Get 70% off QuickBooks for 3 months.

Ends July 29th.

3 ways accounting professionals can help small businesses succeed in 2023

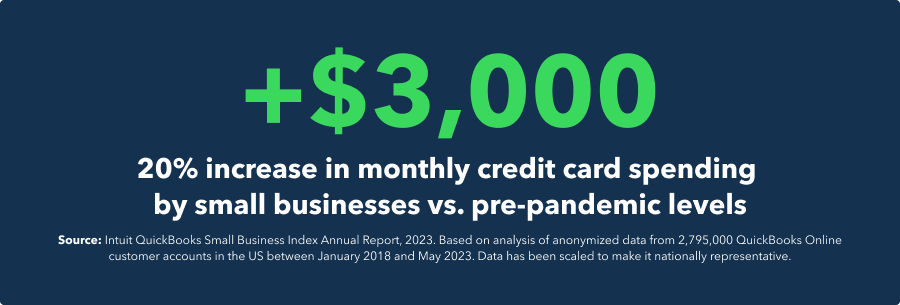

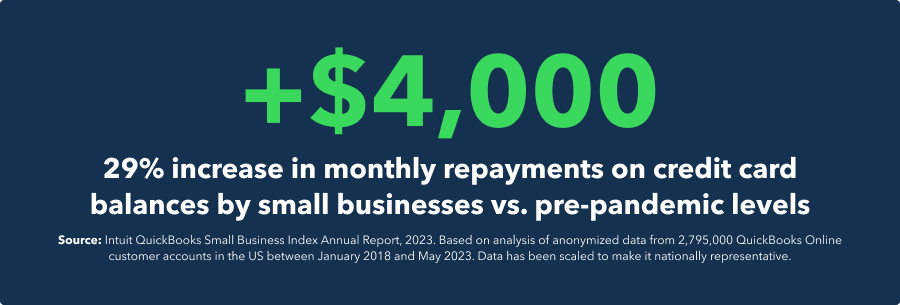

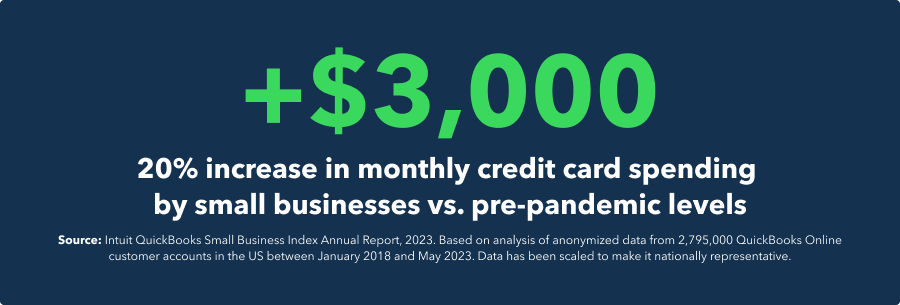

Inflation and rising interest rates have pervaded the US economy in 2023, and findings from the Intuit QuickBooks Small Business Index Annual Report 2023 highlight just how vulnerable some small businesses are to these economic shifts. In the US, monthly small business credit card spending is currently 20% higher, on average, than before the pandemic — equivalent to an extra $3K per business each month. At the same time, monthly repayments on credit card balances are 29% higher, on average, than before the pandemic.

To meet these challenges, small businesses are increasingly employing accounting professionals in an advisory capacity for more resilient and successful operations. More than 3 in 5 accountants report that their clients have needed more support with financial management (67%), filing taxes (62%), managing staffing costs (62%), and financial forecasting (65%) over the past two years.

As more small businesses look for accounting professionals to expand their scope beyond compliance and provide more holistic support, understanding the vulnerabilities of the small business landscape at large is critical. Knowing what small business trends the Annual Report uncovers can keep accounting professionals informed and help them better advise small business clients as they navigate these challenging times.

Key findings from this year’s report reveal:

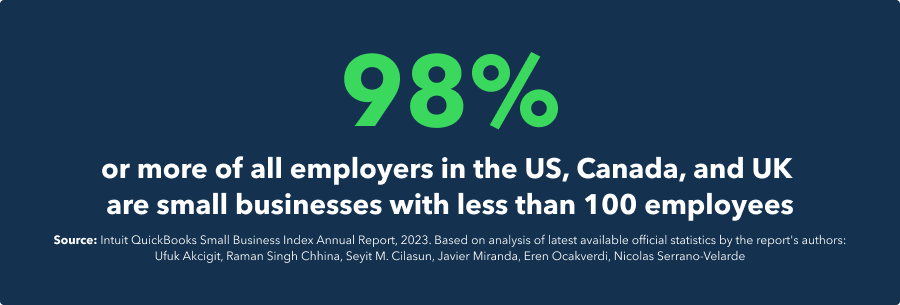

Small businesses play a critical role in the US, Canadian, and UK economies

- More than 98% of employers in the US, Canada, and the UK are small businesses.

- Small businesses provide 36% of US jobs, 47% of Canada’s jobs, and 44% of UK jobs.

Inflation and interest rates are creating unique challenges for small businesses

- The Intuit QuickBooks Small Business Index shows negative small business employment growth in the US, Canada, and the UK during the first half of 2023 following interest rate increases.

- Compared to pre-pandemic levels, average monthly credit card expenditure is up by an average of 20% — creating potential vulnerabilities.

- At the same time, monthly credit card payments made by small businesses are 29% higher, on average, than before the pandemic.

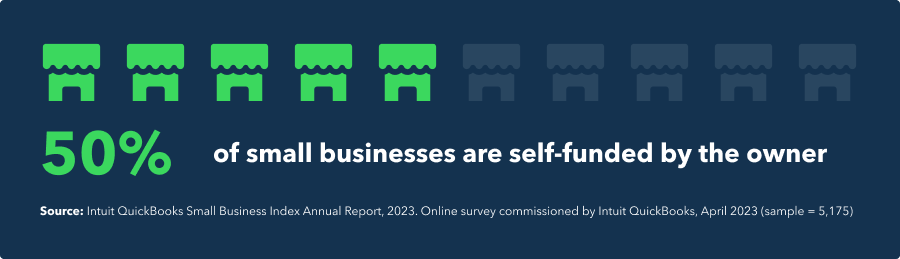

Funding is a persistent challenge for small businesses

- Roughly half of small business owners surveyed in the US, Canada, and the UK have self-funded their business (58% in the US, 51% in Canada, 48% in the UK) — often by working other jobs.

- Young businesses and businesses owned by women and underrepresented racial groups often face greater challenges getting funding. For example, small businesses owned by underrepresented racial groups in the US are twice as likely to say getting funding is currently their number-one challenge.

- Small businesses that applied for credit from banks that were well-financed before recent interest rate rises received more funding than those working with less well-financed banks.

Small businesses making more use of digital tools are more likely to be growing

- Detailed analysis of surveys commissioned by Intuit QuickBooks in the US, Canada, and the UK, reveals a correlation between higher use of digital tools and better business performance.

- For example, US small businesses managing 8 or more areas of their business with software/apps are almost twice as likely to report revenue growth and almost three times more likely to have expanded their workforce over the 12 months prior to April 2023 than small businesses managing up to 2 areas of their business with software/apps.

- This analysis is based on the full spectrum of digital tools used by small businesses including social media, e-commerce, accounting software, HR and payroll software, email marketing, payments, and sales platforms.

Here are three actionable small business insights for accounting professionals to keep in mind as they advise their clients on growth strategies designed to help them succeed.

1. Help clients make strategic financing decisions

As highlighted by this year’s Annual Report, securing funding is a persistent challenge for small businesses — especially for new businesses and those owned by women and underrepresented racial groups. One in 3 small businesses in the US say the cost and availability of financing has worsened over the past 12 months.

And while 3 in 10 small businesses have used credit cards as a top source of funding over the past 12 months, it may come at a cost. As credit card usage has trended upward, so have monthly repayments. In the US, monthly credit card payments by small businesses are 29% higher, on average, than before the pandemic. Whether it’s to get their operations off the ground, expand their workforce, or patch the gaps of strapped cash flow, small businesses often feel the pressure of needing access to capital and needing it fast. This sense of urgency can lead to rushed decisions — such as signing up for quick-pay loans with excessively high fees and APR.

Current headwinds open up an opportunity to advise clients on making informed financing decisions for the short- and long-term, becoming a more crucial area of expertise for accounting professionals.

2. Cash flow advisory is increasingly important

Maintaining a healthy cash flow is a lifecycle imperative for small businesses. Not securing enough of a cash buffer can put small businesses at risk of making decisions that can hurt more than help. This year’s findings reveal that cash-strapped businesses have been increasingly relying on credit to manage cash flow problems — jumping from 51% in September 2022 to 68% in April 2023. And with small businesses increasingly relying on credit cards, knowing how to manage cash flow and handle curveballs can be the key to longevity.

Whether advising clients on earmarking enough cash to cover overhead costs if payments are late or for emergencies, or helping them to identify what products and services are most profitable, accounting professionals can play an invaluable role in helping small businesses succeed in uncertain times.

As inflation and interest remain high, it’s easy to overestimate money coming in and underestimate money being spent. While working with your clients, pay close mind to these areas, in particular:

- Know fixed and variable costs.

- Monitor cash flow projections.

- Treat cash-flow savings as a fixed expense.

- Creating guidelines for tapping into cash reserves.

- Guide clients on whether and what to charge their customers interest on late payments.

- Clearly communicating all payment terms as part of invoicing processes.

The benefits of cash flow advisory extend beyond the present and into the future. Helping clients anticipate future expenses and how these expenses will impact their pricing structure is an increasingly important part of advising small businesses.

3. Leverage the power of digital technology

Now more than ever, digitization is critical for small business success — and small businesses are catching on. Seven in 10 small business owners agree that AI could help them compete with larger businesses. And despite higher interest rates and inflation, this year’s report found that an average of 1 in 2 small businesses using 8 or more apps to run operations report revenue growth — whereas only 3 in 10 businesses using up to 2 apps report the same. Understanding this appetite for technology adoption among small businesses helps inform how to advise clients on technology adoption that can set them up for success.

High adoption of digital technology isn’t just supporting revenue — it’s also supporting employment. As emphasized in this year’s report, the Intuit QuickBooks Small Business Index uncovers signs of a slowdown in small business employment growth following these interest rate increases. That’s because as central banks try to combat the rise in demand and pricing by increasing interest rates, consumers are tightening their spending in an effort to adjust. But as consumers consume less under the pinch of higher interest rates, demand for the services and products of small businesses declines.

If small businesses aren’t hiring, they’re spending more time running their business than managing it. Digitization can be a resource — helping to both keep small businesses that aren’t hiring efficient and to support the businesses that are growing. The report’s authors find a clear correlation between the use of digital technology and small business growth. One in 5 high adopters report workforce growth, but fewer than 1 in 10 low adopters report the same.

Accounting professionals can help small businesses plan their digital strategy by providing tech stack recommendations that are cost-effective and streamline workflows. By empowering small businesses with the knowledge they need to make smart technology decisions, accountants can help set small businesses up for increased efficiency and expansion.

Visit the Intuit QuickBooks Small Business Index Annual Report hub for more about this year’s findings.

Read more about actionable insights for small businesses from this year’s report.

Read more about actionable insights for policymakers from this year’s report.