Methodology

Intuit QuickBooks Holiday Shopping Report 2024

Consumer Surveys

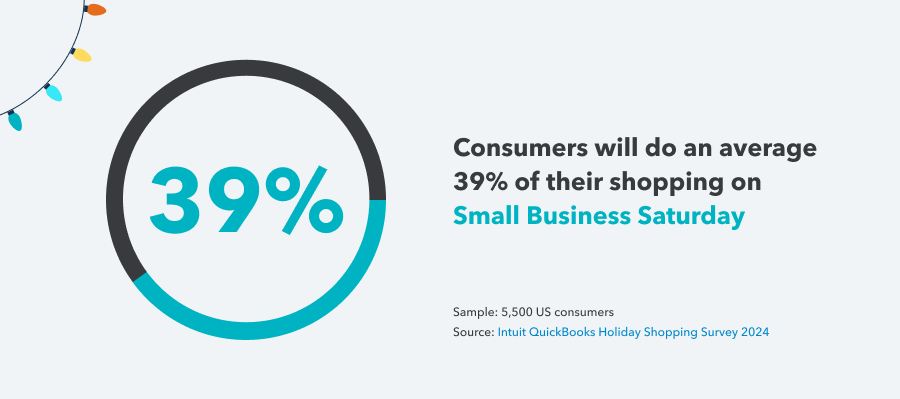

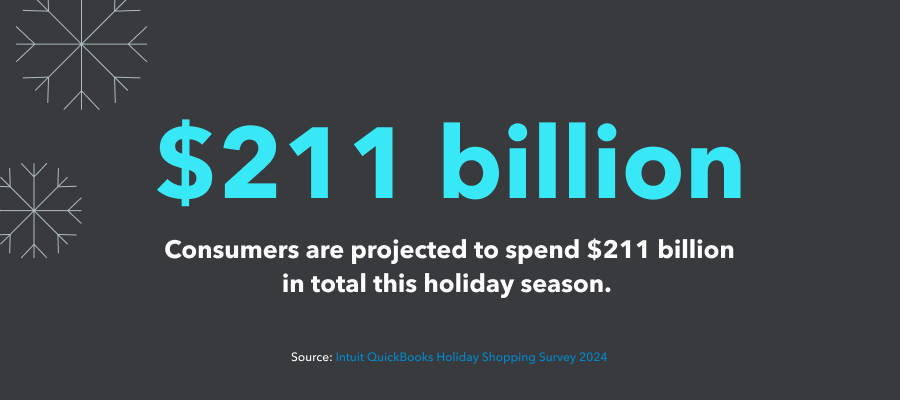

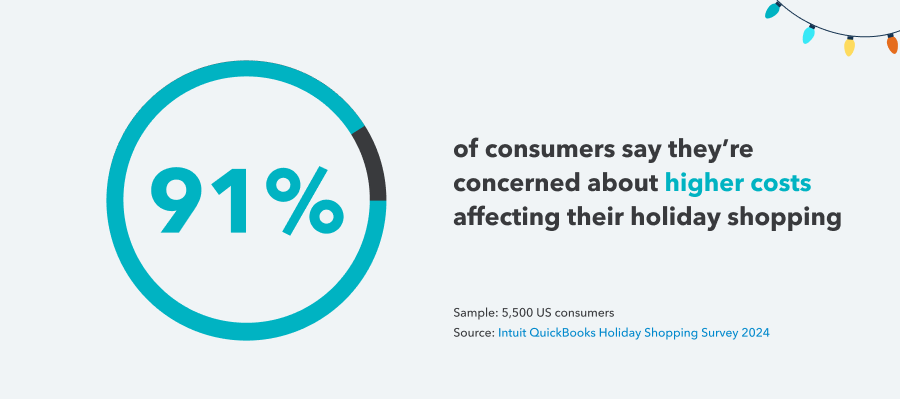

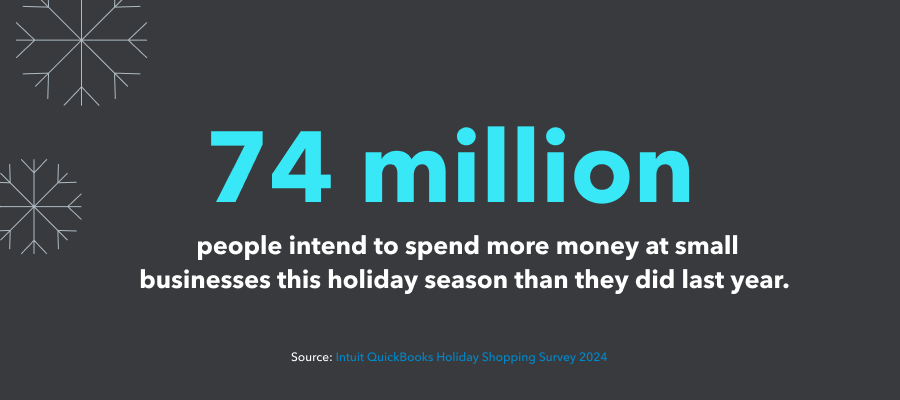

Intuit QuickBooks commissioned an online survey, completed in September 2024, of 5,500 consumers (adults aged 18+) throughout the US. Small business consumer spending estimates are based on a weighted average percentage of total spend budget each survey respondent indicated they planned to spend at small businesses this holiday season multiplied by the equivalent number of people in the US population based on the latest available data from the U.S. Census Bureau ($294 average spend at small businesses per person multiplied by 258 million US adults over the age of 18 equals $76 billion potential revenue for small businesses this holiday season). To ensure the survey findings are as representative as possible, they have been re-weighted using post-stratification based on local census data. For clarity, percentages have been rounded to the nearest decimal place—so values shown in charts and graphics may not add up to 100%. Responses to multiple choice survey questions are shown as a percentage of the number of respondents, not the total number of responses, so will always sum to more than 100%. Respondents received remuneration.

Small Business Owner Surveys

Intuit QuickBooks commissioned an online survey, completed in September 2024, of 2,000 US consumers (adults aged 18+) who have income from employment or self-employment in three cohorts: respondents who identified themselves as small business owners with 1-100 employees (n=646), small business owners with no employes (n=715), and employees of a business who own a small business on the side (n=639). For clarity, percentages have been rounded to the nearest decimal place—so values shown in charts and graphics may not add up to 100%. Responses to multiple choice survey questions are shown as a percentage of the number of respondents, not the total number of responses, so will always sum to more than 100%. Respondents received remuneration.

Small businesses leverage social media shopping to reach more customers

Free shipping isn’t the only perk of online shopping for consumers—52% say shopping online gives them access to exclusive online deals and discounts or lower prices. And when it comes to buying from small businesses online, consumers go directly to the source. Six in 10 say they turn to the business’s website for information about deals and discounts.

The seller’s website is also their first stop for online shopping—59% of consumers say they start here—above even third-party ecommerce platforms like Amazon or Etsy. And small businesses are leaning in. Over half (51%) say they plan to sell products or services directly from their website.

But social media shops are becoming an increasingly popular ecommerce option for small businesses. Shops on social platforms offer small business owners an opportunity to reach larger audiences and engage with customers directly. Over half of small business owners surveyed (52%) say they plan to use social media platforms to sell products or services this holiday season—more than any other platform, including their own website. Facebook, Instagram, and TikTok are top social platforms of choice for both small businesses and their customers.