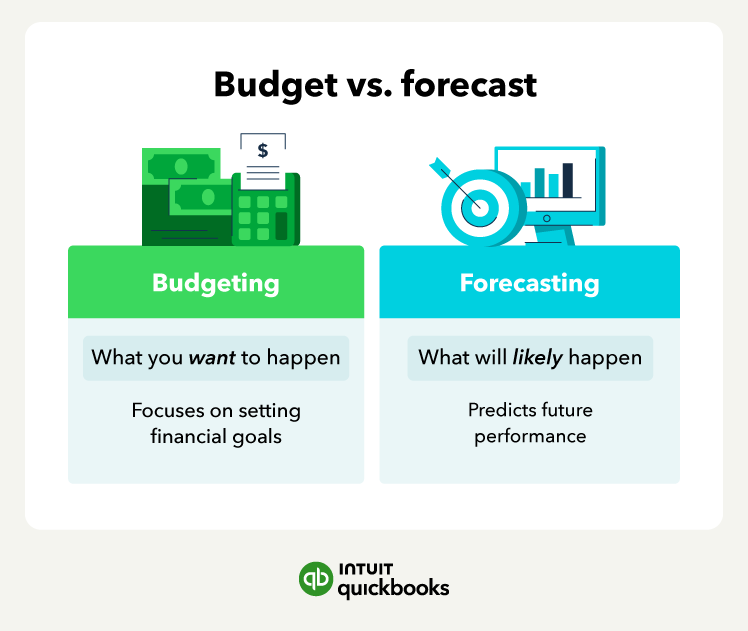

- A budget to set financial goals and track performance.

- A forecast to predict future financial outcomes and make informed decisions.

Budgets help businesses maintain financial discipline by avoiding overspending and ensuring you manage effectively. It allows businesses to plan for future investments, expansion, or debt reduction by allocating resources accordingly.

Using a forecast offers several benefits for businesses. You can use them to create pro forma financial statements or optimize operations by aligning resources and activities with projected financial outcomes. It also helps identify potential financial gaps or shortfalls, allowing businesses to take proactive measures like securing additional funding or adjusting their spending plans.

2. What periods they cover

Budgets and forecasts serve distinct purposes in business planning and tend to cover different periods (although they can cover the same ones).

The periods they cover are:

- Budgets generally cover set periods, such as one year.

- Forecasts cover longer-term periods, such as many years.

Budgets, once set, remain in place for the period. They provide a plan of action for the upcoming year. Forecasts can span several years, but you will want to update them on a rolling basis, such as monthly.

Updating your forecasts will ensure accuracy and relevance. It’s a tactical tool that helps businesses monitor and adjust items like inventory forecasts in response to changing market trends and business conditions.

3. What they track

Budgets and forecasts also differ with what they track, in particular:

- Budgets primarily track planned revenue and expenses.

- Forecasts track predicted financial outcomes.

A budget's key metrics or components include revenue targets, variable costs, and debt reduction goals. By setting revenue targets and estimating expenses, budgets enable business owners and management teams to monitor progress and make necessary adjustments to achieve desired financial outcomes.

Some companies use the budget to award performance-based compensation.

Some companies use the budget to award performance-based compensation.