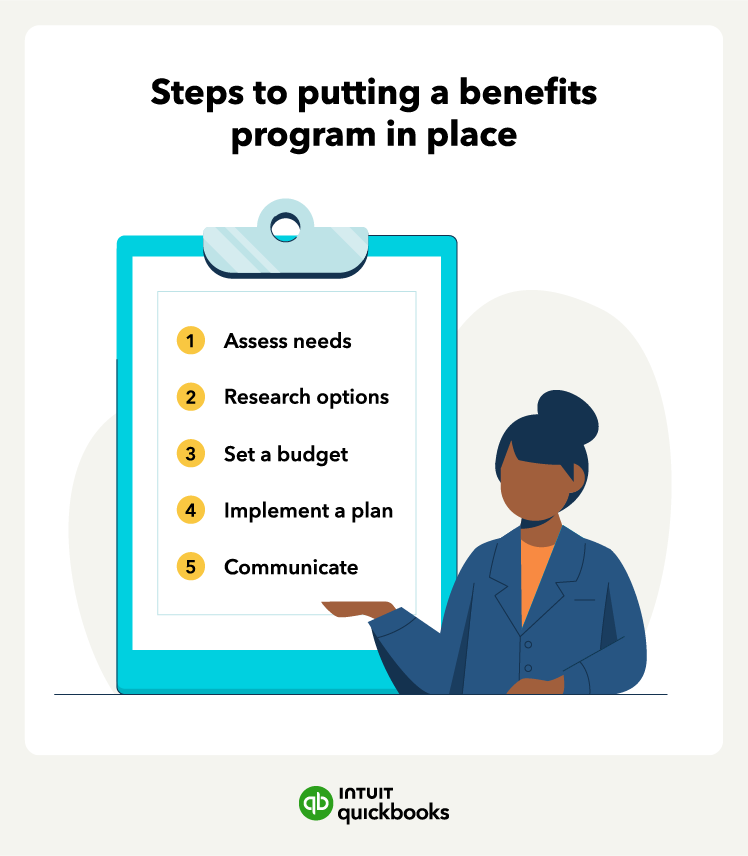

Providing strong employee benefits helps you attract top talent and helps ensure your current employees are engaged. Here are the key steps to effectively implement a benefits program:

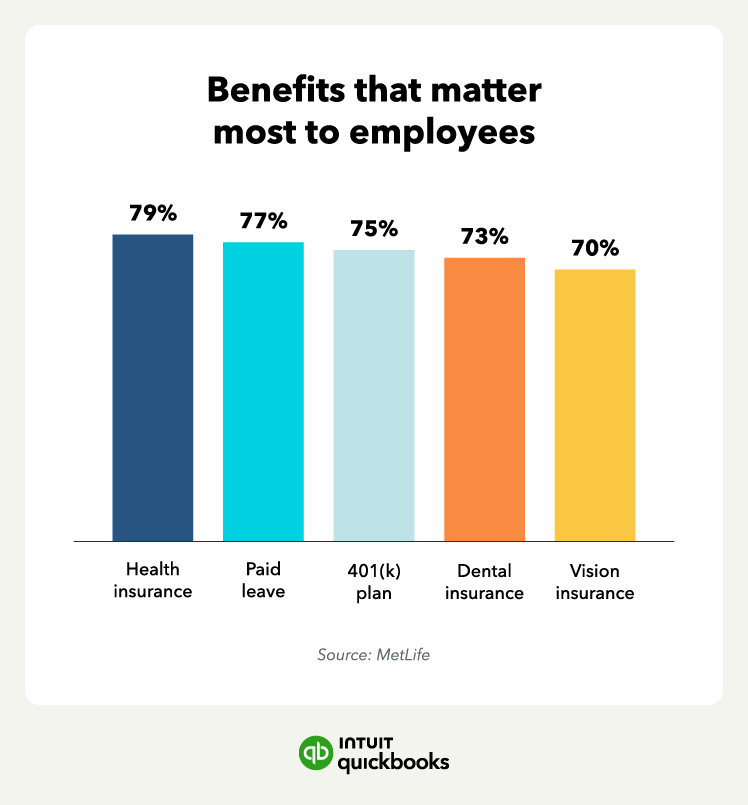

- Assess your needs: Start by evaluating your employees' needs and preferences. Consider conducting surveys or holding meetings to gather feedback on the benefits they value the most. This will help you tailor your benefits program to meet their needs and increase its effectiveness.

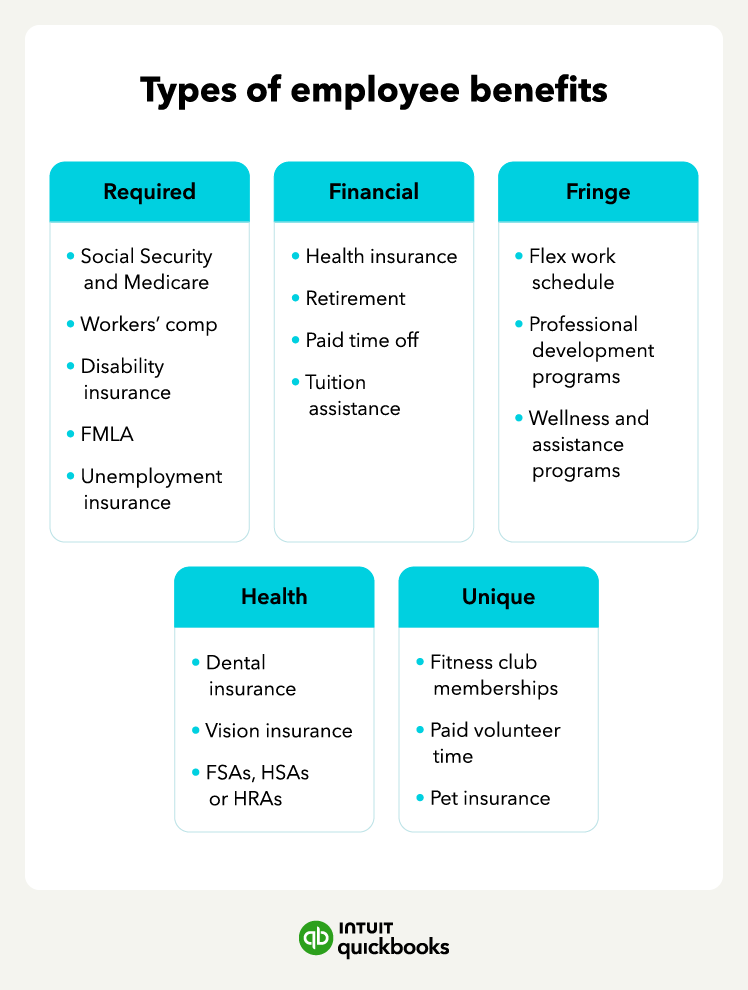

- Research your options. Once you know your needs, you can start researching your options. Research different benefits options available to small businesses. Common benefits include medical, paid time off, types of 401(k)s, and work/life balance perks. Compare costs, coverage, and the potential value they can bring to your employees. You can also talk to other small businesses to get their recommendations.

- Set your budget: Determine how much your business can allocate toward the benefits program. Consider factors such as your financial capacity, industry benchmarks, and the benefits you want to provide. Balancing cost-effectiveness and the potential productivity boost with meaningful benefits is crucial.

- Implement your plan: Develop a timeline for the rollout of your benefits program. This includes determining the start date and outlining the communication strategy to inform employees about the new offerings. Clear and timely communication is key to ensuring a successful implementation.

- Communicate with your employees: Once your benefits program is in place, take proactive steps to educate employees about the available benefits and how to make the most of them. Conduct training sessions, provide written materials, and have an open line of communication to address any questions or concerns.

Even after having your benefits plan in place, you’ll want to set a timeline to evaluate it to ensure it's meeting the needs of your employees. This includes getting feedback from employees and making changes as needed.

Keeping your employees happy and productive

In the race to keep employees happy, employers have gone to great lengths, providing things like dry cleaning pickup and bring-your-dog-to-work days. In truth, the types of benefits you offer, whether health insurance or certain unique benefits, will depend on the type of work environment you are trying to cultivate and the types of employees you want on your team.

Building a benefits package and payroll functions is a balancing act, but one that gets easier if you leverage payroll software like QuickBooks with built-in human resource functions.